During the first half of this year, investors were driven by fear of delusional analysts (FODA). They believed that the analysts were much too optimistic about earnings. Now that the analysts are finally shaving their earnings estimates, FOMO (fear of missing out) is driving investors into a bullish frenzy.

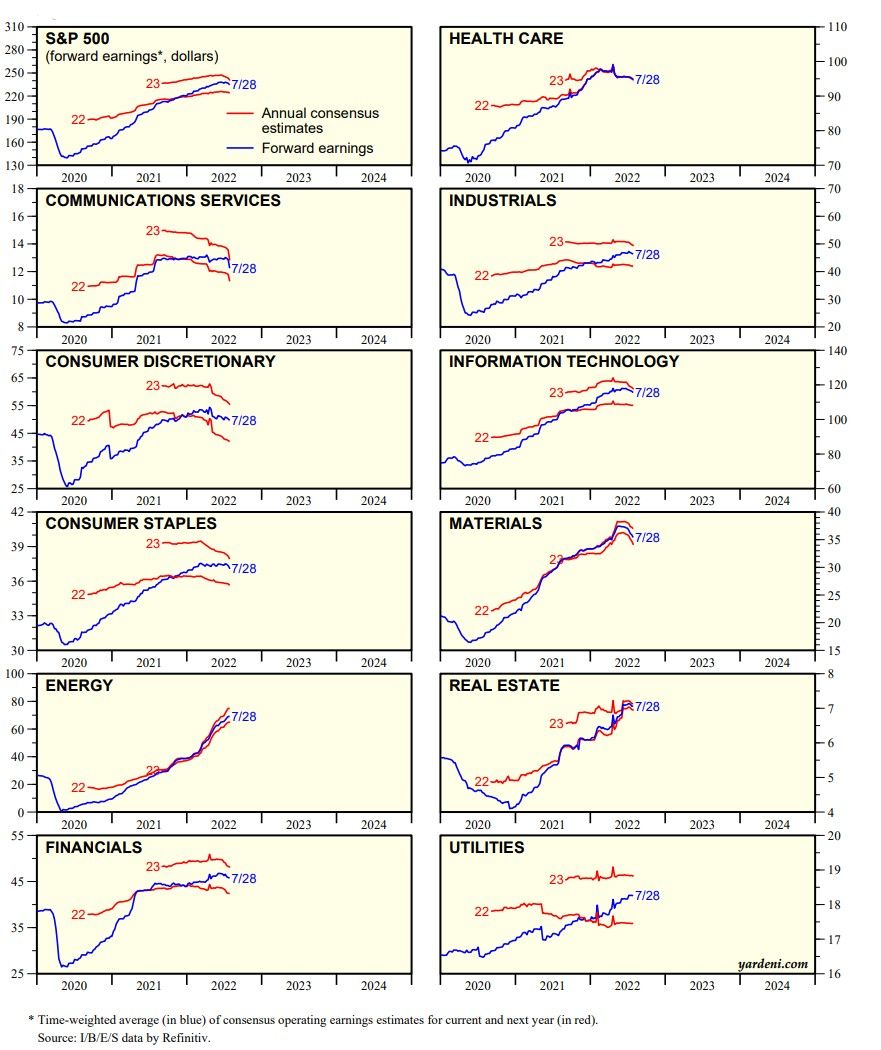

The S&P 500 is up 13.3% since it bottomed at 3666 on June 16. One week after it bottomed, S&P 500 forward earnings peaked at a record high. It's been edging down since then as industry analysts have turned more cautious on the earnings outlook for 2022 and 2023.

Here is the performance derby of the 11 S&P 500 sectors since June 16 through today's close: Consumer Discretionary (24.6%), Information Technology (19.2), Utilities (14.4), S&P 500 (13.3), Real Estate (12.8), Industrials (11.9), Health Care (10.5), Consumer Staples (9.4), Financials (9.1), Communication Services (8.4), Materials (2.9), and Energy (-3.6).

Notice that among the biggest winners are the sectors where analysts have been cutting rather than just shaving their estimates in recent weeks (chart below).

Now that analysts are turning more cautious, investors seem to have concluded that the outlook for the economy and earnings might not be as bad as they feared. That's been our view for a while.