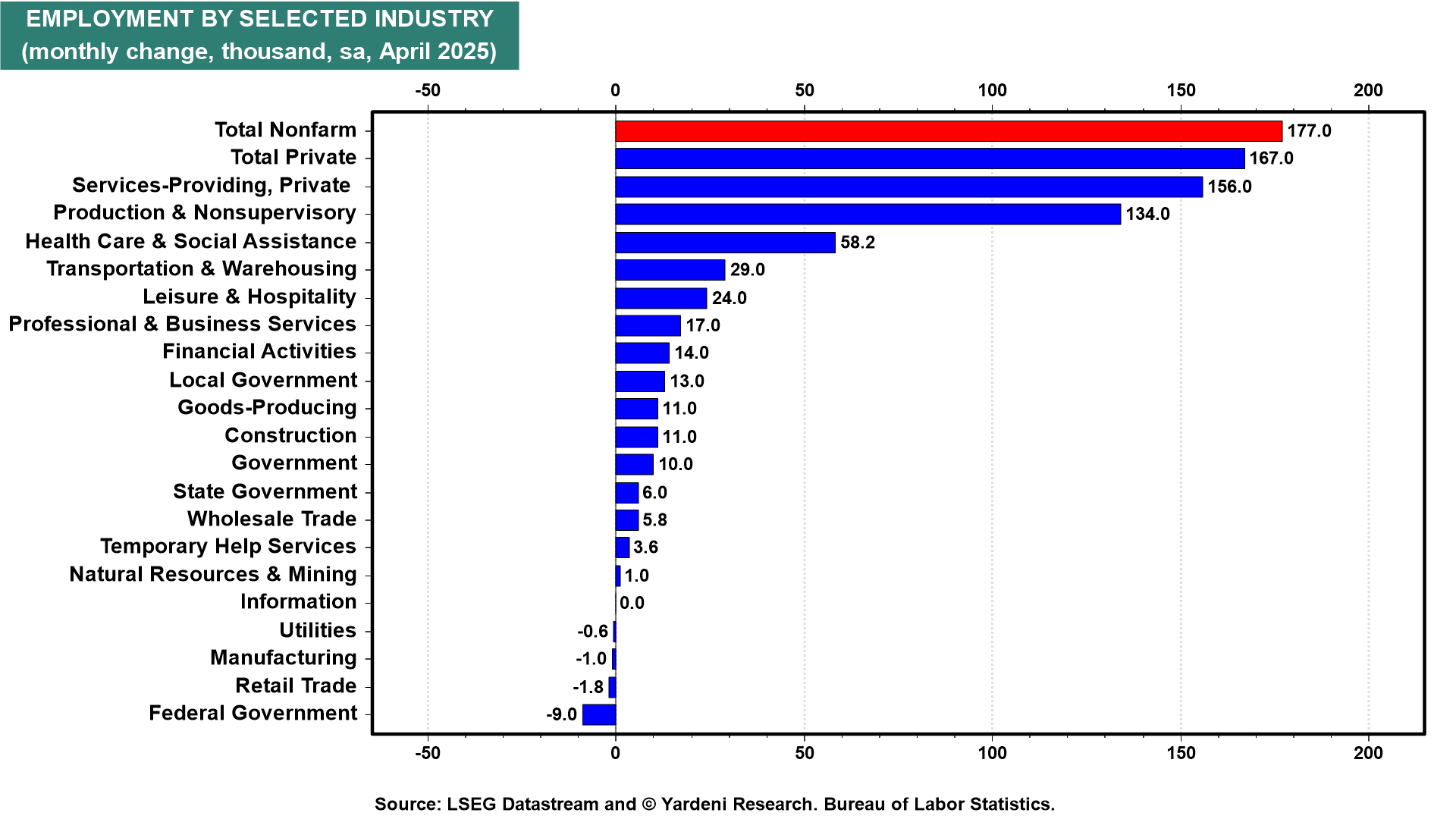

US employers are confounding the naysayers–and complicating the Federal Reserve's decision this week. It's no secret that President Donald Trump wants the Federal Open Market Committee to cut interest rates at its May 6-7 meeting. Yet the economy isn't cooperating, as companies added a robust 177,000 jobs in April (chart). US average hourly earnings, meanwhile, are up 3.8% over the past 12 months. All this means the Fed is in no hurry to cut the federal funds rate.

In an April 16 speech, Fed Chair Jerome Powell reiterated that the Fed is "always focused on the dual mandate goals" of maximum employment and stable prices. Friday's jobs data probably did little to change Powell's sense that "despite heightened uncertainty and downside risks, the US economy is still in a solid position." Or that the labor market is "at or near maximum employment" while inflation "is running a bit above our 2% objective."

A bunch of data reports out this week will likely confirm this assessment of the economy:

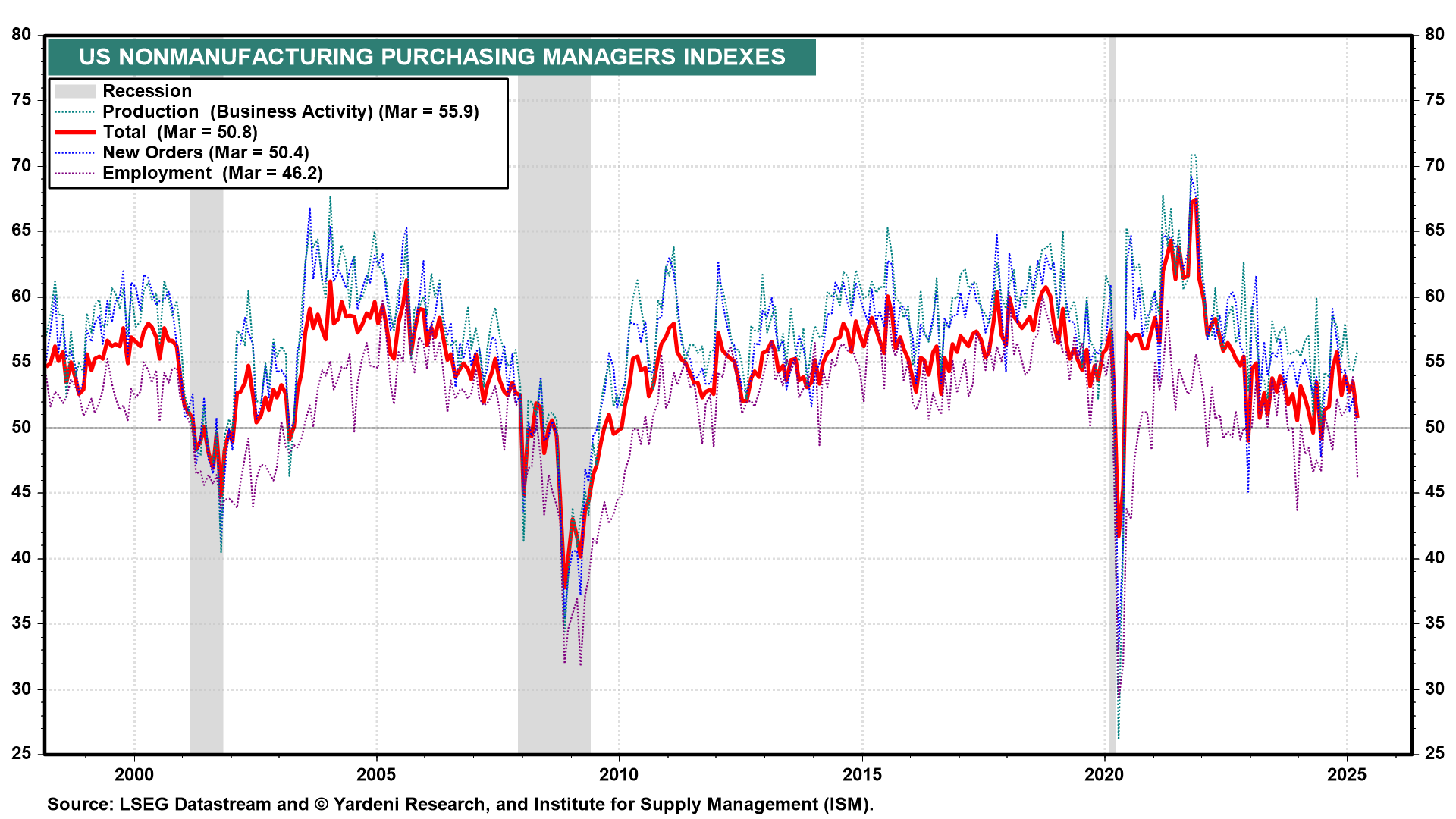

(1) Services PMI. Services employment remains robust enough to help offset trade headwinds. The 156,000 jump in private service-providing industries augurs well for April's non-manufacturing purchasing managers' index (Mon). It probably remained solidly above the 50.0 mark denoting expansion (chart). That's despite indications to the contrary emanating from the March NM-PMI employment reading of 46.2%, anomalously low (which didn't make much sense to us).

