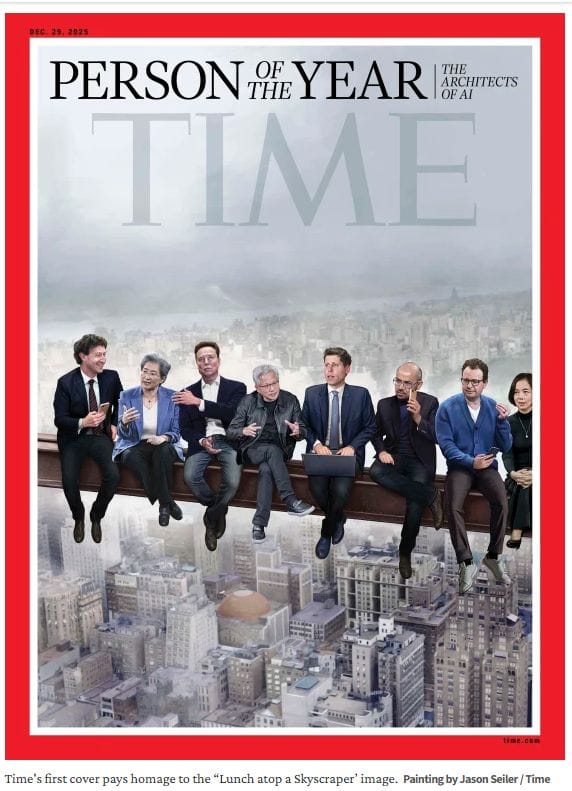

Our December 11, 2025, QT was titled "AI CALL: The TIME Curse & The Game of Thrones." The TIME Cover Curse hit AI in mid-December when the magazine featured "The Architects of AI" as the 2025 TIME Person of the Year. We wrote: The AI trade is turning into a Game of Thrones. In the past, the Magnificent-7 had their own kingdoms surrounded by big moats. They each had their unique monopolies. But now they are competing in the AI race, threatening one another's kingdoms. That's why we recommended underweighting the Magnificent-7 in Sunday's QT, anticipating that the bull market will broaden to the S&P 493 in 2026."

In our December 18, 2025, QT, we warned, "The Mag-7 may be undergoing a correction similar to the DeepSeek correction earlier this year. ... In recent weeks, investors have started to fret that the [AI infrastructure] spending is depleting the Mag-7s' cash flows and slowing profits growth. Before AI, the Mag-7 had lots of cash flow because their spending on labor and capital was relatively low. That changed once AI forced them to spend much more on both. They found themselves competing more with one another to win the AI race."

The stock market is down again today, even though Alphabet reported fabulous revenues and earnings. However, the company also announced that it would double its 2025 capex to $175-$185 billion in 2026.

The ratio of the S&P 500 Magnificent-7 ETF (MAGS) to the Impressive-493 ETF (XMAG) peaked at a record high of 3.09 on November 3, a few days after Michael Burry trashed the AI trade in an October 27 post. It is down to 2.76 around noon today (chart). The selling of both the Mag-7 and, more broadly, the tech sector may be getting a bit overdone. There are certainly AI-related tech stocks that will make lots of money in this space.