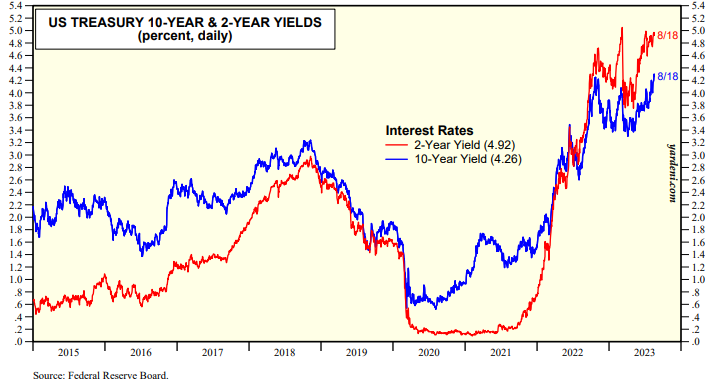

Does the Fed really want to see the yield curve "disinvert" with the 10-year Treasury bond yield (currently 4.26%) rising up to the 2-year Treasury note yield (currently 4.92%) (chart)? We will find out on Friday, when Fed Chair Jerome Powell speaks at the Fed's annual Jackson Hole conference.

If Powell wants to calm the bond market down, he should acknowledge that inflation has moderated significantly and say that if it continues to do so, the Fed will probably lower interest rates next year. That would be consistent with the FOMC's June Summary of Economic Projections showing the federal funds rate at 5.6% this year, 4.6% in 2024, and 3.4% in 2025.

Having disinversion occur with short-term rates falling (along with inflation), and falling faster than long-term rates would be a much better alternative to the one above.

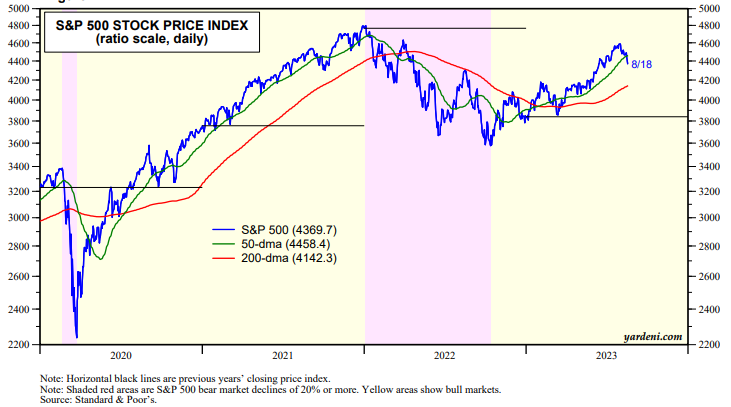

The uncertainty of which version of disinversion will play out is weighing on the stock market (chart). The S&P 500 dropped below its 50-day moving average last week. It is now down 4.95% from its July 31 bull market high. If Powell doesn't calm the bond market, then the S&P 500 could continue to fall towards its 200-dma. That would be almost a 10% decline from July 31. Nevertheless, we still expect a yearend rally to boost the S&P 500 back to 4600 if inflation continues to moderate, as we expect, causing the bond yield to stop climbing.

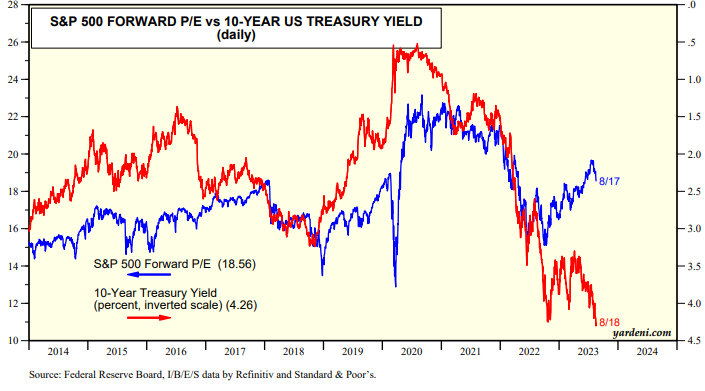

The rising bond yield has been weighing on the S&P 500 forward P/E since August 1, when Fitch downgraded US government debt (chart).

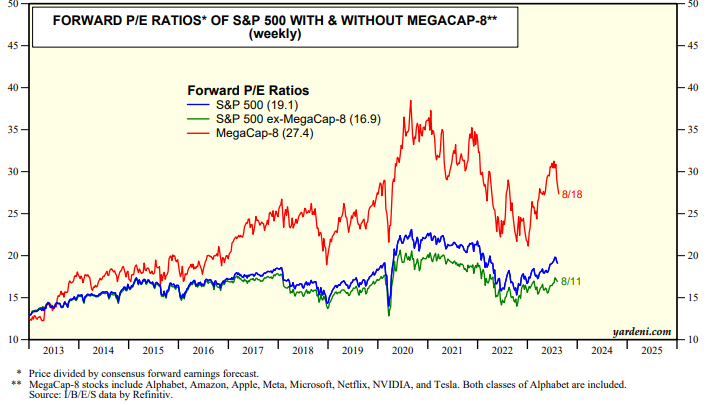

The forward P/E of the MegaCap-8 has been especially hard hit by the rising bond yield (chart). It's down from a recent high of 31 to 27 now.

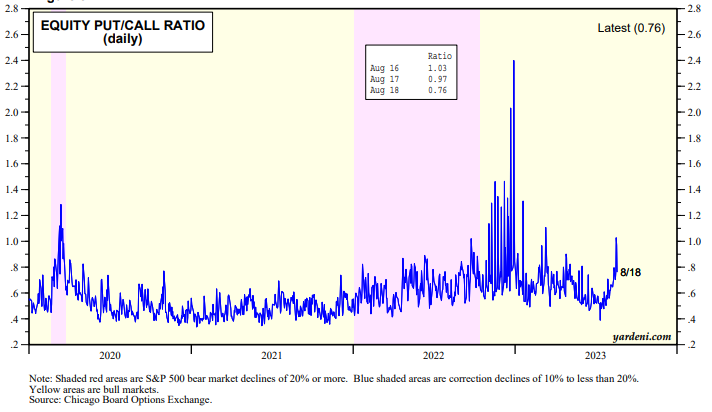

The equity put/call ratio has been trending higher suggesting that investors are starting to worry more about the downside risks of the market (chart).

We asked Joe Feshbach for his latest insights on the stock market from a trading perspective: "Wednesday and Thursday last week had unusually high put/call ratios. That probably explains why the market fought back late on Friday. However, while a short-term bounce is always possible, I continue to remain cautious. I’m not thrilled with many of the individual stock charts, and pessimism is just starting to build. It certainly can increase some more." Thanks Joe!

Finally, below is the performance derby table for the S&P 500 and its 11 sectors and 100+ industries from the bull market's peak on July 31 through Friday's close.