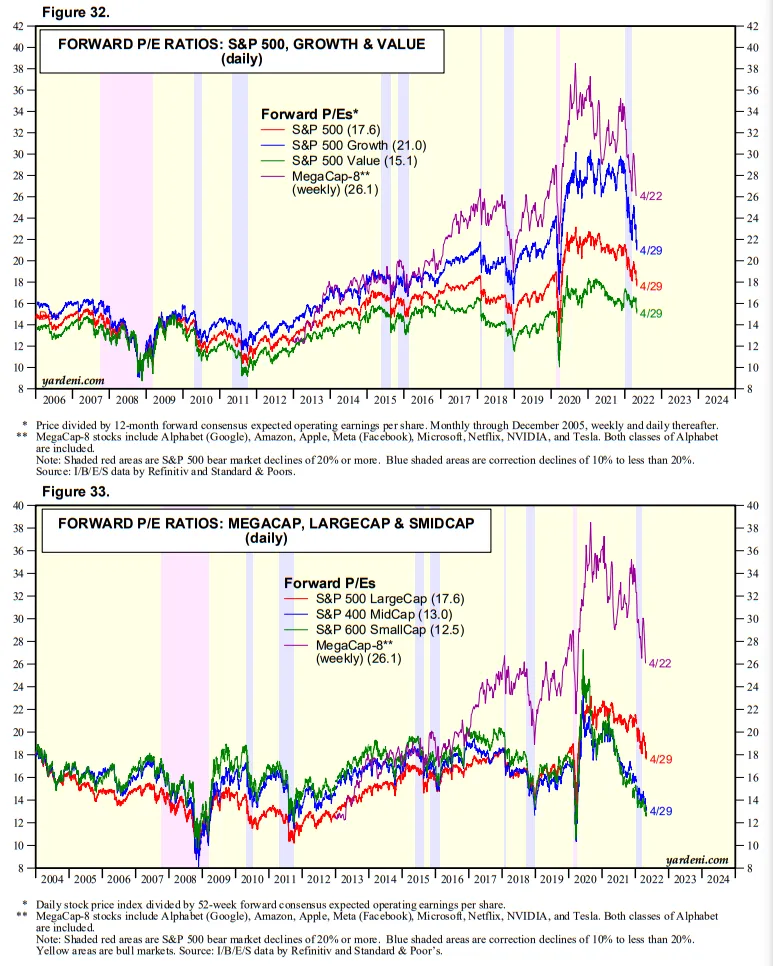

| Index | Start of Year | Now |

|---|---|---|

| S&P 500 | 21.4 | 17.6 |

| S&P 500 Growth | 28.3 | 21.0 |

| S&P 500 Growth’s MegaCap-8 | 33.8 | 25.5 |

| S&P 500 Value | 17.1 | 15.1 |

| S&P 400 | 15.9 | 13.0 |

| S&P 600 | 15.1 | 12.5 |

We’ve been thinking that the S&P 500’s forward P/E might range between 16.0 and 19.0 this year. Looks like it’s moving quickly toward the bottom end of this range. Investors clearly are discounting a rising probability of a recession. Meanwhile, industry analysts continue to raise both their revenues and earnings estimates to record highs. The analysts are probably seeing that inflation is boosting both of these variables, while investors are worrying that the Fed will cause a recession, either by accident or by design, to bring down inflation.

We see a 30% risk of a recession over the next 12-18 months. So we are clearly in the soft-landing/correction camp. Admittedly, that’s quickly becoming a contrary scenario.