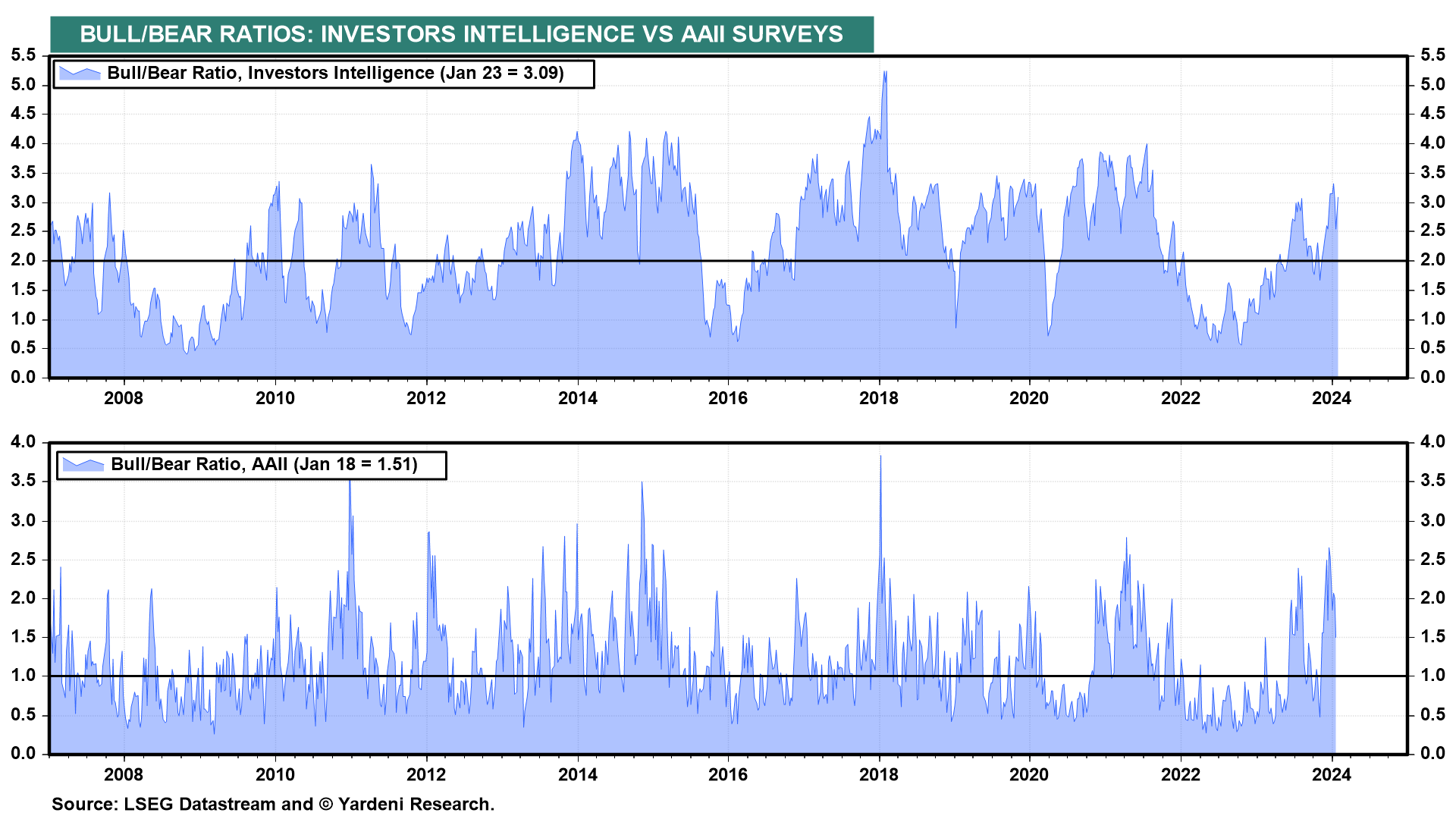

The S&P 500 and Nasdaq 100 rose to fresh record highs today. That's great. Not so great is that bullish sentiment remains high. The two bull/bear ratios we monitor remain elevated (chart). From a contrarian perspective, that's bearish.

