The week ahead is light on economic indicators. Fed officials undoubtedly will make some headlines. They are likely to reiterate Fed Chair Jerome Powell's basic message during his May 7 presser: "We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension. If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close. For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance."

Congressional Republicans along with President Donald Trump need to make some headlines that suggest progress in formulating a budget plan that will convincingly reduce the federal budget deficit relative to nominal GDP over the next 10 years. Instead, Friday's headline was "House Republicans stall spending package for steeper cuts to Medicaid and green energy."

Also on Friday, Moody's downgraded the US sovereign credit rating due to concerns about the nation's growing, $36 trillion debt pile. Moody's first gave the United States its pristine "Aaa" rating in 1919 and is the last of the three major credit agencies to downgrade it.

Let's briefly review this week's data outlook:

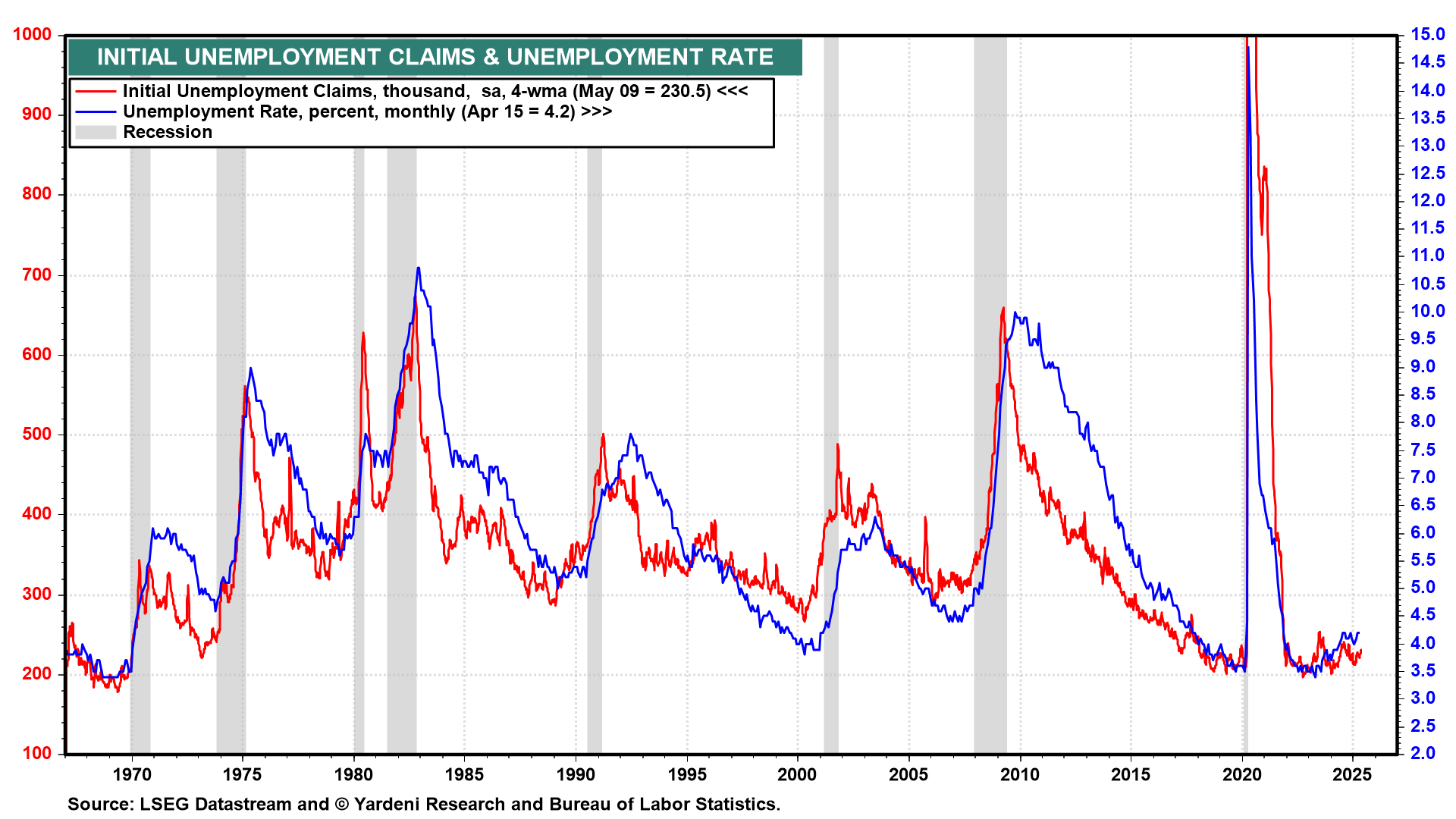

