The 10-year Treasury bond yield rose yesterday and today on mostly upbeat employment indicators. Yesterday, the JOLTS report came in stronger than expected. In addition, initial unemployment claims edged down, according to yesterday's report. Today, the Challenger report showed a drop in layoffs. The bond market chose to tune out the uptick in continuing unemployment claims in yesterday's report, and it also ignored today's weaker-than-expected ADP payroll report.

We are inclined to agree with the bond market's current assessment: The labor market remains relative strong. The bond market clearly won't ignore tomorrow's employment report, especially if it is surprisingly weak. If it is weak, though, we doubt that it would change our minds because we view the current slowdown in economic activity as just a first-half-2025 soft patch. We still expect that the tariff issue and geopolitical worries will weigh much less on the economy during the second half of this year. The record highs in stock prices confirm our outlook and also increase its probability of panning out, by providing a very positive wealth effect on consumer spending. Low gasoline prices provide another tailwind for consumer spending.

Our guess is that June's payroll employment rose between 100,000 to 125,000.

Let's review the latest employment indicators:

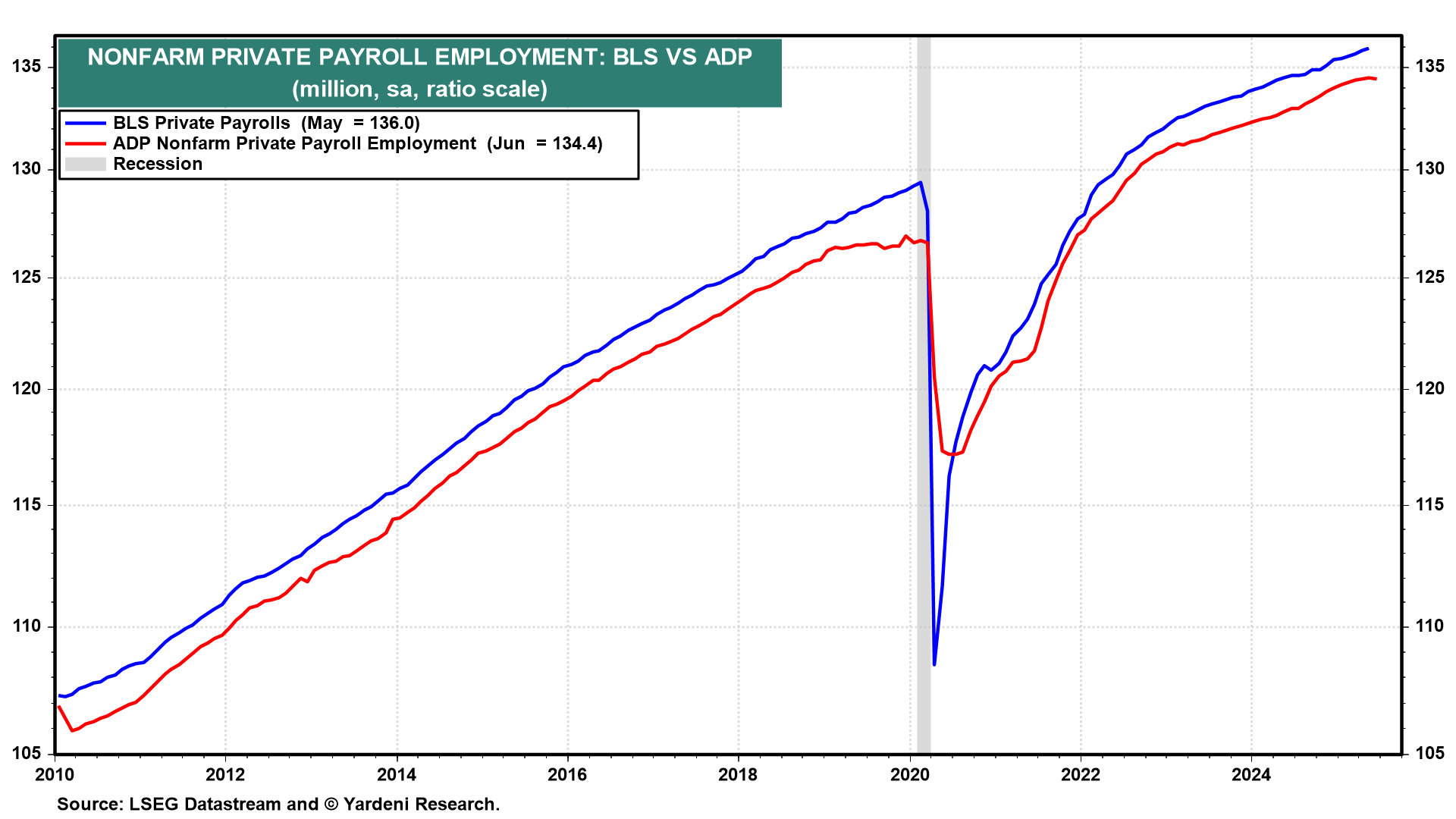

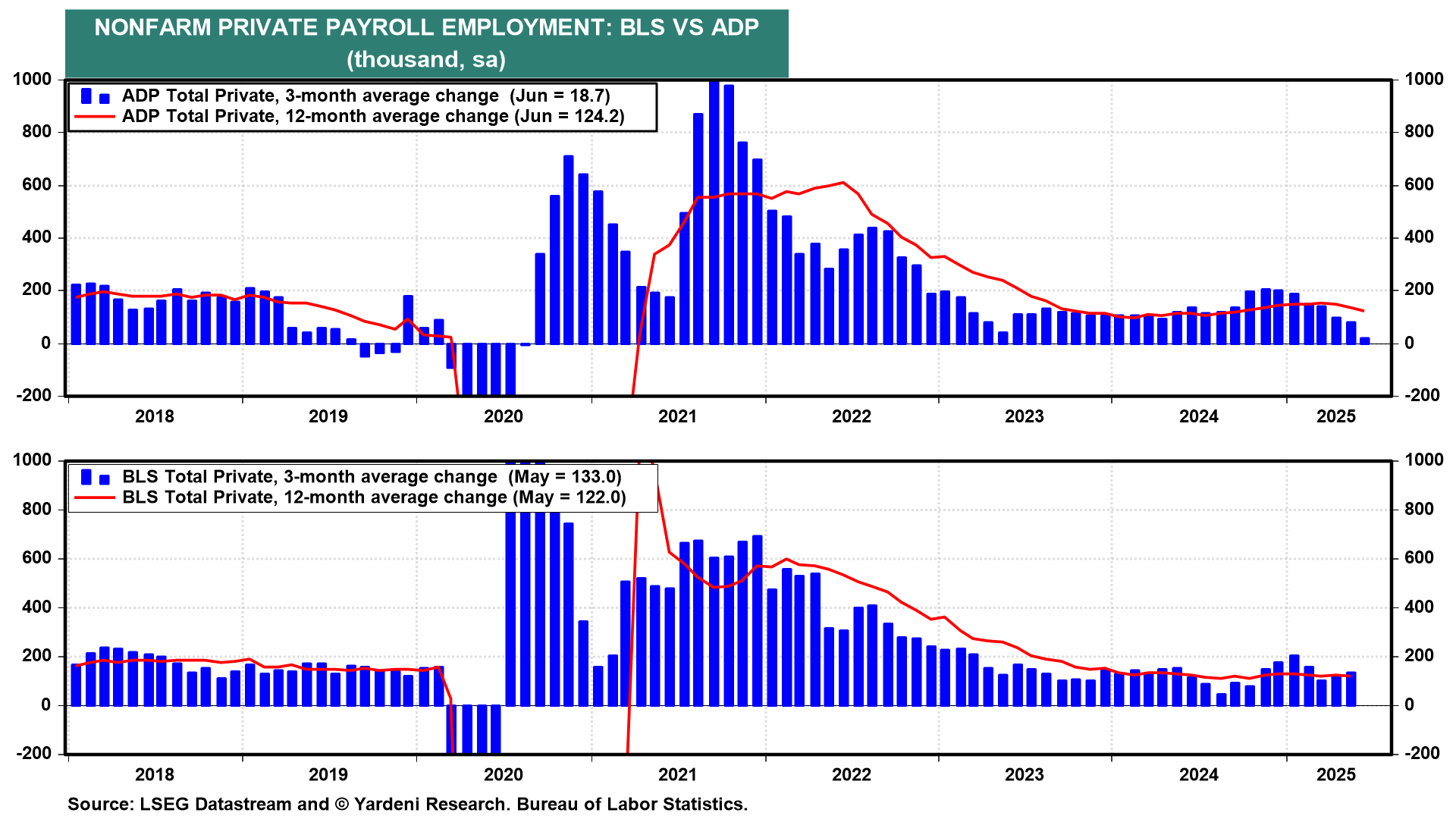

(1) ADP. The ADP measure of private industry payrolls has been a misleading indicator of the comparable data compiled by the Bureau of Labor Statistics (BLS) in recent months (chart). We aren't sure why that's happened.

