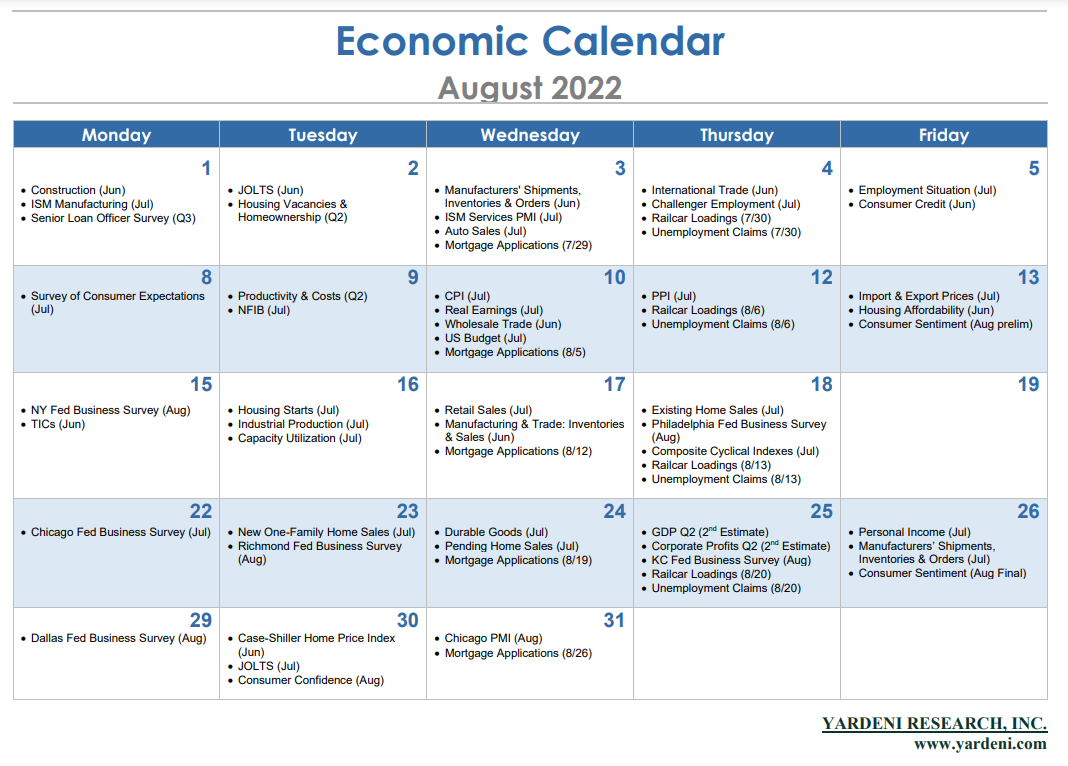

It's a big week for inflation indicators. The fun starts on Monday, when the FRB-NY releases its July survey of consumer expectations for inflation over the next 12 months and 36 months. Falling gasoline prices last month might have reduced expectations for inflation a bit.

Then on Tuesday, Q2's productivity and labor costs release is likely to show another big drop in the former and sharp increase in the latter as occurred during Q1. It may be that companies have been hoarding scarce workers, but don't have enough for them to do, especially if supply-chain disruptions disrupted operations.

July's CPI comes out Wednesday morning. The consensus is that the headline rate will be up just 0.2% m/m, down from 1.3% in June. The core rate is expected to decline to 0.5% from 0.7%. Look for the drop in gasoline prices during July to be the major contributor to the moderation in inflation last month. Durable goods prices are also expected to bring down the inflation rate. Rent will undoubtedly be among the biggest upside contributors to inflation.

The markets are likely to respond most to any surprises in the CPI rather than in Thursday's PPI report for July. We will be looking for signs in both releases confirming that peak inflation might have occurred in June.