The stock prices of banks and credit card companies fell today after President Donald Trump announced late Friday that credit card companies would be subject to a 10% cap on the interest rates they can charge customers. The President proposed a one-year cap on interest rates starting January 20. The Trump administration is scrambling to address the affordability crisis before this year's midterm elections.

We expect that the banking industry will pop this trial balloon before it takes off. The industry's trade groups issued a joint statement late Friday, making their case: "Evidence shows that a 10% interest rate cap would reduce credit availability and be devastating for millions of American families and small business owners who rely on and value their credit cards, the very consumers this proposal intends to help."

We view today's selloff in financial stocks as an opportunity to buy them ahead of the big banks' better-than-expected Q4-2025 earnings announcements at the end of this week. Here's why there might be upside surprises:

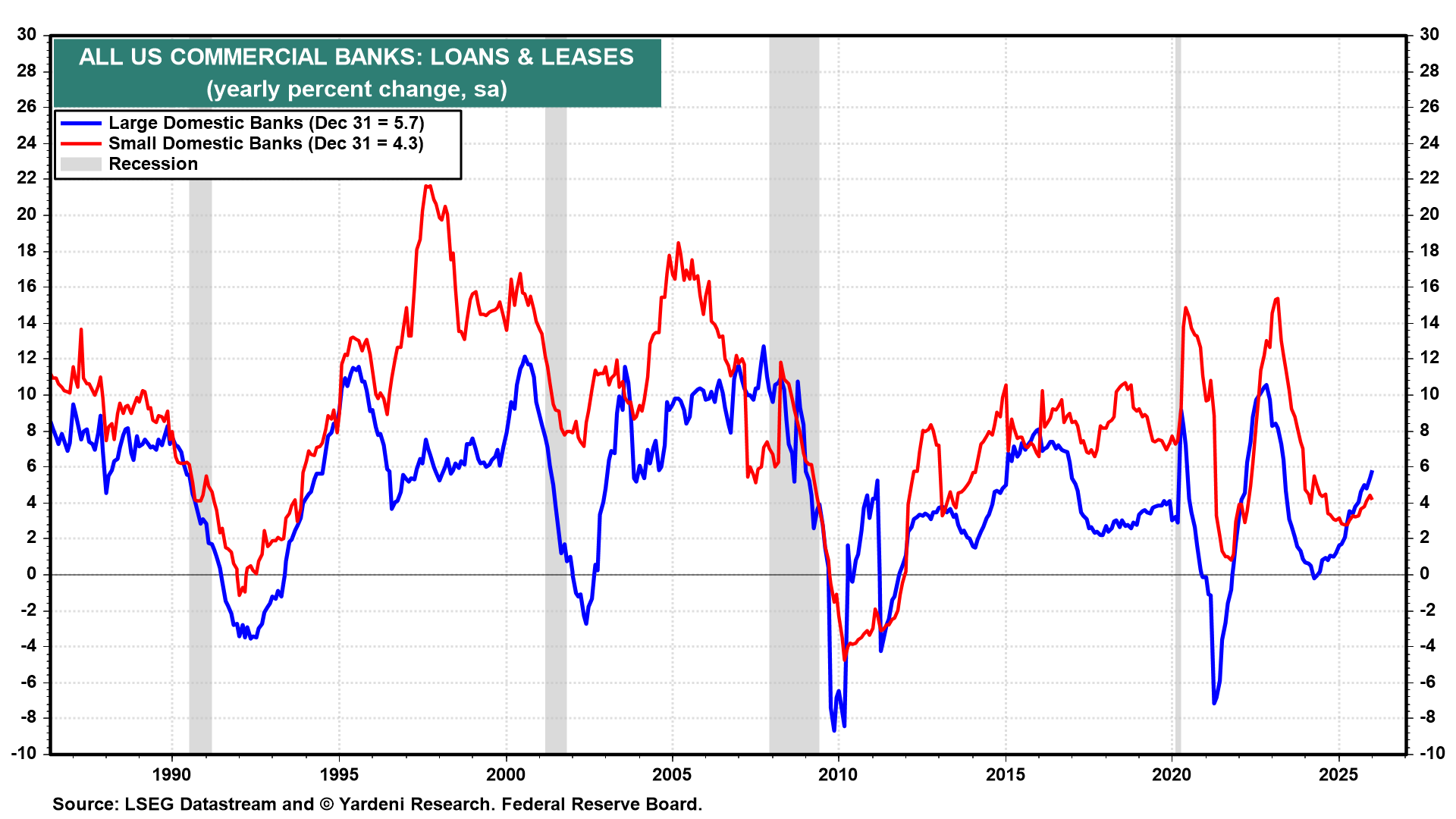

(1) Loan demand rebounded last year. The growth rate of loans and leases at both large and small banks rebounded last year (chart). For large banks, it rose from 0% y/y in April 2024 to 5.7% at the end of last year.

(2) The slope of the yield curve has been steepening since late 2024. The spread between the 10-year and 2-year Treasury yields widened from zero on December 2, 2024 to 64bps at the start of this year (chart). That should have boosted banks’ Q4 net interest margins.