Private industry payrolls fell 33,000 during June according to ADP (chart). It was the first decline since March 2023, after a downwardly revised increase of 29,000 in May.

The ADP payroll series has been weaker than the BLS series during Q2. It was stronger in previous months, which explains why the average monthly increases over the last 12 months have been almost the same (124,200 vs. 122,000).

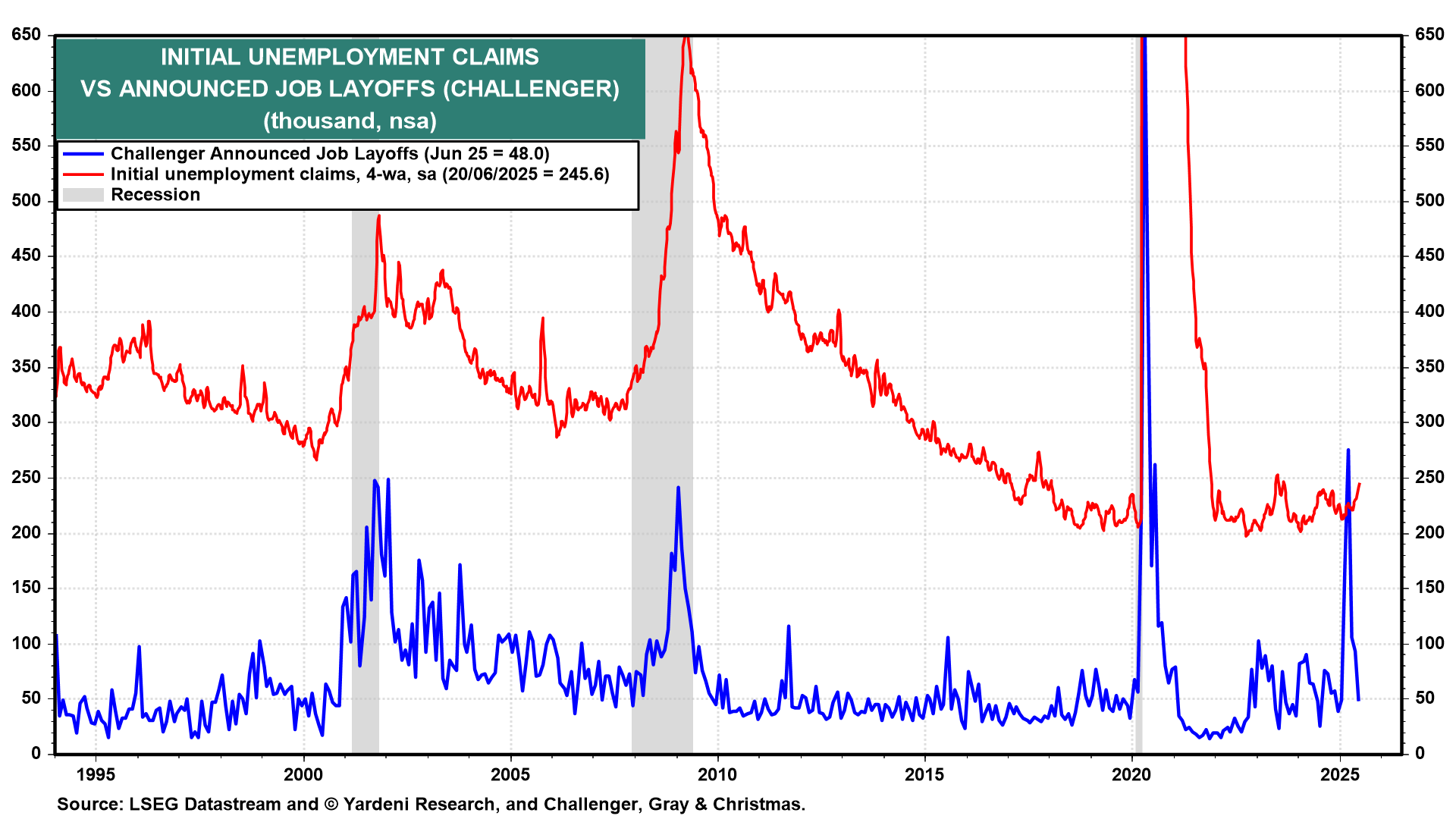

(2) Challenger layoffs. A separate report from global outplacement firm Challenger, Gray & Christmas showed job cuts announced by US-based employers totaled 47,999 in June, a drop of 49% from the prior month (chart).

