This past week was an ugly one for the S&P 500 adding significantly (5.1ppts) to the 18.2% ytd loss in the index.

The MegaCap-8 stocks continued to weigh most heavily on the S&P 500 Information Technology, Communication Services, and Consumer Discretionary sectors. Here is the ytd and past week's performance derby for the index and its 11 sectors:

Energy (58.7%, -0.9%), Utilities (-1.0, -4.1), Consumer Staples (-7.5, -2.6), Materials (-10.3, -5.8), Industrials (-14.5, -5.0), Financials (-17.1, -6.8), S&P 500 (-18.2, -5.1), Real Estate (-20.8, -6.2), Information Technology (-25.2, -6.4), Communication Services (-28.2, -4.1), and Consumer Discretionary (-30.0, -6.1).

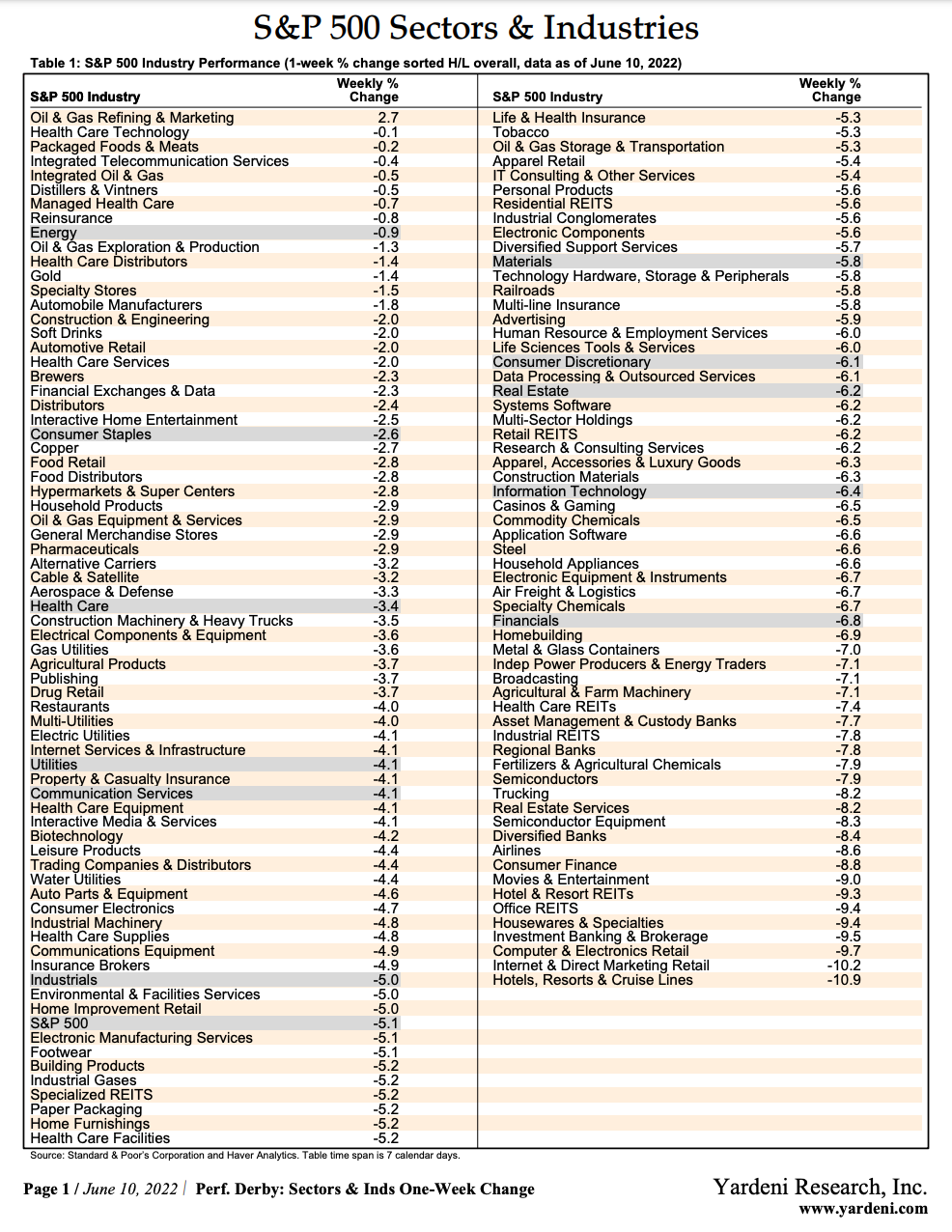

Of the 100+ industries we track, only one was up last week (table below). Most of last week's damage was done during the last two days of the week as investors feared that May's CPI might be higher than expected on Thursday, which it was on Friday.

Investors concluded that the Fed remains well behind the inflation curve and must move more aggressively to tighten monetary policy, increasing the risks of a recession. Treasury yields soared on the news and the forward P/E of the S&P 500 dropped back down to 16.4 with S&P 500 Growth at 19.5 and Value at 14.4.