I. From Digital Back To Analog

The “AI Immunity Trade” has caused more casualties in the stock market. It started with selloffs in software and private credit stocks at the beginning of the year. Since then, it has hit wealth managers, insurance brokerage, tax preparation, accounting services, professional data, and legal research. Today, it pummeled office REITs, trucking, and logistics stocks.

Investors are scrambling to get out of the digital world and back to the analog, physical world, which is less likely to be disrupted by AI. Who knew that office buildings and trucking had become so digital? The result is that portfolios are rebalancing away from Information Technology, Communication Services, and Financials and toward Consumer Staples, Energy, Health Care, and Industrials.

We think that the AI Immunity Trade is getting overdone, especially in the Financials sector. Many of the trade’s stock market casualties will survive and boost their productivity and profits using AI. However, AI is a disruptive technology causing lots of known unknowns about its ultimate impact on the earnings and the earnings growth of companies likely to be disrupted.

Nevertheless, we are still targeting 7700 for the S&P 500 index by the end of this year. We are dropping our overweight recommendation on Financials to market weight, while maintaining our overweights on Health Care, Industrials, and Materials (as of yesterday). We are glad that we advised underweighting the Magnificent-7 and overweighting overseas stocks in early December last year.

On January 1, we reiterated our expectations that the stock market would be volatile during the first half of the year for various reasons. We did see mounting "AI Fatigue," but we didn't anticipate the AI Immunity Trade weighing on the market currently.

