What do Nvidia and the Fed have in common? They are both data-dependent. Nvidia's GPUs are the latest stage of the Digital Revolution, which started during the mid-1960s with IBM's mainframes. The Digital Revolution is all about processing ever more data, faster and faster, and at ever lower cost. In this context, GPUs are just the latest development in the Digital Revolution. The next big, new thing is likely to be quantum computers.

As data processing productivity increases, so does the amount of data that needs to be processed. The supply of data will continually expand to infinity and beyond, to quote Buzz Lightyear. We view AI as a high-powered App that is exponentially increasing the demand for computing power for ever more data.

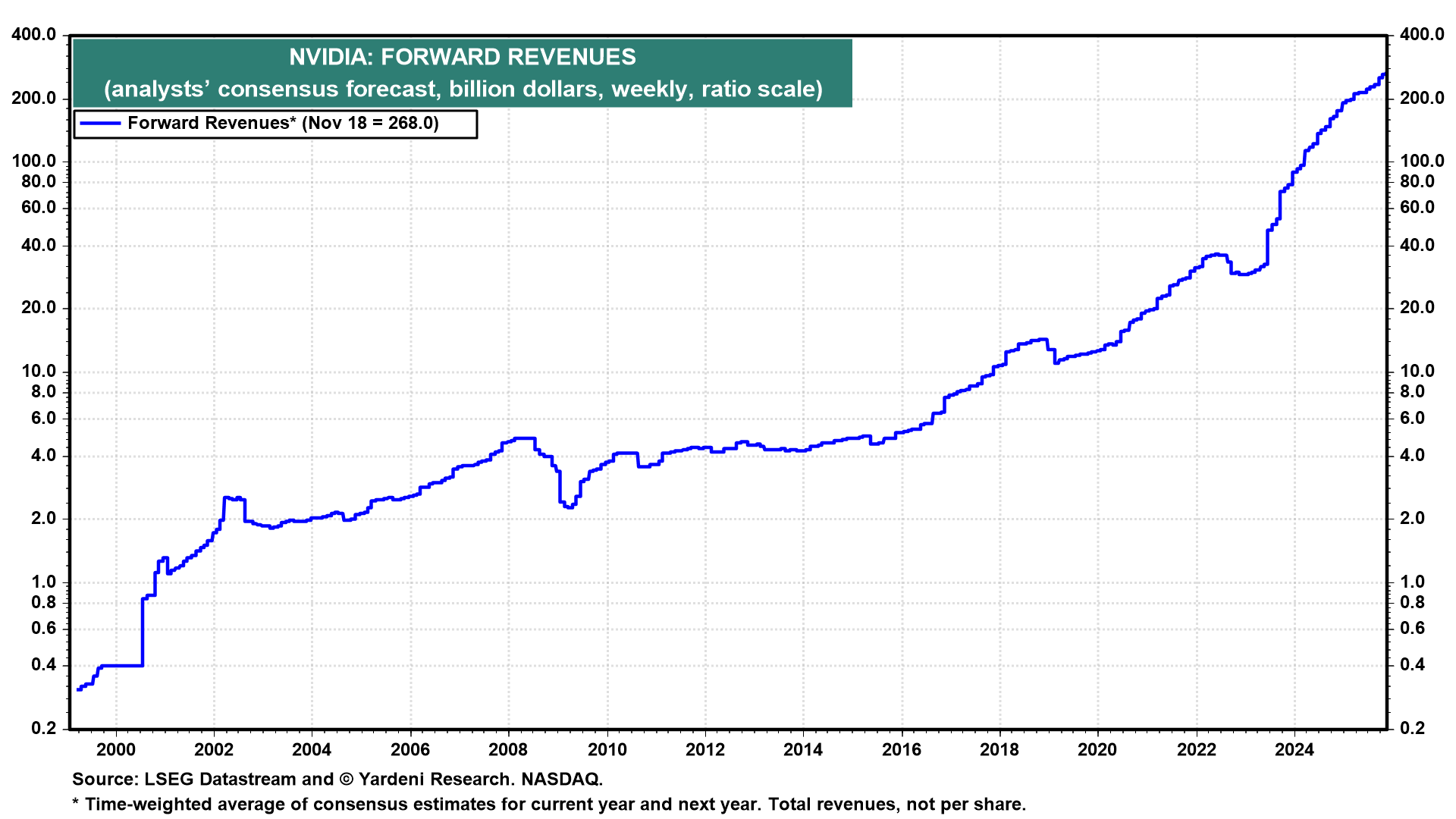

Nvidia reported Q3 earnings after the close today, topping Wall Street expectations for sales and profits, and provided stronger-than-expected guidance for Q4 sales. Nvidia's most important business is data center sales. The company said it had $51.2 billion in data center sales, easily beating analyst expectations of $49.1 billion, a 66% year-over-year rise. Nvidia's forward revenues rose to a record $268 billion during the week of November 18, a fivefold increase since late 2023 (chart).

