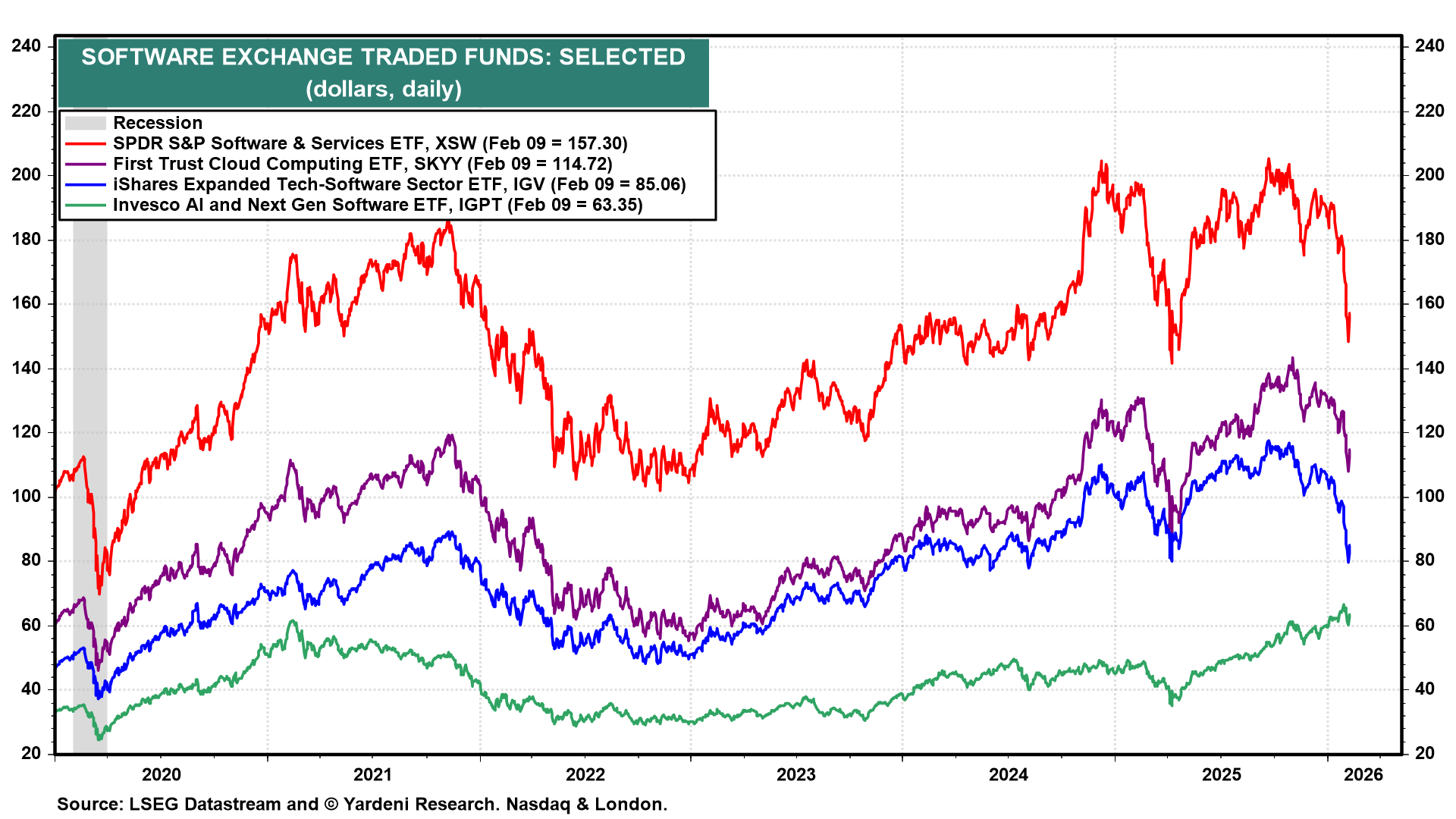

AI is an extremely disruptive technology. It has already turned on its masters: The software stocks have been pounded by fears that AI will make coders redundant (chart). Now it is turning on the financial industry.

The most direct hit today comes from news that Altruist, a wealth management startup, has launched new AI-enabled tax planning features. This has sparked a "sell first, ask questions later" reaction among investors who fear that legacy firms will struggle to compete with AI-automated services. Charles Schwab, LPL Financials, and Morgan Stanley got clipped. Nevertheless, we are sticking with our overweight recommendation for Financials, especially the money-center banks, regional banks, and investment banks. We also think that the selloff in software stocks is overdone.

