The MegaCap-8 stocks were also the Magnificent-8 during 2020 and most of 2021. Their businesses greatly boomed during the pandemic when many people worked, schooled, and entertained at home. The MegaCap-8 include Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, NVIDIA, and Tesla. During H1-2022, they lost a lot of their magnificence and market capitalization, and weighed heavily on the S&P 500. Let’s review their rise and fall:

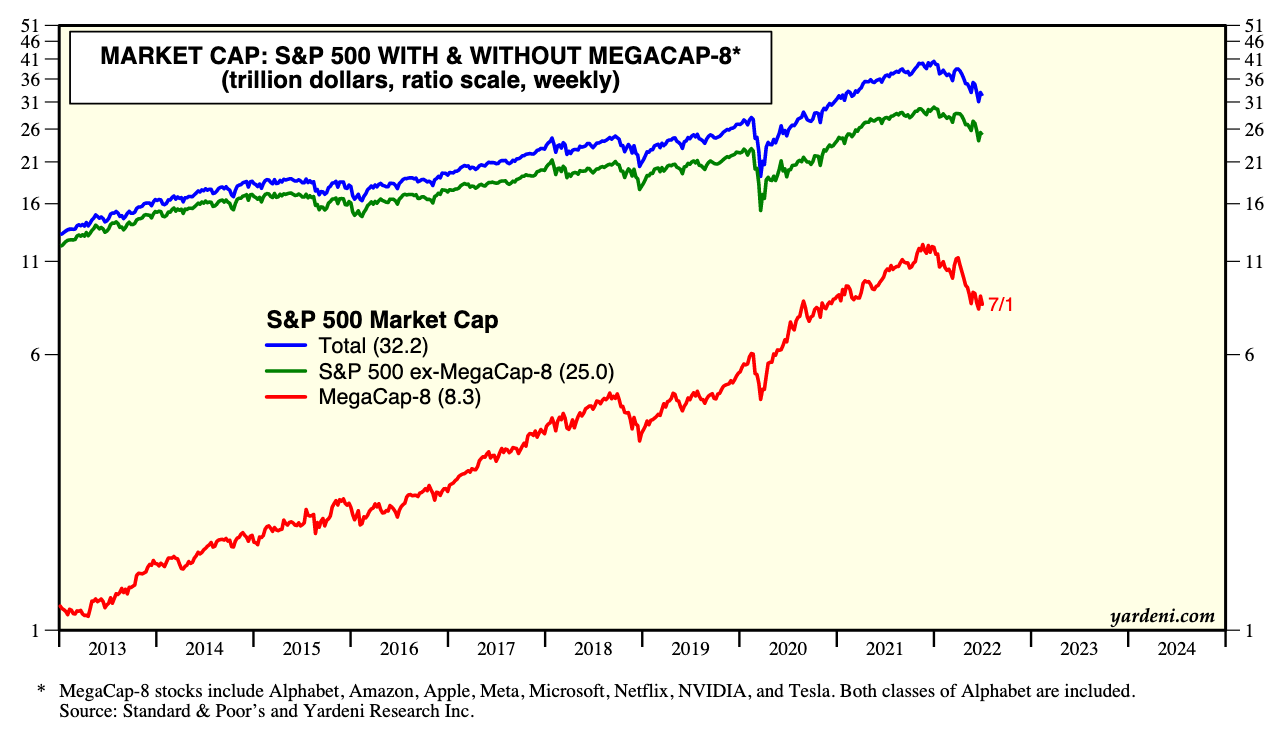

(1) From the March 23, 2020 low of that year through its December 27, 2021 peak, the market cap of the MegaCap-8 rose $7.9 trillion, or 175%. Over this same period, they accounted for 36% of the increase in the market cap of the S&P 500, which rose 119%.

(2) Since the S&P 500 peaked at a record high on January 3, 2022 through the end of H1-2022, this composite's market cap is down $8.4 trillion, or 21%. Over this same period, the market cap of the MegaCap-8 is down $3.5 trillion or 32%, accounting for 41% of the drop in the market cap of the S&P 500. Excluding them, the market cap of the S&P 500 fell $4.9 trillion, or 16% over this same period.