(1) Unemployment claims. The only economic release this week that might move the financial markets, because it might increase or decrease the odds of a Fed easing, is the one for unemployment insurance claims (Thu) (chart). It's likely to be a Rorschach test of sorts for those betting on a rate cut in short order and those who think Powell & Co. is in no hurry. We're in the latter camp and suspect new claims will remain low. Continuing claims also should confirm the resilience of the labor market and confirm that there's little reason for the Fed to ease anytime soon—if at all in 2025.

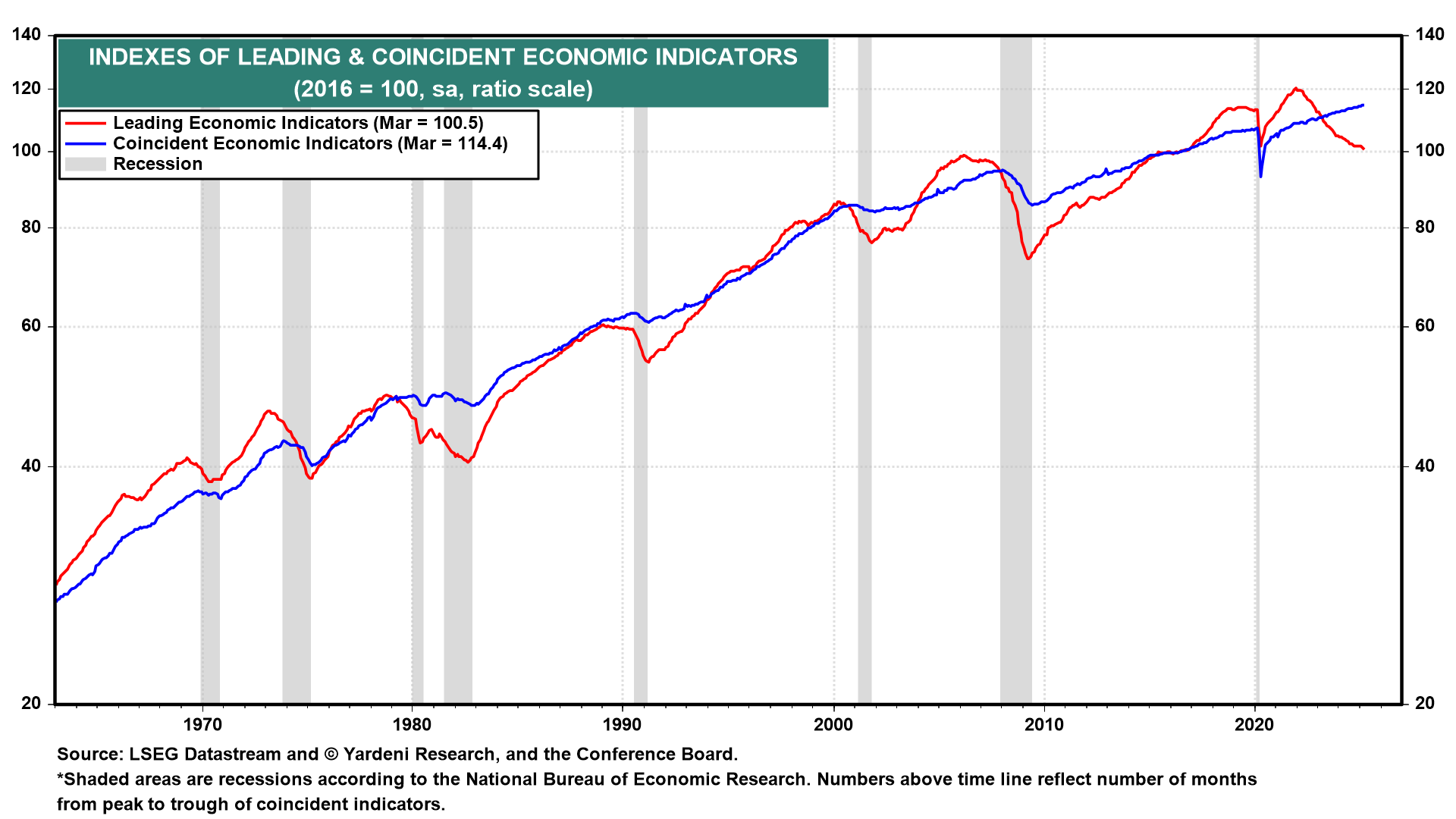

(2) Composite economic indicators. April's composite cyclical indexes (Mon) might feature their own eye-of-the-beholder dynamic (chart). The leading economic indicators series is likely to drop again in April, given the tariff-related battering to consumer expectations. Yet the coincident economic indicators series is likely to be more attuned to April's solid gains in employment. Odds are, an uptick in the CEI will better reflect where the economy is heading as the second half of 2025 beckons.