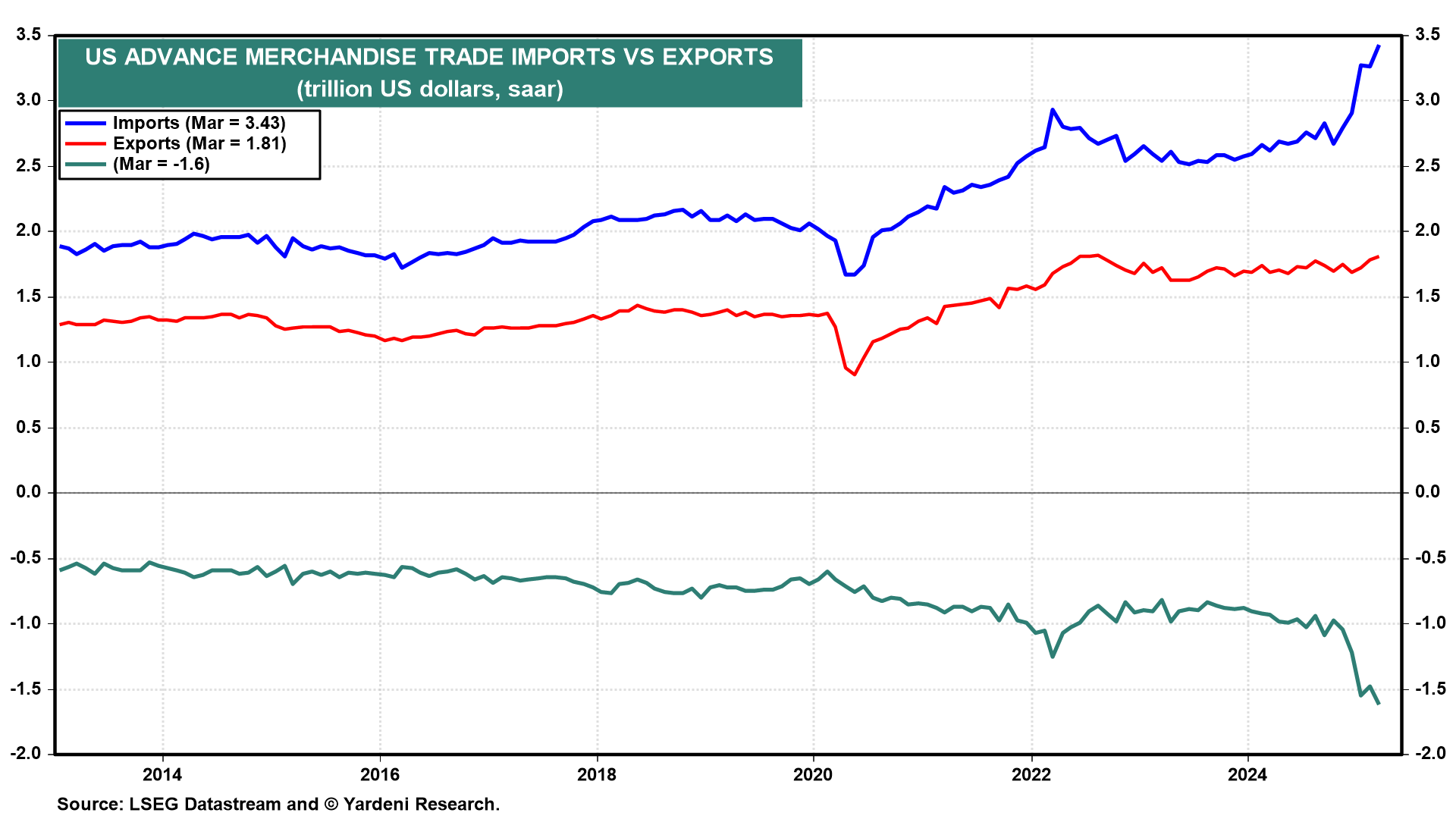

(3) Merchandise trade. Reading trade dynamics these days through the haze of tariffs and frontloading efforts is far more fraught than usual. But last week's advance report on the March merchandise trade deficit confirmed that the final report (Tue) will show a record trade gap attributable to soaring imports. The 0.3% contraction in Q1's real GDP was mostly due to the jump in imports. If imports normalize in the second quarter, though, GDP growth should get a boost.

