At the end of last year, the words "uncertain" and "uncertainty" appeared 12 times in the minutes of the December 17-18 meeting of the Federal Open Market Committee. Those words appeared more often during this year's meetings. The June 17-18 meeting minutes released today included those words 28 times. During his presser, Fed Chair Jerome Powell mentioned the two words 19 times.

Most of the uncertainty faced by Fed officials has to do with Trump's Tariff Turmoil (TTT). Collectively, they are leaning toward lowering the federal funds rate. But they are in no hurry to do so since they are worried that TTT might still boost inflation.

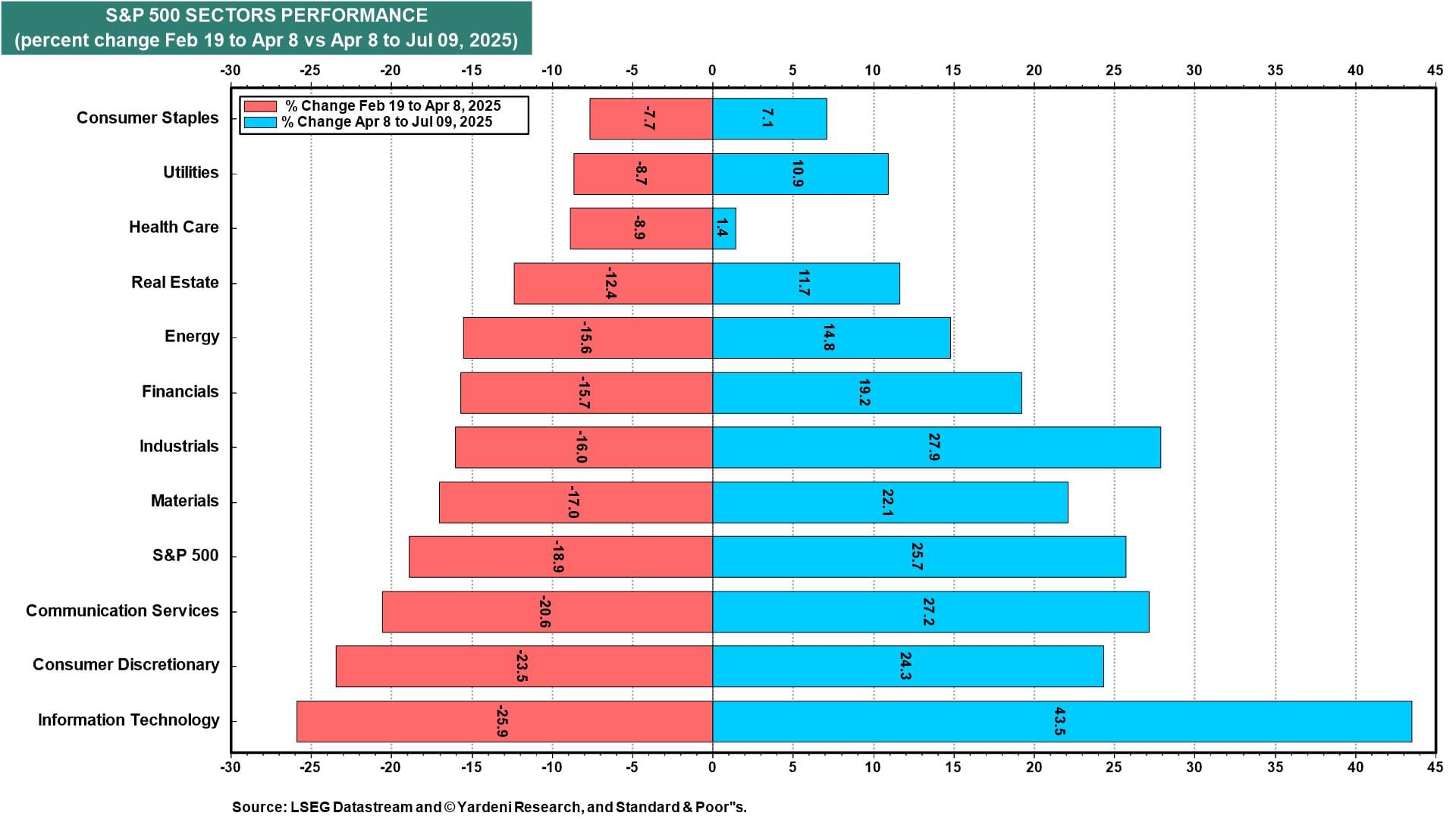

Uncertainty about Trump's tariffs was the major cause of the correction in the S&P 500 from February 19 through April 8. There was also uncertainty about the impact of DeepSeek on AI infrastructure spending. But the bulls stampeded again once Trump postponed his April 2 Liberation Day reciprocal tariffs on April 9 and the major AI and cloud computing companies in the US said that they remain committed to their capital spending plans during their April conference calls with investors.

Now that the S&P 500 is back in record-high territory, investors once again are worrying (as they have at such points since the beginning of the current bull market in October 2022) that the post-correction rebound since April 8 has bad breadth. We've been pushing back against this notion (since the start of the bull market) by observing that the stellar outperformance of the Magnificent-7 has distracted from the very solid performance of the rest of the stock market.

Consider the following:

(1) It has been a broad V-shaped recovery among S&P 500 sectors (charts). The only serious laggard has been the Health Care sector.

(2) Five of the Magnificent-7 stocks have fully recovered (chart). The laggards are Apple and Tesla.