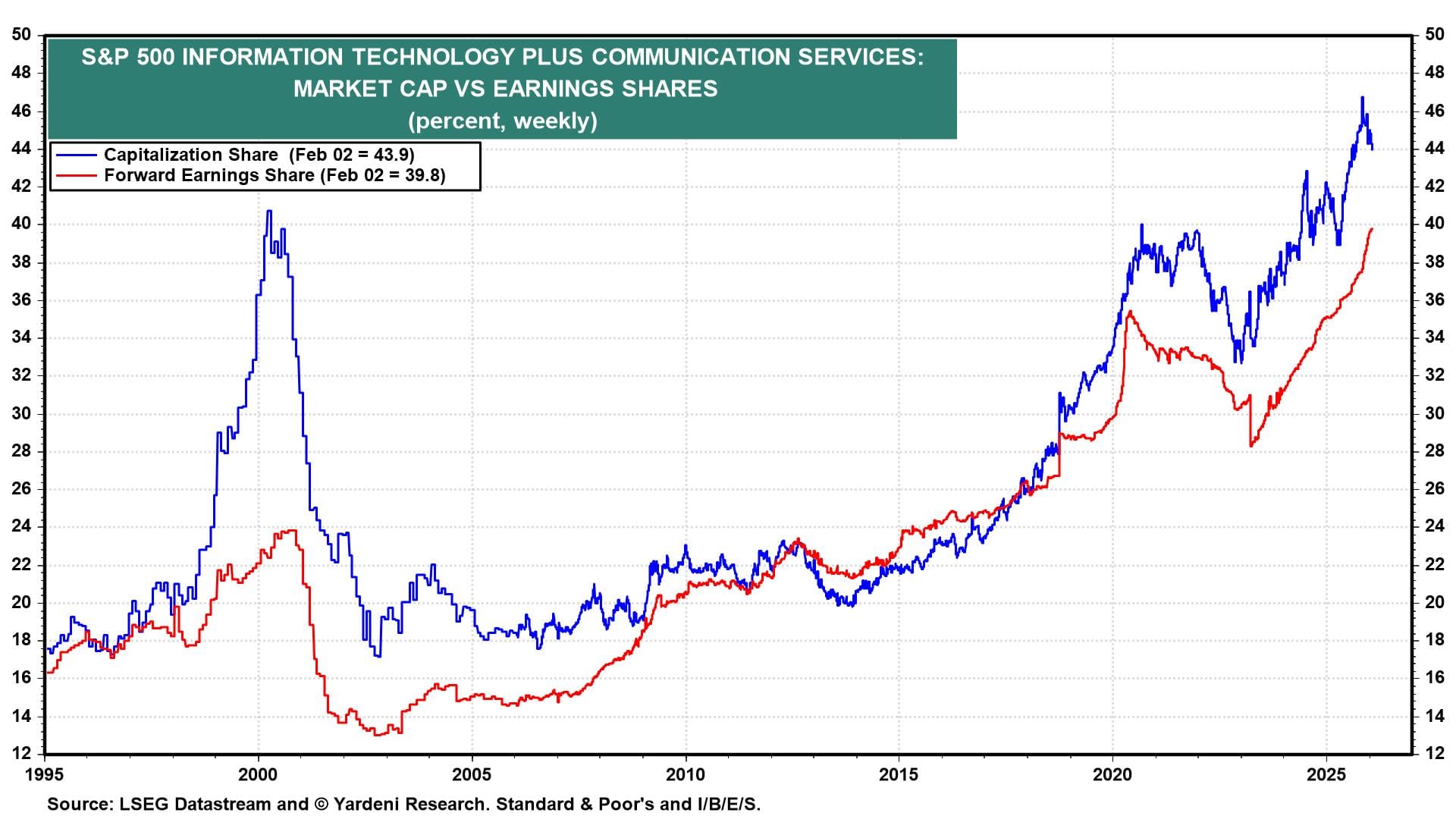

On December 7, 2025, we recommended market weighting rather than overweighting the Information Technology and Communication Services sectors of the S&P 500. Their combined share of the S&P 500 market capitalization has declined from a record 46.7% on November 5, 2025 to 43.9% on Monday (chart). That's even though their combined earnings share of the S&P 500 continued to rise to a record 39.8% yesterday.

