This is an excerpt of the November 24, 2025 Yardeni Research Morning Briefing.

Roaring ’20s I: Just Another Year of the Roaring 2020s. We are getting into the warm-and-fuzzy spirit of the holidays. Thanksgiving is on Thursday. Hanukkah begins the evening of December 14 and lasts through the evening of December 22. Christmas Eve is on December 24. Kwanzaa is from December 6 through January 1. The season ends with fireworks on New Year’s Eve. Then it is back to work after New Year’s Day as 2026 rolls in.

We expect that 2026 will be just another year of the Roaring 2020s, which remains our base-case scenario. Our Roaring 2020s scenario has had a good six-year run since we first predicted it in 2020. It has also had a good few months lately, with upward revisions to GDP and downward revisions to payroll employment, suggesting that productivity growth was strong during Q2 and Q3 of this year. Q4 might also show surprisingly strong productivity growth despite the government shutdown.

In the November 24, 2020 issue of our Morning Briefing, we wrote: “This should be the first and last Thanksgiving requiring us all to socially distance from one another. Apparently, we will have a cornucopia of vaccines and treatments available for mass distribution early next year. If so, then 2020 may mark the beginning of the Roaring 2020s.” We then reviewed the similarities we expected to see between the Roaring 1920s and the forthcoming Roaring 2020s.

First and foremost, among the similarities we anticipated was a technology-led productivity boom: “Today’s ‘Great Disruption,’ as Jackie and I like to call it, is increasingly about technology doing what the brain can do, but faster and with greater focus. Given that so many of the new technologies supplement or replace the brain, they lend themselves to many more applications than did the technologies of the past, which were mostly about replacing brawn. Today’s innovations produced by the IT industry are revolutionizing lots of other ones, including manufacturing, energy, transportation, healthcare, and education. My friends at BCA Research dubbed it the ‘BRAIN Revolution,’ led by innovations in biotechnology, robotics, artificial intelligence, and nanotechnology. That’s clever, and it makes sense.”