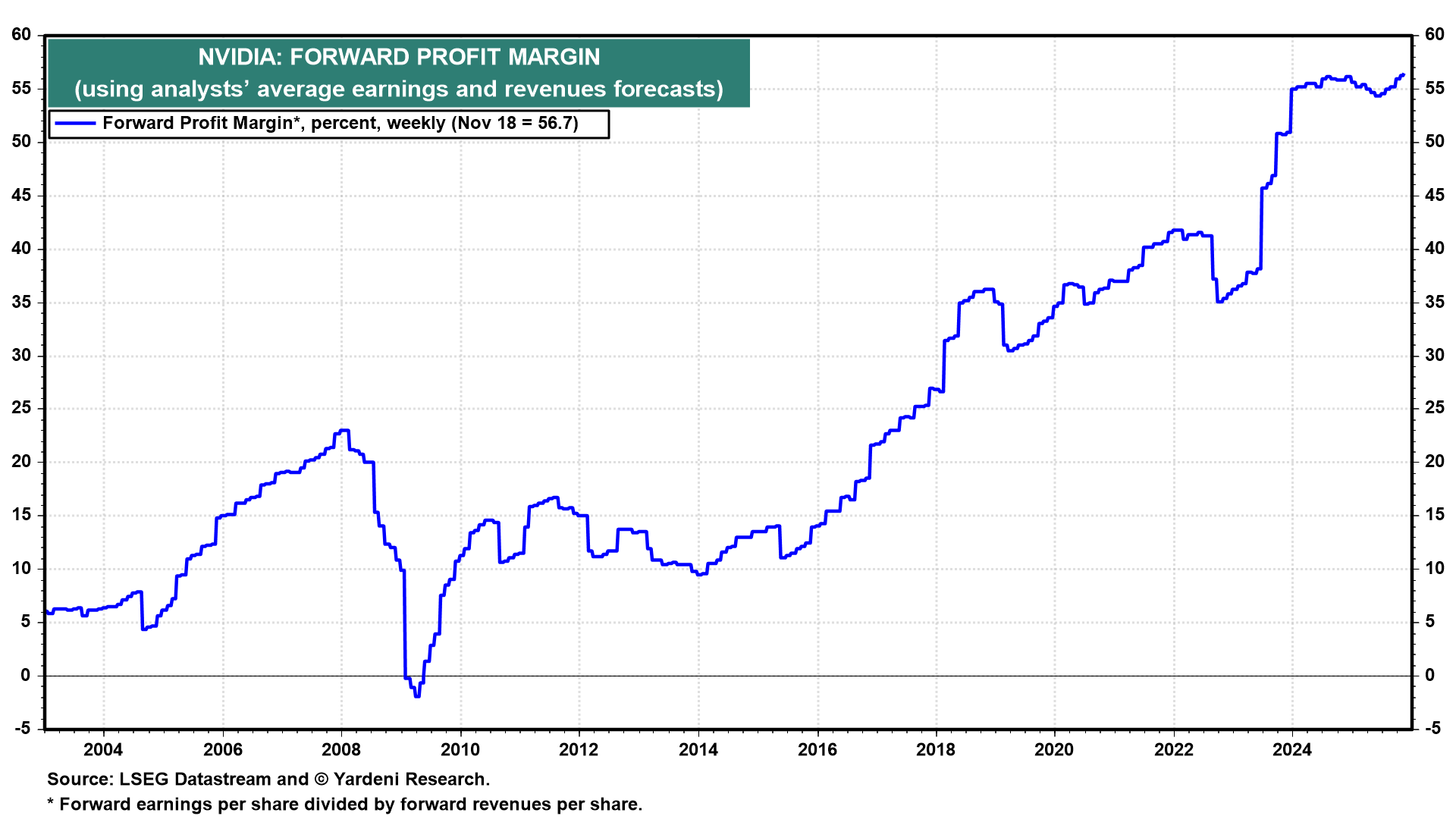

Nvidia sports a 56.7% forward profit margin (chart). For more, see our Nvidia Brief in our new Corporate Reports In Brief (CRIB) section of Our Charts.

The Fed is also data-dependent. That's been a problem during the government shutdown, which started in early October. Nevertheless, the FOMC, the Fed's monetary policy committee, voted to cut the federal funds rate (FFR) by 25bps at its October meeting. There were two dissenters. There could be more at the December meeting. The minutes of the October meeting noted that officials expressed "strongly differing views" about whether a rate cut would be appropriate at the December meeting.

Many participants suggested that, given their economic outlooks, it would be appropriate to keep the target range unchanged for the rest of the year. The primary concern among this group is that inflation progress has "stalled" and a quick cut could be misinterpreted as a lack of commitment to the 2% inflation target.

Several participants assessed that another rate cut "could well be appropriate" in December if the economy evolved as they expected. This group is more focused on the risks to the labor market and preventing a sharp rise in unemployment.

The CME Fedwatch tool shows that the odds of a FFR cut next month is down to 32.8% from over 50.0% a week ago. No matter what decision is made, there could be more than than two dissenters at the next meeting. The 10-year US government bond yield remains just above 4.00%, which is where it was before the Fed started cutting the FFR by 150bps last year in September (chart).

By the way, the minutes noted, "Some participants commented on stretched asset valuations in financial markets, with several of these participants highlighting the possibility of a disorderly fall in equity prices, especially in the event of an abrupt reassessment of the possibilities of AI-related technology."

As we expected yesterday, the Bull-Bear Ratio dropped below 3.00 this past week to 2.88 (chart). From a contrarian perspective, the fewer bulls, the better for those of us who remain bullish.