Wow, the Fed lowered the federal funds rate (FFR) by 50bps yesterday and the economy is already responding. Jobless claims fell and two regional business surveys strengthened in September, while the Coincident Economic Index rose to a new record high, though in August!

We are kidding, of course. But perhaps the economy didn't need to be stimulated so much. It appears Fed officials got their soft landing but feel a need to act fast to avert a hard landing. The most immediate impact of the Fed's easing move was to send stock prices soaring today to new record highs in a way that is reminiscent of the late 1990s meltup. Consider the following:

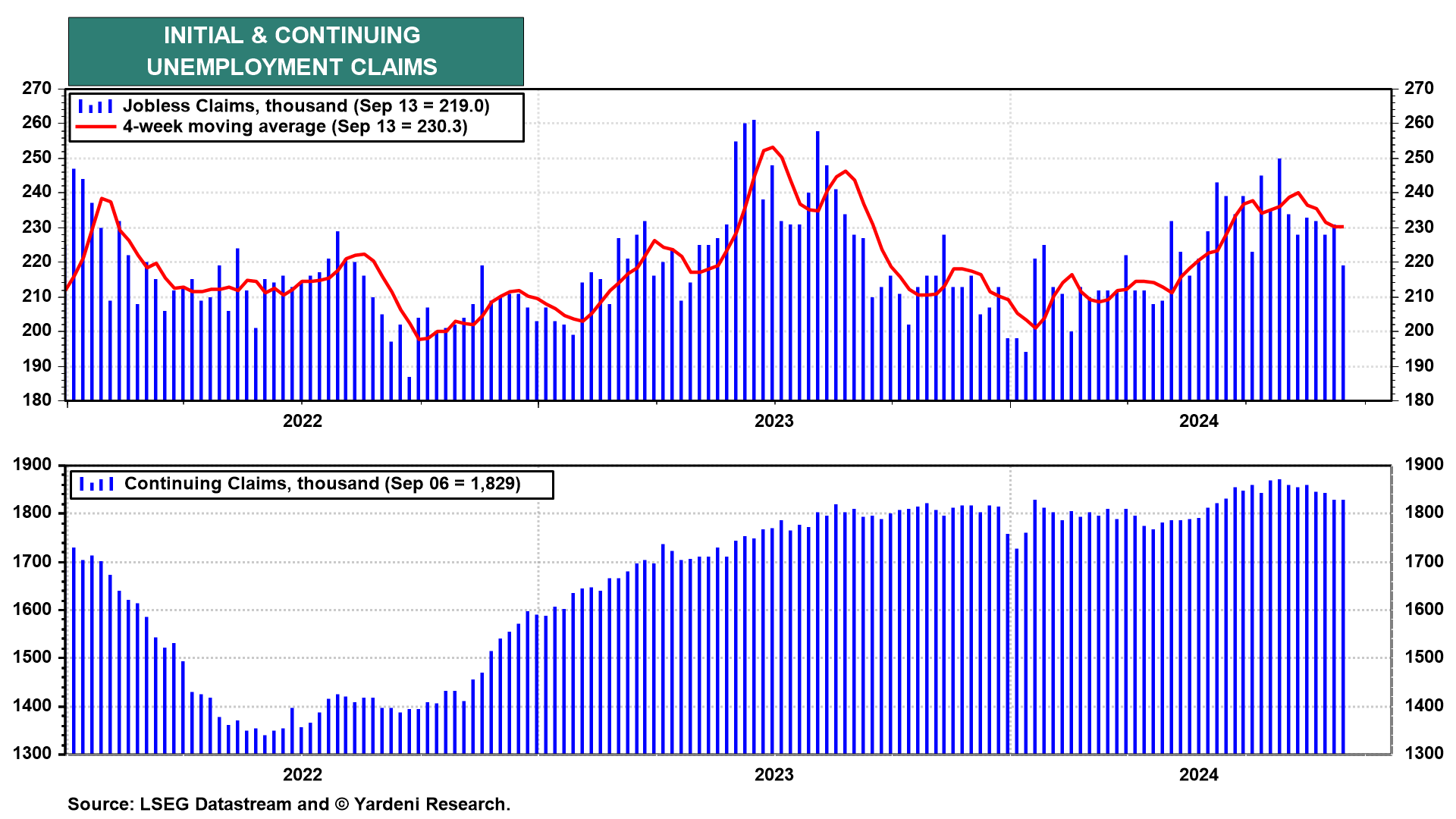

(1) Jobless claims. The labor market is already seeing fewer layoffs, just as we predicted during the summer. Initial weekly unemployment claims fell 11,000 in the week ended September to 219,000 (chart). That was the lowest level since May. Continuing claims also fell by 21,000 to 1.829 million in the week prior, a substantial decrease in the number of Americans on unemployment benefits.