II. Dividends Are Back In Style

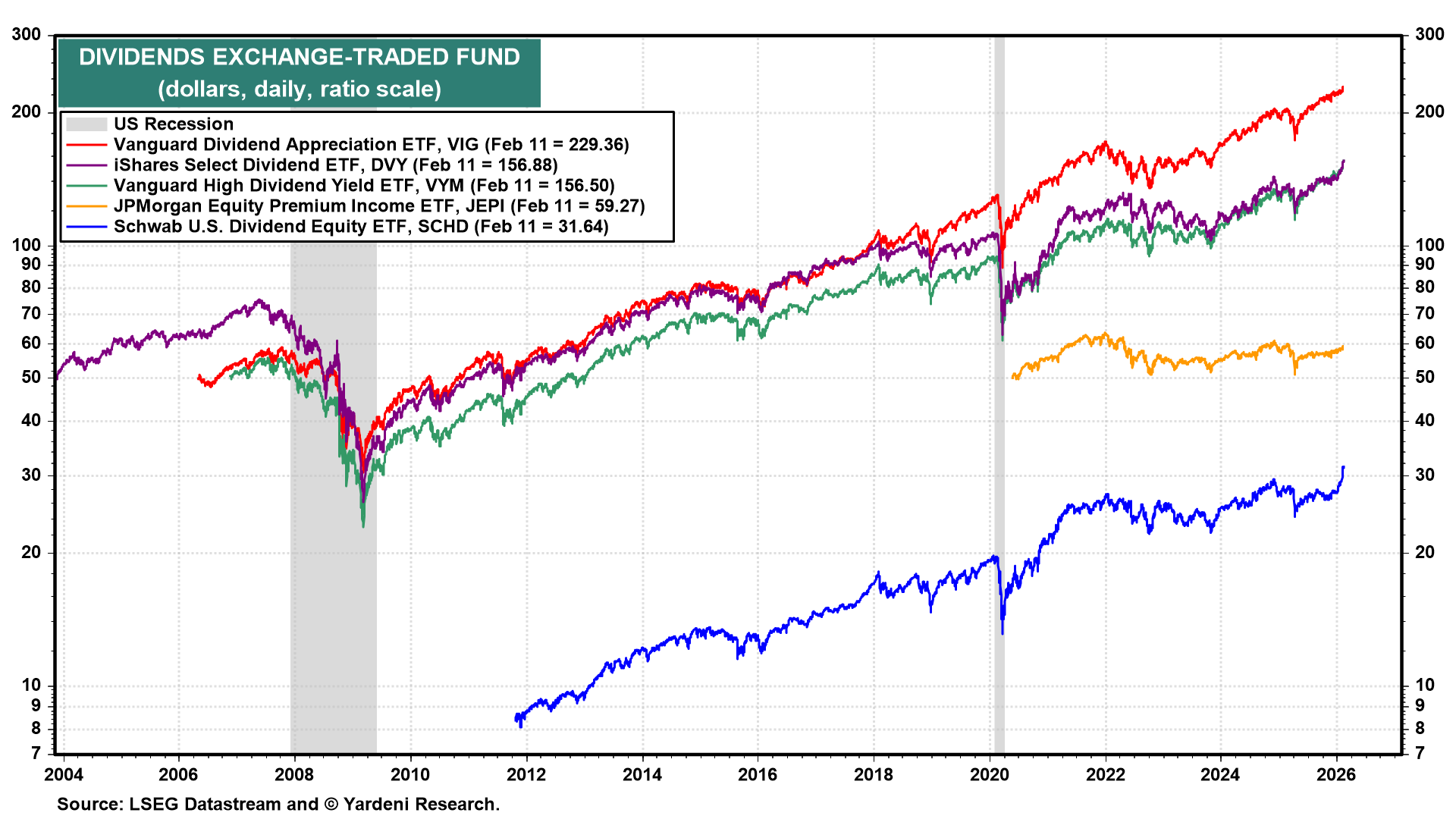

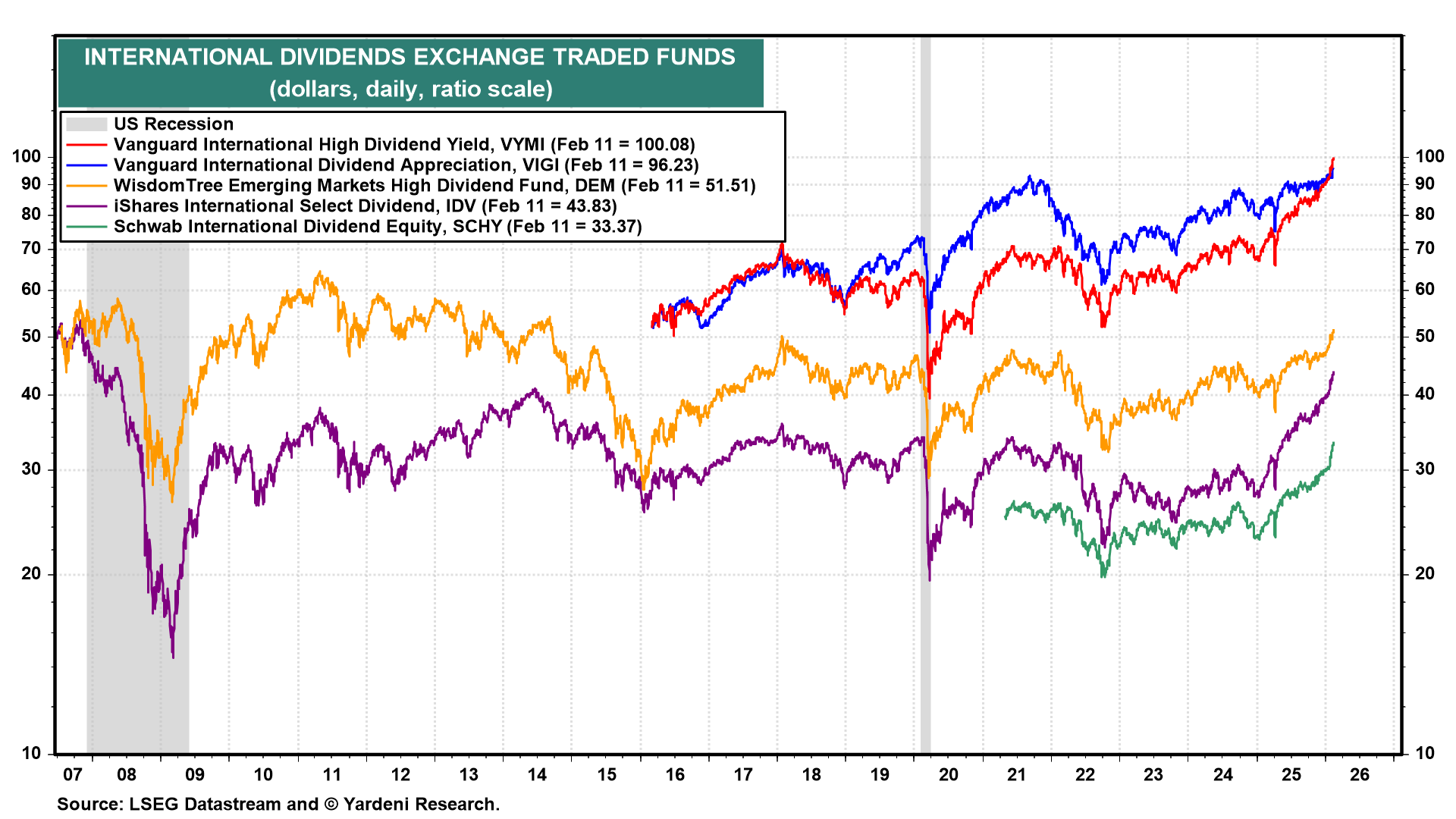

It is encouraging to see that investors are rebalancing their portfolios into the stocks of companies likely to benefit from AI rather than into cash. Among the best-performing ETFs are those invested in domestic and international dividend payers (charts). Such companies tend to be in the Value rather than the Growth universe of stocks. The recent outperformance of the former stocks may continue for a while until there is more clarity on the downside of AI on earnings.

