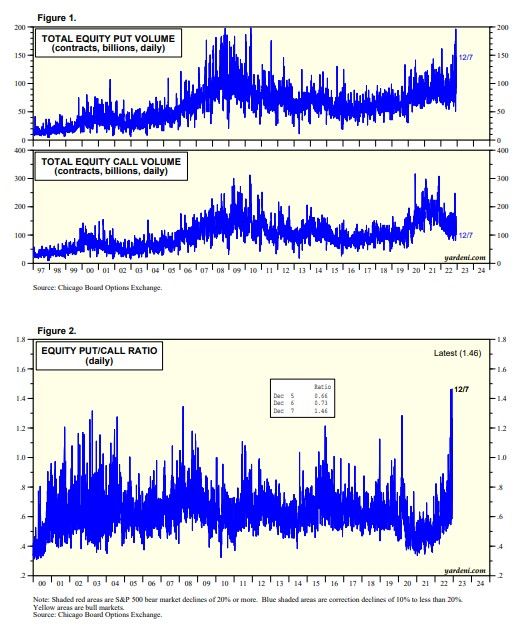

Jitters about a consumer-led recession over the past few days pushed the CBOE equities Put/Call Ratio up to 1.46 yesterday (chart). That's a very elevated reading and suggests that there is too much pessimism. It favors a yearend rally rather than a yearend crash.

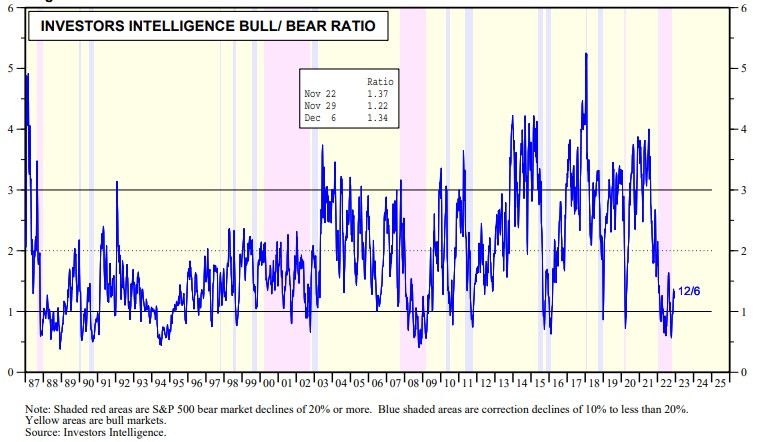

There is also still lots of bearishness in Investors Intelligence Bull/Bear Ratio. It rose to 1.34 this past week (chart). Low readings around 1.00 have been good buying opportunities for long-term investors in the past.