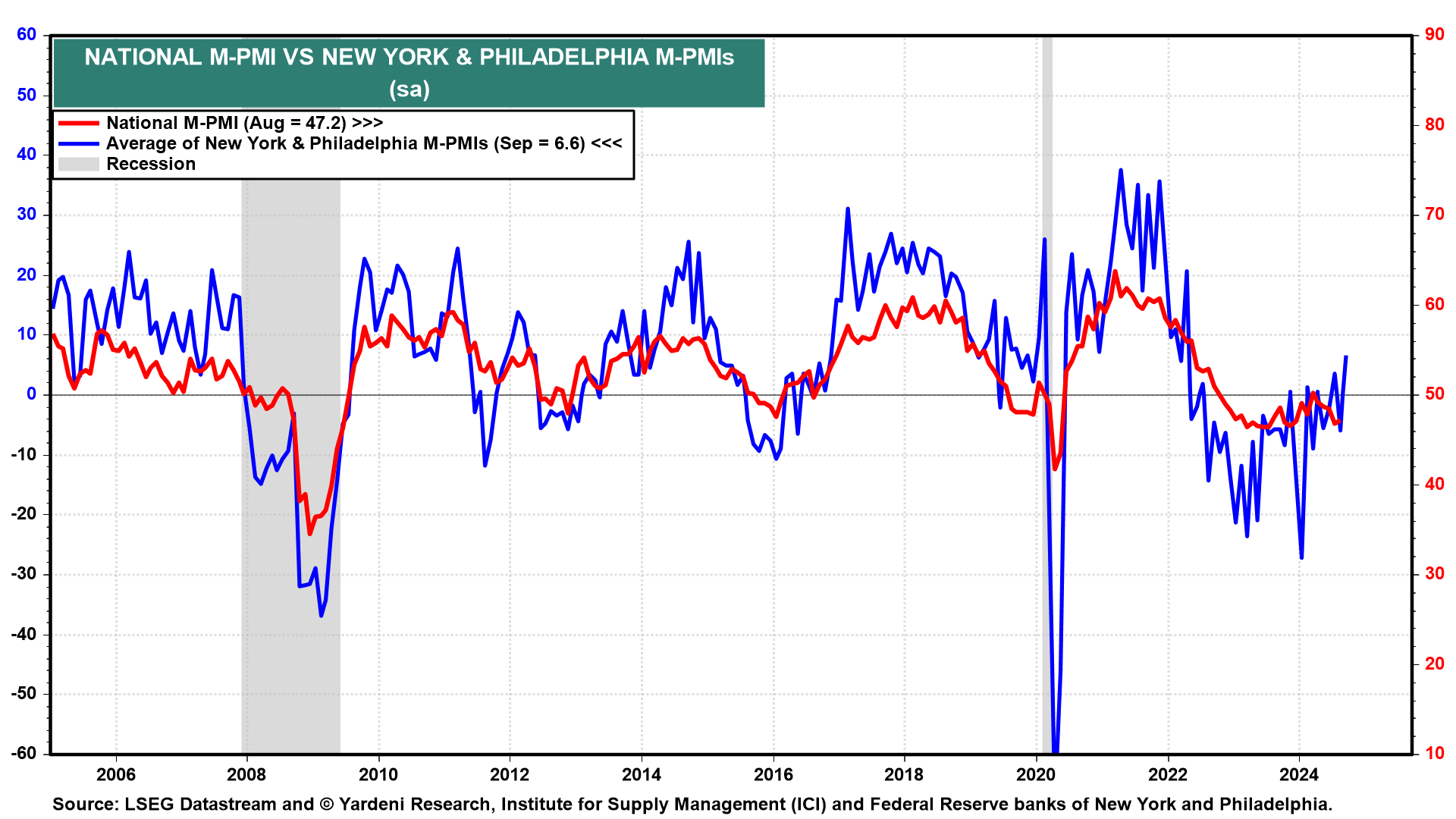

(2) Business surveys. September's Philly Fed's M-PMI jumped back into positive territory this morning following a spike in the New York Fed's M-PMI earlier this week (chart). Assuming the other three regional Fed surveys follow suit, this bodes well for September's national ISM M-PMI. It suggests that yesterday's rate cut will be an additive force to an already recovering goods-producing sector. Also of note, the Philly Fed's employment index jumped from -5.7 to 10.7 this month. Meanwhile, the prices paid indexes in both the New York and Philly surveys are climbing again.