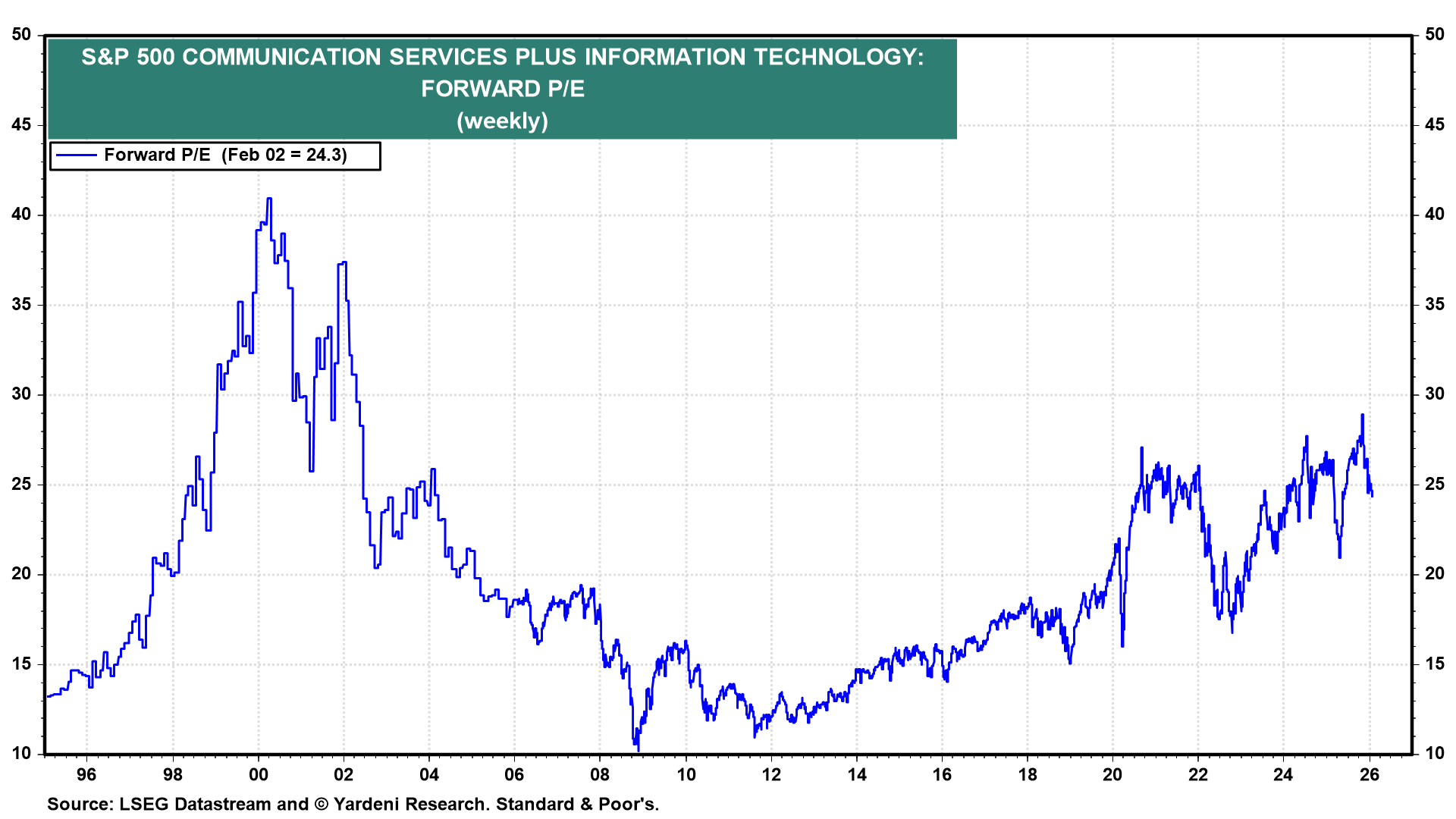

Despite the rapid growth of the two sectors' combined forward earnings, the forward P/E of the two combined has dropped from 28.9 on November 5, 2025 to 24.3 currently (chart).