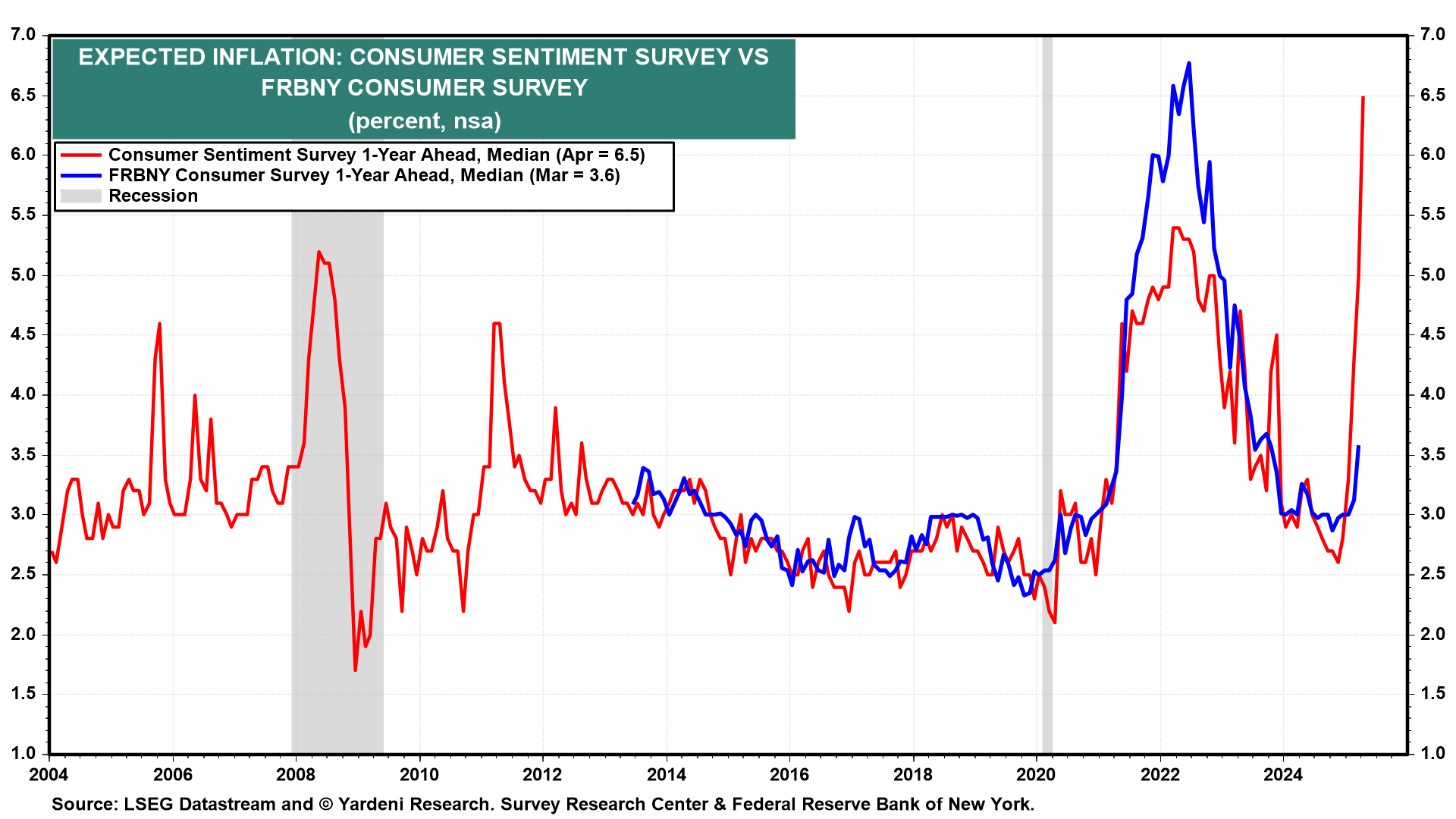

(4) Inflation expectations. Evidence of tariff-induced price pressures seems more persuasive than hints of economic weakness. The New York Fed's March survey of 12-months ahead inflation expectations (Thu) jumped to a 3.6% rate from 3.1% a month earlier. Given the University of Michigan survey's 6.5% year-ahead inflation level in April, the highest since 1981, things could get worse. The Fed has to be concerned that inflation expectations are not "well anchored."