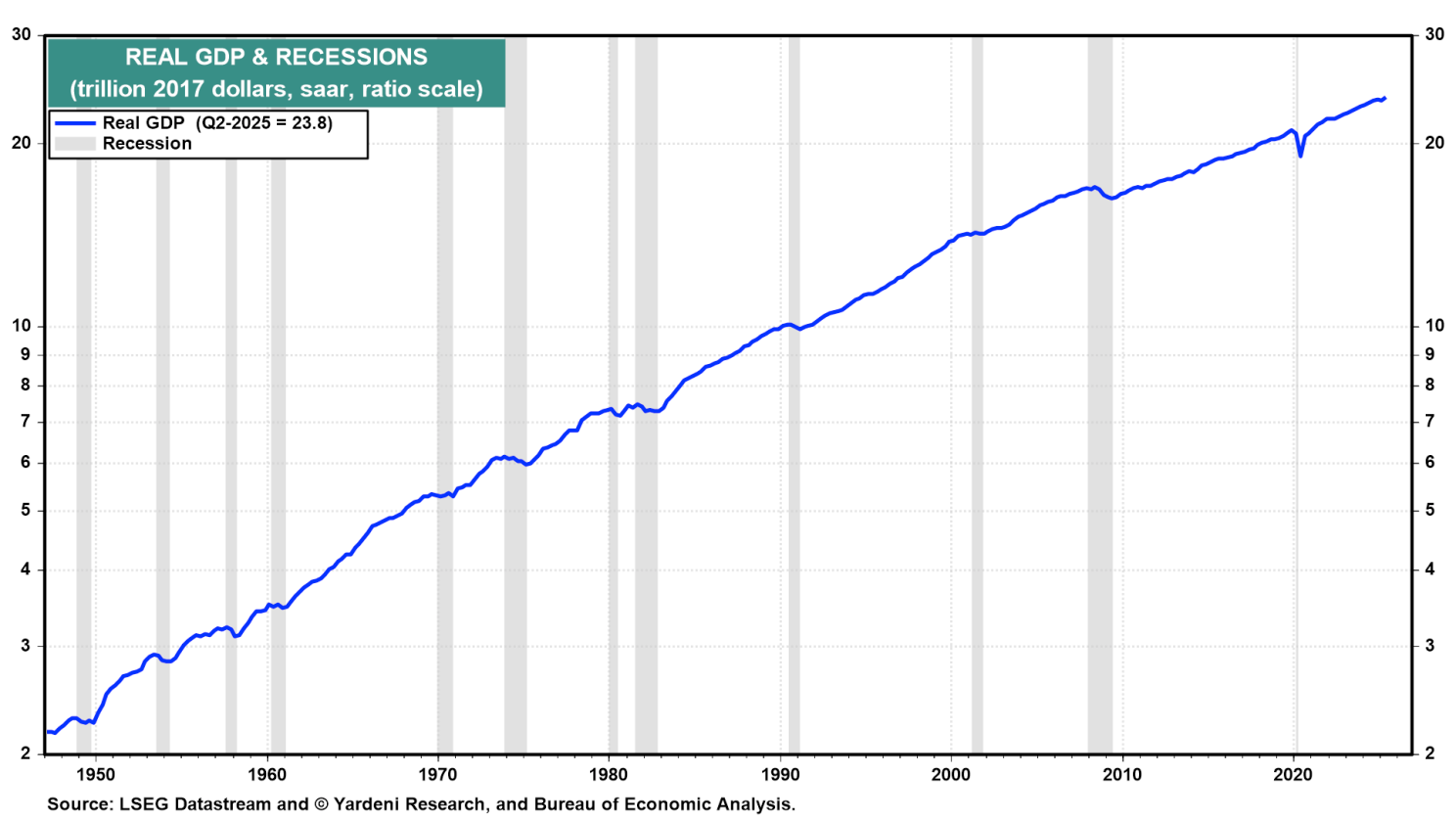

So far, so good. Indeed, notwithstanding numerous shocks, real GDP is at a record high (Fig. 1 below). Real personal consumption per household is at a record high (Fig. 2). Corporate profits is at a record high (Fig. 3). So is real capital spending (Fig. 4). The major stock market indexes rose to record highs on October 29 of this year as well (Fig. 5).

This happened despite the pandemic at the start of the Roaring 2020s. There was a recession in 2020, but it lasted only two months. The end of the lockdowns that caused the recession was followed by social distancing restrictions. Supply-chain disruptions from 2020 through 2023 resulted in an inflation spike during 2021 and 2022. So did Russia’s invasion of Ukraine in early 2022. The Fed responded to that spike by tightening monetary policy significantly during 2022 and 2023. This year, the big shock was Trump’s tariffs. And now, the pace of payroll employment gains has slowed dramatically.

The economy has proven its resilience to all these challenges. If it continues as we expect, the recent decade should remain recession-free. Instead of economy-wide recessions, there might continue to be rolling recessions hitting various industries at different times.

We forecast real GDP growth of 2.5% this year. In 2026, we expect 3.0% growth, with productivity rising 2.5% and both the labor force and employment increasing by only 0.5%. The unemployment rate is likely to end this year at 4.5%, primarily because of the rising jobless rate among recent college graduates due to the rapid proliferation of AI. The same may be said about 2026.

