The economic indicators released during the shortened week ahead should confirm that economic growth remains solid and that inflation is continuing to moderate. Here's what we're watching this week:

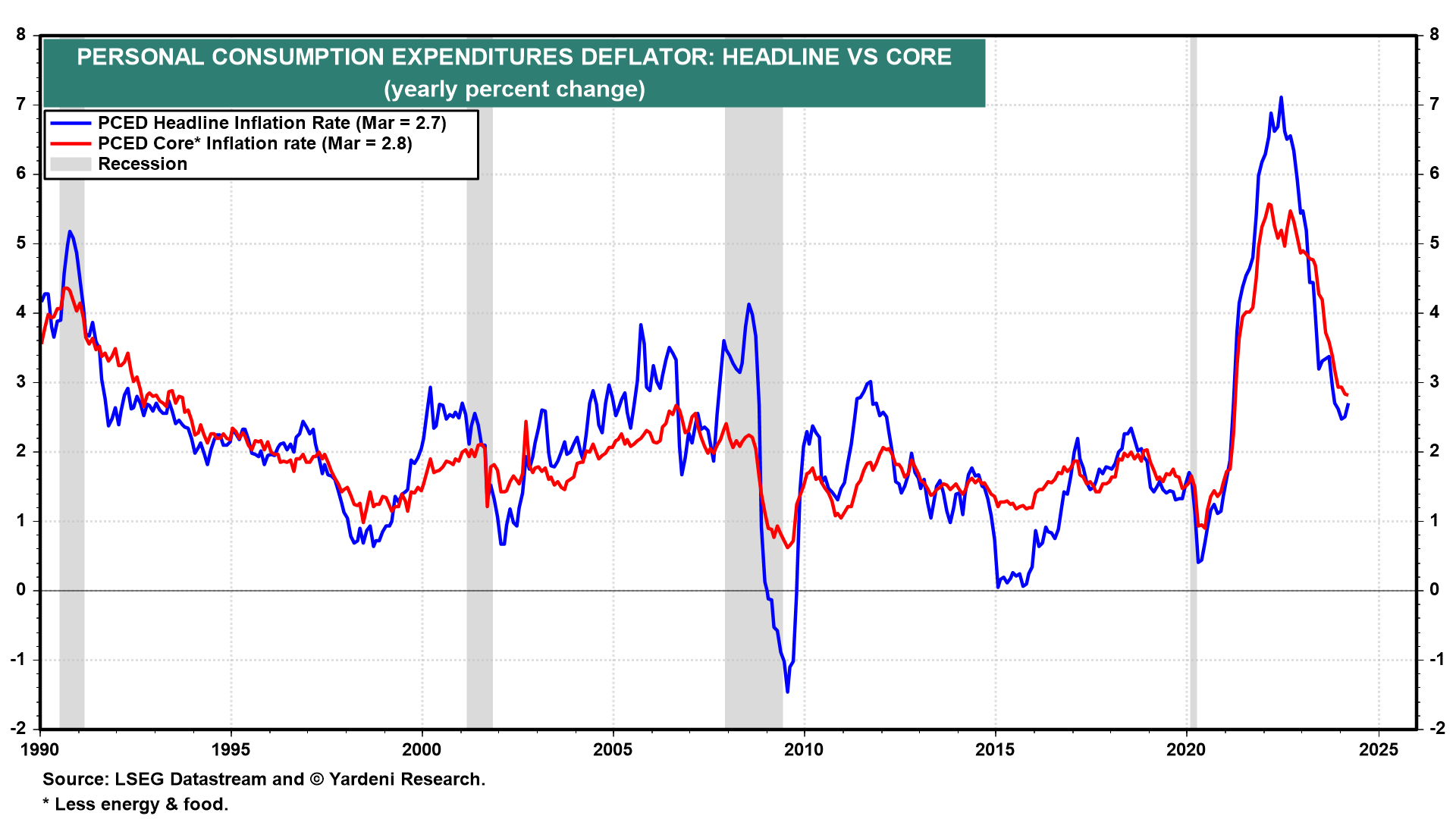

(1) PCED. The Cleveland Fed’s Inflation Nowcasting model shows headline and core PCED rose 2.68% and 2.74% y/y (0.27% and 0.23% m/m) last month (chart). That would be the lowest y/y reading for core PCED since March 2021.