III. January's Jobs Jump

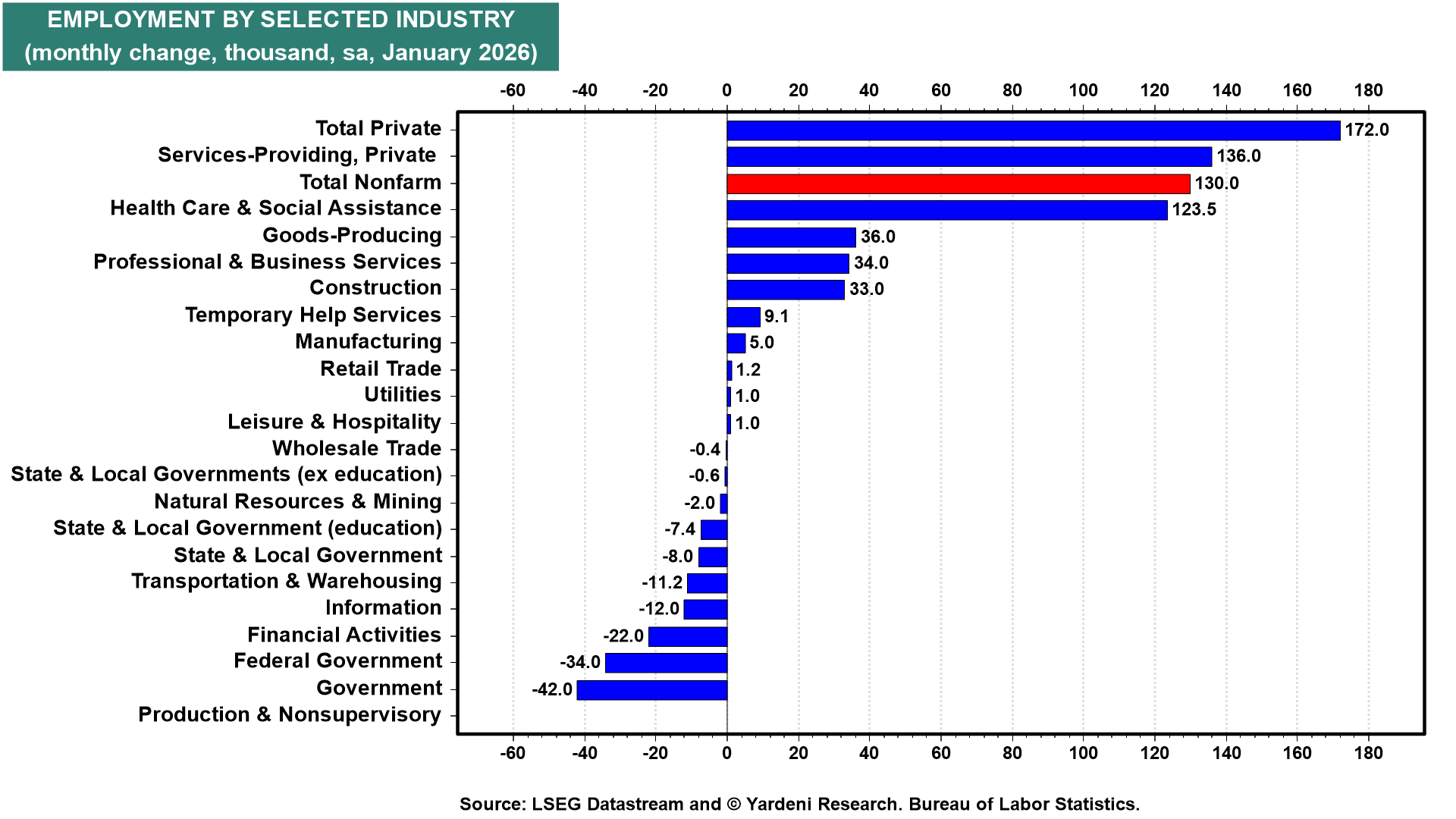

On January 1 of this year, we wrote, "The biggest surprise this year might be a rebound in payroll employment growth. That's supported by the decline in initial unemployment claims at the end of 2025." January's payrolls rose 130,000, led by a 172,000 increase in private industry payrolls (chart). Health Care and social assistance led the gain, but there were solid increases in professional & business services, construction, temporary help services, and manufacturing.

