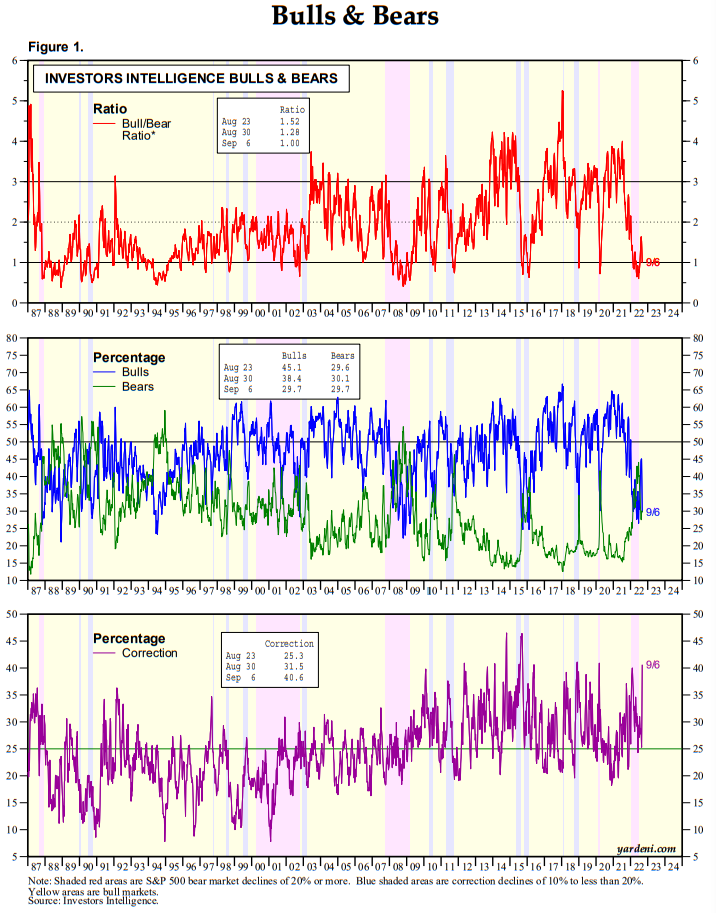

Investors Intelligence Bull-Bear Ratio (BBR) slipped this week for the third week, to 1.00 (chart below). It had advanced the previous six weeks from 0.76 to 1.64, which was the highest reading since early January. (It was at 0.60 during mid-June, which was the lowest since the week of March 10, 2009’s 0.56.) BBR readings of 1.00 or less tend to be associated with good buying opportunities for long-term investors. Here's more:

(1) Bullish sentiment has tumbled 15.4ppts the past two weeks to 29.7%—back near the 26.5% 11 weeks ago, which was the fewest bulls since early 2016.

(2) Meanwhile, bearish sentiment fell to 29.7% after climbing the prior two weeks to 30.1%.

(3) The correction camp advanced for the second week to 40.6%—the highest since early March 2020—after sinking five of the prior six weeks from 31.0% to 25.3%, which was the lowest since early June.