We expect markets to welcome inflation's progress toward the Fed's 2.0% target, particularly after they were spooked by some of the hawkishness in the FOMC minutes released last week. That meeting occurred about two weeks before April's more-moderate-than-expected CPI and PPI were released.

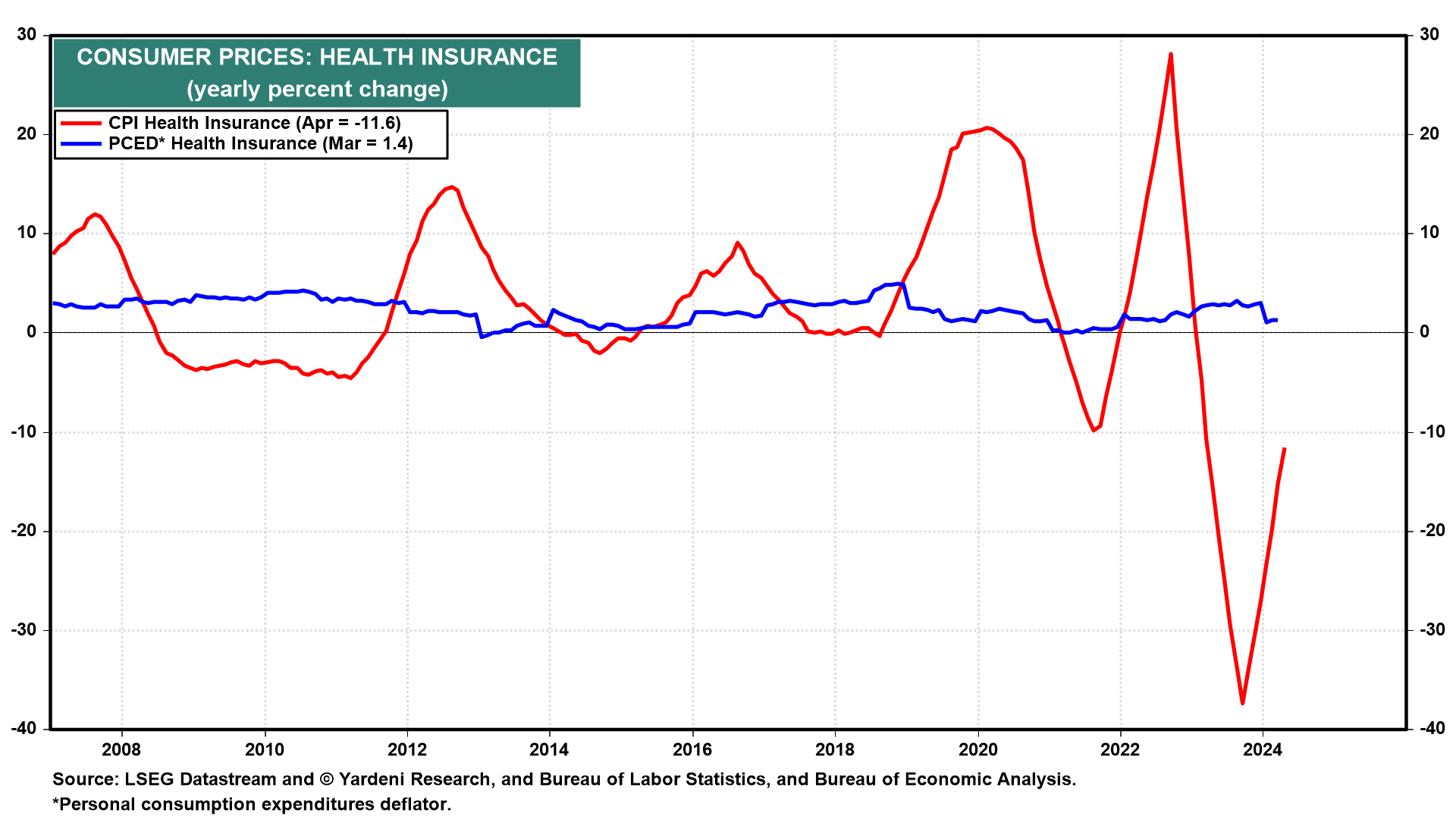

Lagging rent disinflation continued to boost April's CPI. However, this category accounts for roughly 1/3 of the index, while shelter is only about 16% of the PCED. Also troublesome has been the health insurance premiums component of the CPI, which is extremely volatile compared to the comparable component of the PCED, which is much more subdued (chart).