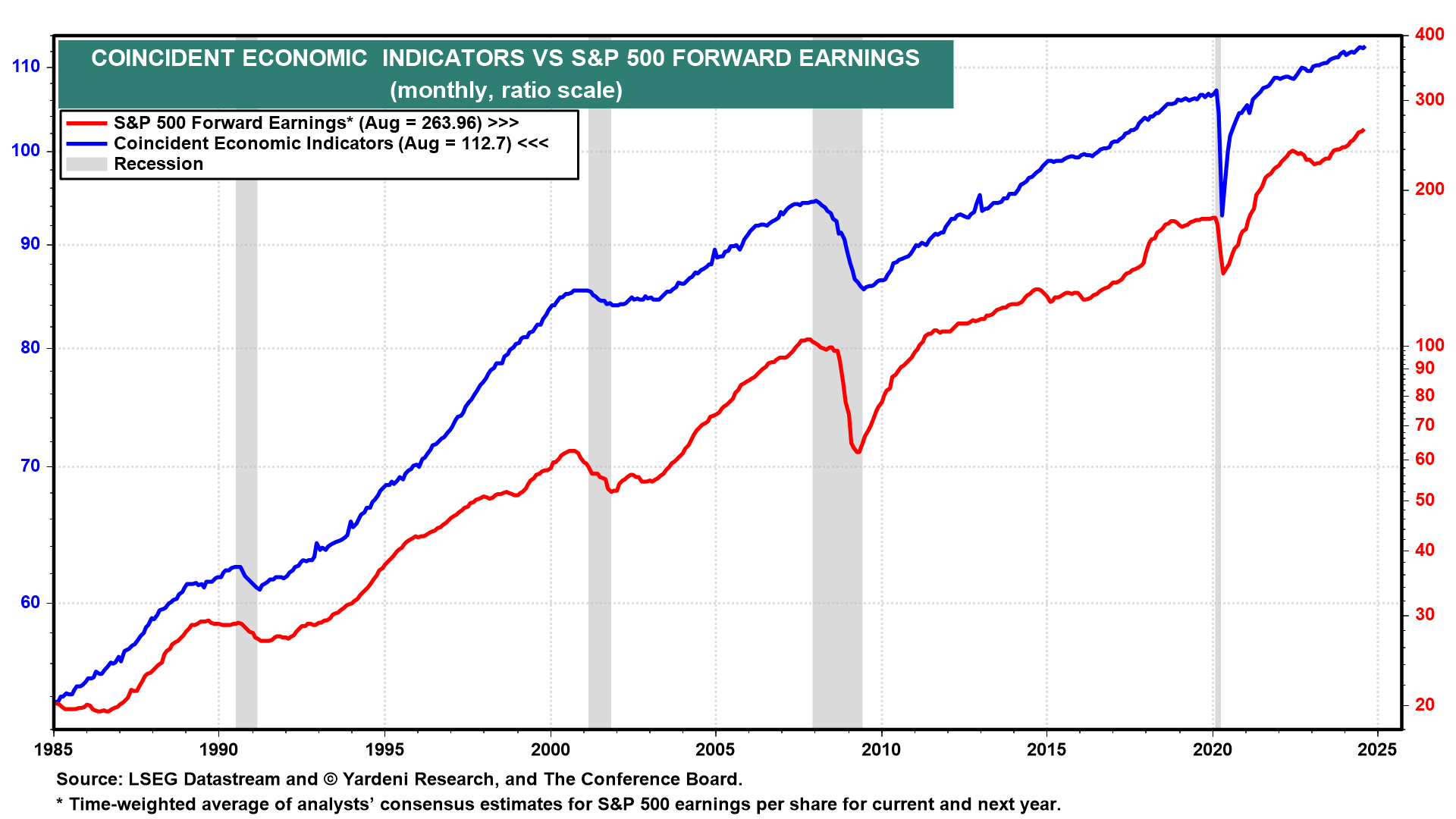

(3) Composite Economic Indicators. The Conference Board Coincident Economic Index (CEI) for the US increased by 0.3% m/m in August to a new record high (chart). The CEI's component indicators—payroll employment, personal income less transfer payments, manufacturing and trade sales, and industrial production—are included among the data used to determine recessions in the US. All components improved in August, with industrial production recovering the most after July's decline. The CEI is highly correlated with S&P 500 forward earnings, which rose to a record high in August too. The Leading Economic Index fell again as it has been since its record high during October 2021. It has been a very misleading indicator for a very long time.

