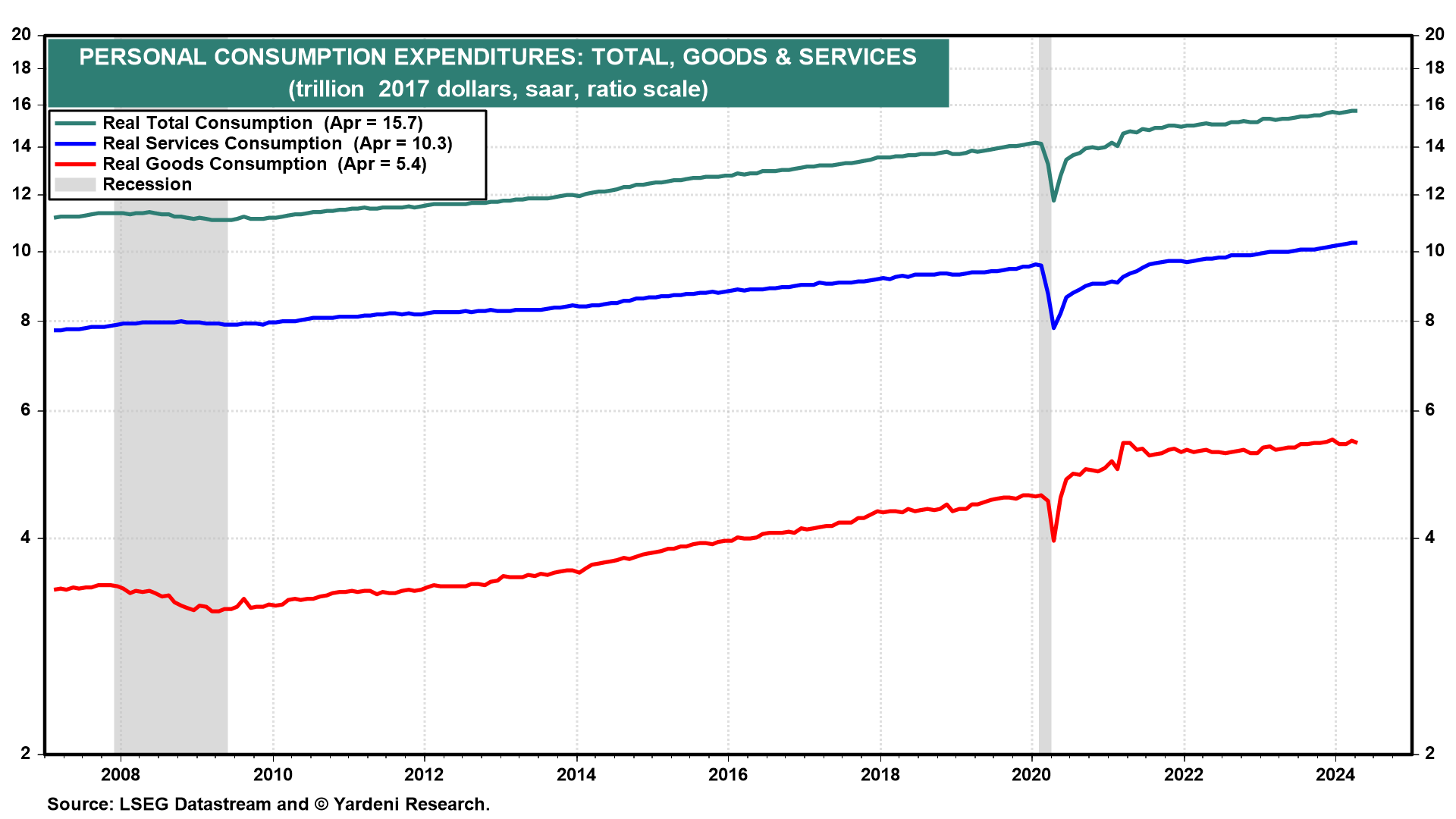

A growth recession is still rolling through the goods sector. Real consumer spending on goods has been flat at a record high since early 2022. We expect that spending on services, technology, and onshoring will keep the economy growing. There's still no stagflation or recession in our forecast.

Today's M-PMI report was weaker-than-expected. That followed Friday's weaker-than-expected personal income report with spending on goods down more than it increased on services. In the fixed income market, 2-year and 10-year yields declined as more Federal Reserve rate cuts are back on the table. The US dollar also fell to a three-week low. Stocks have been on a rollercoaster ride of late and may continue to do so through the summer. Let's review the latest data:

(1) Consumers. The pandemic buying binge for goods boosted consumer spending through early 2022–but then stalled at a record high (chart). Rising spending on services has been the primary driver of consumption since then. Friday's personal income report showed real consumption of goods fell 0.4% in April, led by an odd decline in spending on gasoline and energy.

(2) Purchasing managers. May's weak ISM M-PMI caught markets off guard because S&P Global's flash survey showed manufacturing recovered in May. We weren't surprised that the ISM national number remained below 50.0 as the average of five regional M-PMIs from 12 of the Federal Reserve banks was negative (chart).

By the way, the China Caixin manufacturing purchasing managers index (up from 51.4 in April to 51.7 in May) is the highest since June 2022. China is dumping cheap goods onto the global market crowding out US manufacturers.