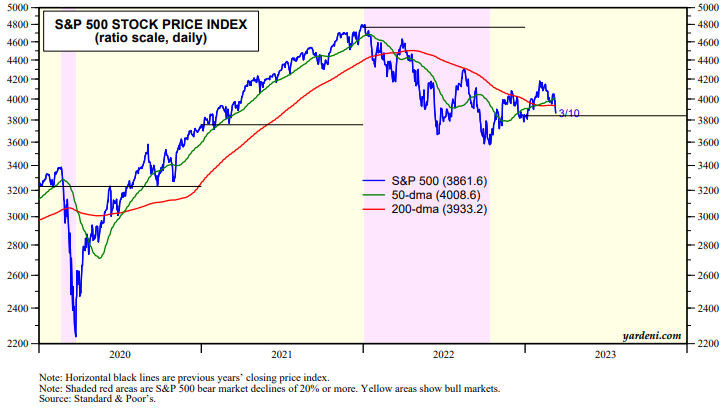

The S&P 500 dropped 3.3% on Thursday and Friday, led by money center and regional bank stocks as a result of the SVB debacle. The index fell through both its 50-day and 200-day moving averages to close at 3861.59, just 0.6% above its 2022 close (chart). January’s big gains among the 11 sectors of the S&P 500 mostly evaporated during February and the first 10 days of March.

Last week’s rout in the stock market started on Tuesday, March 7, when the S&P 500 fell 1.5% following Fed Chair Jerome Powell’s congressional testimony that day. He came across as more hawkish than he had been at his February 1 press conference mostly because January’s economic and inflation data were stronger and hotter than expected. Market expectations for the federal funds rate decision when the FOMC meets later this month jumped from an increase of 25bps to 50bps following his testimony. In response to SVB’s debacle, expectations were back down to a 25bps rate hike.

We asked Joe Feshbach, our go-to market maven, for an update of his thoughts on the S&P 500. He responded: "Two weeks ago, the Financials started to falter and were pounded this past week. That’s almost never a good sign for the stock market, especially as the market entered by our estimation the corrective phase of what has been a very wide trading range in the S&P 500 (3500-4200). I mentioned that premature rallies only extend the corrective process and that's what occurred." We note that S&P 500 Regional Banks was especially hard hit last week (chart).