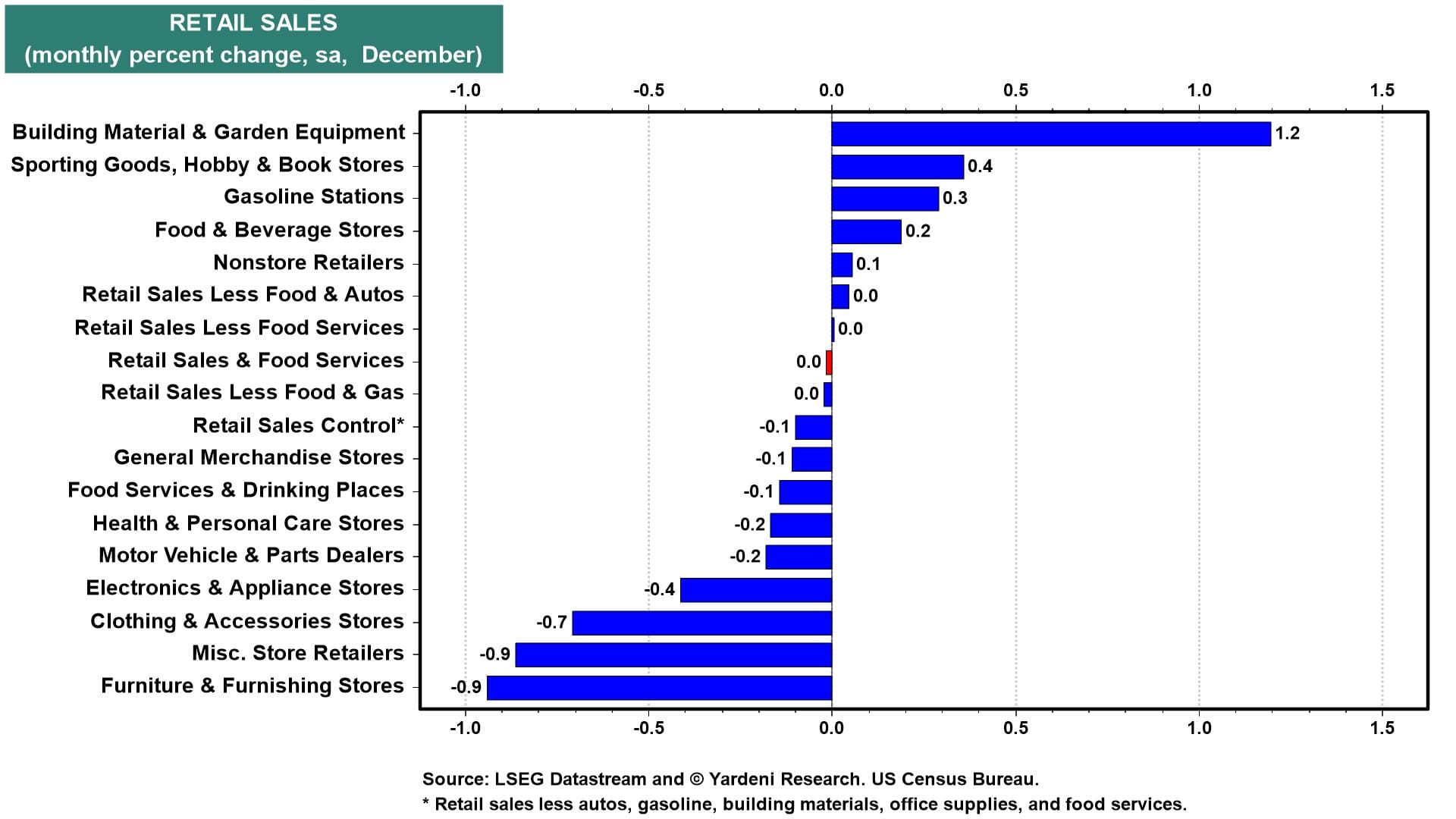

In economic news yesterday, January's ADP private payroll employment rose just 22,000. Today, December's retail sales growth was reported at 0.0% m/m, with the control group down 0.1% (chart). As a result, real GDP growth for Q4-2025 was revised down from 4.2% to 3.7%, led by a drop in real consumer spending from 3.1% to 2.4%, according to the Atlanta Fed's GDPNow.

As we've occasionally said in the past: Any data that doesn't support our forecast is either bad data or it will be revised to show we were right after all! Consider the following: