2026 I: What Will Likely Go Right?

The Roaring 2020s remains our base-case scenario. For 2026, we are raising our subjective odds of this prospect from 50% to 60%. We are less concerned about a meltup/meltdown scenario now, so we are lowering the odds of that from 30% to 20%. We are keeping our bearish scenario at 20%.

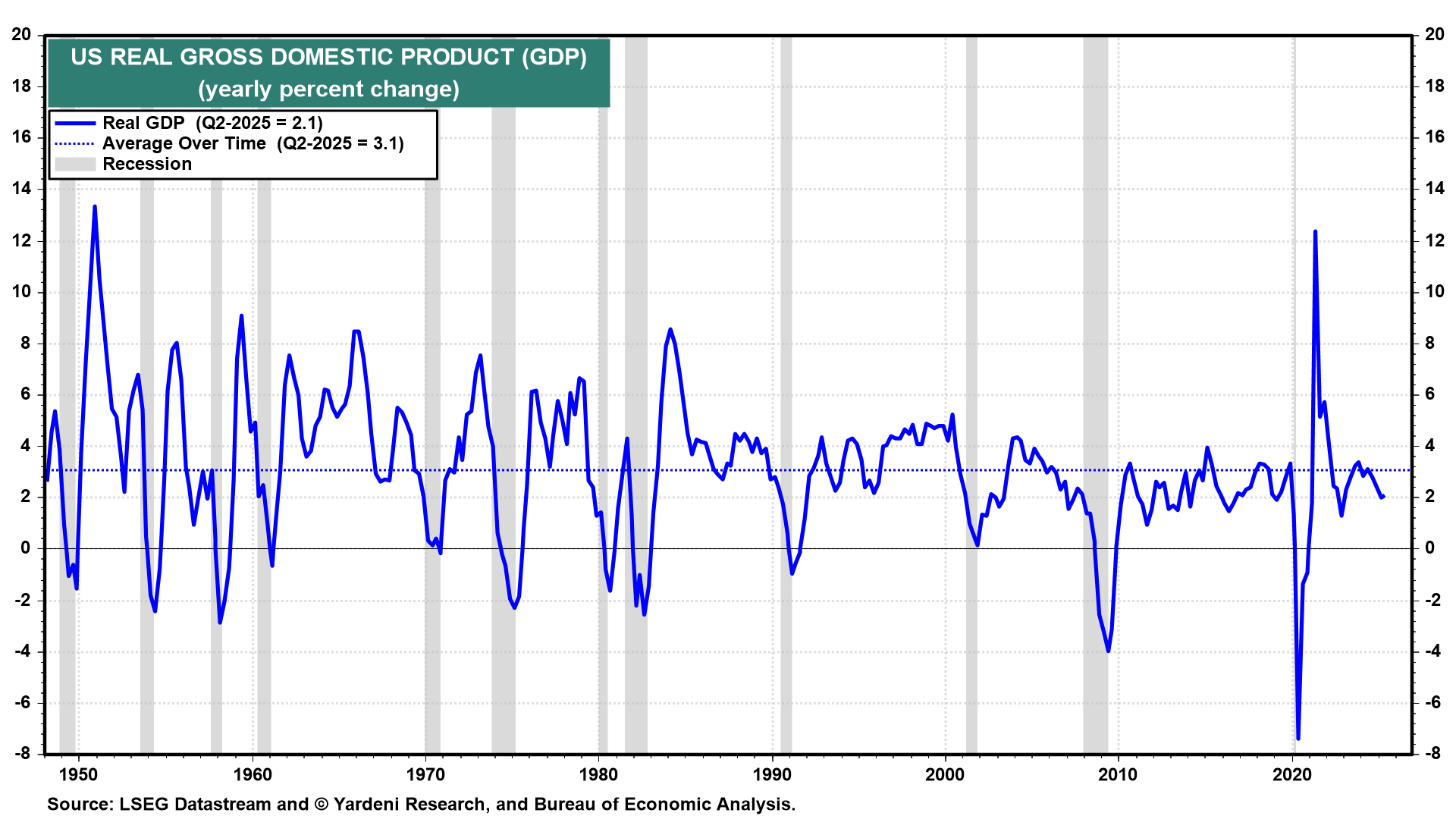

In our base-case scenario, real GDP should grow 3.0%-3.5% next year, following this year’s likely gain of 2.0%-2.5% (Fig. 1 below). We expect the labor force to increase by only 0.5%, implying that productivity will rise by 2.5%-3.0% in 2026 (Fig. 2). Productivity-led growth should reduce unit labor cost inflation to 2.0% next year, bringing consumer price inflation (measured by either the CPI or PCED) down to 2.0% as well (Fig. 3).

