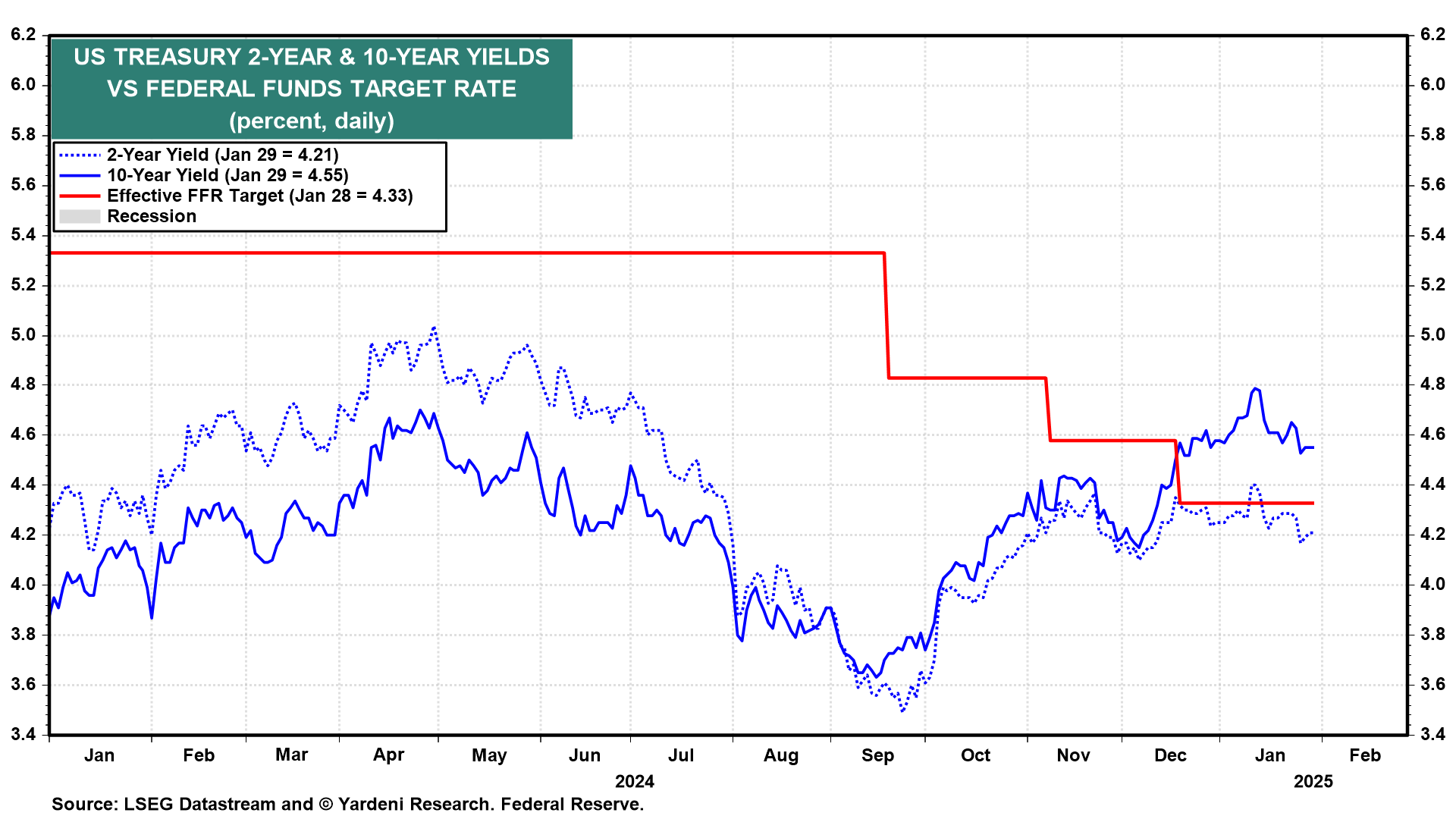

The FOMC left the federal funds rate (FFR) unchanged yesterday at 4.25%-4.50%, as widely expected. At his presser yesterday, Fed Chair Jerome Powell confirmed that the Fed might pause cutting rates for a while. He mentioned five times that the Fed is in no hurry to resume the cutting. He said eight times that the Fed needs to see further progress in lowering inflation.

Powell acknowledged that the labor market has been stronger than the FOMC expected when the committee began lowering the FFR, by 50bps on September 18. He claimed that the Fed's policy is working to achieve its dual mandate of keeping the unemployment and inflation rates low.

Nevertheless, he signaled that the Fed isn't done easing by stating that the FFR remains restrictive. He said that it is "meaningfully" above the neutral rate. Regarding fiscal policy, he observed that it is unpredictable, which is another reason for the Fed to pause. Our conclusion is that the Fed remains patiently dovish. Stock and bond markets didn't react much.