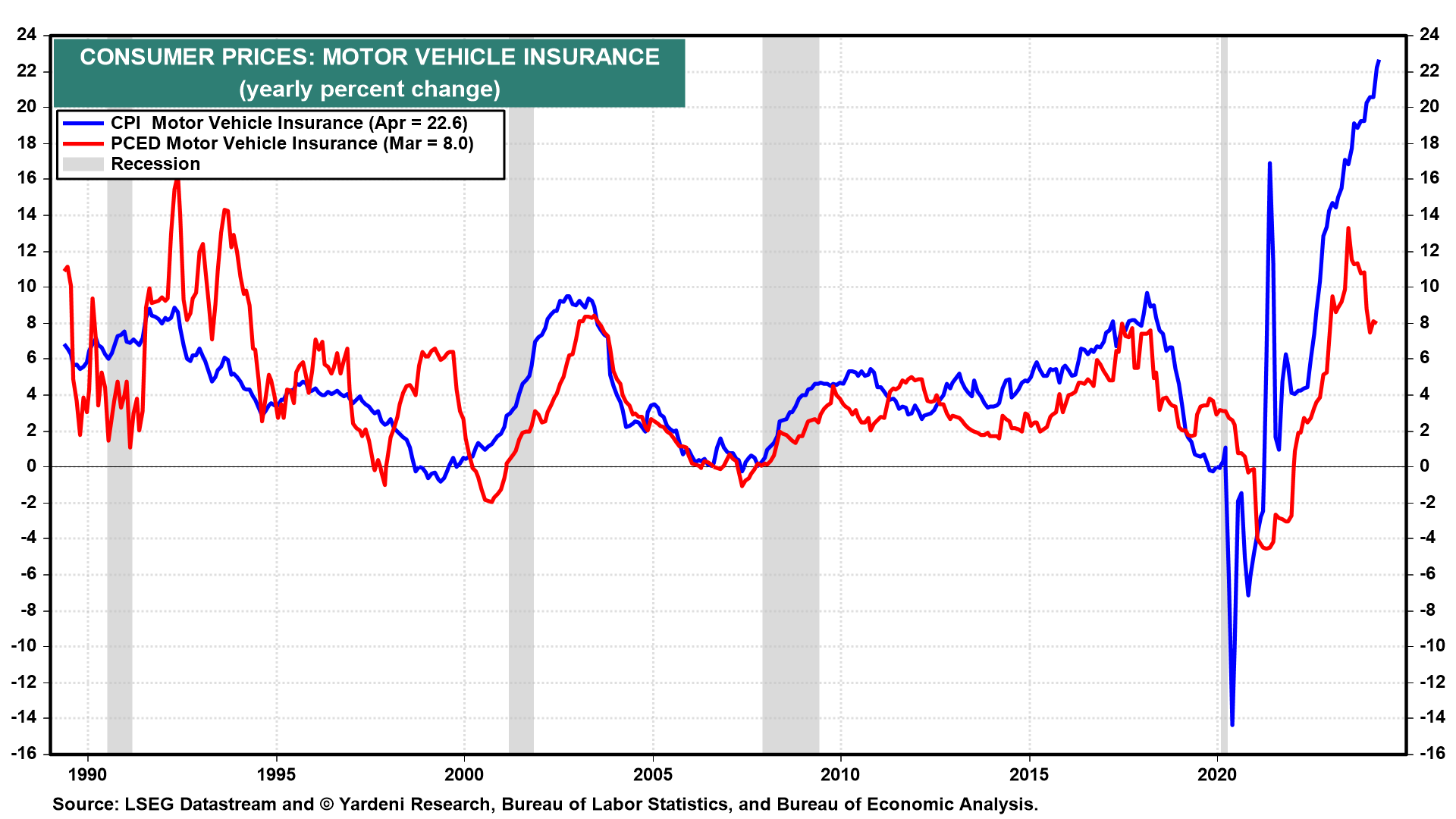

And auto insurance--one of the biggest contributors to CPI inflation this year--has been disinflating in the PCED recently (chart). The deflator nets out insurance claims from premiums and only gives auto insurance a fifth of the weight that the CPI does.

