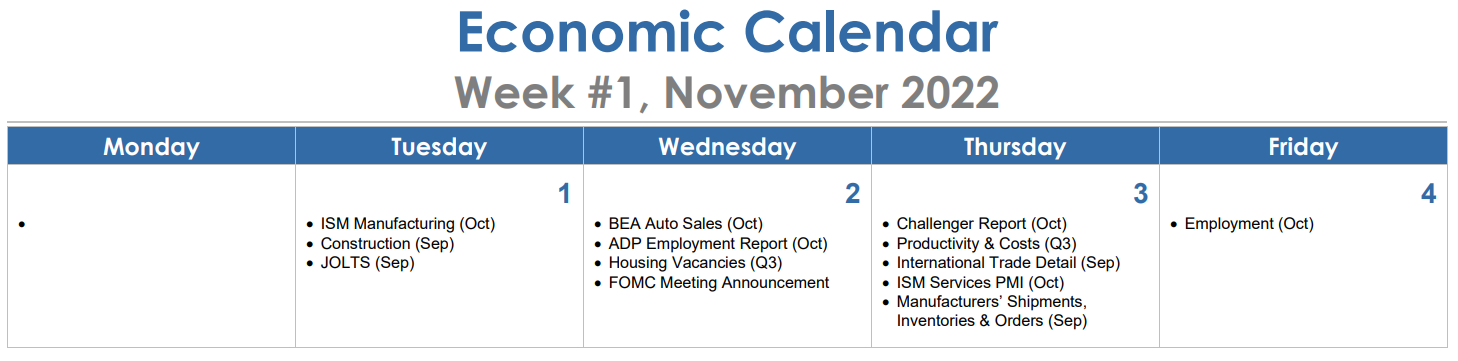

It's yet another Fed week. On Wednesday, the FOMC is expected to announce another 75bps hike to a range of 3.75%-4.00%. That would make the fourth consecutive hike of that magnitude. Fed Chair Powell will have to acknowledge that the federal funds rate is now further into restrictive territory and will be even more so come the FOMC’s December meeting, when the rate is widely expected to be raised by 50bps to 75bps.

We are expecting to hear more Fed officials talking about pausing rate hiking early next year, especially if this week's major labor market indicators continue to show moderation in September's job openings (Tues.) and in October's employment and wages (Fri.).

October's manufacturing PMI survey (Tues.) should confirm the five Fed regional business surveys showing that activity continues to weaken in this sector. The comparable survey for the nonmanufacturing (Thur.) should show ongoing strength. September's construction activity (Tues.) was weighed down by single-family construction, while October's auto sales was depressed by tighter auto lending standards.