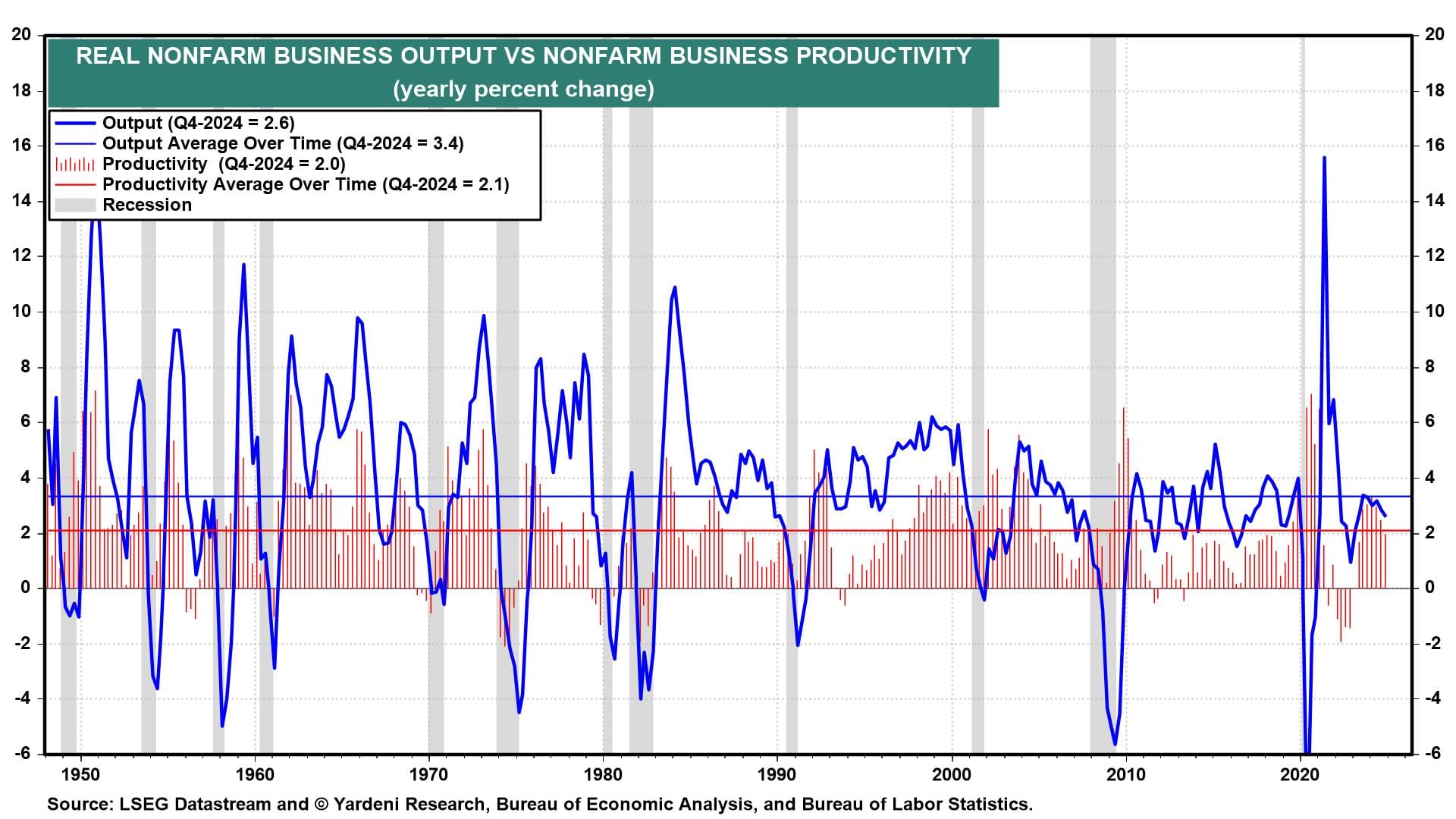

(5) Productivity and costs. Complicating things is the temporary setback in productivity gains. With real GDP contracting in Q1, the increase in aggregate hours worked suggests worker efficiency isn't optimal given the tightness of labor markets. All things considered, though, year-on-year productivity growth (Thu) should still be around the historical average of about 2.1%.