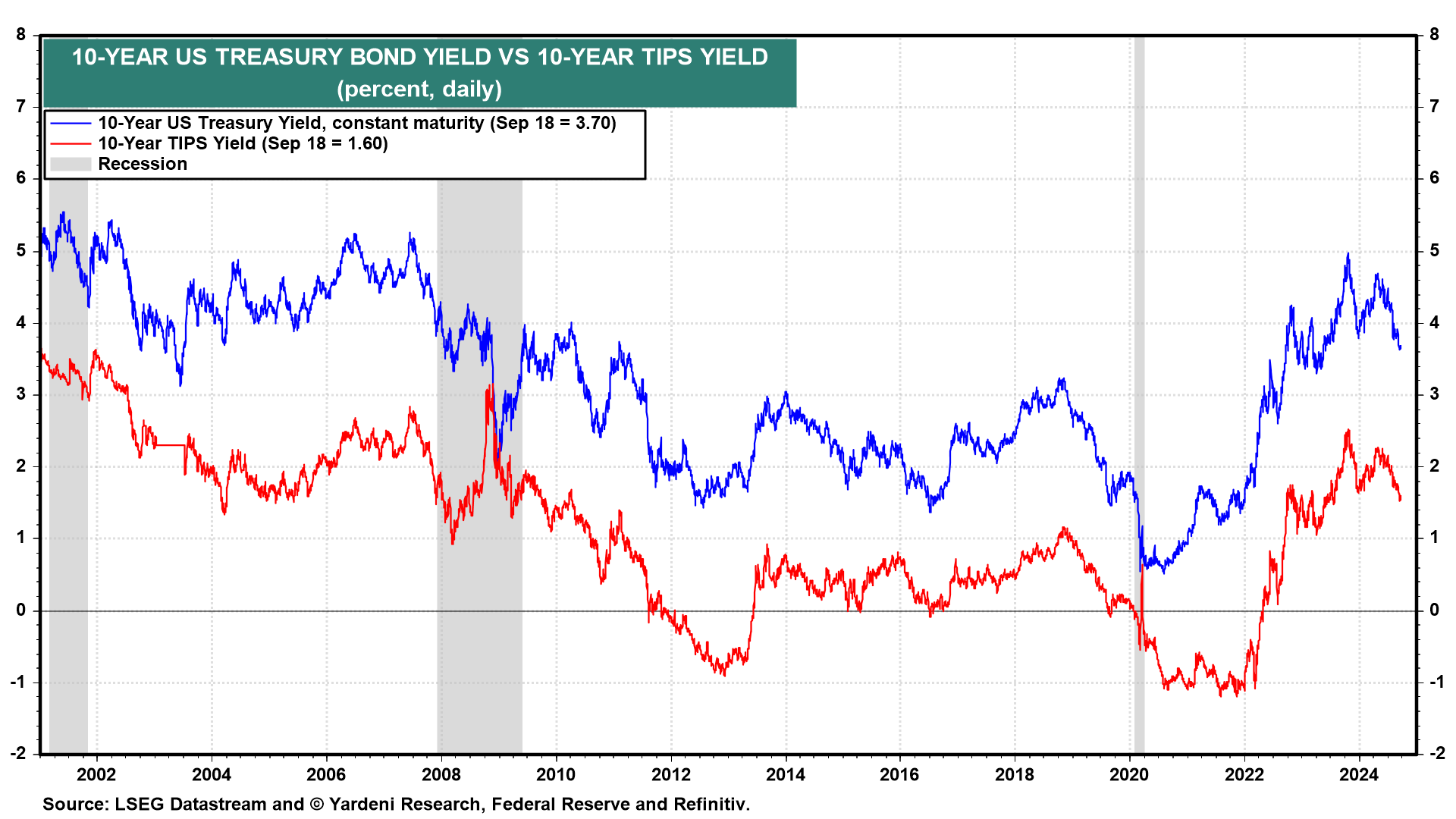

(4) Bond yield. The 10-year Treasury yield is up 13 bps from its Tuesday closing level to 3.75% today (chart). While TIPS yields are edging higher, nominal Treasury yields are climbing even more, suggesting that the bond market is less convinced that inflation will be lower in the future now that the Fed is slamming the pedal to the metal.

