It certainly has been an action-packed week so far, and there is still Friday to go. Today, the ECB raised its official interest rates by 25bps; the People’s Bank of China lowered the reserve requirement ratio for most banks by 25 basis points; and, the price of oil continued to increase.

Yesterday's headline CPI and today's headline PPI inflation rates for August were boosted by energy prices. However, core inflation rates should continue to moderate, in our opinion. August's real merchandise retail sales (excluding building materials and food services), released today, suggests consumer spending on goods remains flat. Meanwhile, the housing market is weakening again according to yesterday's mortgage applications. Today's initial unemployment claims show that the labor market remains tight. Yesterday, we learned that the federal deficit narrowed a bit during August. The Fed is widely expected to pass on another rate hike next week.

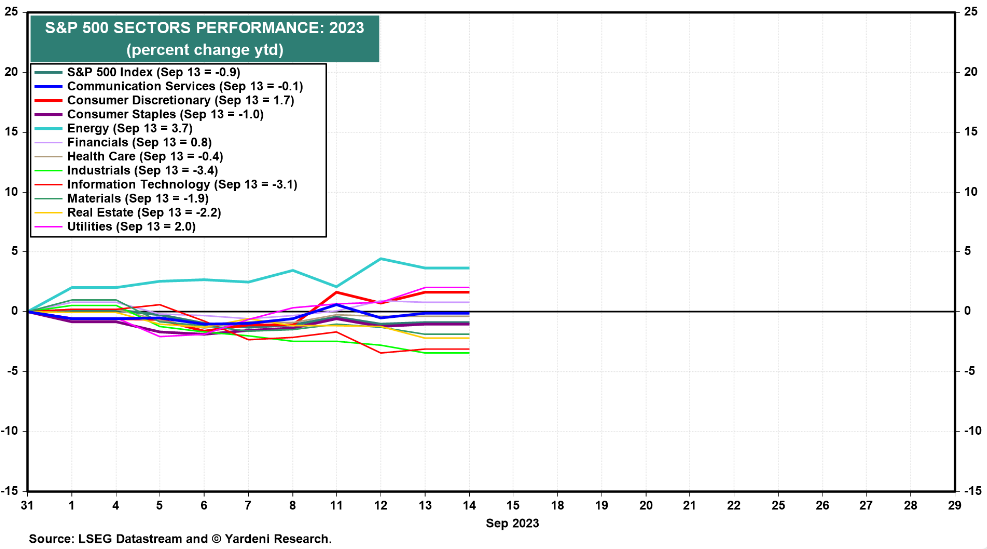

Stock and bond prices remained firm this morning. September has a tendency to be the worst month of the year for stocks. Below is the month's performance derby so far for the S&P 500 (chart). The overall index was down 0.9% mtd. Energy is the outperforming sector with a 3.7% gain. We are still recommending overweighting this sector.