While most of the market’s focus is on artificial intelligence, many companies continue to work on quantum computing in the hopes of creating a computing system that’s far more powerful than traditional computers. Among the largest players, IBM, Microsoft, and Google are working to make the technology feasible by the end of the decade.

The government has also recognized the national importance of quantum computing. It’s considering taking equity stakes in some of the industry’s smaller players in exchange for giving them grants. The stocks of a few of these smaller players have risen by more than 100% this year, leading some to wonder whether the industry is in its own bubble.

Here’s an update on the latest news in this exciting industry.

(1) IBM gives a timeline. By 2028 or 2029, quantum computers will solve problems that will “surprise and amaze” us, promises IBM’s CEO Arvind Krishna. Quantum computers will be able to calculate bond pricing, construct investment portfolios, and forecast corrosion on aircraft wings in real-time and more accurately than traditional computers. Quantum today is where AI and GPUs were in 2015, he told CNBC.

IBM has made progress in improving coherence times, or how long a quantum bit maintains its quantum state. It can currently maintain that state for about 1/10 of a millisecond. When it can maintain that state for a full millisecond, quantum computers will be able to perform calculations that exceed traditional computers’ capabilities. IBM is developing smaller, specialized models tailored for specific business applications to run on its quantum computers.

(2) Google’s breakthrough. Using a new quantum chip dubbed Willow, Google’s engineers ran an algorithm 13,000 times faster on its quantum computer than it would run on a traditional supercomputer. “The algorithm in question is called Quantum Echo and models a physics experiment in Nuclear Magnetic Resonance (NMR, the spectroscopic variant of the popular MRI), revealing internal molecular structures by detecting magnetic spins at the center of atoms,” Tom’s Hardware reported.

The experiment had tongues wagging because it can be reproduced and verified, and because it was a real-use case for quantum computing. IBM and Microsoft have also introduced chips for the quantum world. IBM recently introduced its Loon and Nighthawk chips, while Microsoft in February introduced Majorana 1.

(3) The government declares quantum vital. Several small quantum computing companies are in talks with the US government to exchange federal funding for equity stakes, the WSJ reported. The discussions suggest that the US government views quantum computing as vital to the country’s national interests and security.

If successful, quantum computers could potentially crack security codes that are impenetrable to traditional computers and help discover new drugs, materials, and chemicals. National security was also cited when the US government took equity stakes in Intel and rare earth metals producer MP Materials.

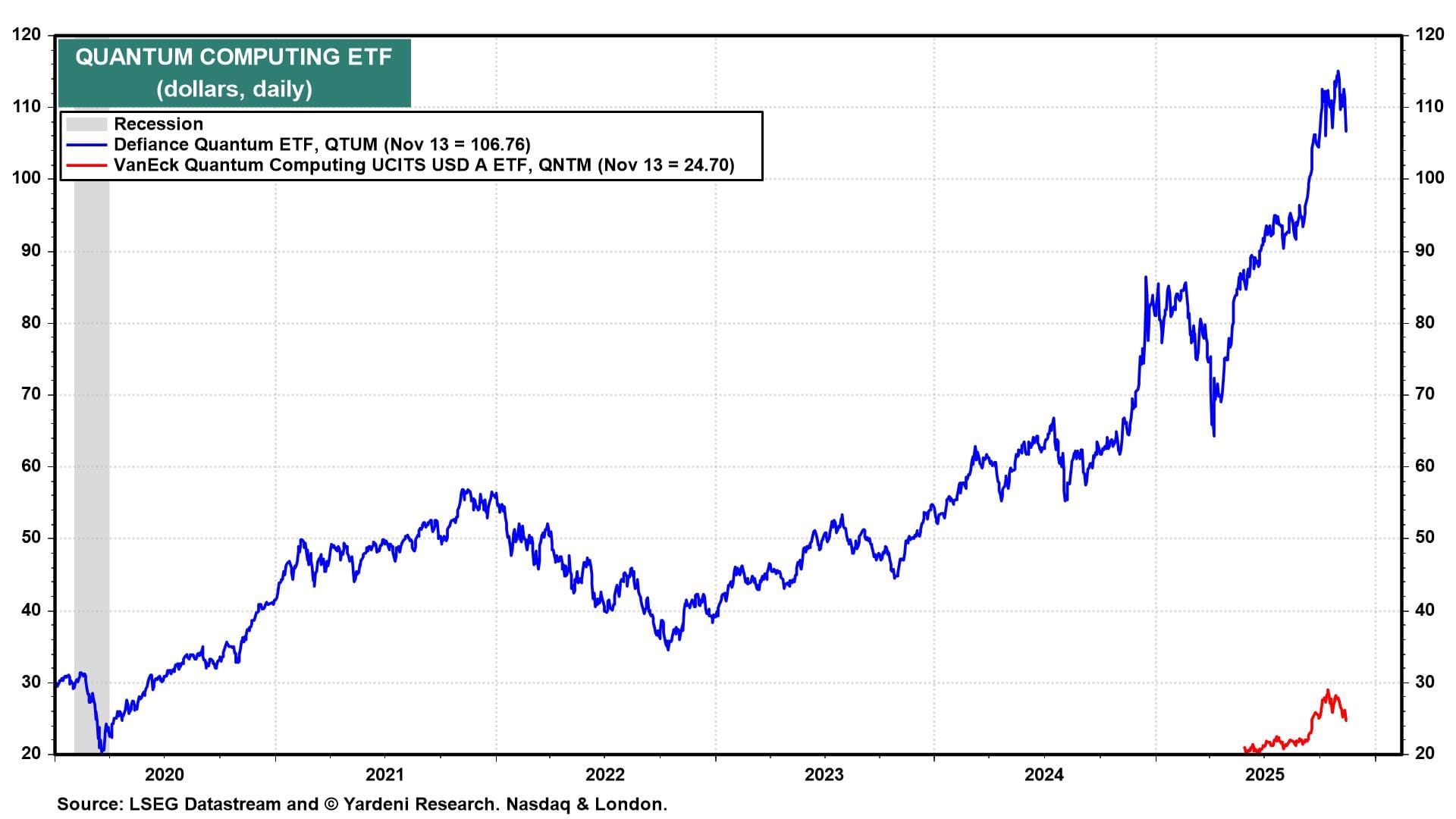

IonQ, Rigetti Computing, and D-Wave Quantum are among the companies reportedly in discussion with the government. Quantum stocks have risen sharply this year, including the shares of IonQ (30.3%), Rigetti (105.8), and D-Wave (245.1) (chart).

Each of the companies recently reported Q3 results that illustrate their youth. D-Wave’s Q3 revenue grew to $3.7 million from $1.9 million a year ago, and the company reported an adjusted loss of $18.1 million, versus an adjusted loss of $23.2 million in the year-ago quarter.

Rigetti’s Q3 revenue was $1.9 million, down from $2.4 million a year ago. Its operating loss of $20.5 million was up from a $17.3 million loss in Q3-2024. IonQ’s Q3 revenue more than tripled from the same period last year to $39.9 million from $12.4 million, but its net loss ballooned to $1.1 billion, and its adjusted EBITDA loss was $48.9 million, up from a loss of $23.7 million in the year-ago quarter.

Before investors get too excited about the government’s investment, they might want to wait and see how much equity the government requests in exchange for grants to companies that have yet to turn a profit.