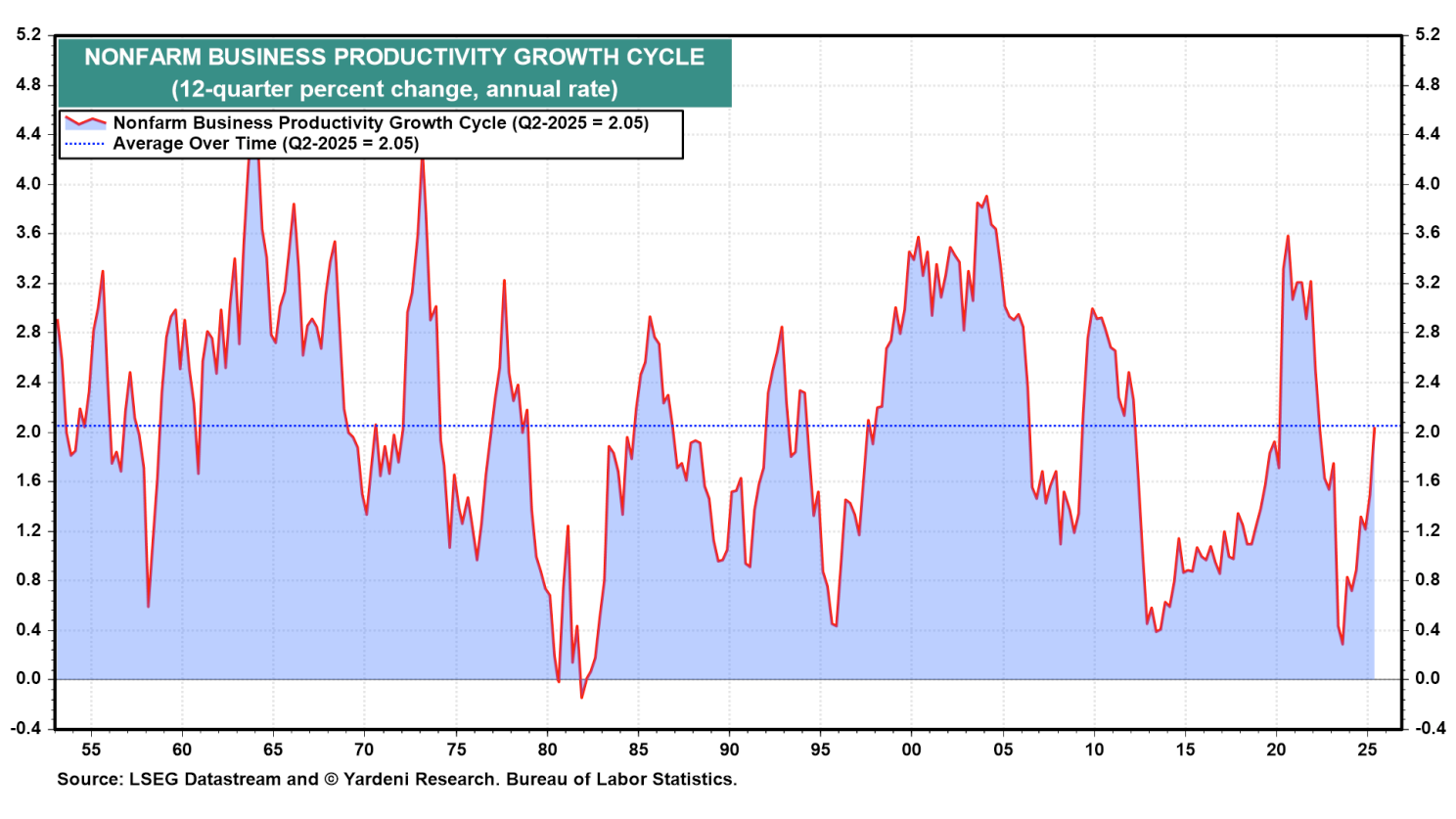

Roaring ’20s II: Productivity-Led Economic & Earnings Growth Fueling Bull Market. Over the past three years, the average annual productivity growth rate has risen back to 2.0%, the historical average for this series (Fig. 6 below). We expect productivity to grow closer to 3.0%-3.5% over the remainder of the Roaring 2020s, which should boost real GDP growth to 3.5%-4.0% over the rest of the decade (Fig. 7). Again, our upbeat forecast is based on the impact of BRAIN technologies in boosting the productivity of scarce workers.

