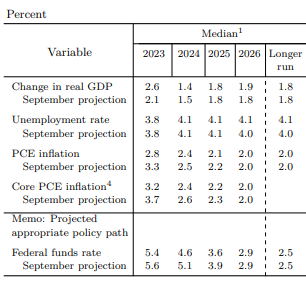

Today's Summary of Economic Projections (SEP) released by the FOMC after the committee's meeting was dovish. As a result, bond and stock prices continued their Santa Claus rallies that started at the beginning of November. The most important change in the latest SEP from the previous one during September is that the federal funds rate is projected to fall in 2024 to 4.6% rather than 5.1%, implying three rather than two 25bps cuts in this rate next year (table).

For the next three years, real GDP is expected to grow by less than 2.0% with the unemployment at 4.1%. This SEP scenario is deemed likely to lower the core PCED inflation rate below 2.5% next year and down to 2.0% by 2026. The resulting downward trend in the federal funds rate is expected to lower the rate to 2.9% in 2026. That may or may not happen. But what did happen today, particularly during Fed Chair Jerome Powell's presser, is that the FOMC's shrieking hawks have turned into cooing doves. That should be confirmed in coming days now that the blackout period for the Federal Open Mouth Committee is over.

The 2-year and 10-year Treasury yields dropped to 4.33% and 3.97% this evening. The S&P 500 flew with the doves as the market-cap-weighted index rose 1.4% and the equal-weighted index jumped 2.1%. The ratio of the latter to the former shows that the market rally this year narrowed from January 10 through November 13, and has broadened since then (chart). It should continue to do so, in our opinion.

Among the S&P 500 market-cap-weighted index's sectors, the Industrials rose to a new record high today (chart). That makes sense since companies in this sector are benefitting from the onshoring construction boom.