We've been busy bees today as a slew of economic indicators have entered our hive. On balance, they show that the global economy is weak, while the US economy is strong, though the US banking system has some stress cracks. Consider the following:

(1) Moody's downgrades the banks. First and foremost, stock prices fell, while bond prices rose today on Monday's news (after the close) that Moody's cut the credit ratings of several small to mid-sized US banks and said that it may downgrade some of the nation's biggest lenders, warning that the sector's credit strength likely will be tested by funding risks and weaker profitability.

That supports our cautious market call for the rest of this year, but it pulls the rug out from under our recommendation to overweight the S&P 1500 Financials, for now. However, we're still expecting lots of M&A activity in the sector to provide a boost to the bank stocks. The downgrade should hasten that scenario. But for now, the downgrade is what it is, i.e., bearish for the Financials over the short term.

Ironically, Moody's downgrade of the banks should make it easier for the US Treasury to fund its deficit with its securities (downgraded by Fitch on August 1) without a significant increase in interest rates in the Treasury's auctions for now. This confirms our prediction that the 10-year Treasury yield’s peak of 4.25% last year on October 24 should not be breached this year. It certainly came close on Friday, when the yield jumped to 4.20% before falling closer to 4.00% by day-end (chart).

The Moody's downgrade should convince Fed officials that the federal funds rate is at a sufficiently restrictive level to bring inflation down without causing a recession. They risk overkill if they continue to hike.

(2) US economy still flying. The Atlanta Fed's GDPNow tracking model is currently showing a 4.1% increase in Q3's real GDP with consumer spending up 3.2% and gross private domestic investment rising 8.1%.

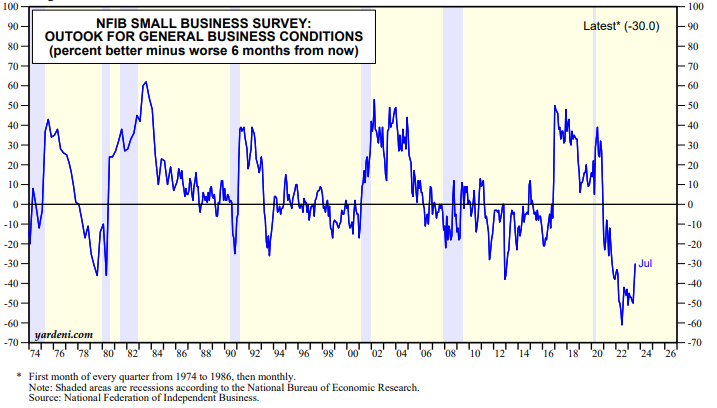

Even the NFIB's small business survey showed a jump in the outlook for general business conditions (chart). The survey's capital expenditures plans improved sharply in recent months. In July, 42.0% of small business owners reported having job openings. So the US labor market remains strong.

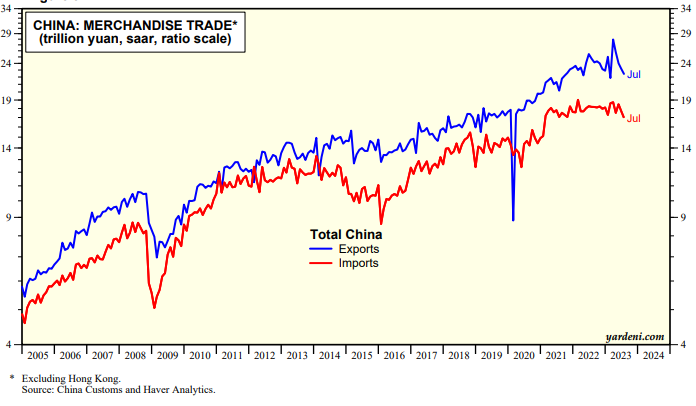

(3) China's trade numbers were weak in July. China's exports and imports continued to fall last month suggesting that both global and domestic demand for goods are weak. The price of copper dropped by more than 1.5% on the news. China's July PPI is likely to show that deflation remains a problem. That would suggest that the July's PPI for finished goods on Friday will also be in deflation territory again as it was in June.