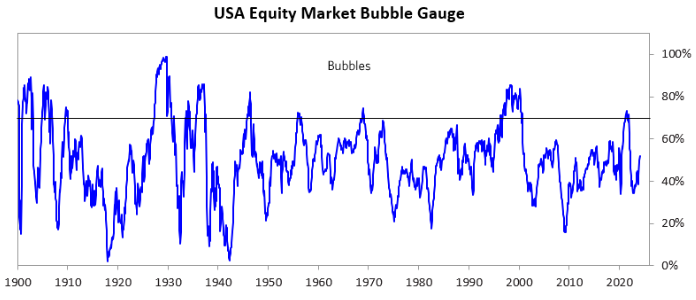

In a February 29 LinkedIn post, Ray Dalio wrote that his bubble gauge for the overall stock market is at a mid-range reading of 52 (chart). He concluded that the stock market "doesn't look very bubbly." His meter is based on six inputs that signal whether speculative activity is too widespread. So it is currently indicating rational exuberance rather than irrational exuberance, which typically fuels a meltup that turns into a meltdown.

Source: Ray Dalio

We agree, for now. However, we didn't agree with Dalio's outlook last year. On September 28, 2023, he was interviewed by Sara Eisen on CNBC. While we were bullish back then, he sounded quite bearish, warning, "We’re going to have a debt crisis in this country." He added, "I think you’re going to get a meaningful slowing of the economy." Nevertheless, we're glad that Dalio's meter is currently confirming our view.

The S&P 500 is up 19.5% since Dalio's September 28 interview to 5137.08 on Friday. We are still targeting 5400 by the end of the year (chart). If it gets there a lot sooner, say by mid-year, we expect Dalio's meter will be higher at levels that are consistent with past bubbles. We hope he continues to update it and share it with the rest of us.

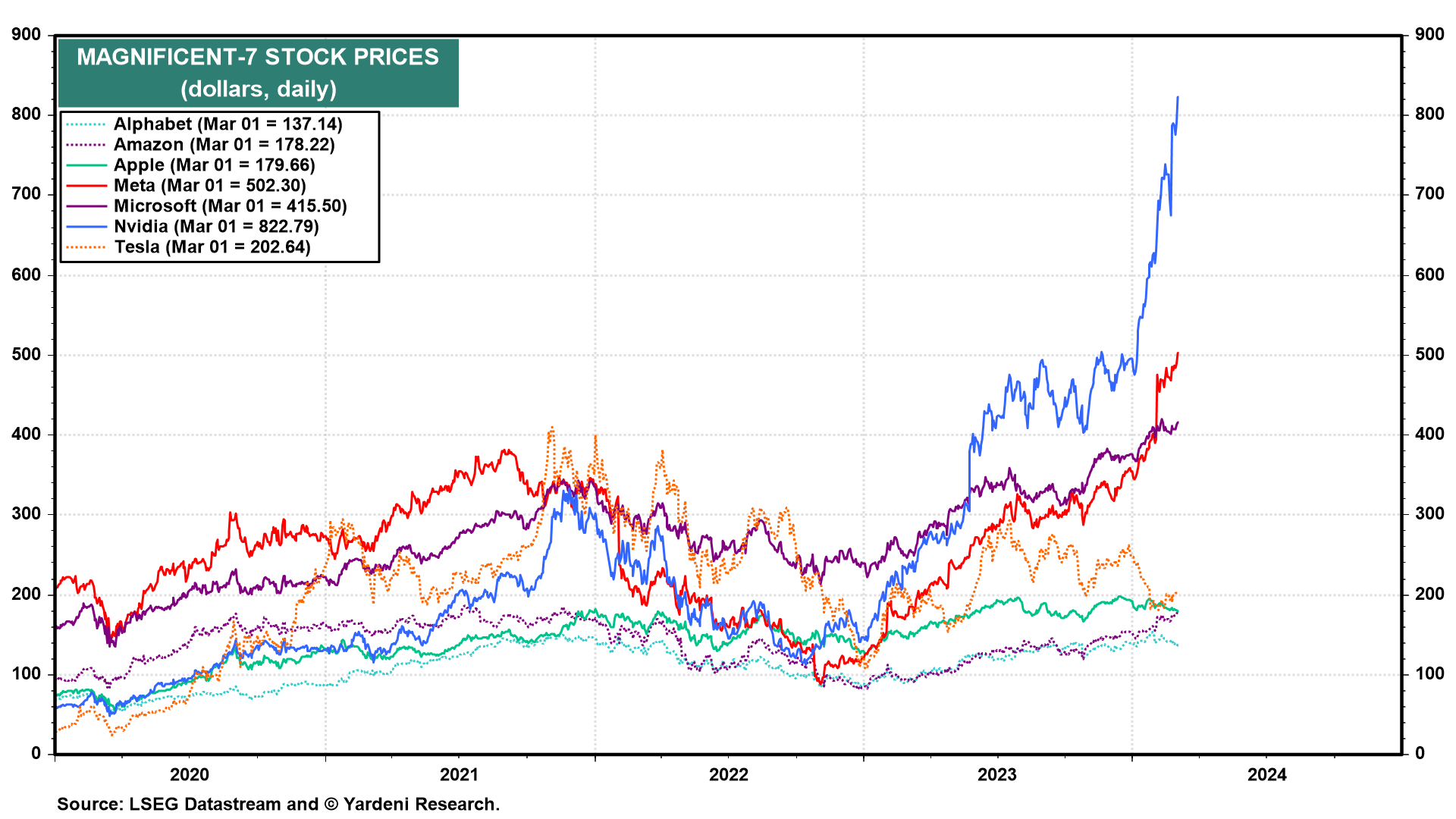

We asked Joe Feshbach for his opinion about the stock market from a trading perspective: "The tech stocks continued to climb after Nvidia, the last of the Magnificent 7 reported their earnings. However, the advance is getting even more narrow as some of the prior leaders like Alphabet, Apple, and Microsoft have started to lag (chart). Breadth on Nasdaq in aggregate remains very unimpressive, while the Nasdaq 100 breadth is almost keeping pace with the index. The tech stocks that continue to rally are looking parabolic, which is often indicative of a final climax. This is all occurring while a variety of sentiment indicators show optimism for the near term. My view is that this environment is entering one of heightened risk."

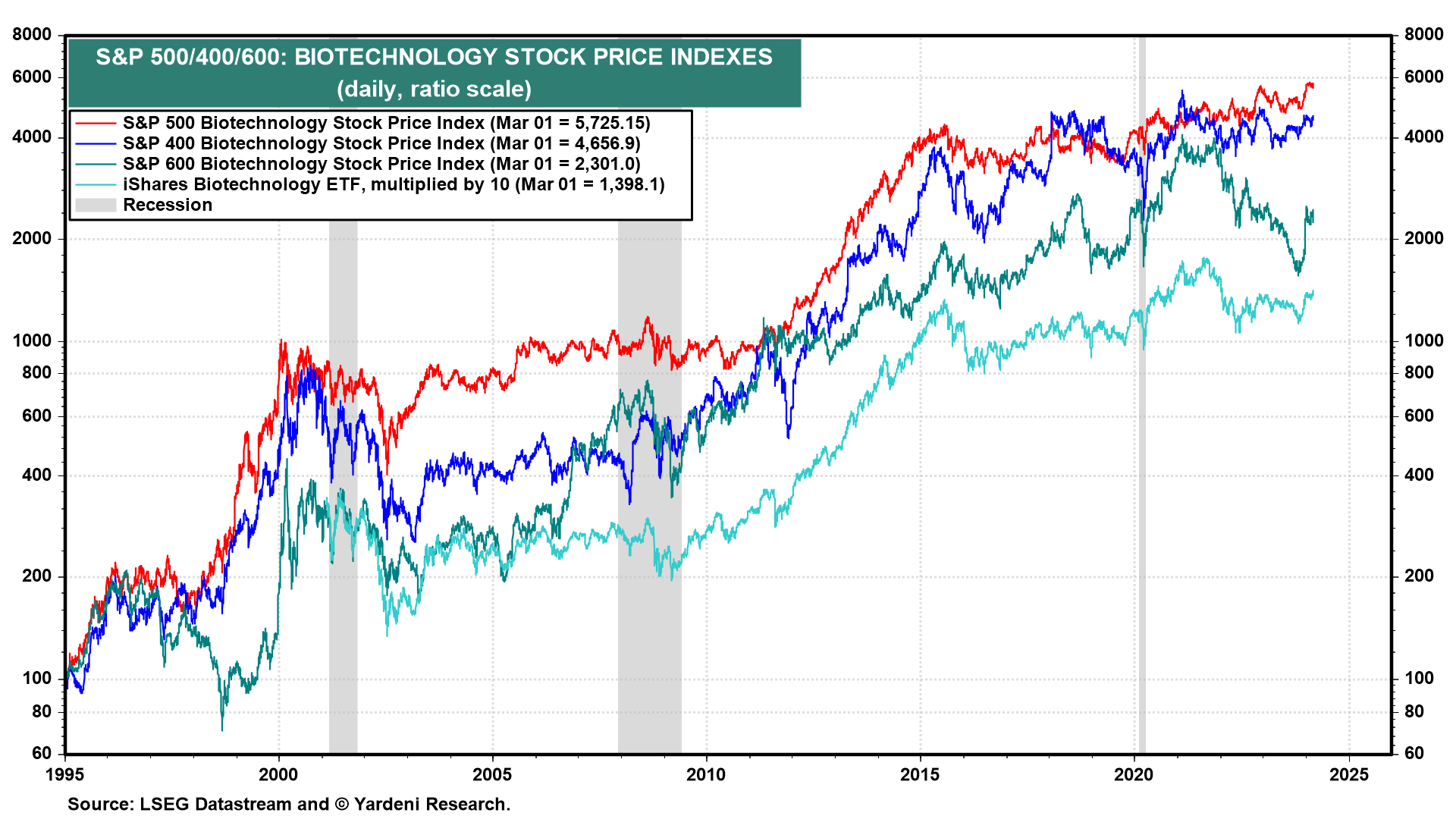

Michael Brush provided us with an update of insider activity: "Insider buying remains light relative to selling, suggesting a lack of appetite for stocks at these levels. Insiders who are buying favor three areas: biotech firms, regional banks, and investment companies that offer rich yields of 10% or more. The insiders' activities suggest: (1) the biotech break out rally will continue (chart); (2) lingering fears about regional bank exposure to commercial real estate and deposit flight are exaggerated, and (3) interest rates may fall, benefitting companies and closed end funds structured to deliver high payouts."