The odds of a Federal Reserve rate cut at the July 29-30 FOMC meeting are down to 4.7% based on futures pricing from the CME FedWatch Tool. A strong June jobs report, which added 147,000 nonfarm payrolls and showed the unemployment rate drop to 4.1%, has significantly reduced expectations for a July cut. Fed Chair Jerome Powell and other Fed policymakers have emphasized a cautious, data-dependent approach, citing persistent inflation above the 2% target and uncertainties from tariffs. Most market participants and analysts now expect the Fed to hold rates steady at 4.25%-4.50%, with a September cut being more likely, at 60.7% probability.

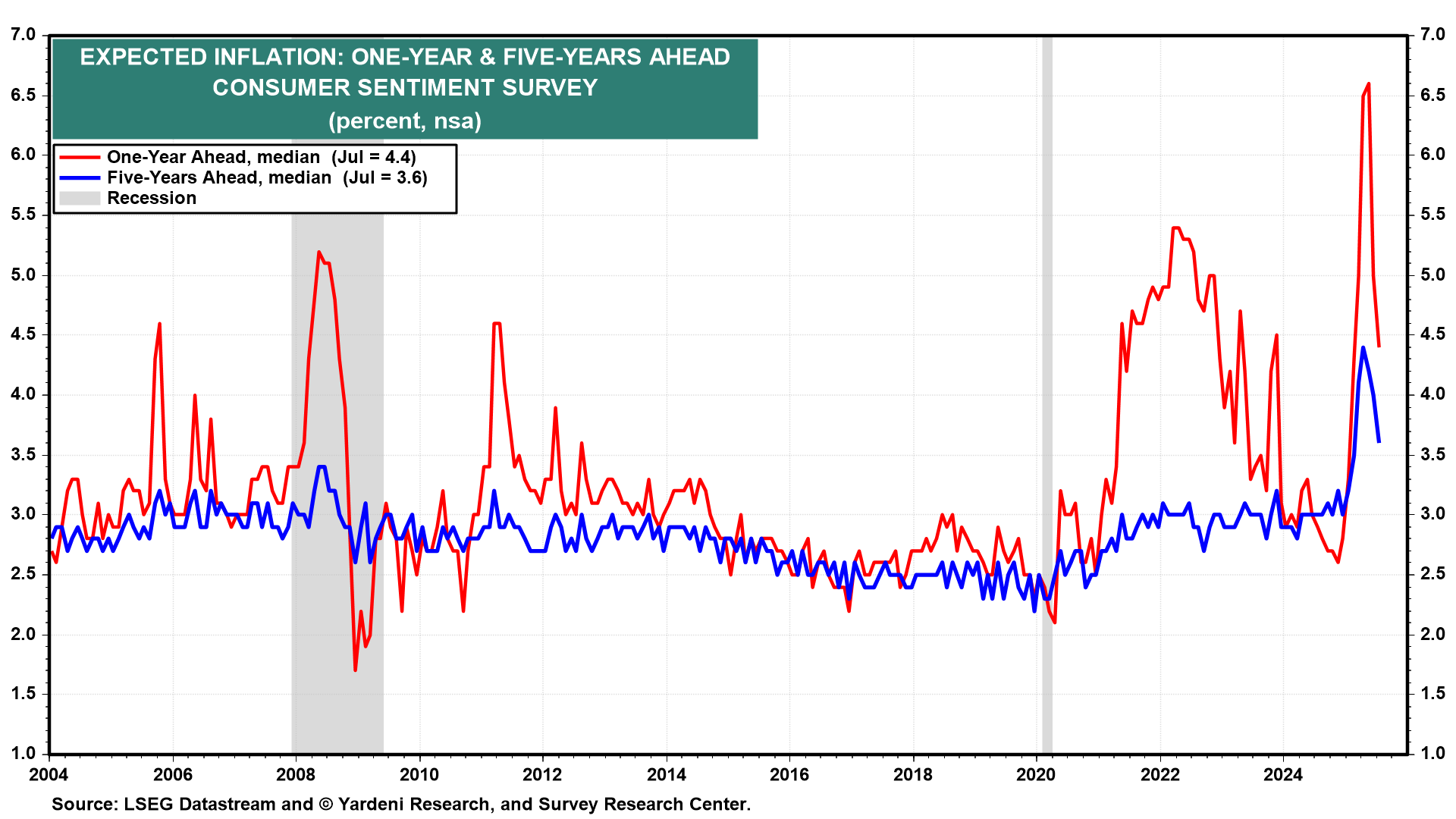

The latest batch of weaker-than-expected inflation reports, including the drop in July's expected inflation series, might persuade Fed Chair Jerome Powell and his colleagues to signal they are leaning toward lowering the federal funds rate at the September 16-17 meeting, as markets expect (chart).

We expect a more dovish tone from next week's FOMC statement and Powell's press conference. If so, that would continue to fuel the bull market in stocks, especially since the Q2 earnings reporting season should continue to beat expectations. The blended (actual/estimated) S&P 500 earnings per share growth rate edged up to 4.3% y/y last week (chart). It should be closer to 8.0% when all the results are in.