Here are a few more of our thoughts on the Fed as well as yesterday's US economic growth data and tech company earnings reports:

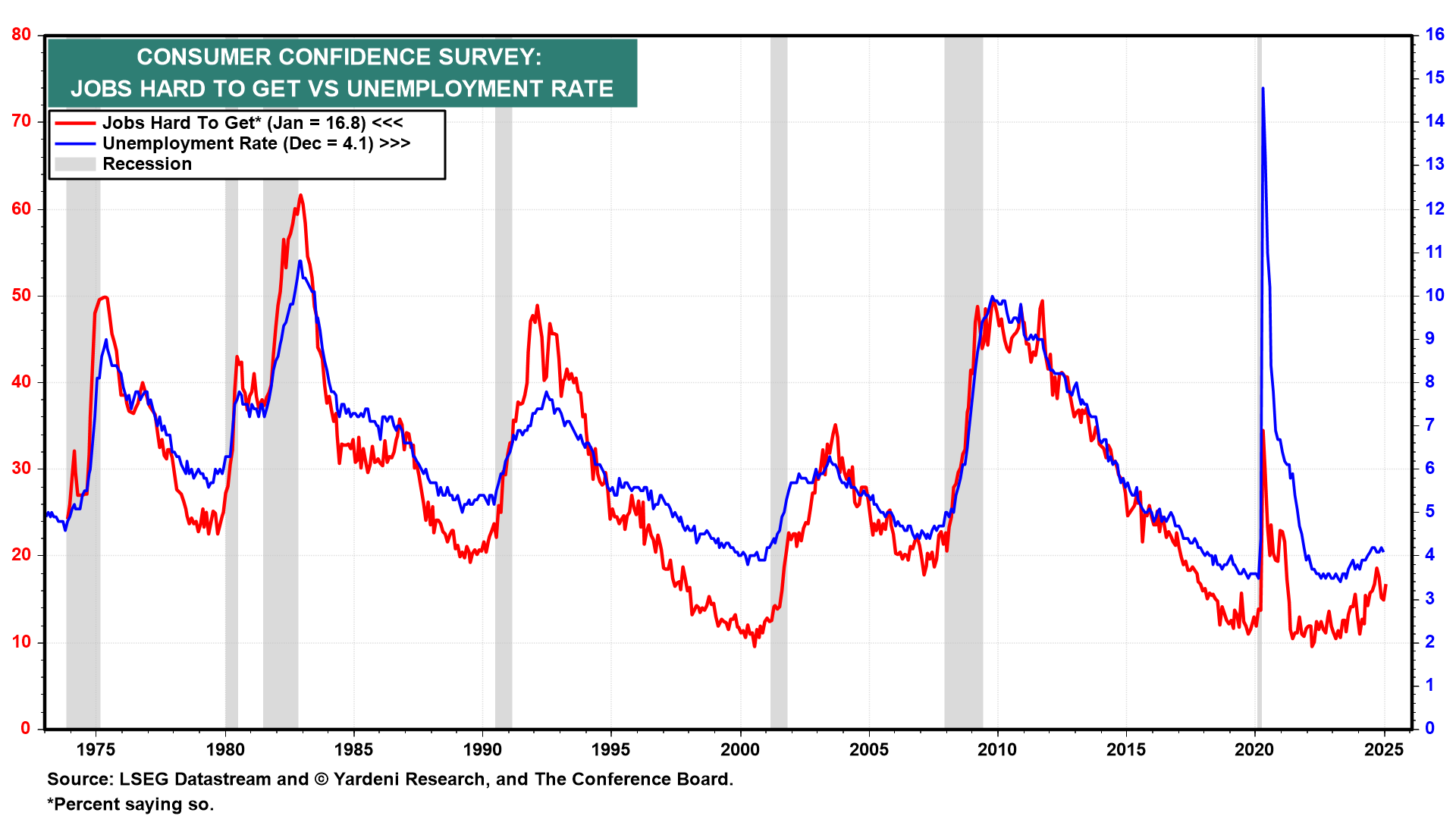

(1) Labor market. We are pleased to see that the Fed finally concurs with our upbeat assessment of the labor market. The FOMC lowered the FFR by 100bps from September 18 to December 18 largely because of the committee's concern about (misleading) signs of weakness in the jobs market. January's consumer confidence survey confirms that jobs are relatively plentiful rather than hard to get, suggesting that the jobless rate remains low (chart).

Powell agreed with that assessment: "The labor market does seem to be pretty stable and broadly in balance, when you have an unemployment rate that has been pretty stable now for a full half a year."

(2) Bonds. Powell dismissed the backup in bond yields again, as he had in December, saying: "For reasons unrelated to our policy, longer rates have moved up" (chart). We disagree. We think that the bond market has been signaling that the Fed was risking reviving inflation by stimulating the economy when it didn't need stimulating. In addition, the Fed was ignoring that fiscal policy might turn inflationary under the new administration.

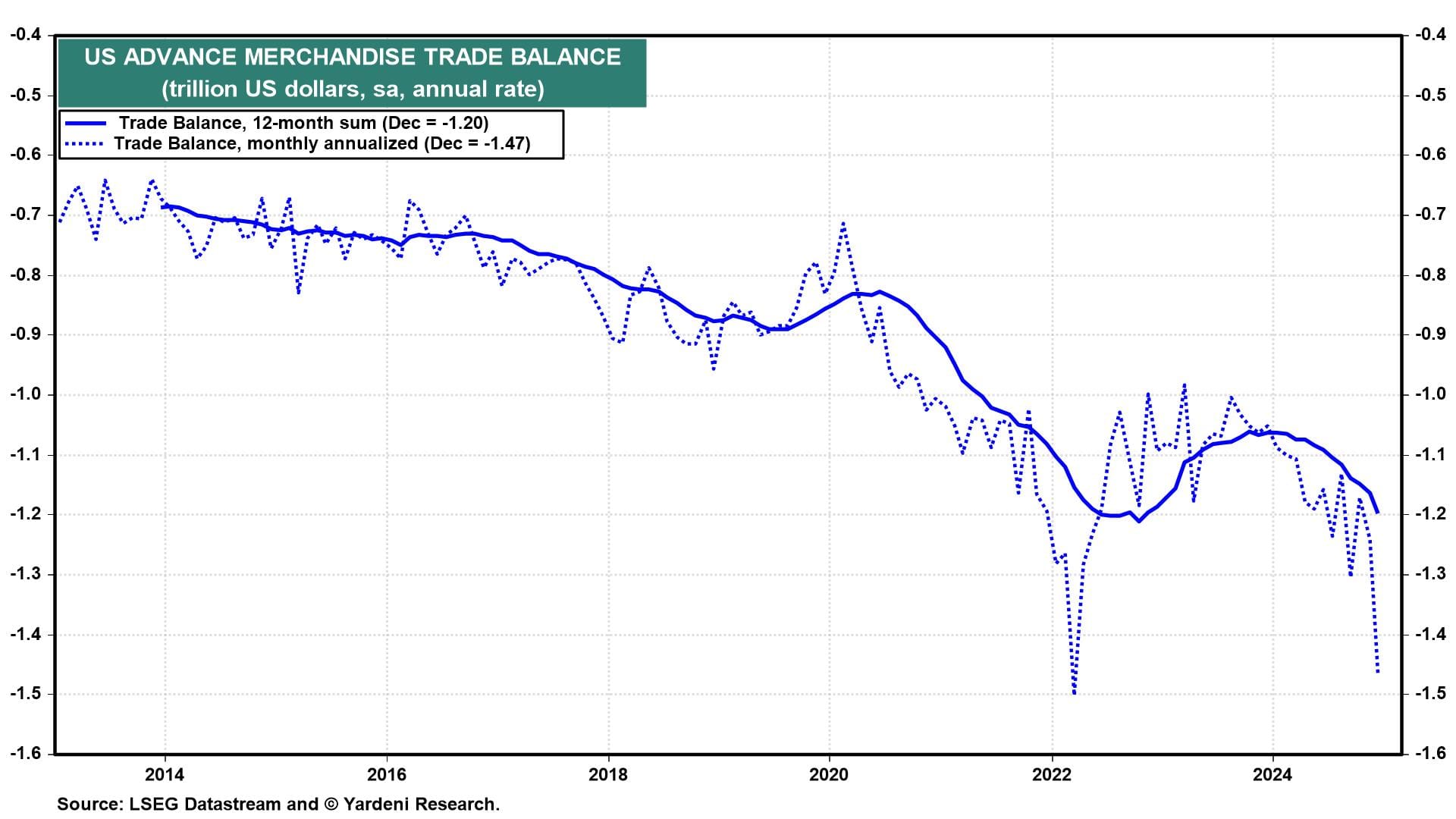

(3) GDP. Yesterday, the Atlanta Fed's GDPNow tracking model revised its Q4-2024 estimate for real GDP growth down from 3.2% to 2.3% (saar). Much of the decline was due to a huge trade imbalance in December, as imports surged ahead of expected tariff increases (chart). Today's GDP release showed an increase of 2.3%, but most of the weakness was due to slower inventory accumulation and a small decline in real capital spending. Real consumer spending jumped 4.2%.

(4) Earnings. Tesla and Meta share prices both rose this morning, while Microsoft slipped following their Q4 earnings reports after the market closed yesterday. We are still expecting a solid 12% y/y gain in S&P 500 earnings per share for Q4 once all the S&P 500 companies have reported.