Exercising Fed Put Would Fuel Stock Market Meltup.

Stock investors have been joyously discounting a Fed rate cut in September following the release of July’s weaker-than-expected employment report. The S&P 500 rose to yet another record high on Thursday. It is up 3.4% since the close on August 1—the day of the disappointing jobs report—through Friday’s close. There hasn’t been a similar party in the bond market since then, as the 10-year Treasury yield has risen 10 basis points over the same period (Fig. 6 below).

Notwithstanding my concerns about an adverse bond market reaction to a Fed rate cut in September, I am not as sure about what the bond yield will do as I am about what stock prices will do. Stocks will rise on expectations of another rate cut before the end of the year. What could be a better development for the stock market than another Fed Put when the economy doesn’t need the Fed’s help?!

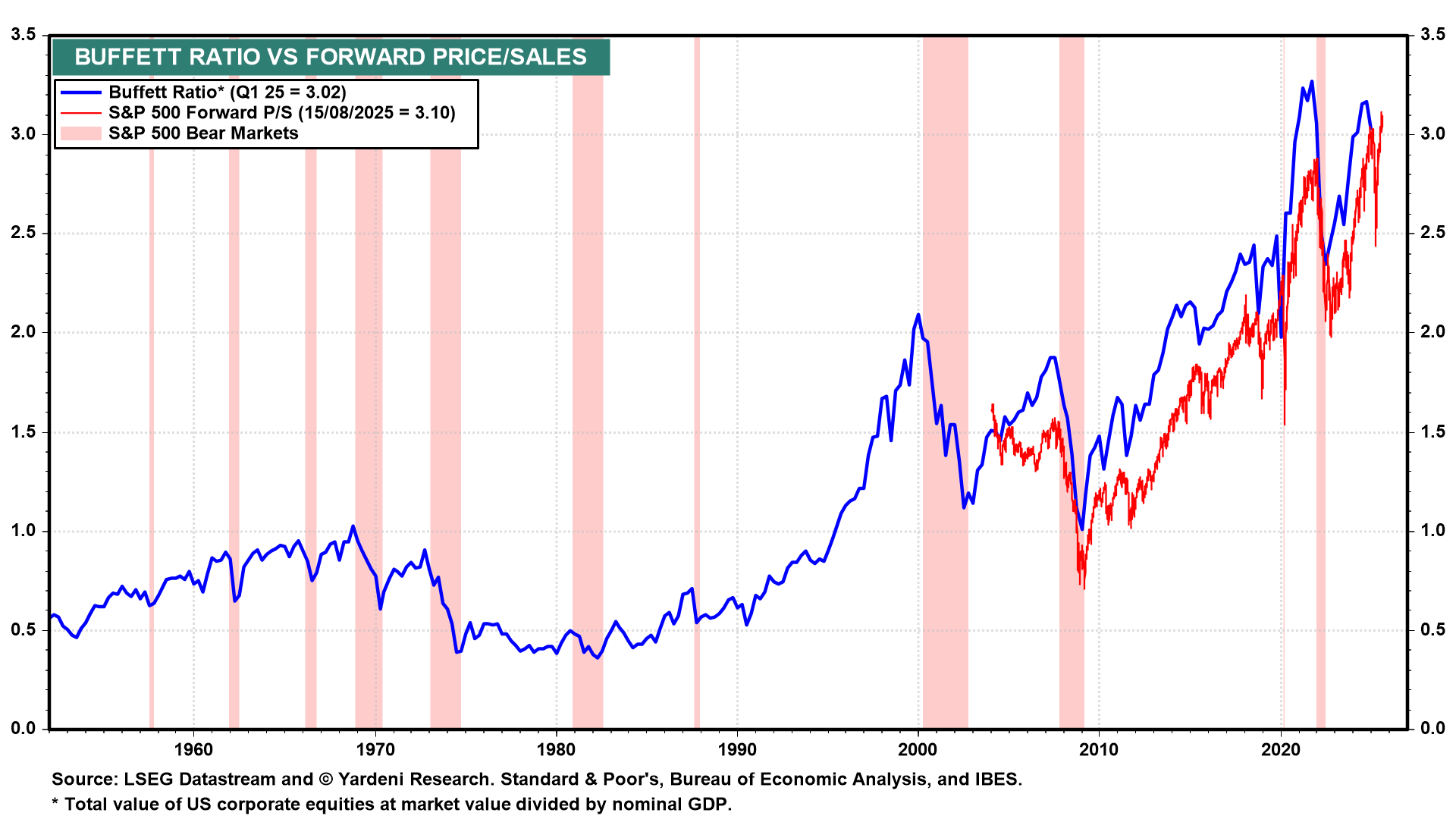

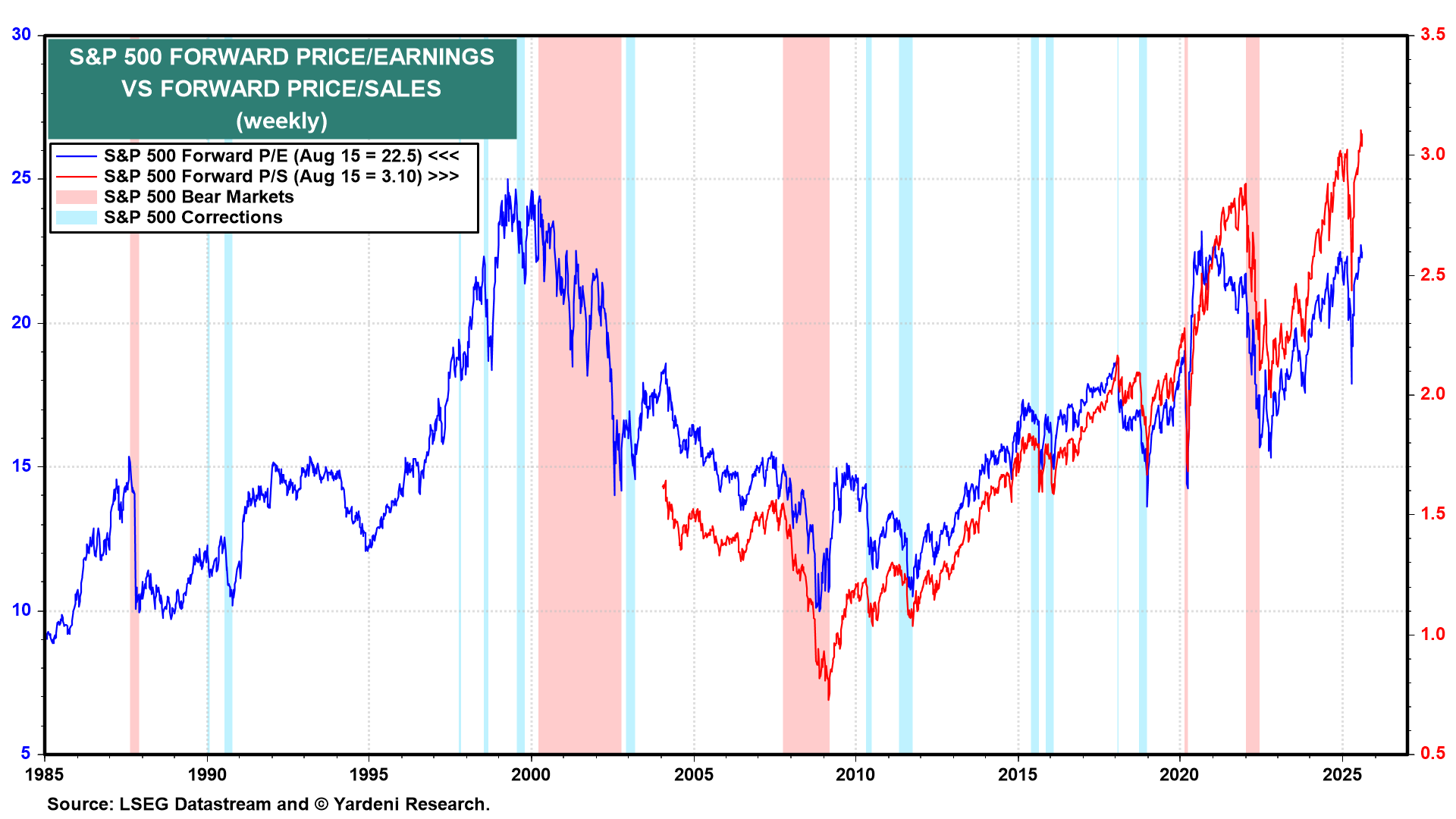

In this scenario, the Fed could very well fuel a wild meltup in the stock market. Valuation multiples would get even more stretched than they are already. On a weekly basis, the Buffett Ratio rose to a record 3.1 during the August 14 week using the forward price-to-sales ratio of the S&P 500 (Fig. 7 below). That same week, the forward P/E of the index rose to 22.5 (Fig. 8 below). It would need to rise only another 11% to match its record high of 25.0, hit just before the Tech Wreck of 2000.