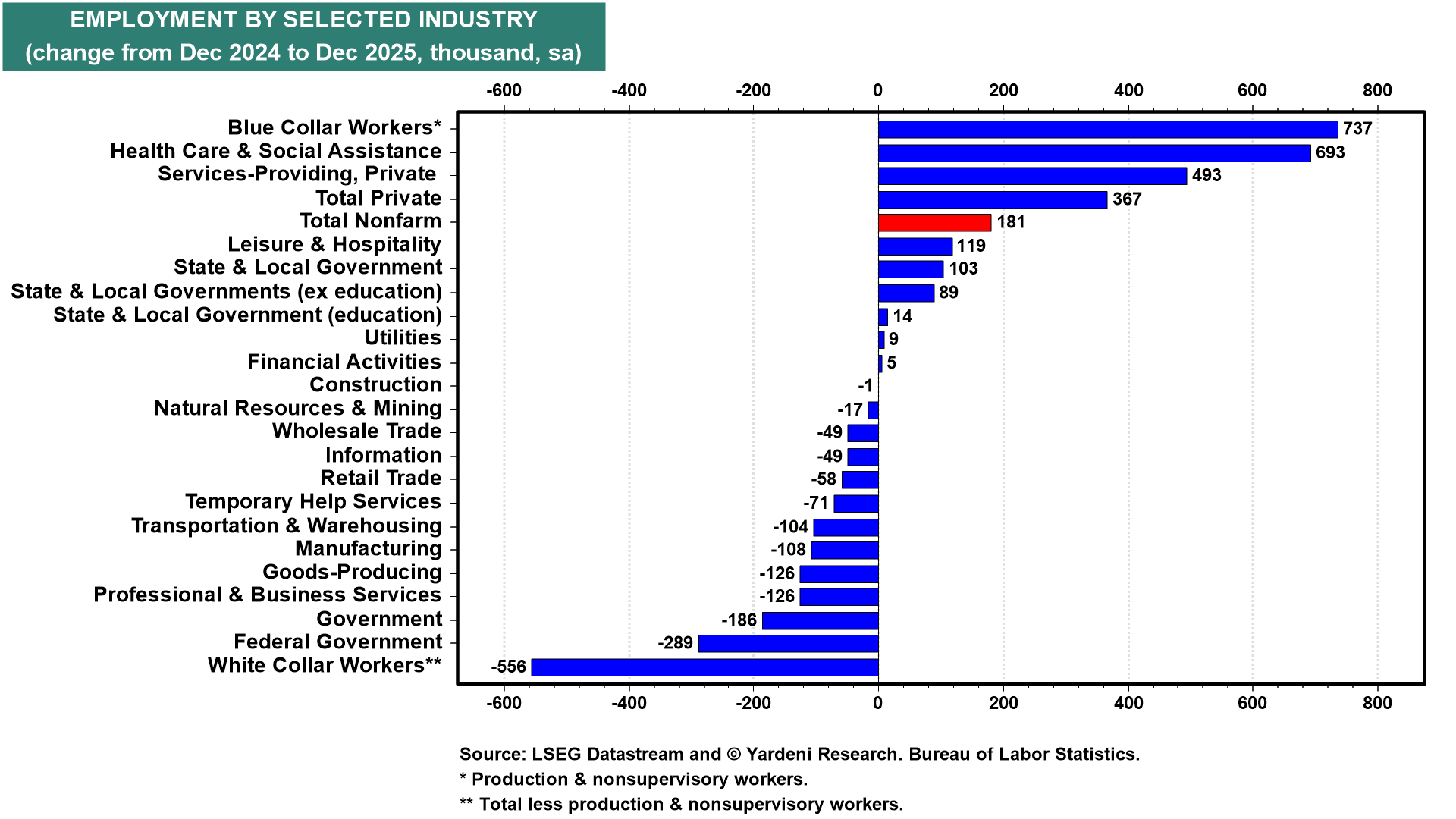

Yesterday's annual benchmark revision to the payroll employment data showed that it increased by just 181,000 last year. Blue-collar jobs rose by 737,000, while white-collar jobs fell 556,000 (chart). Nevertheless, we aren't convinced that January's pop was an aberration. We think the labor market will continue to improve this year compared to last.