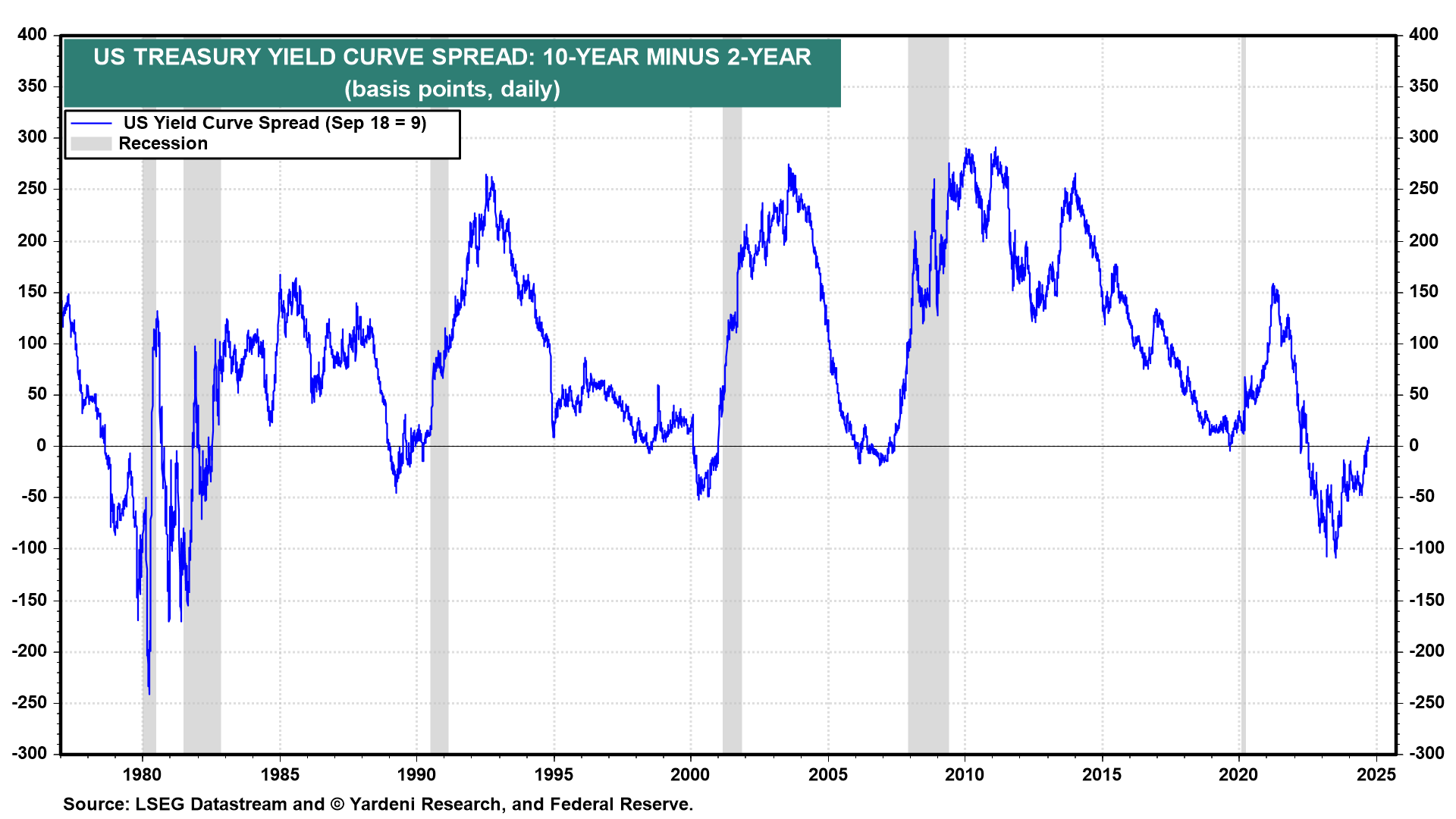

(5) Yield curve. The US Treasury yield curve spread between the 10- and 2-year bonds steepened further into positive territory, rising to 0.13 percentage points early today (chart). The current move confirms that the bond market doesn't think the economy needed yesterday's 50bps jolt.

