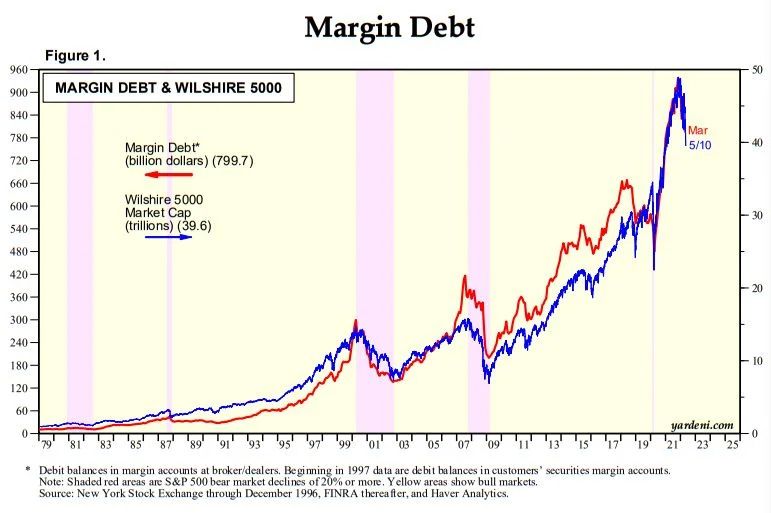

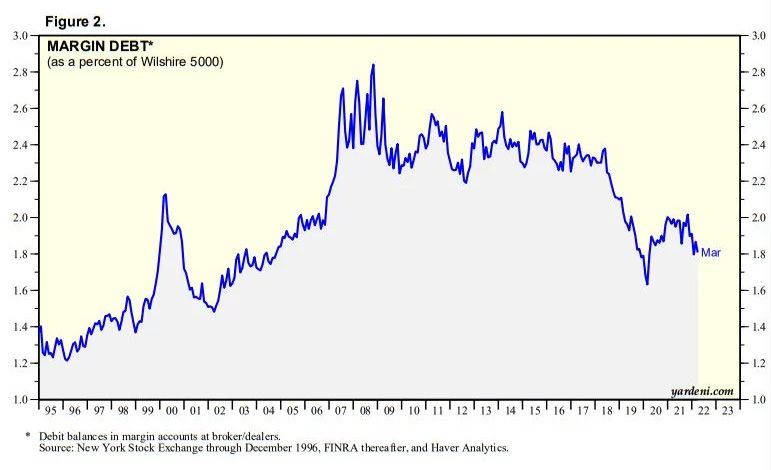

The former was $800 billion during March, down from $950 billion during January, while the latter was $39.6 trillion on May 10. So margin debt is just 1.8% of the market cap of the Wilshire 5000.

In our opinion, the selling pressure has been much more attributable to investors bailing out of equity ETFs. That would account for the indiscriminate selling of stocks. In recent years, lots of money has come out of equity mutual funds and put into equity ETFs. That would explain why a handful of MegaCap stocks' valuation multiples and market caps soared. That's because ETFs aren't restricted from having concentrated portfolios the way that actively managed funds are restricted from putting too much of their portfolios in any individual stock.

Now we are seeing the downside of that: As money comes out of ETFs, the valuation multiples of the MegaCaps have been hard hit. Our hunch is that this indiscriminate selling may have peaked now that the MegaCaps are in a bear market.