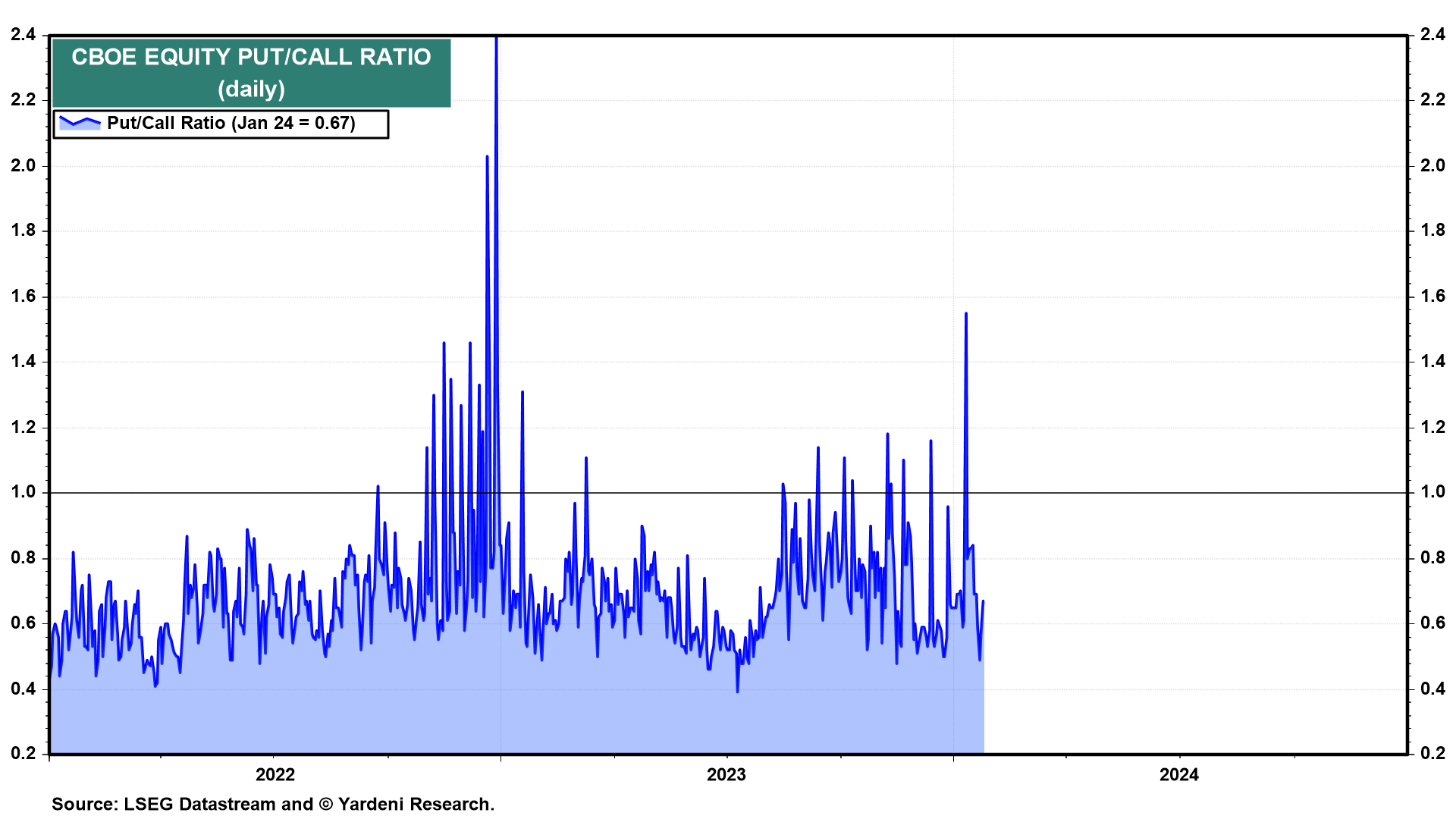

Today's put/call ratio was relatively low at 0.67 (chart). From a contrarian perspective that's bearish too.

The price of a barrel of Brent crude oil has been moving higher. It rose from a recent low of $73.24 on December 12, 2023 to $80.04 today (chart). It may be starting to signal that the risk of Middle East supply disruptions is increasing and that the Chinese government may do more to stimulate its economy. By the way, the EIA today estimated that US crude oil field production dropped sharply by 1.0 mbd during the January 19 week to 12.3 mbd. We'll be watching to see what it does next week, for sure.