In a recent press interaction in Iowa on Tuesday, President Trump made headlines by using the "yo-yo" metaphor to describe his perceived influence over the US dollar. When asked about the dollar's recent slump to a four-year low, he dismissed concerns, saying, "I could have it go up or go down like a yo-yo."

The comments immediately rattled currency markets. The Bloomberg Dollar Spot Index dropped about 1.2% following the statement, as traders interpreted it as a sign that the administration might actively favor or encourage a weaker dollar to boost export competitiveness. Despite the "yo-yo" comment, Trump also claimed he would prefer the dollar to "seek its own level," which he described as the "fair thing to do."

Speaking on CNBC on Wednesday, Treasury Secretary Scott Bessent said that a strong dollar is the natural result of "sound economic fundamentals." He suggested that as long as the US remains the best destination for capital—driven by tax clarity and deregulation—the dollar will remain strong over the long term. He explicitly stated that the US is "absolutely not" intervening in currency markets to weaken the dollar or support other currencies, such as the Japanese yen, dismissing recent market rumors of a "joint intervention."

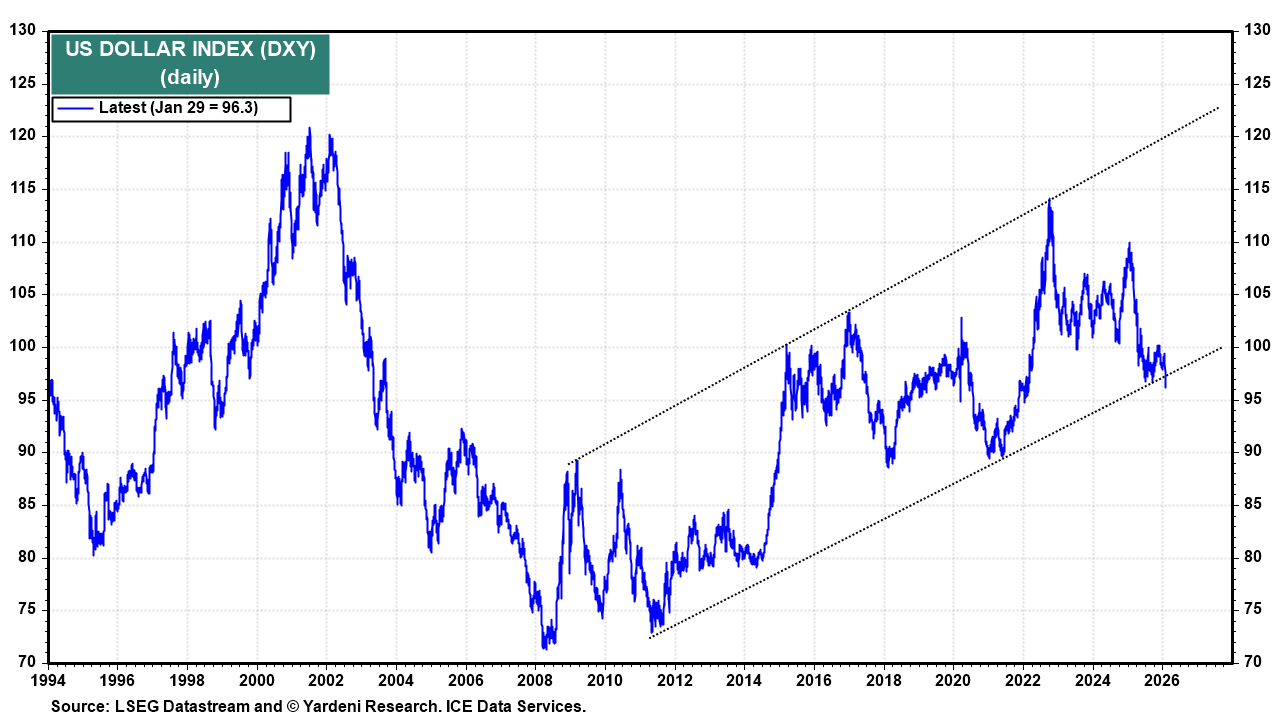

Following Bessent's Wednesday morning interview, the US Dollar Index (DXY) snapped a four-day losing streak (chart). We are still inclined to be bullish on the dollar, along with Bessent.

The major stock market price indexes have also been in a yo-yo formation since late last year (chart). Today was a yo-yo day for the Magnificent-7, as investors were disappointed by Microsoft's earnings report and elated by Meta's numbers. After the close, Apple reported "staggering" iPhone demand, especially in China. Precious metals prices also yo-yo-ed today.