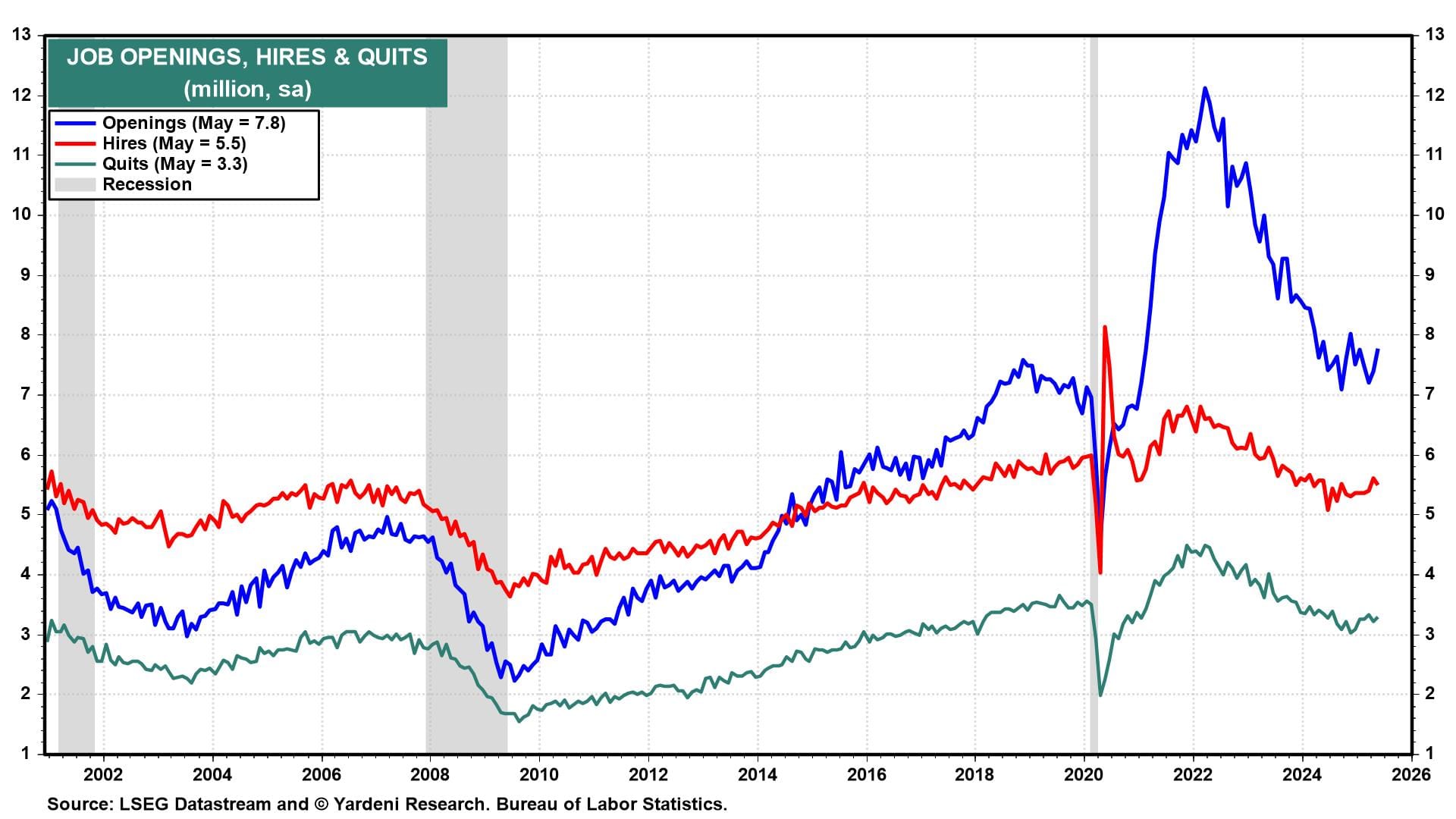

(3) JOLTS. Hiring remained relatively robust in May, according to the JOLTS report (chart). It showed hires at 5.503 million in May, a slight decline of 112,000. Job openings increased so that there were 1.07 job openings for every unemployed person in May, up from 1.03 in April.