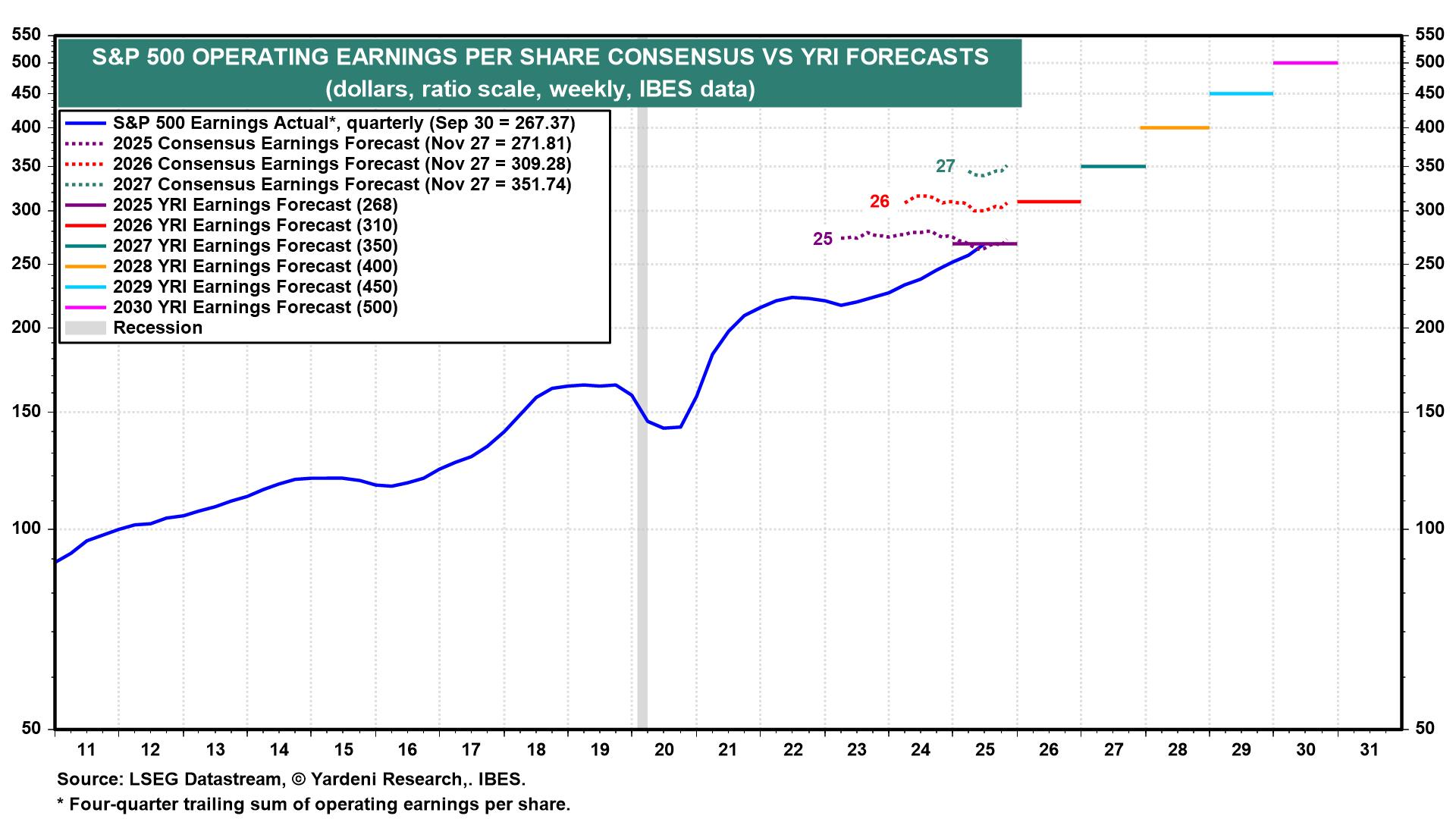

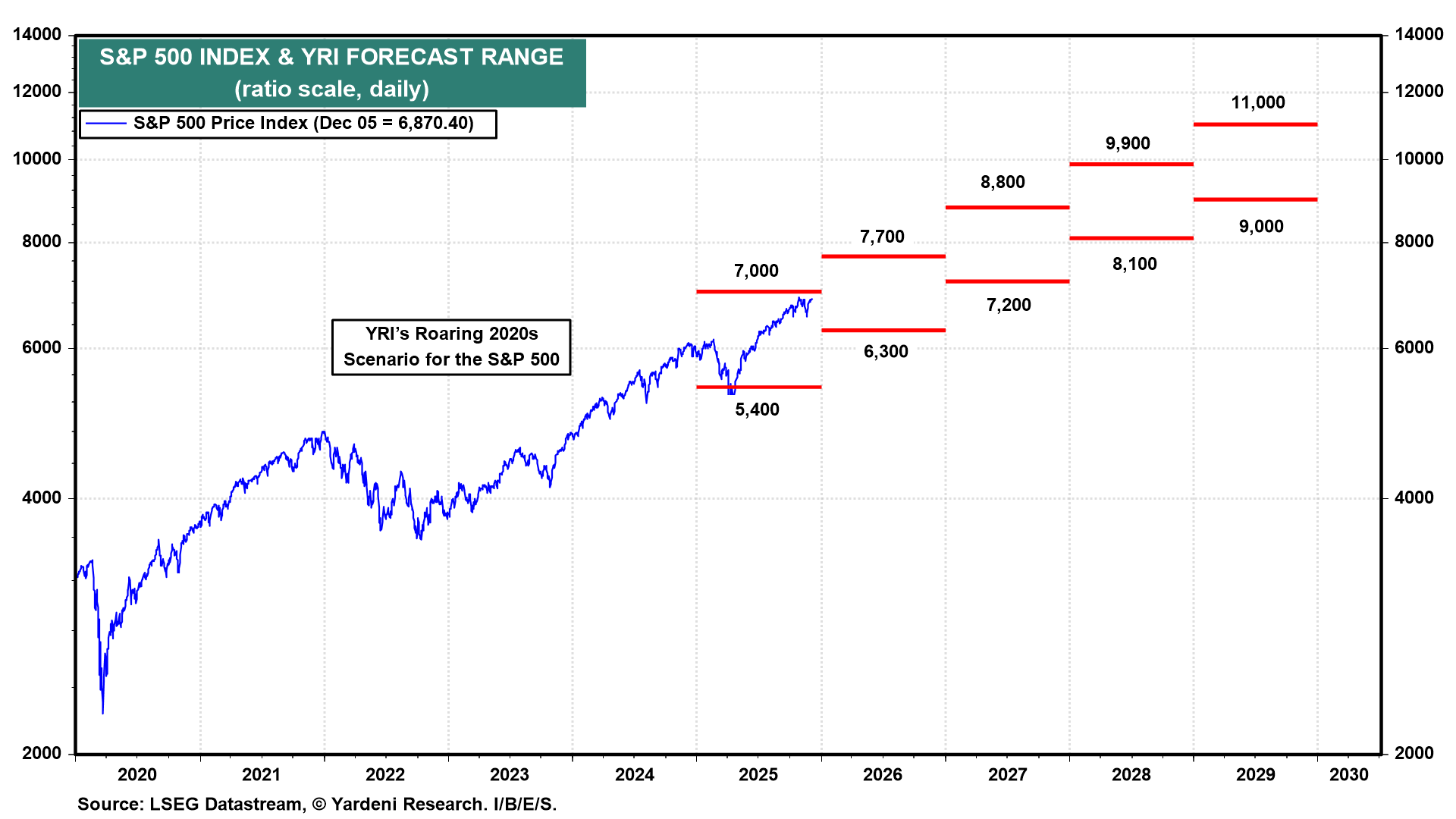

In this scenario, we expect that S&P 500 companies’ collective earnings per share will increase from $268 this year to $310 next year. By the end of next year, we expect the industry analysts’ consensus to be $350 for 2027 (Fig. 4 below). The forward P/E range by the end of next year should be 18-22, resulting in our target range for the S&P 500 of 6300-7700 (Fig. 5 below). Our single-point estimate is the upper end of this range.

Our year-end 2026 target for the S&P 500 assumes that the economy and earnings will remain resilient. Our odds of a severe correction or a bear market, triggered by either recession fears or an actual recession, remain low at 20%.

We see several reasons why economic growth is likely to be strong, supporting our Roaring 2020s productivity story: