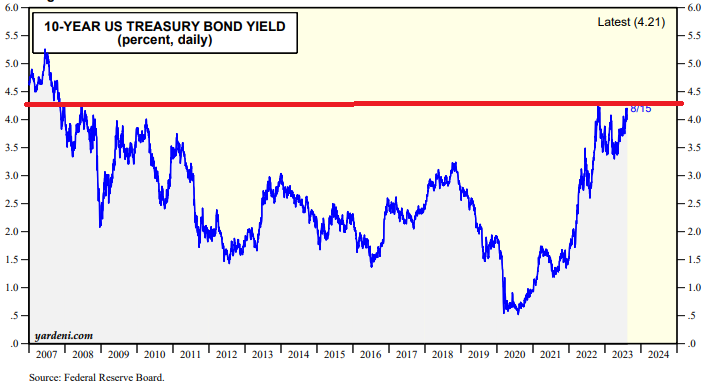

The Bond Vigilantes kept the suspense going today. They closed the 10-year Treasury bond yield at 4.22% (chart). It's widely feared that if it rises above 4.25% (i.e., last year's high), the next stop could be 4.50% and even 5.00% if the yield curve disinverts with the long end rising up to meet the short end.

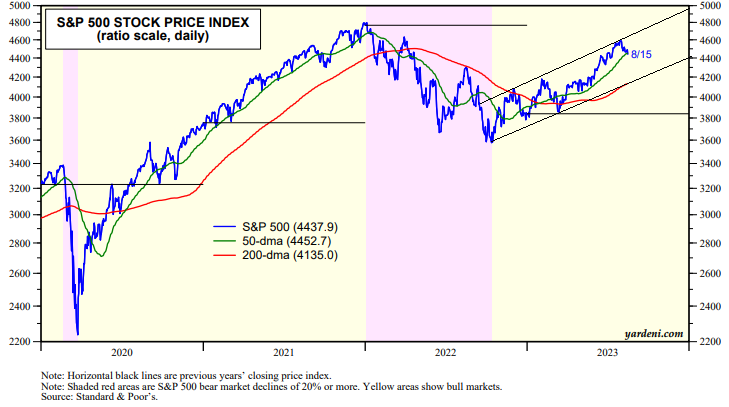

The stock market has been on edge ever since the yield crossed back above 4.00% at the start of the month. The S&P 500 is down 3.3% from its July 31 high for the year (chart). It fell below its 50-dma today. A bounce off the 200-dma still looks possible without violating the market's bullish channel since the bull market started on October 12.

Why didn't the yield vault over 4.25% this morning when July's retail sales came out with a much-stronger-than-anticipated gain of 0.7%? A slew of data out of China suggested that the Chinese economy is in trouble and exporting deflation to the US. Also this morning, Fitch warned it may have to downgrade dozens of banks including JP Morgan. If commercial real estate (CRE) mortgage rates continue to rise along with bond yields, there will be lots more CRE loan defaults. Minneapolis Federal Reserve President Neel Kashkari said that capital requirements should be raised for banks with more than $100 billion in assets.