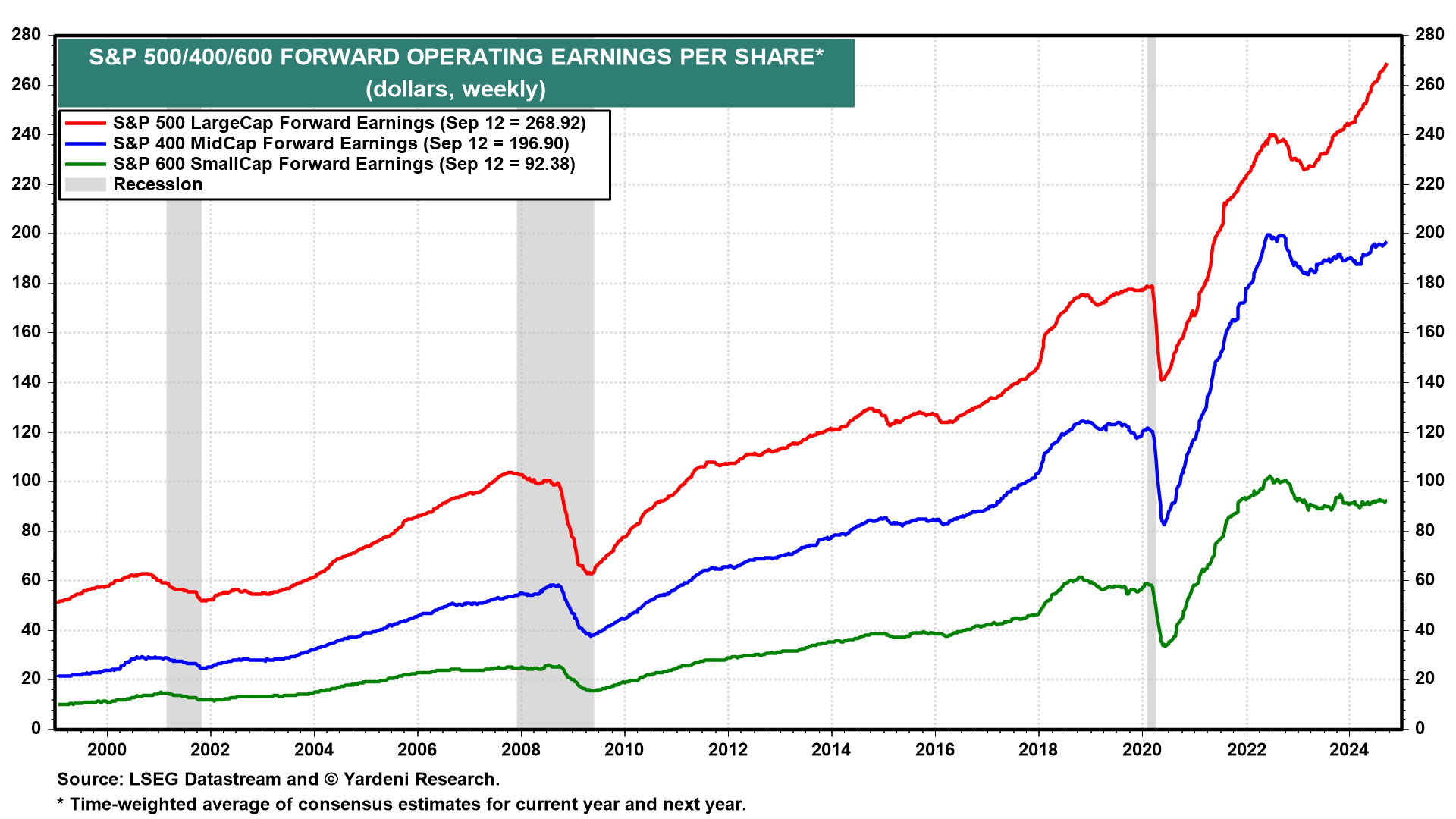

(6) Stock market. US stocks are surging this morning, led by the Nasdaq. The Russell 2000 index of SmallCaps is up less than MegaCap tech stocks, however. This jibes with our forecast that the Fed won't cut rates by as much as widely anticipated due to stronger-than-expected economic data. Had the Fed's rate cut yesterday confirmed expectations of a wave of cuts, then SmallCaps would rally much harder after having both stock prices and forward earnings remaining relatively flat since the Fed began raising rates (chart).