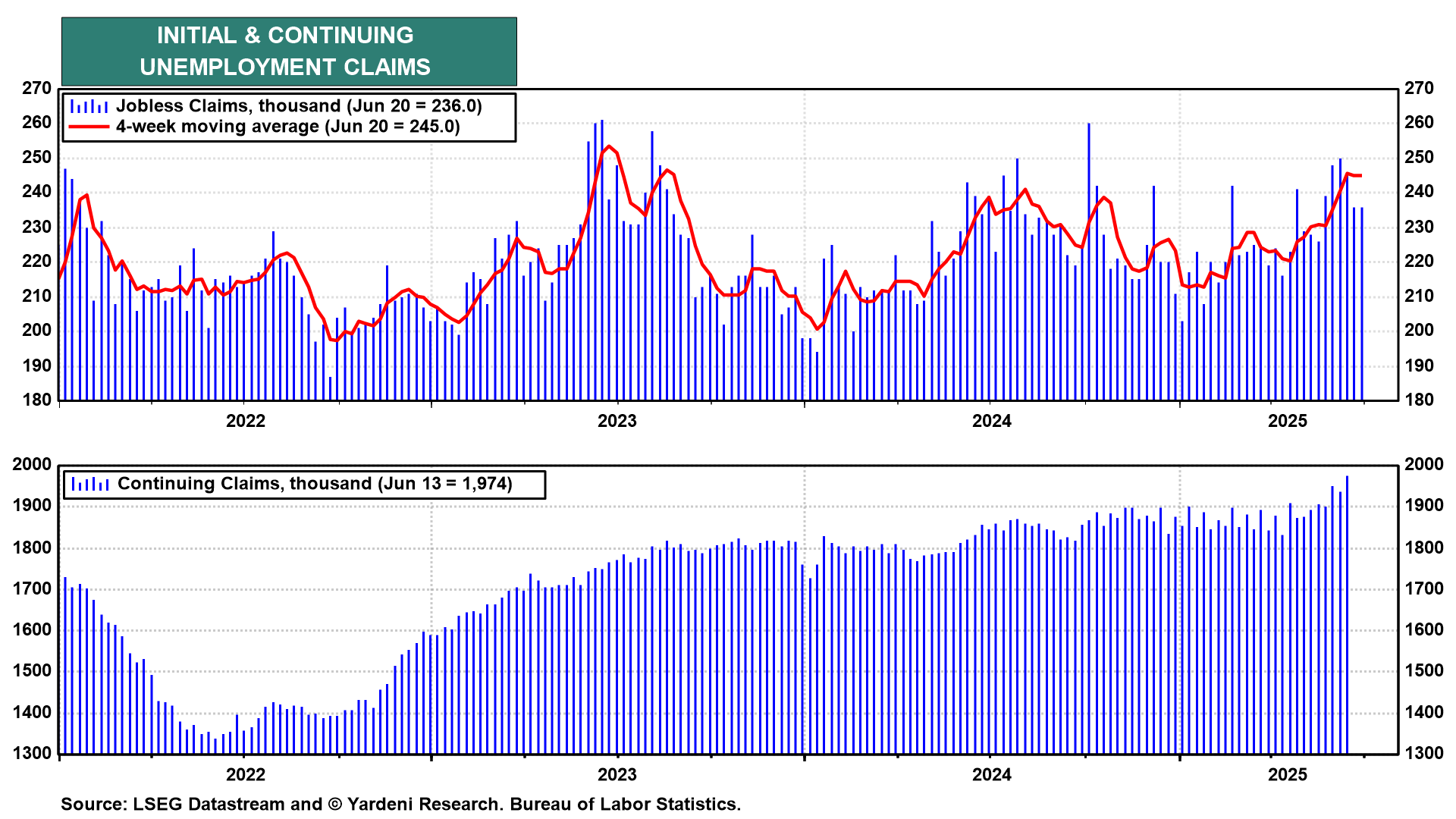

(4) Unemployment claims. The low readings for initial unemployment claims in recent weeks confirm the drop in Challenger's layoffs series. However, the rise in continuing claims indicates that it is taking longer to get a job. This suggests that the unemployment rate might have edged up slightly in June to 4.3% from 4.2%.