Today’s batch of economic indicators resulted in an increase in the Atlanta Fed’s GDPNow tracking model to 2.5% real growth for Q2, up from 1.8%.

The “nowcasts” of real personal consumption expenditures growth, real gross private domestic investment growth, and real government spending growth increased from 4.3% to 4.8%, -2.8% to -1.3%, and 1.4% to 1.6%, respectively. There’s no recession suggested by those numbers.

April’s retail sales report showed a broad rise of 0.9%. March’s was revised upward from 0.5% to 1.4%. The increase in retail sales was led by receipts at auto dealerships, which rebounded 2.2%. Industrial production rose 1.1% to a new record high, led by a 3.9% increase in motor vehicles production. Apparently, the auto industry’s parts shortages are diminishing. Output of information technology equipment and components remained unchanged at the March record high. There’s no recession in any of those numbers.

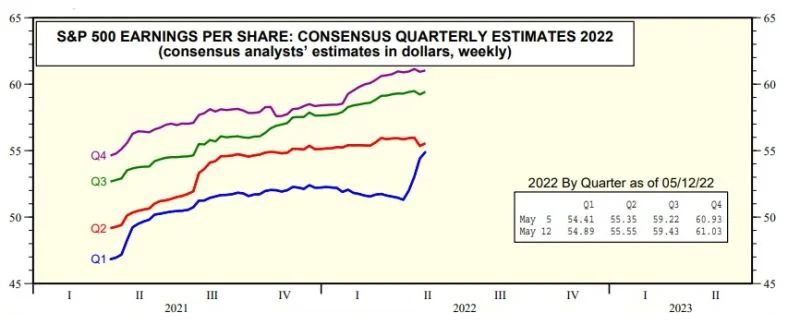

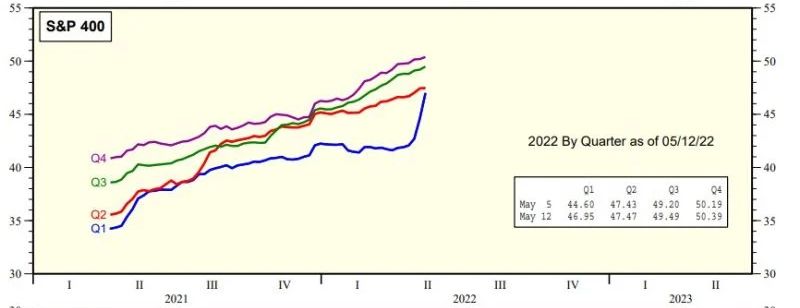

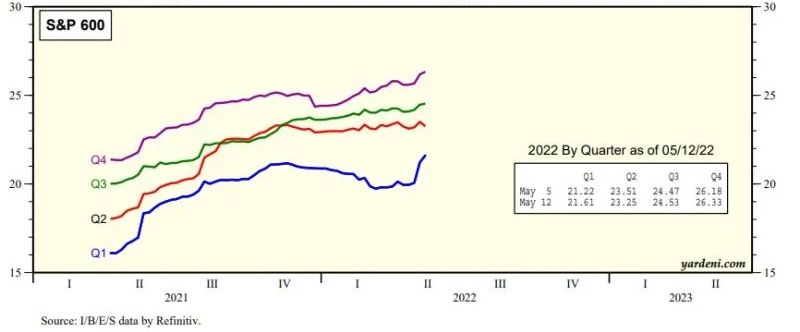

Q1 earnings for the S&P 500, S&P 400, and S&P 600 indexes have come in better than industry analysts expected, with the blended numbers (estimates and actuals) showing double-digit y/y gains during the May 12 week of 11.7%, 30.1%, and 21.7%. The analysts continue to raise their earnings estimates for Q2, Q3, and Q4. They didn’t get the recession memo.