Why has the stock market held up reasonably well in the face of a more hawkish Fed, more vigilant Bond Vigilantes, a 1970s-style wage-price spiral, depressed consumer and small business confidence, and the war on the eastern front? Consider the following:

(1) While the S&P 500's forward P/E is weighed down by both rising inflation and tightening credit conditions, we estimate that there is still about $3 trillion in excesses M2 liquidity. As we have previously observed, while the Fed Put may be kaput, the CFO Put remains in place as evidenced by strong buybacks, dividends, and M&A activity.

(2) The severe geopolitical crisis may be convincing managers of global equity portfolios that the US is a safe haven from the tumult.

(3) As we have previously observed, S&P revenues growth has slowed from its peak during Q2-2021, but it is getting a boost from rising prices. The same can be said for earnings because profit margins seem to be holding up quite well. Indeed, there is some evidence in the PPI data that companies are marking up their costs without any resistance from their customers. (Amazon reportedly will levy a 5% fuel and inflation fee on online merchants that use its shipping services.)

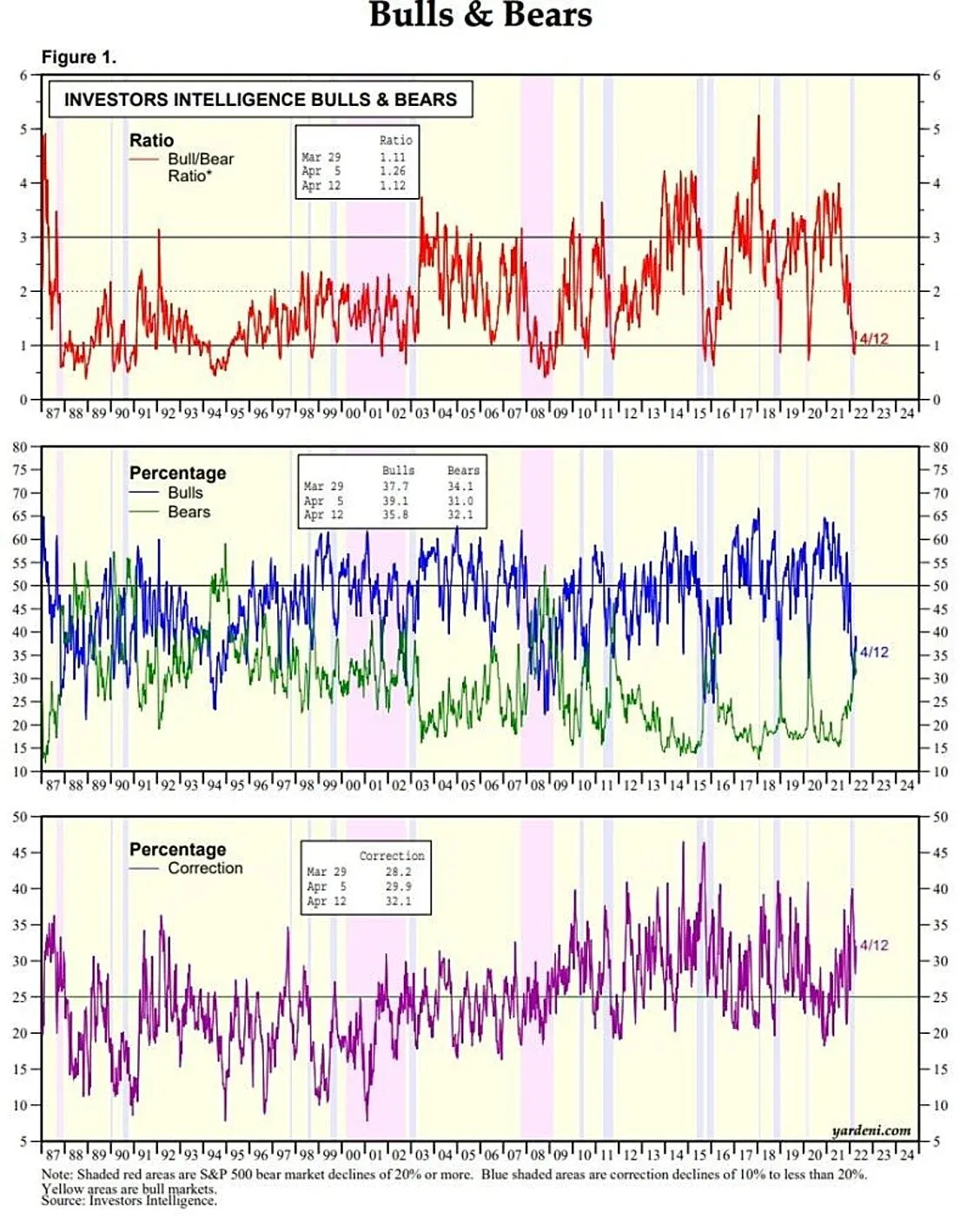

(4) Sentiment remains bearish, which is bullish from a contrarian perspective. Investors Intelligence Bull-Bear Ratio remains around 1.00, which in the past has signaled a good buying opportunity. However, it might stay depressed for a while longer while the Fed is tightening monetary policy and until there are convincing signs of peak inflation.

It all adds up to a sideways and volatile market. Our range for this year for the S&P 500 is 4200-5000, mostly reflecting the uncertainty about the valuation multiple given all these crosscurrents. We expect that earnings will continue to grow barring a recession, which we currently assess as having a 30% probability through next year.