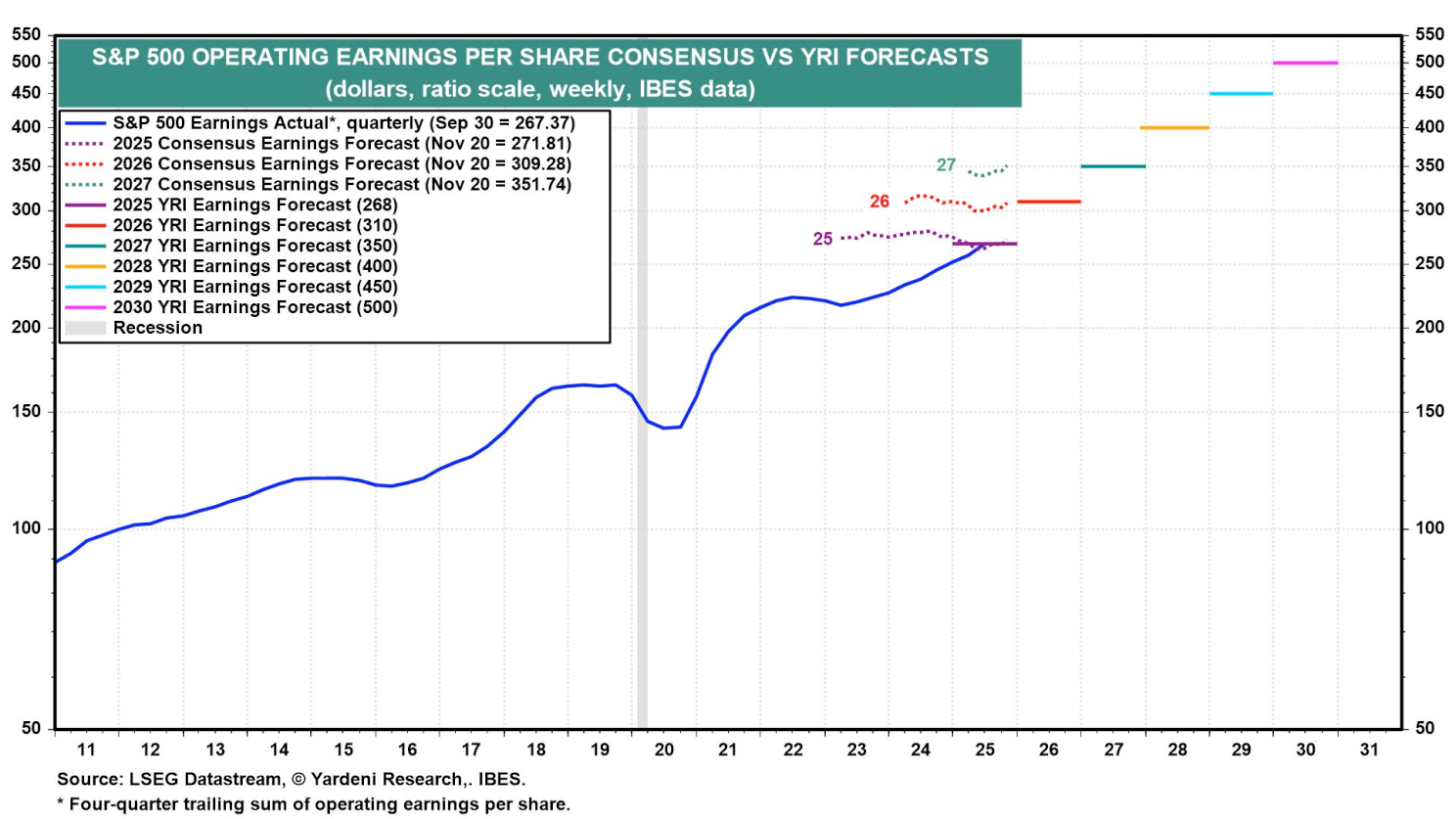

The outlook for earnings and the stock market over the remainder of the decade is very bullish under our base-case Roaring 2020s scenario. Let’s walk through it:

