The latest bull market, which started on October 12, when the previous bear market ended, may be on course to be among the most hated bull markets in history. That's because it started with historically high P/Es. In the past, valuations offered compelling opportunities at the end of bear markets. Most despicable is that the bull has the chutzpah to charge ahead when almost everyone agrees a recession is coming any day now. The bull is a contrarian and the consensus crowd hates him for it and continues to claim that it is a rally in a bear-market.

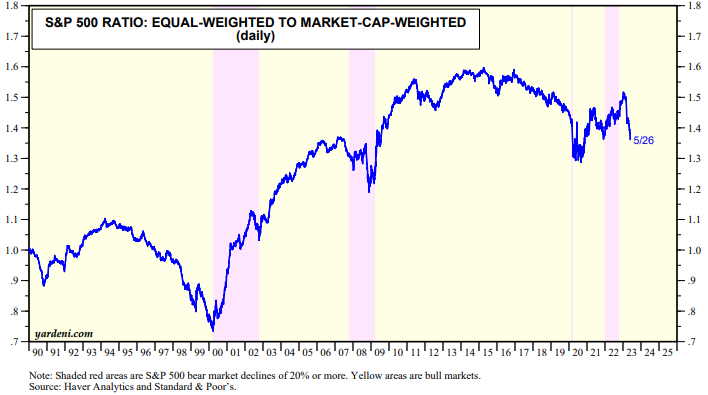

Especially disconcerting to the crowd is that the S&P 500 has continued to rally since March 8, when the banking crisis started. They observe that the ratio of the equal-weighted to market-cap-weighted S&P 500 has plunged since then (chart). Such bad breadth is not the hallmark of young bull markets.

Yes that's true, but look at the breadth of earnings forecasts. The percent of S&P 500 companies with positive 3-month percent changes in forward earnings rose to 73.9% during the May 26 week (chart).