IV. US Budget Deficit Getting Some (Temporary) Relief From Tariffs

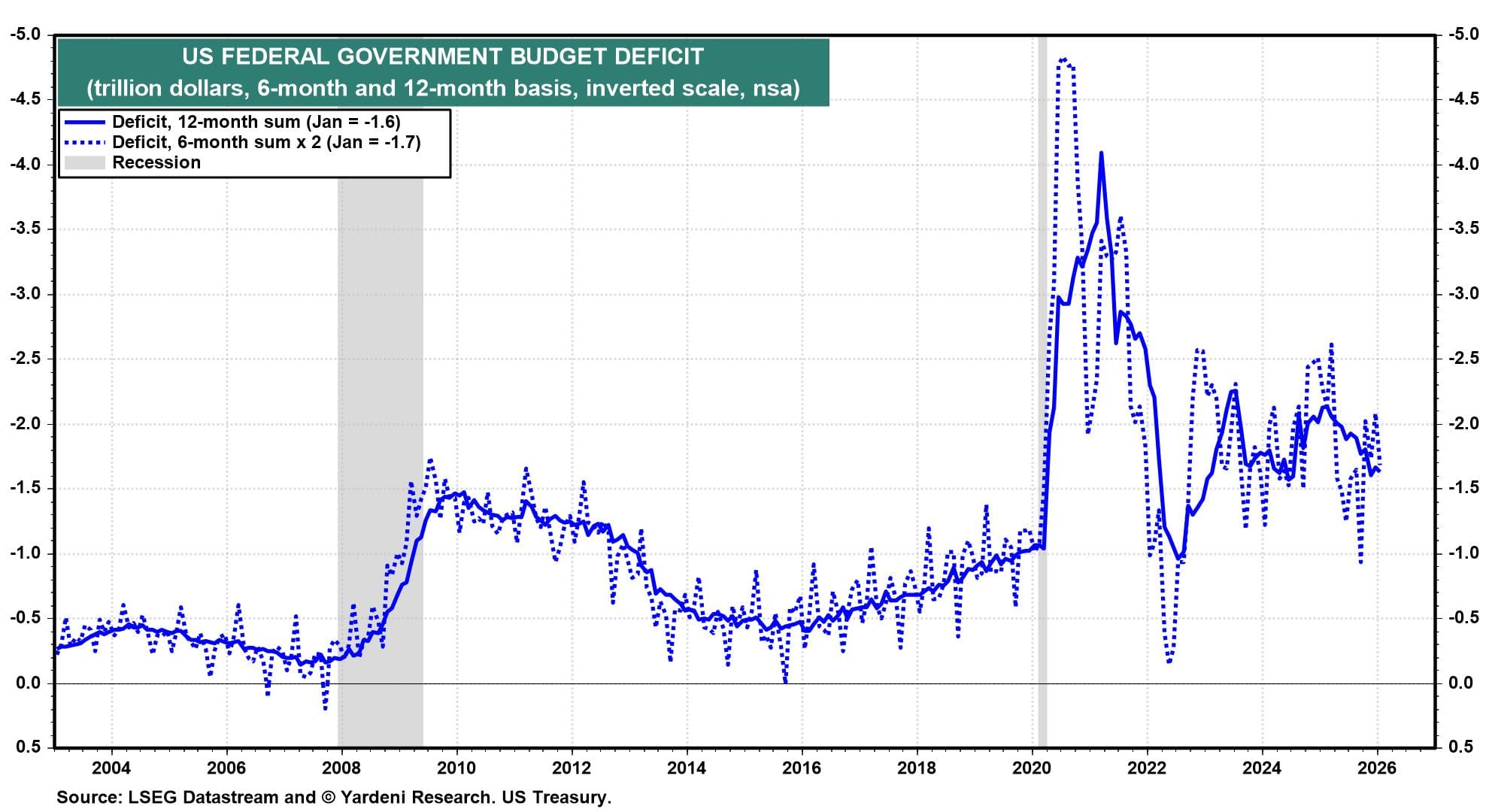

On a 12-month basis, the US federal budget deficit has been narrowing. It recently peaked at $2.1 trillion in February 2025 and was down to $1.6 trillion in January of this year (chart).

