President Donald Trump will need to declare victories in his trade wars with multiple countries around the world sooner rather than later. He and his fellow Republicans have to avoid a recession caused by his tariff wars. Otherwise, they risk losing their thin majorities in both houses of Congress later in 2026. In addition, court cases are piling up that challenge the President’s legal authority to declare a crisis to justify his tariff hikes. In the event that the courts rule that Trump's tariffs are unconstitutional, he still could declare that he won the trade wars and so doesn't need tariffs anymore.

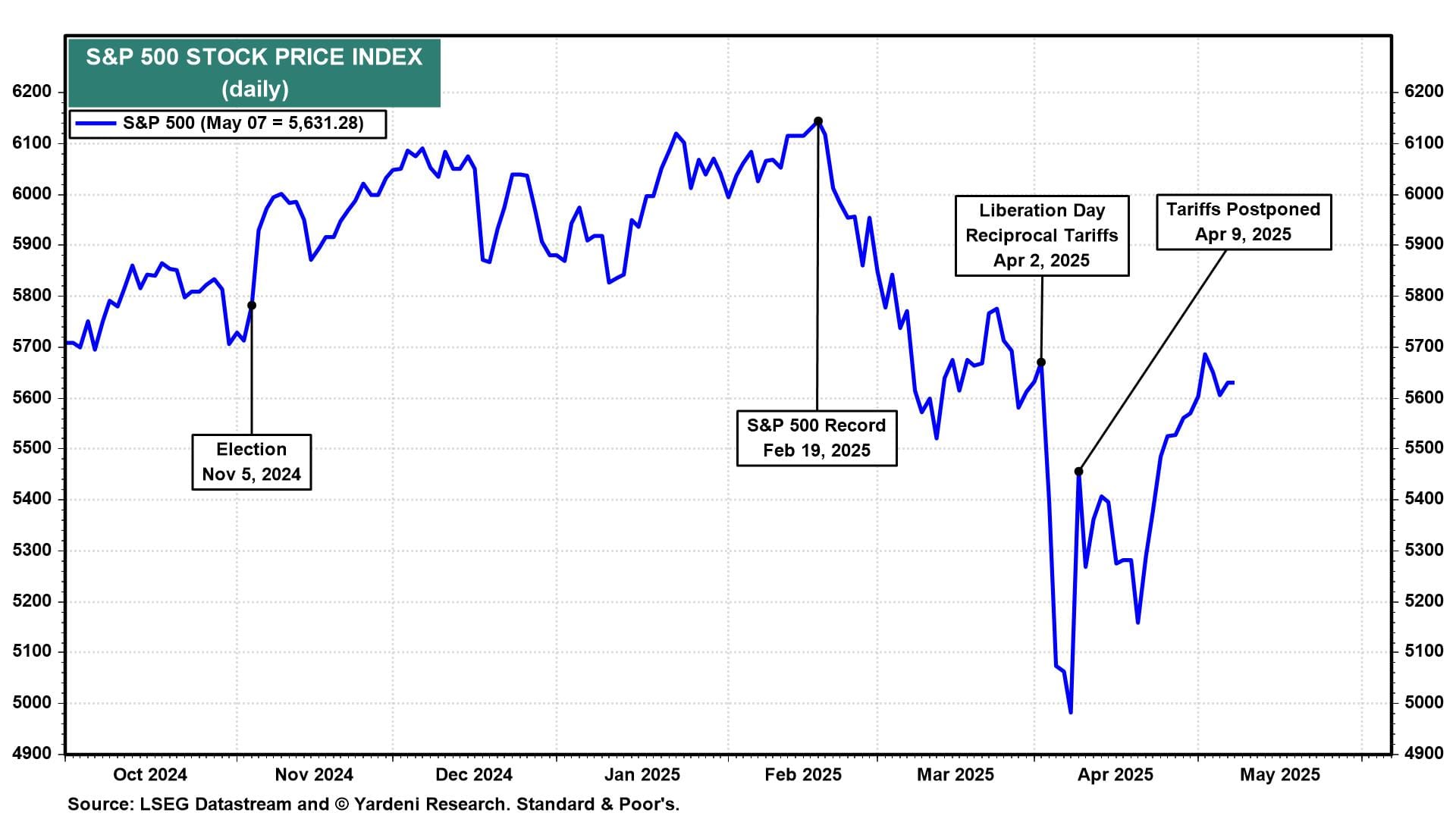

On April 9, stock investors were overjoyed that Trump postponed his April 2 Liberation Day reciprocal tariffs, which were announced after the market close (chart). The correction in the S&P 500 that started on February 19 ended on April 8. The S&P 500 now has regained almost all its losses since the April 2 close, just before it tanked during the Annihilation Days on April 3 and April 4 (chart).

Yesterday, investors were happy to learn that American and Chinese officials will meet this weekend to talk about talking about a trade deal. Today, they were pleased that the President announced that the US and the UK have a trade deal. "The final details are being written up," Trump said. "In the coming weeks, we'll have it all very conclusive." As we've previously observed, negotiating trade treaties and implementing them can't be done in 90 days. But odds are that there will be multiple trade agreements in principle by the deadline and that another postponement period will be declared for the stragglers.

The stock market will soon have deals fatigue and tire of Trump's declarations of victory. We think the trade issue will be behind us by July or August. If so, then the focus should be on how much Trump's tariff skirmishes weighed on the economy and earnings. We expect both will remain surprisingly resilient.

Consider the following: