Today started out with a triple whammy for the stock market. Meta took it on the chin, the GDP report was stagflationary, and the bond yield rose to a five-month high:

(1) Meta. Yesterday afternoon after the stock market close, Mark Zuckerberg, Meta's CEO, took some air out of the AI bubble by saying his company would have to spend a fortune to make this technology work and the benefits could take a long time to occur. That insight is likely to apply to lots of other companies entering the AI arms race. However, the designers and manufacturers of the AI arms will certainly benefit right away. Furthermore, all the money that will be spent to compete in the AI arms race will undoubtedly pay off in greater productivity and profitability.

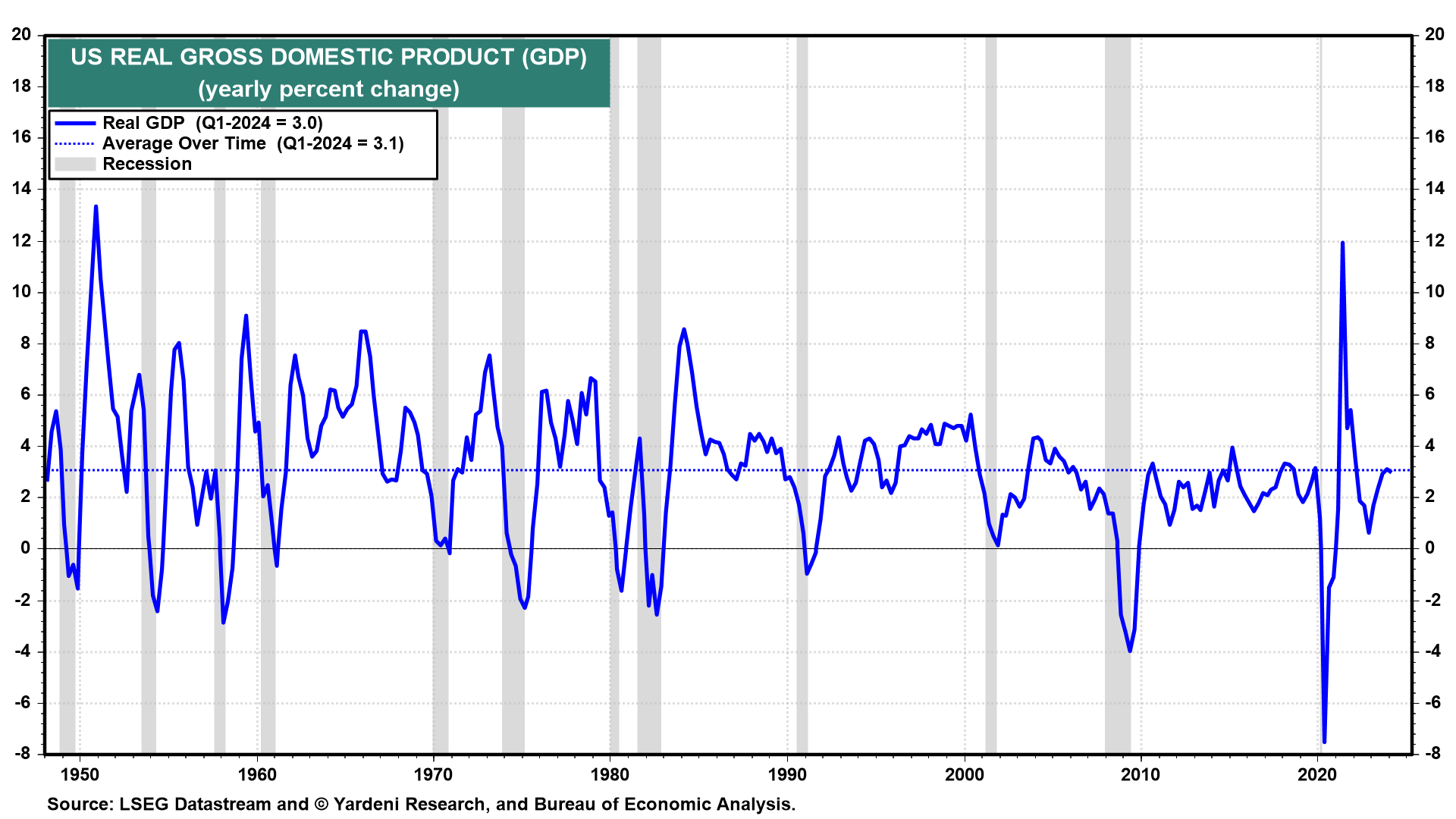

(2) GDP. Q1's real GDP rose only 1.6% q/q (saar). Most of the weakness was attributable to slower inventory investment and to stronger imports. Real final sales of domestic product rose 2.0% (chart). Real final sales to private domestic purchasers rose 3.1%. Meanwhile, real GDP was up 3.0% on a y/y basis (chart). That doesn't support the "stag" part of the stagflationary story.

(3) Inflation. The personal consumption expenditures deflator (PCED) increased 3.4% (saar) during Q1, up from 1.8% at the end of last year. Excluding food and energy prices, the PCED increased 3.7%, compared with an increase of 2.0% (chart). That spooked the bond market with the 10-year yield rising above 4.70%. The good news is that the core PCED inflation rate continued to moderate on a y/y basis to 2.9%.