On December 7 of last year, we concluded that AI was causing the Magnificent-7 to compete more with one another, forcing them to significantly increase their spending on AI infrastructure. That's why we recommended underweighting them. The main beneficiaries of this competition should be the S&P 500's Impressive-493, which are using the AI tools to increase productivity.

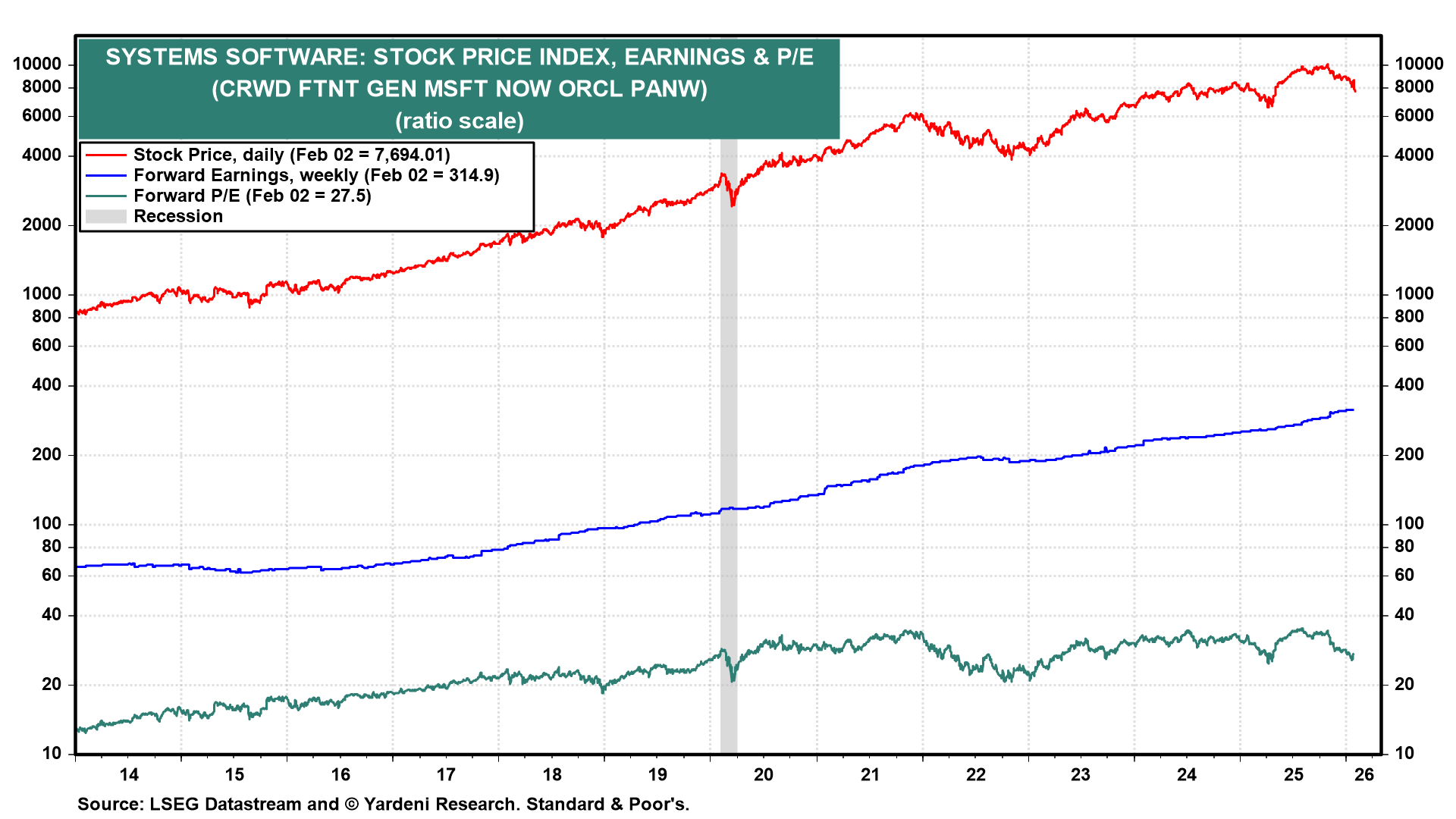

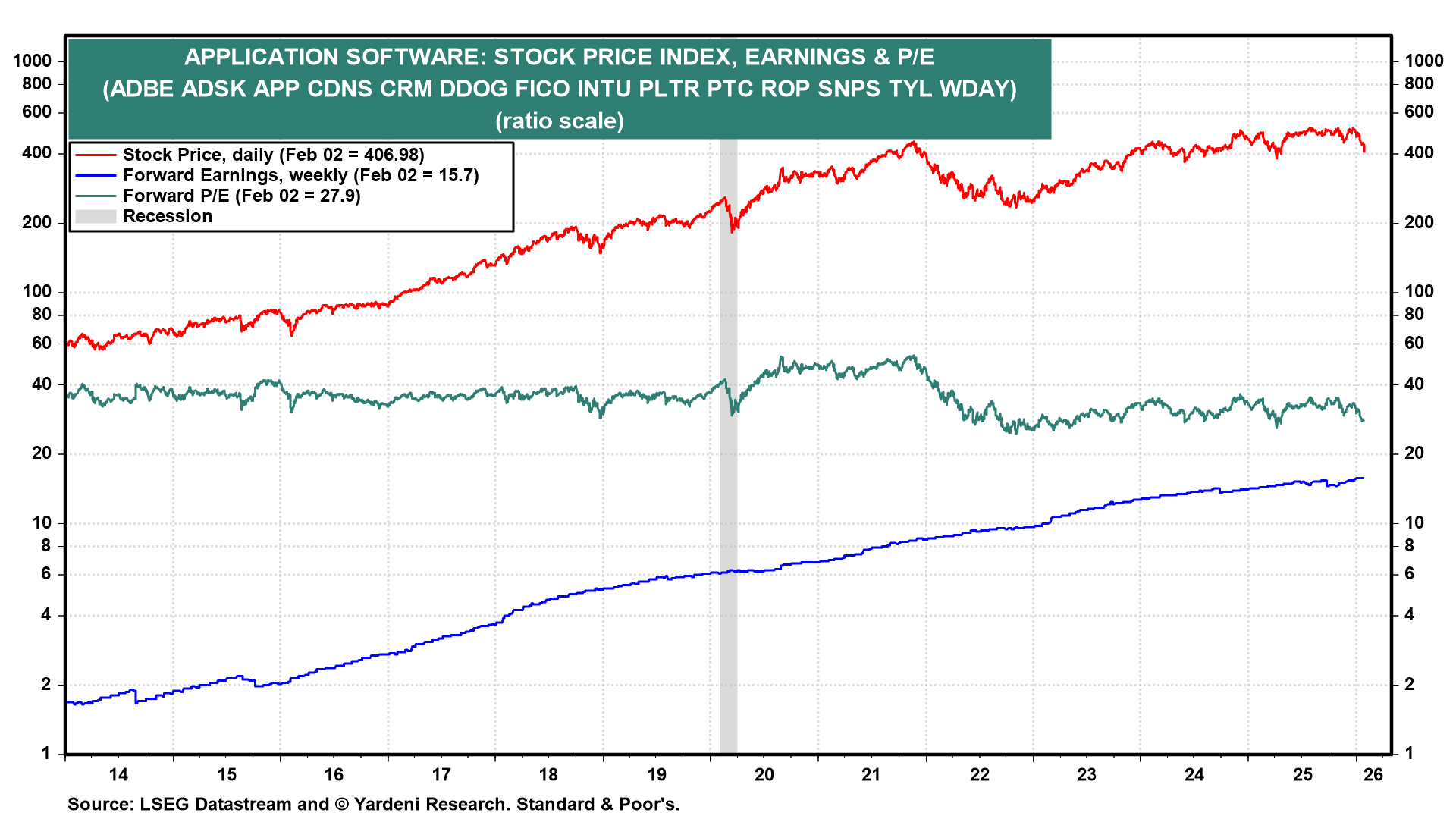

Technology, broadly speaking, has always been competitive and is becoming even more so as a result of AI. In my 2018 book Predicting the Markets, I wrote that the technology industry provides the perfect example of “creative destruction." It is incessantly destroying old technologies by creating new ones. Most recently, software stock prices have been falling because AI tools are getting very good at writing software code (charts). Their forward earnings have been rising to record highs, but investors have reduced their valuation multiples amid increasing competition from AI.

