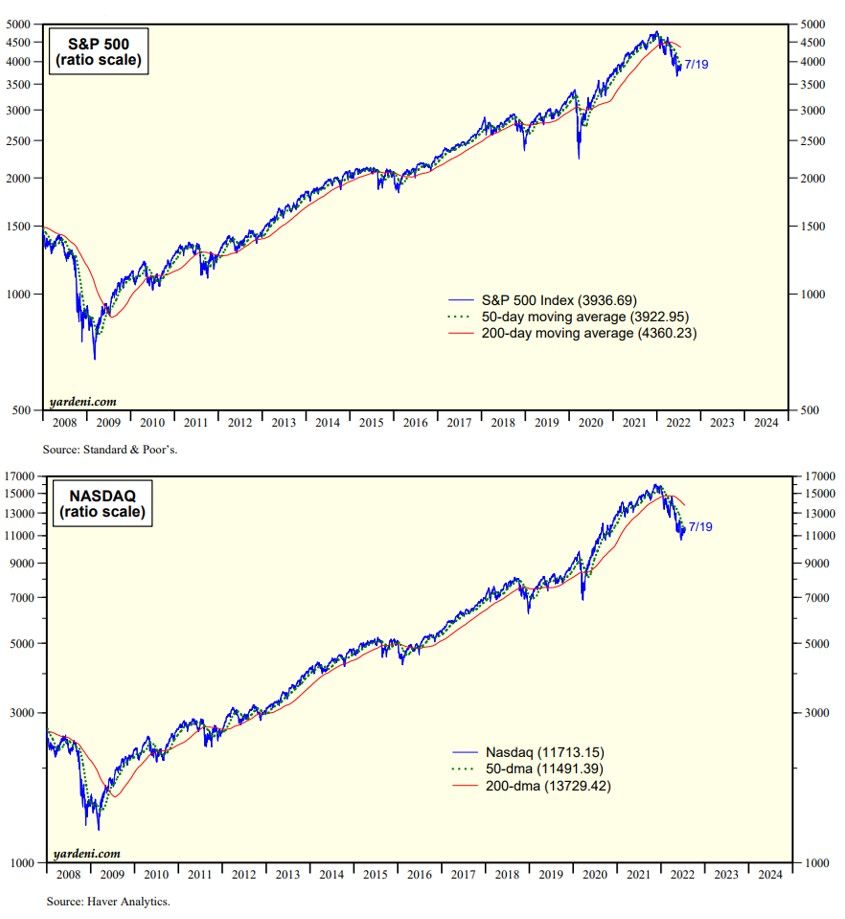

The S&P 500 rose yesterday by 2.76% to 3936.69. It is up 7.4% from its June 16 low of 3666.77. At that low, the index was 23.4% below its January 4 record high. Now it is down 17.9% from the record high.

The S&P 500 index rose above its 50-day moving average yesterday. The Nasdaq also rose above its 50-day moving average yesterday (charts).

Bearish sentiment remains high. Investors Intelligence Bull/Bear Ratio rose to only 1.0 this past week, which is bullish from a contrarian perspective. On the other hand, the Fed is on course to raise the federal funds rate by 75bps next Wednesday. That has certainly been discounted by the markets. The rally since June 16 may be discounting that June's CPI marked peak inflation and that July's CPI (to be released August 10) will show that inflation is moderating.