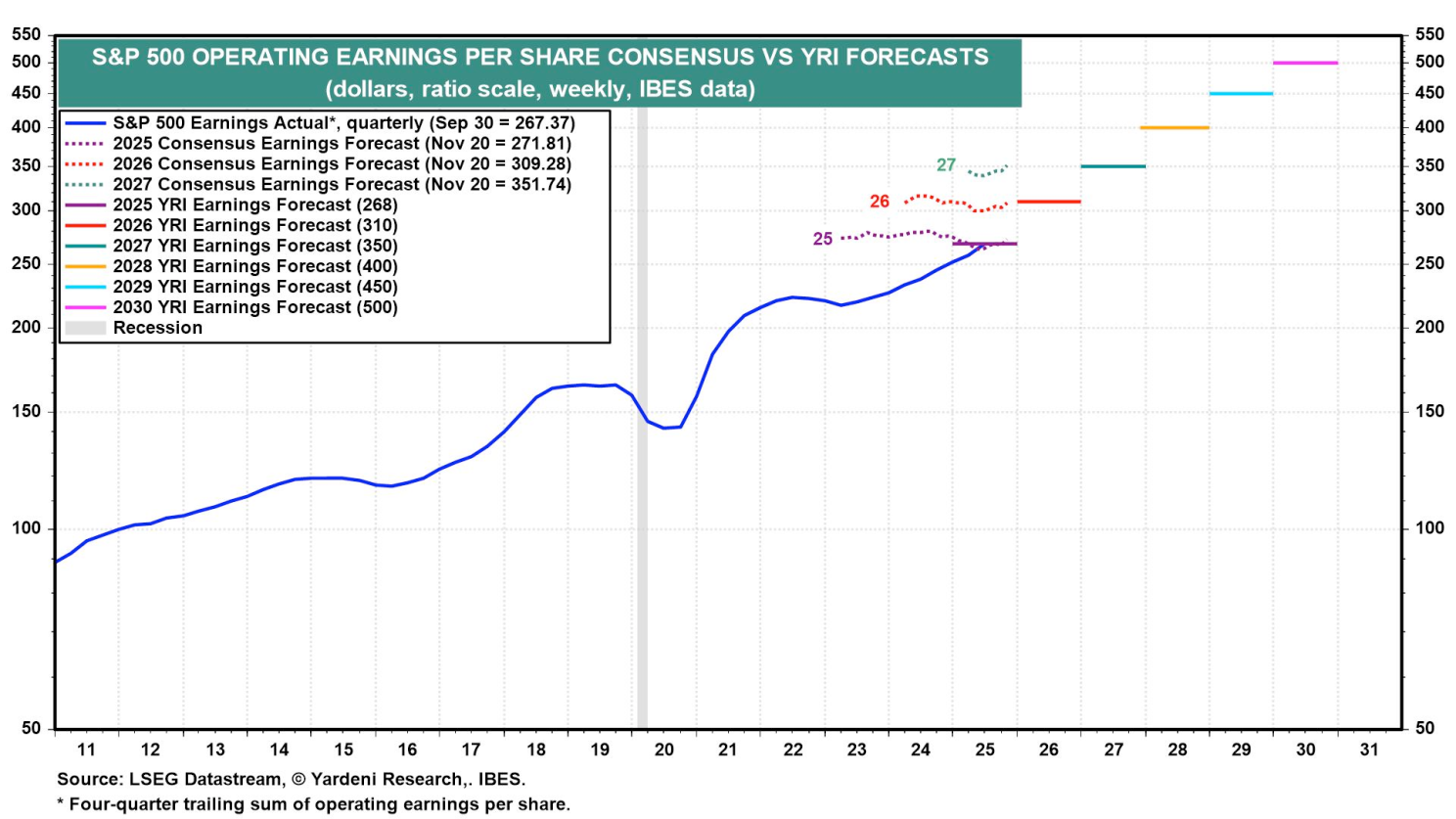

(1) We predict that S&P 500 operating earnings per share will rise from $268 this year to $310 in 2026, $350 in 2027, $400 in 2028, and $450 in 2029 (Fig. 8 below). Admittedly, this will require the S&P 500 profit margin to rise to record highs in the coming years in response to faster productivity growth.

(2) Our scenario for the S&P 500’s forward earnings is equally bullish. We forecast where forward earnings will be at year-ends simply by lagging each of our annual earnings forecasts by one year (Fig. 9).

(3) We assume that the forward P/E of the S&P 500 (i.e., the multiple with forward earnings as the “E” value) will range from 18 to 22 over the rest of the decade (Fig. 10).

