(1) The Index of Leading Economic Indicators (LEI) fell 0.3% during April from a revised 0.1% increase in March. The decline was led by weak consumer expectations and a drop in residential building permits. The Index of Coincident Economic Indicators (CEI) increased 0.4%. The LEI and CEI are in line with a moderate growth outlook in the near-term.

(2) April's existing home sales fell to the slowest pace since June 2020. High prices and rising mortgage rates are depressing home sales. But so is the shortage of homes at only a 2.2-month supply in April. The median price of an existing home sold in April increased 14.8% y/y.

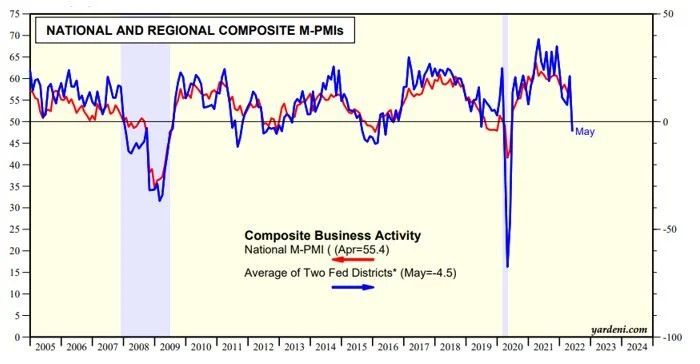

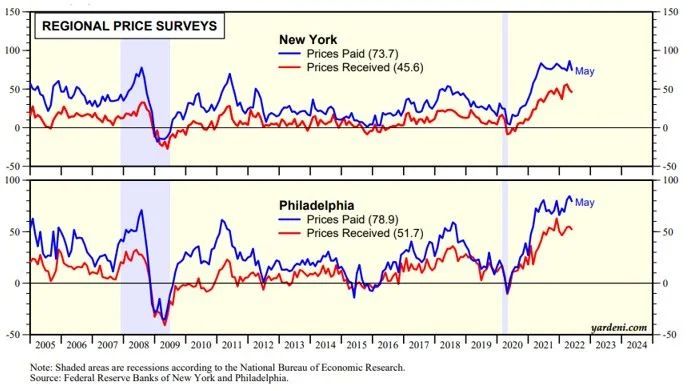

(3) The average of the composite business activity indexes for the NY and Philly regions fell to -4.5 during May, the first negative reading since the lockdown of 2020. This suggests further weakness in the national M-PMI during May. The prices-paid and prices-received indexes remained elevated in both Fed districts.