June's Treasury International Capital System (TICS) was released on Monday. The TICS data tend to confirm our TINAC thesis, i.e., there is no alternative country: the US is a safe haven for global investors confronted with a very stormy global investment climate. Consider the following:

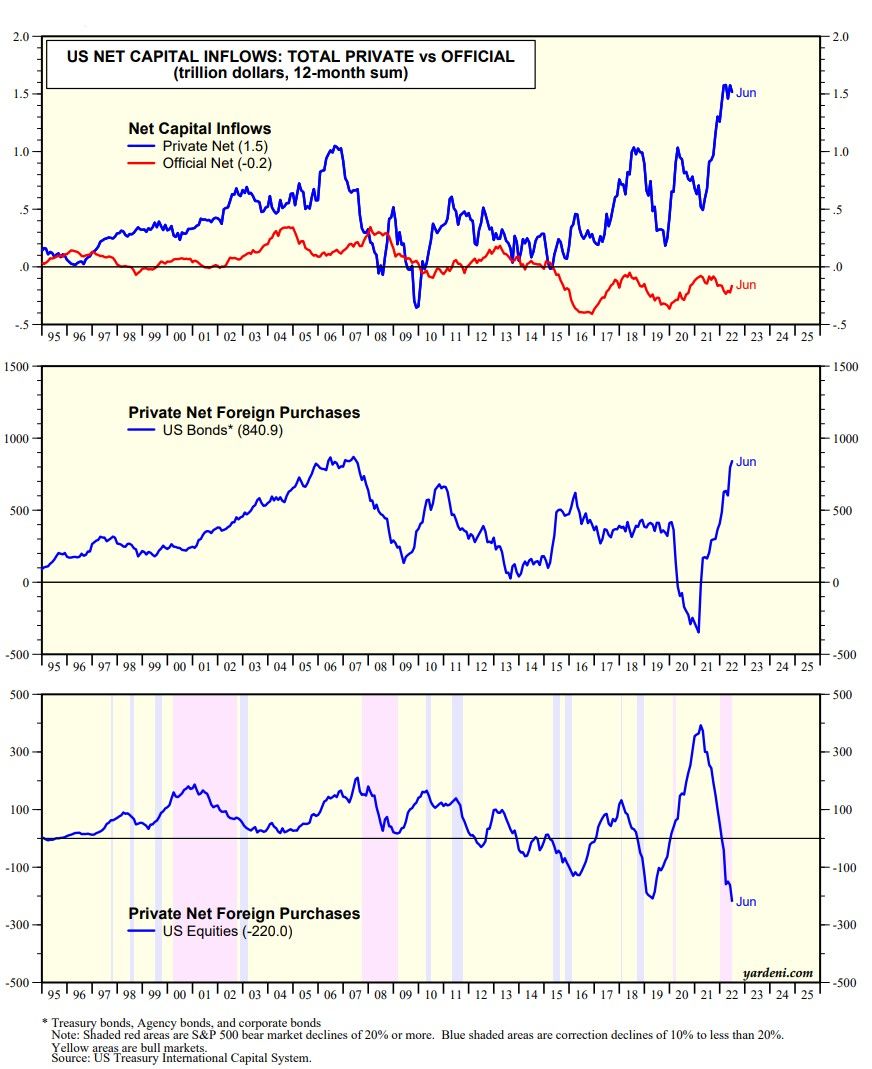

(1) On a 12-month basis through June, the US had private net capital inflows of $1.5 trillion (chart below). It's been rising at this record pace since the end of last year. That certainly helps to explain why the US dollar index (DXY) is up 14.3% y/y.

(2) On a 12-month basis through June, private net foreign purchases of US bonds was a near record $840.9 billion (chart below). That certainly helps to explain why bond yields have remained so low this year despite the Fed's rate hikes and persistently high inflation.

(3) On the other hand, private net foreign purchases of US equities was a record -$220 billion during the 12 months through June (chart below). With all due respect to our overseas friends, foreign investors tend to be contrary indicators for the stock market by increasing their purchases near market tops only to sell during bear markets and corrections (chart below). They might have contributed to making a capitulation bottom on June 16!