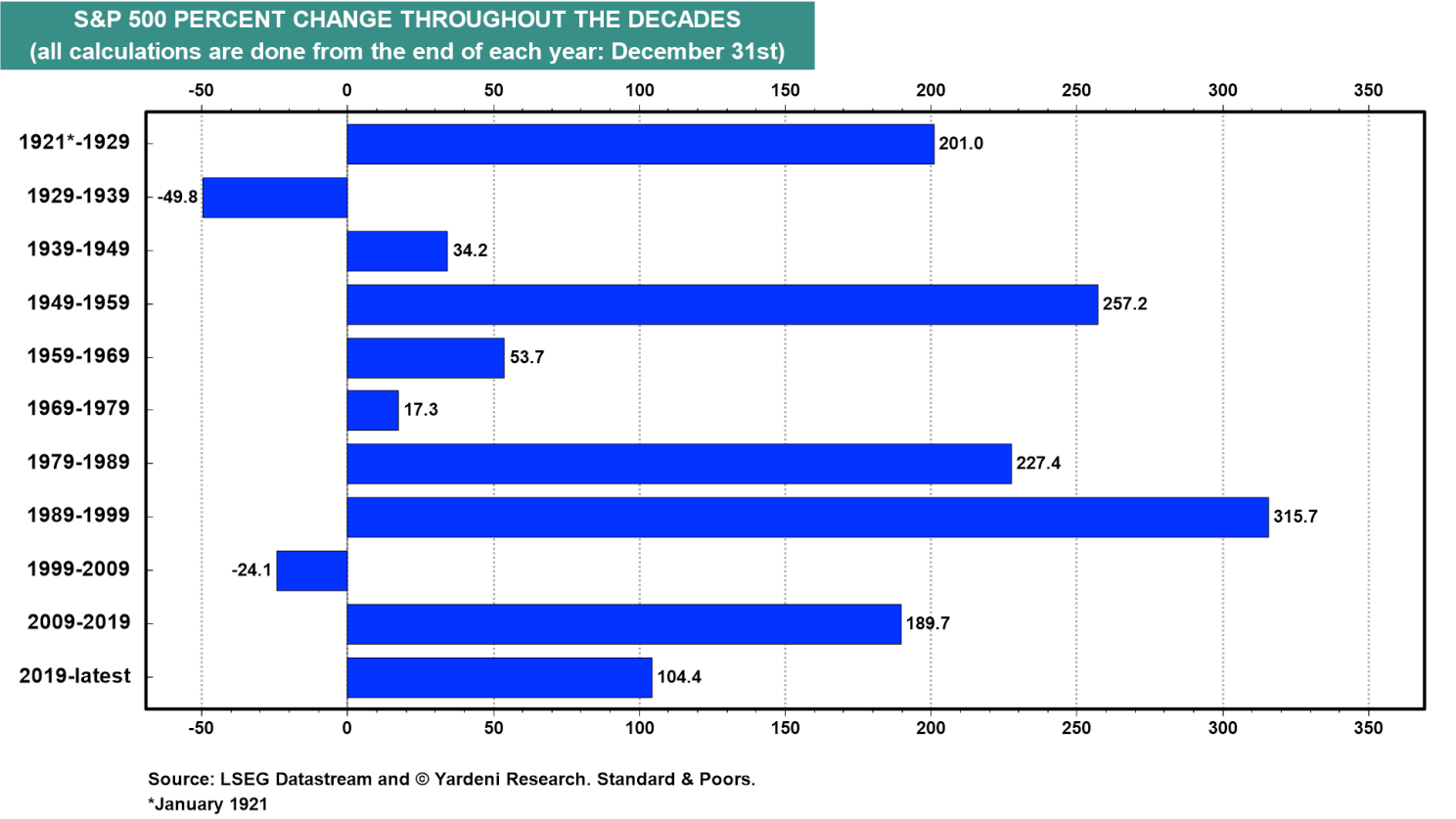

(4) The result of this exercise is that the S&P 500 would be on track to rise to 9,000 to 11,000 by the end of 2029 (Fig. 11). Let’s split the difference and aim for 10,000 by the end of the Roaring 2020s! That would be up from 3,230 at the end of 2019, representing an increase of 210%. Is that amount of gain delusional? Not really, since it was exceeded during three of the previous decades since the 1920s (Fig. 12 below). Since the Roaring 1920s, there have been three roaring decades for the stock market with gains of over 200%!

Roaring ’20s III: A Disinflationary Year. During 2025, consumer price inflation has stalled around 3.0% y/y. It probably would have been down to 2.0% by now but for Trump’s tariffs, which boosted consumer durable goods inflation this year (Fig. 13). The underlying inflation rate in the labor market should remain disinflationary. It is simply the yearly percent change in unit labor costs (ULC) inflation, which is hourly compensation divided by productivity. ULC was up just 2.5% y/y during Q2 (Fig. 14). It should be lower next year if productivity growth roars ahead, as we expect. The Fed might actually hit its 2.0% inflation target next year.

Roaring ’20s IV: A More Independent Fed. What does all this mean for monetary policy and the bond market? We believe that the Fed actually will be more independent in 2026 even though President Donald Trump is expected to pick a dove as the next Fed chair to replace Jerome Powell during May 2026. Other participants on the Federal Open Market (FOMC) are likely to be increasingly independent of the new Fed chair. In the past, Fed chairs succeeded in maintaining a consensus with few if any dissenters. October’s FOMC minutes showed that there is already less consensus than usual.

In any event, we are expecting no rate cut at the December 10 meeting of the FOMC and one cut next year that drops the federal funds rate to 3.50%-3.75%. We also expect that the bond yield will continue to range between 4.00%-5.00% in 2026.

Why wouldn’t interest rates be lower if inflation falls to 2.0% next year? They might be. But the interest-rate levels we are forecasting would be neutral ones, neither restrictive nor stimulative to the economy, since productivity would be boosting real GDP growth and moderating inflation. Lower rates than those would risk a stock market bubble.

Roaring ’20s V: Rebalancing Toward the Impressive-493. The recent concerns about an AI bubble are already taking some air out of it without bursting it. Almost all the bubble is in the Information Technology and Communication Services sectors of the S&P 500. Together, they account for 45% and 38% of the market capitalization and earnings shares of the S&P 500 (Fig. 15 below). It’s hard to imagine that they will continue to take so much oxygen out of the room.

As a result, we recommend market weighting them rather than overweighting the Information Technology and Communication Services sectors. We still recommend overweighting Financials and Industrials (Fig. 16 and Fig. 17). We now also would overweight Health Care going into 2026 (Fig. 18).

It is also getting harder to recommend Stay Home rather than Go Global. The latter has beat the former this year. Stay Home has worked since 2010. The market capitalization share of the US in the All Country World MSCI rose to over 65% at the end of last year (Fig. 19). We would be looking for more opportunities abroad and will be doing so in 2026.

Roaring ’20s VI: A Good Year for the Dollar & Gold. We remained bullish on the dollar this year and viewed its weakness as a correction in a bull market (Fig. 20 below). That remains our view for 2026. We expect that the proliferation of stablecoins backed by US Treasury bills will proliferate around the world, boosting the demand for both US Treasury debt and the dollar. So we are not in the “debasement camp” nor in the camp that has been warning that a US debt crisis is imminent.

We also remain bullish on gold, which we expect will rise to $5,000 by the end of next year and $10,000 by the end of 2029 (Fig. 21 and Fig. 22). Geopolitical uncertainties are likely to remain high over the rest of the decade. Central banks are likely to continue diversifying their international reserves into gold. Chinese investors are also likely to remain strong buyers, as they hope to offset losses on their “ghost” apartments and in their volatile stock market.

Roaring ’20s VII: A Bad Year for Bitcoin. Bitcoin has been described as “digital gold.” The recent severe selloff suggests that it might be digital fools’ gold. Yes, we know, it fell sharply in late 2021 through 2022, which turned out to be a great buying opportunity (Fig. 23). That could happen again this time. However, its rebound from 2023 through 2024 was largely attributable to support from Wall Street and the Trump administration. The GENIUS Act of July 2025 legitimized stablecoin for transactions purposes, thus eliminating that as a role for bitcoin, which is proving to be a very volatile store of value. Next year is likely to be another bad one for bitcoin advocate Michael Saylor’s Strategy company (Fig. 24).

Roaring ’20s VIII: Will the Roaring 2020s End Badly? We first started writing about the Roaring 2020s in our January 6, 2020 Morning Briefing: “So the Roaring ’20s remains a viable scenario. The problem is that that decade was followed by the Great Depression of the 1930s; if history repeats that pattern, we can party for another 10 years.” Trump’s tariffs have already stress-tested the US and global economies for a 1930s-style Smoot-Hawley scenario without much signs of stress.

In other words, the 2030s could be another roaring decade. Happy holidays!