Today, the software stocks were especially hard hit because Anthropic rolled out new tools for its Cowork product. It's too soon to tell how useful the new tools will be, but investors decided to cut the valuation multiples of software stocks.

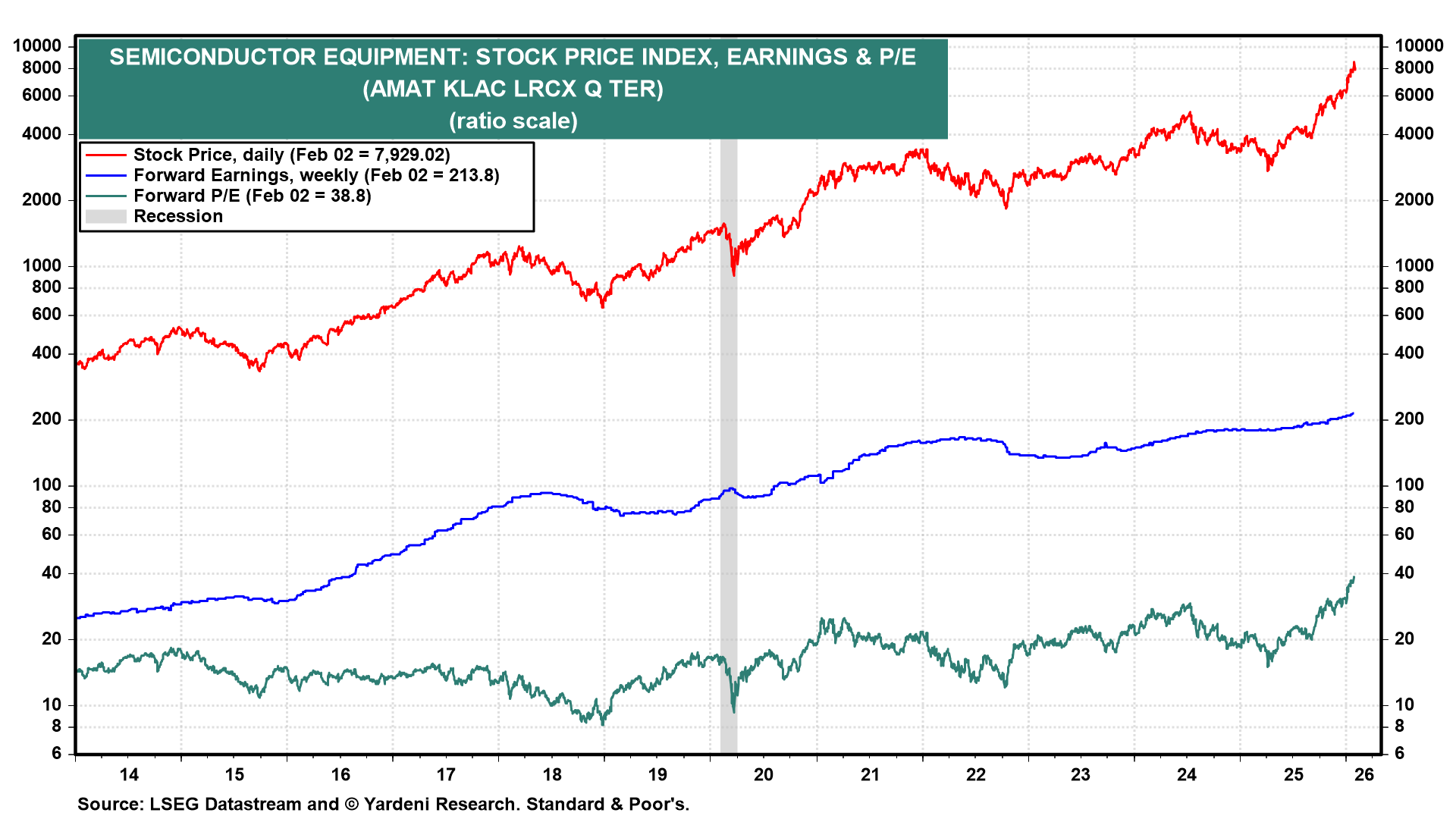

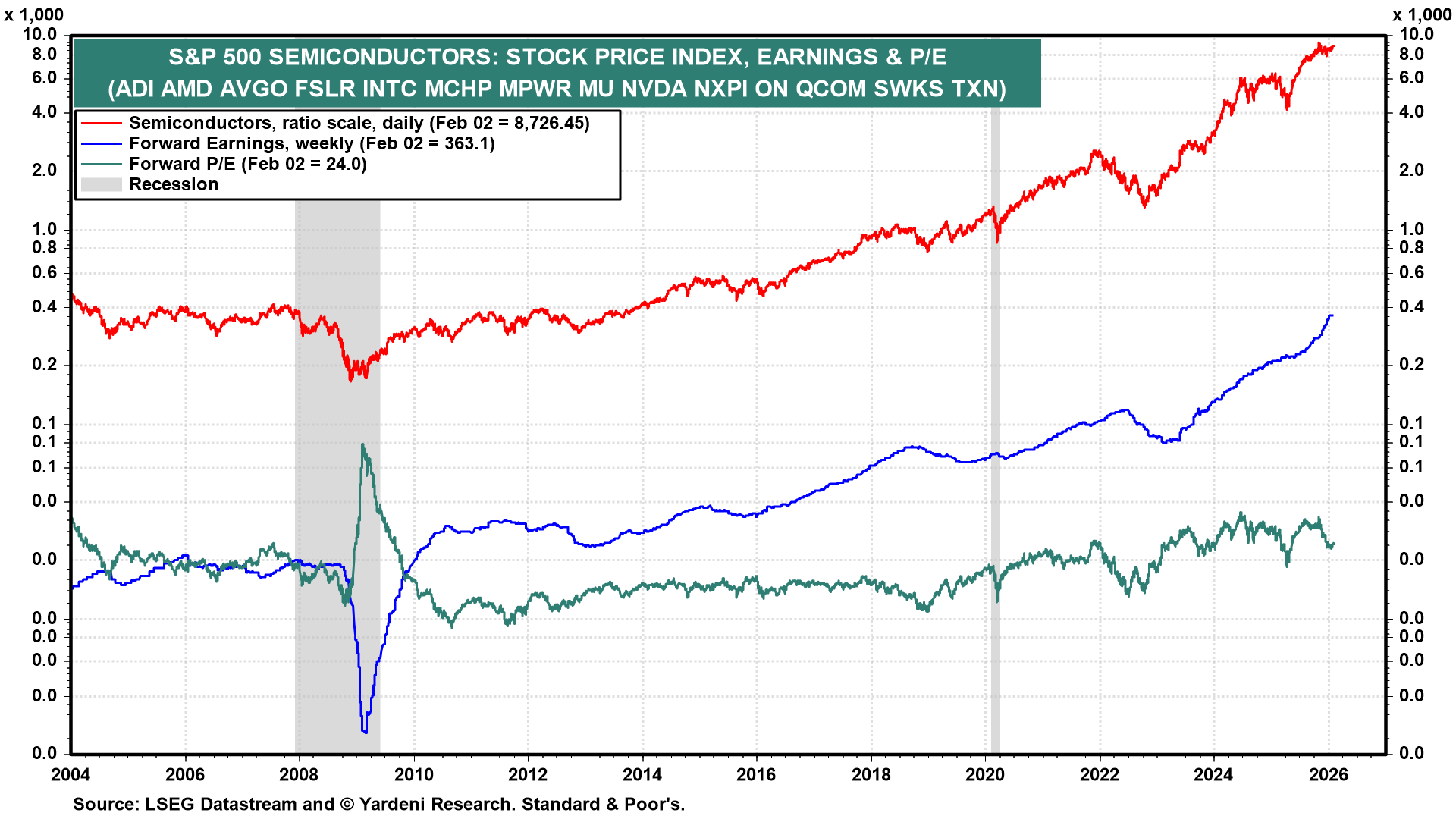

Meanwhile, semiconductor stocks have held up quite well, though the industry's forward P/E has been falling as forward earnings have been soaring (chart). Competition has been heating up, especially among chips competing with Nvidia's GPUs. A shortage of memory chips is causing their prices to soar; but when capacity expands to meet demand, those prices will likely drop, as they have in the past.

The stocks of semiconductor equipment companies have continued to soar, along with both their earnings and valuation multiples (chart). That's because companies in this industry are relatively immune to competition. They do well as long as there is strong demand for equipment that can increase the semiconductor companies' capacity.