Yesterday, Minneapolis Fed President Neel Kashkari told CNBC that he wants to see "many more months of positive inflation data" before he's ready to cut rates. He also didn't rule out a hike. Fixed-income investors are starting to realize that this is the new party line from the Fed. Earlier this year, we argued that there was no reason for the Fed to rush to lower the federal funds rate (FFR) and wrote that in a March 25 Financial Times op-ed.

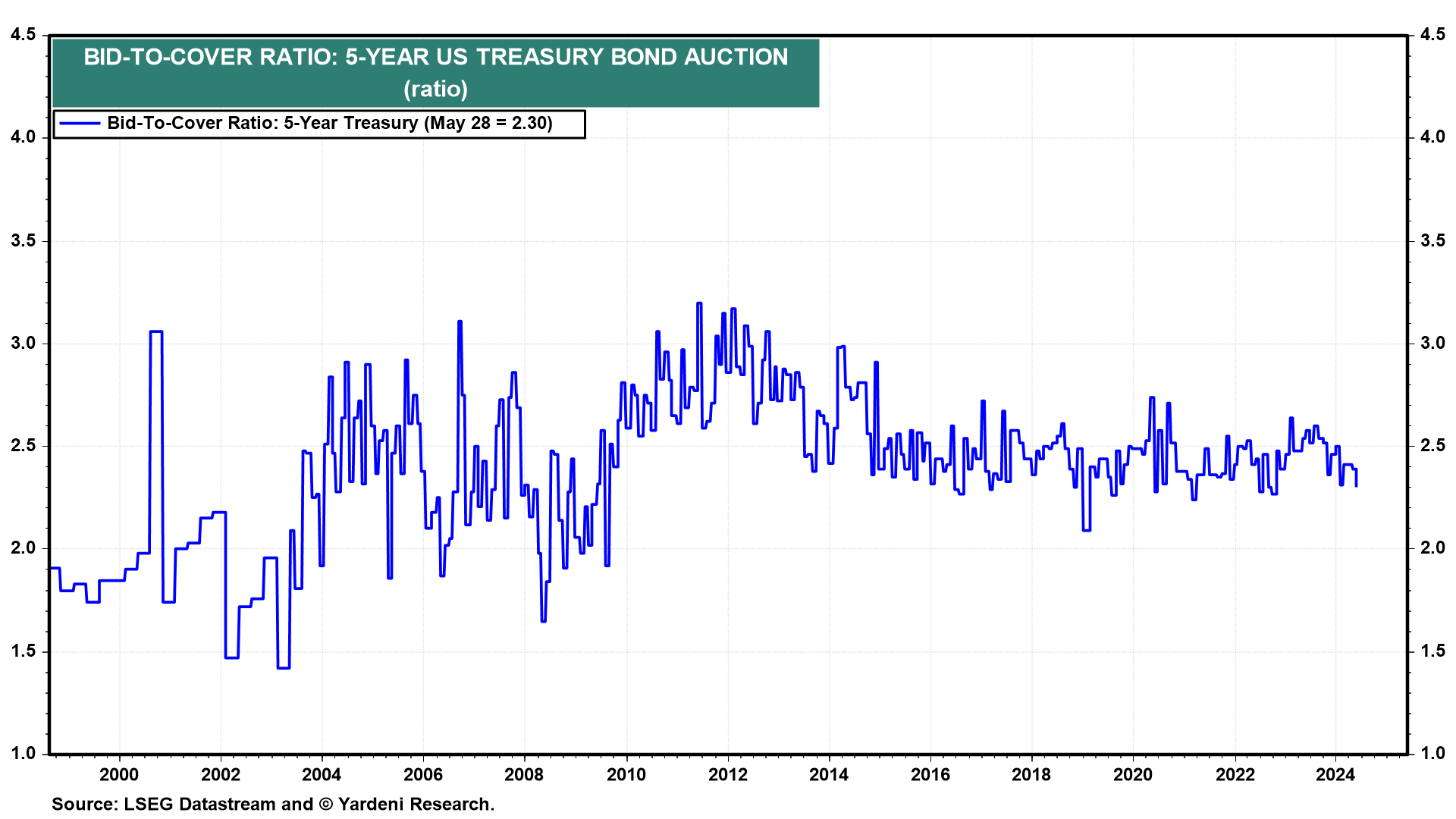

The higher-for-longer outlook for the FFR weighed on demand across this week's 2-, 5-, and 7-year Treasury auctions as evidenced by weaker bid-to-cover ratios (chart)

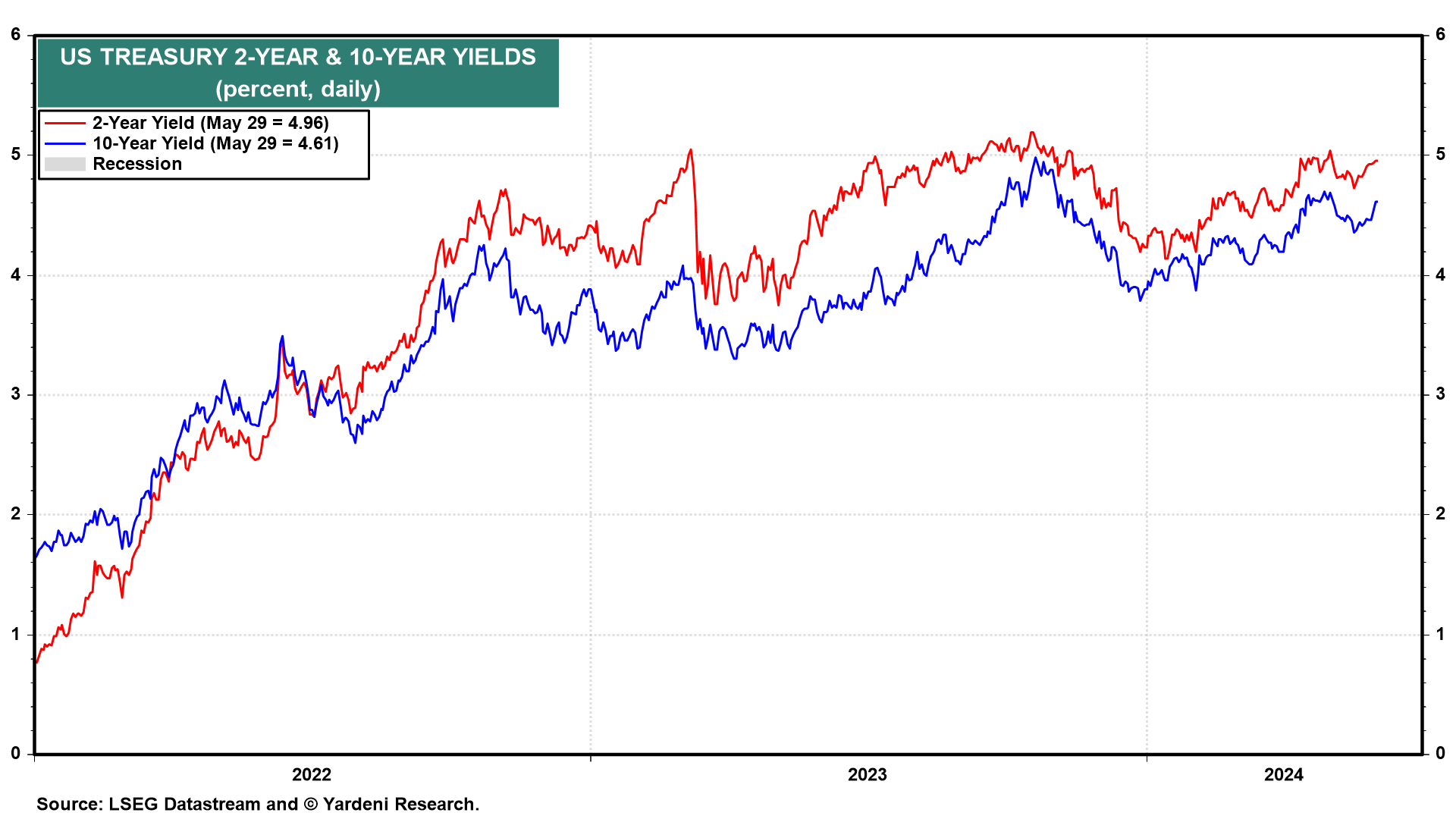

The 2-year and 10-year Treasury note yields rose to 4.96% and 4.61% today (chart). In our normal-for-longer scenario, the 10-year yield remains rangebound between 4% and 5%, which is where it was before the Great Financial Crisis which was followed by abnormally low interest rates.

The higher-for-longer scenario also weighed on stocks in recent days with the S&P 500 equal-weight index significantly underperforming the market-cap-weighted index (chart).