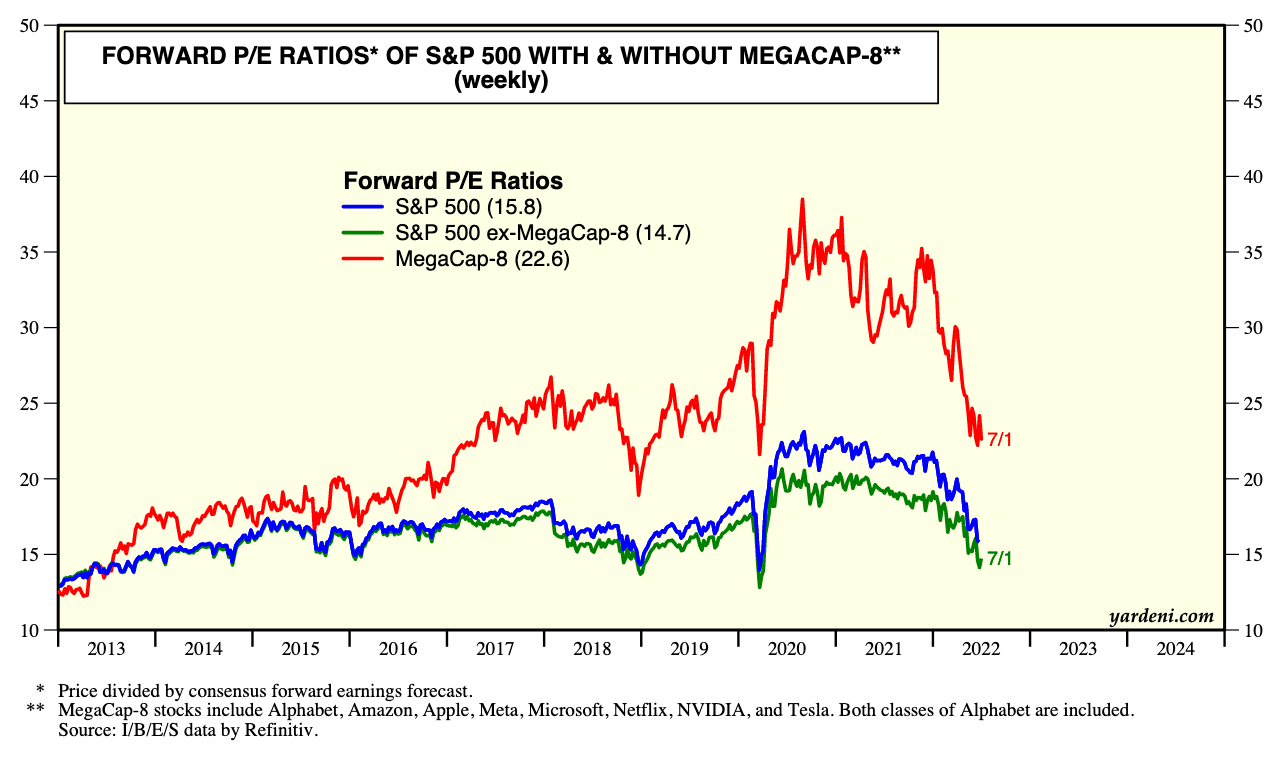

(3) Since the beginning of this year through the July 1 week, the forward P/Es of the S&P 500 fell from 21.4 to 15.8, the S&P 500 excluding the MegaCap-8 fell from 19.1 to 14.7, and the MegaCap-8 fell from 33.8 to 22.6.

(4) At the end of last year, the MegaCap-8 accounted for 26% of the market cap of the S&P 500. They are now down to 22%.

(5) The MegaCap-8 are cheaper than they were at the start of the year, but not cheap. And they still account for a large percentage of the market cap of the S&P 500.