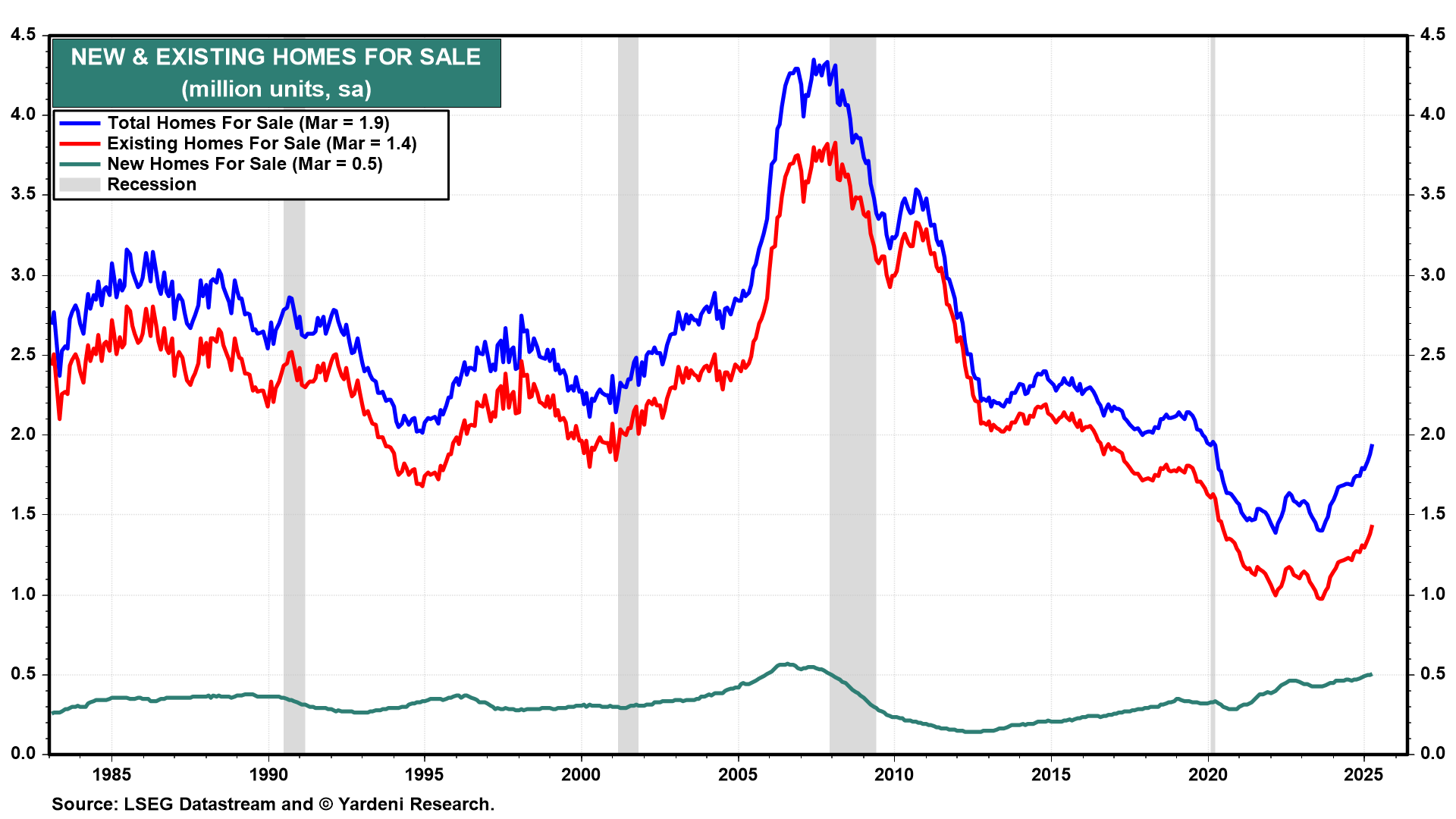

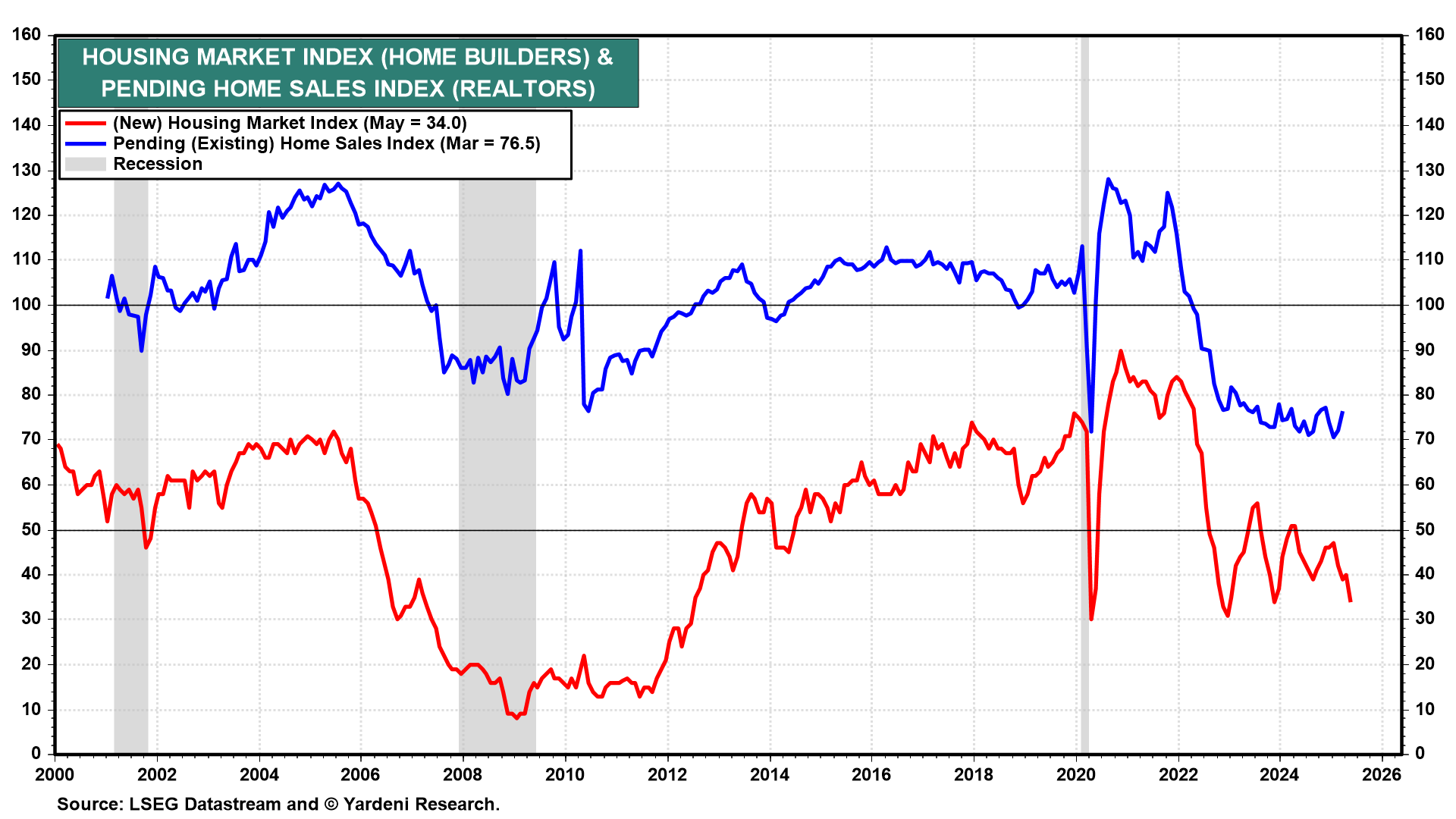

(3) Existing and new home sales. Housing market indicators of new home sales (Fri) and pending existing home sales (Thu) remain depressed (chart).

The 5.9% drop in sales of previously owned homes in March from February turned many a head as concerns over the broader economy dominated newscasts. Yet the jump in new home sales that same month thickened the plot. It suggests that so long as the labor market remains robust, there's no reason to cancel that open-house appointment just yet. The main problem for the housing market is that the inventory of unsold homes continues to increase (chart).