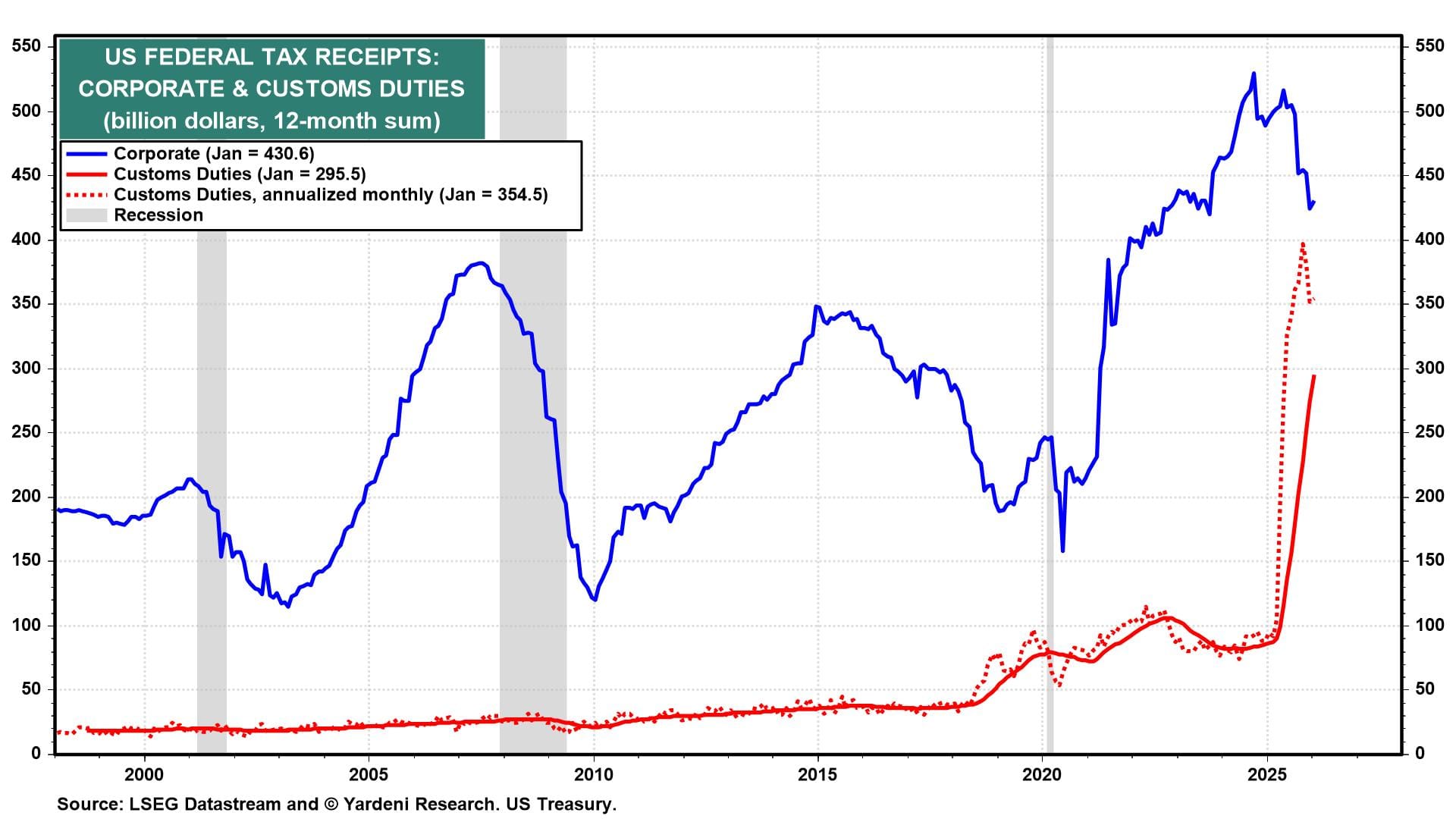

The bad news is that much of that narrowing was attributable to Trump's tariffs, which might soon be ruled unconstitutional by the Supreme Court. If so, the Treasury might have to refund the proceeds. Meanwhile, NY Fed researchers found that "nearly 90 percent of the tariffs’ economic burden fell on U.S. firms and consumers." In fact, because higher customs duties are a corporate expense that reduces affected companies’ profits, they have reduced federal tax receipts from corporations by $64 billion over the past 12 months, offsetting 24% of the $268 billion received from customs duties (chart).