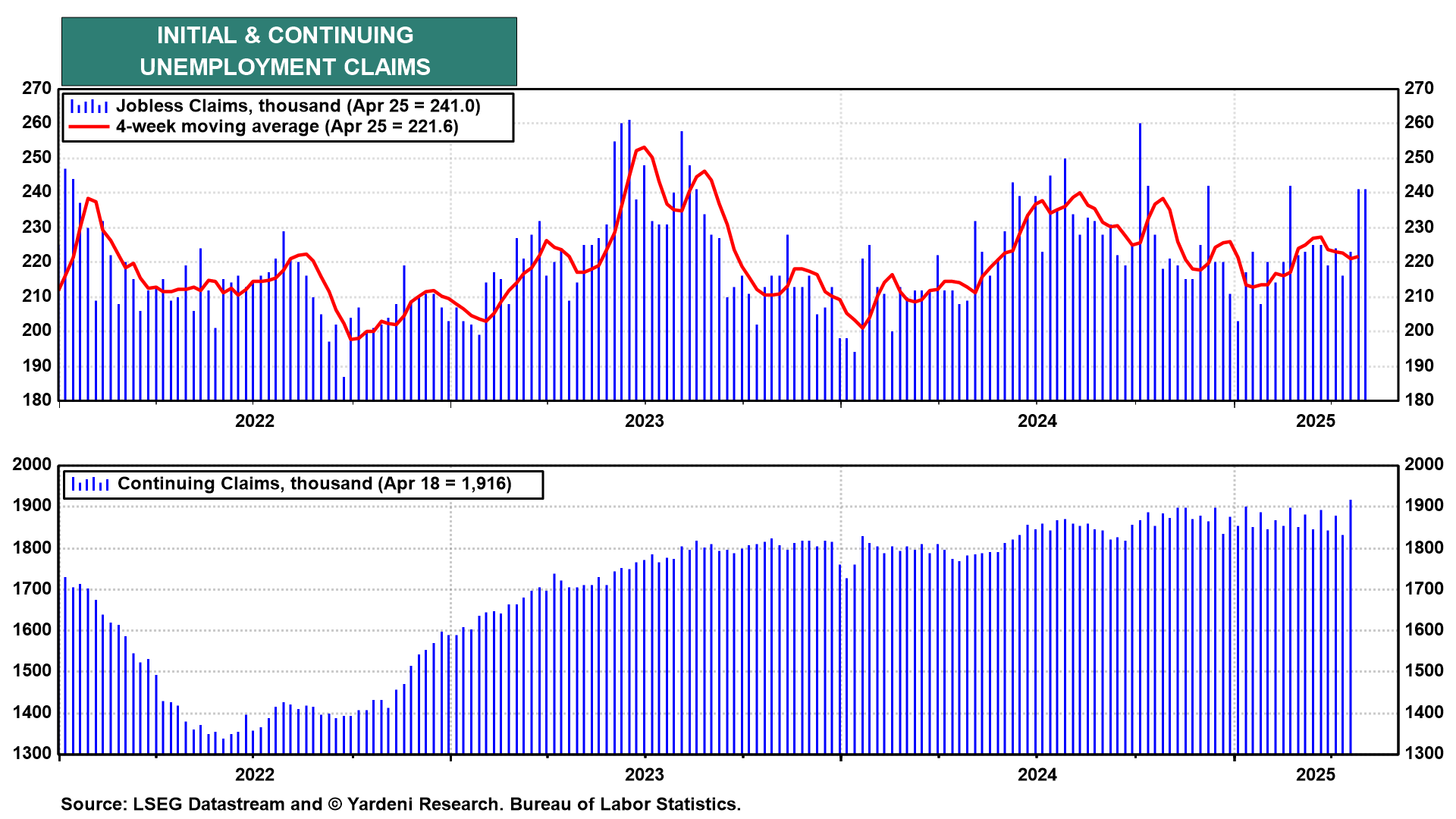

(6) Jobless claims. One clear wildcard is last week's jump in weekly jobless claims (Thu). If confirmed, the 241,000 increase in the week ended April 26, up 18,000 from the prior week, could mean the economy is headed for a rougher patch than we thought. That would increase the odds of the Fed making Trump's day sooner than later. However, we are expecting claims to remain low.