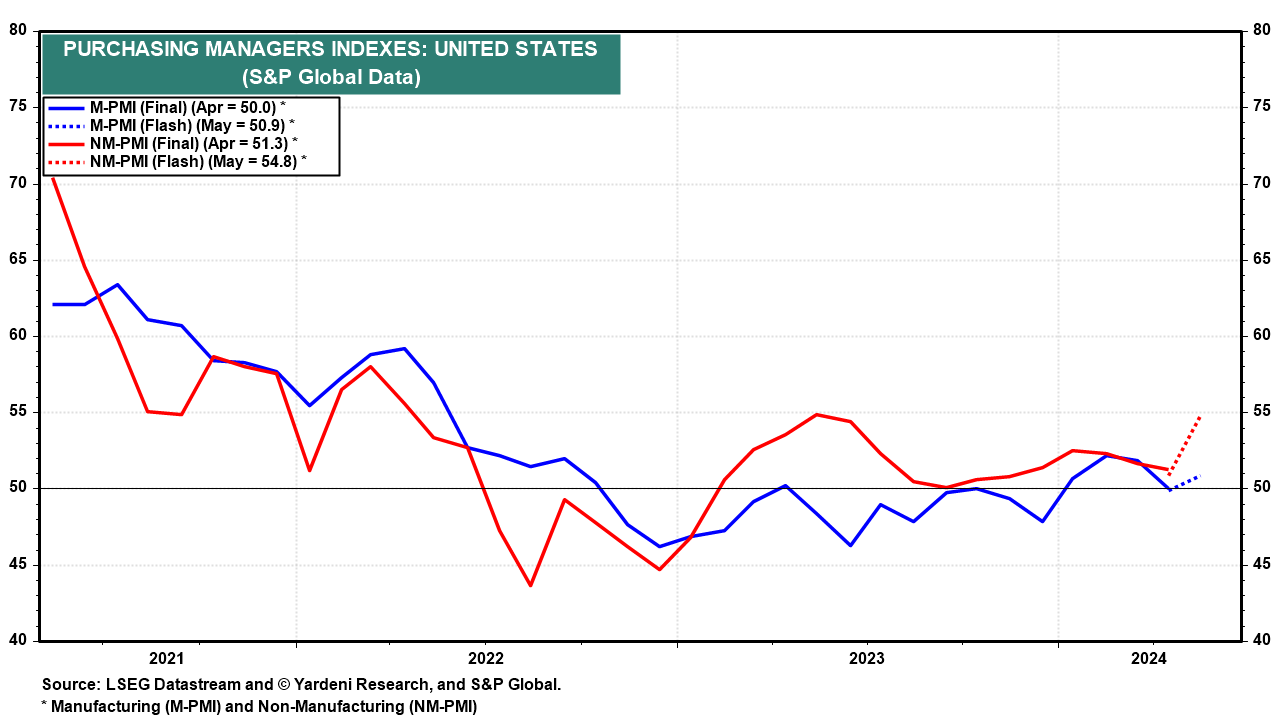

(2) Manufacturing. S&P Global's May survey of purchasing managers showed the manufacturing sector may be starting to recover from its rolling recession or at least starting to bottom. But that hasn't been convincingly confirmed by the regional business surveys conducted by the Federal Reserve Banks of NY, Philly, and KC this month. We expect that the Dallas and Richmond surveys (Wed) will also be on the weak side.

S&P Global's nonmanufacturing PMI confirmed that the services sector is still going strong (chart).

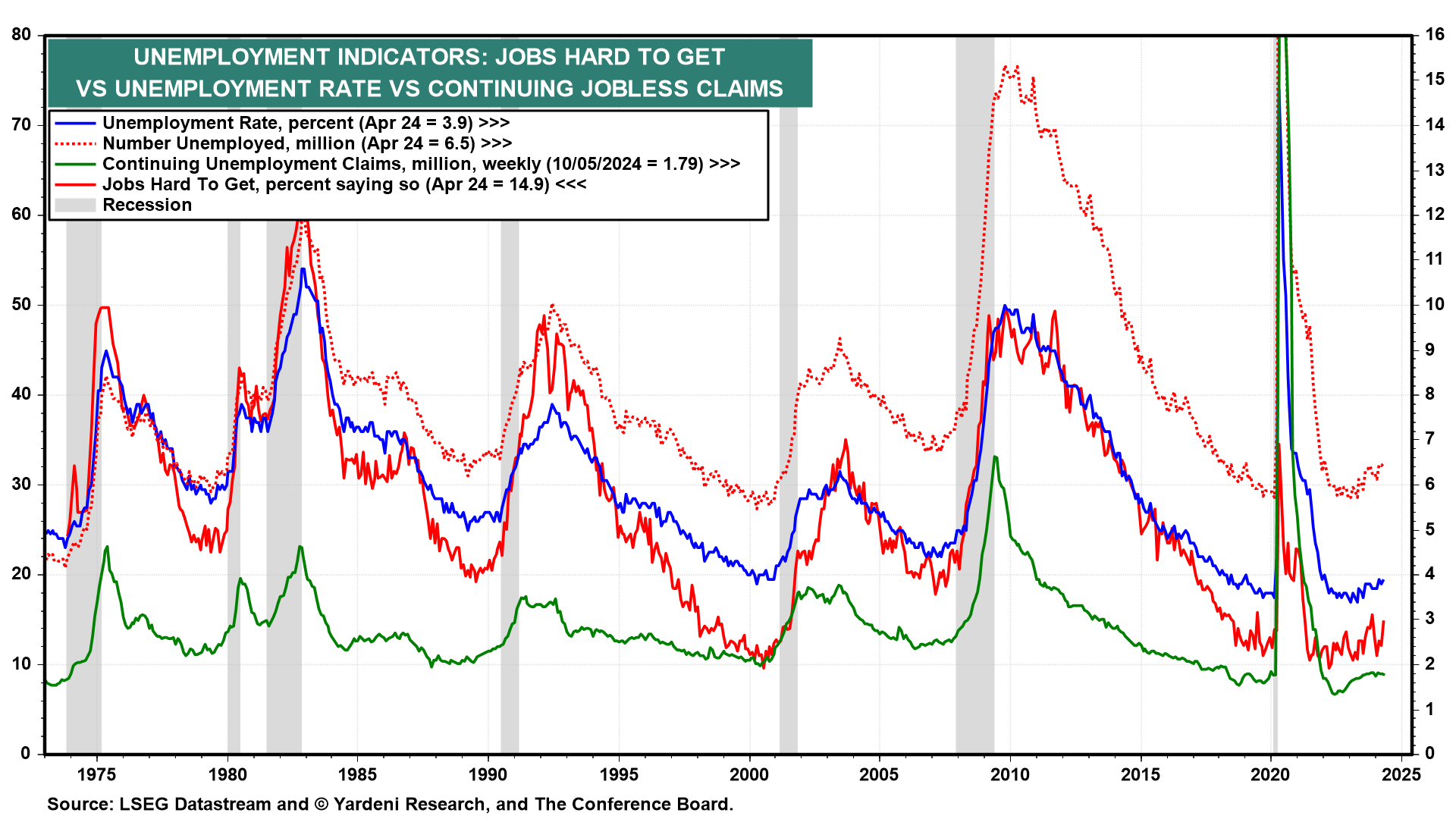

(3) Consumers. Very low continuing unemployment insurance claims suggest that May's Consumer Confidence Index survey (Tues) should confirm that jobs remain plentiful and not hard to get (chart). April's consumption report (Fri) is likely to show that weak spending on goods was more than offset by spending on services.