There are lots of confusing recent developments for stock investors to consider. The economic indicators are mixed, with some justifying a December 10 rate cut by the Fed, others not. President Donald Trump said he will announce his pick for the next Fed chair in January. It's not clear whether the Fed will be more or less independent as a result. The Supreme Court is likely to rule in January that Trump's tariffs are unconstitutional. Still, Treasury Secretary Scott Bessent said today that the administration has a Plan B to reimpose them immediately.

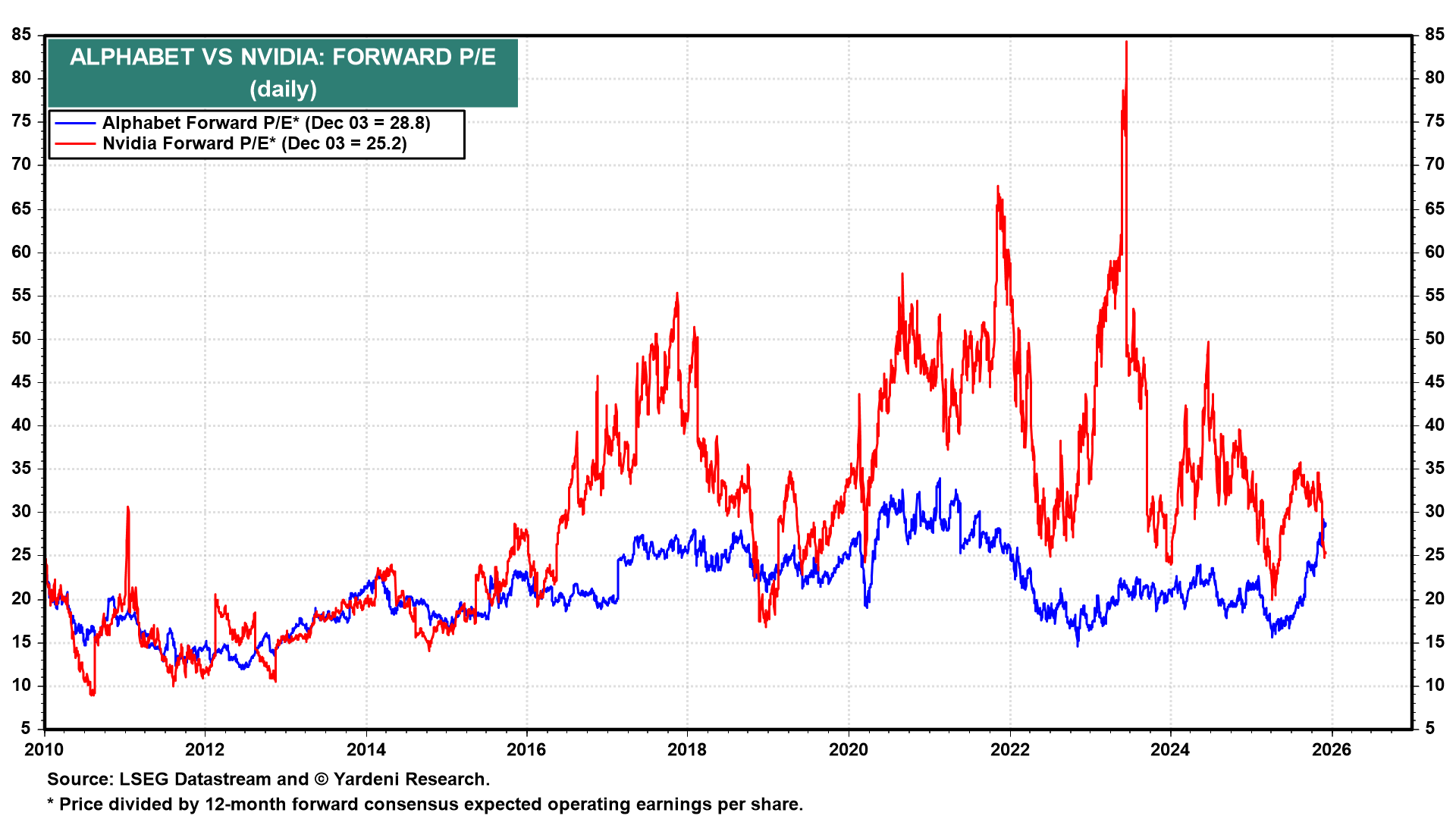

Meanwhile, investors are struggling to sort out a lot of confusion about the AI story, including whether the earnings of hyperscalers are inflated because they are depreciating their Nvidia GPU chips over six years rather than three. The introduction of Gemini-3 by Google, running on the company's TPU chips, has reminded investors that the pace of technological disruption is accelerating. AI has turned into a race among leaping frogs.

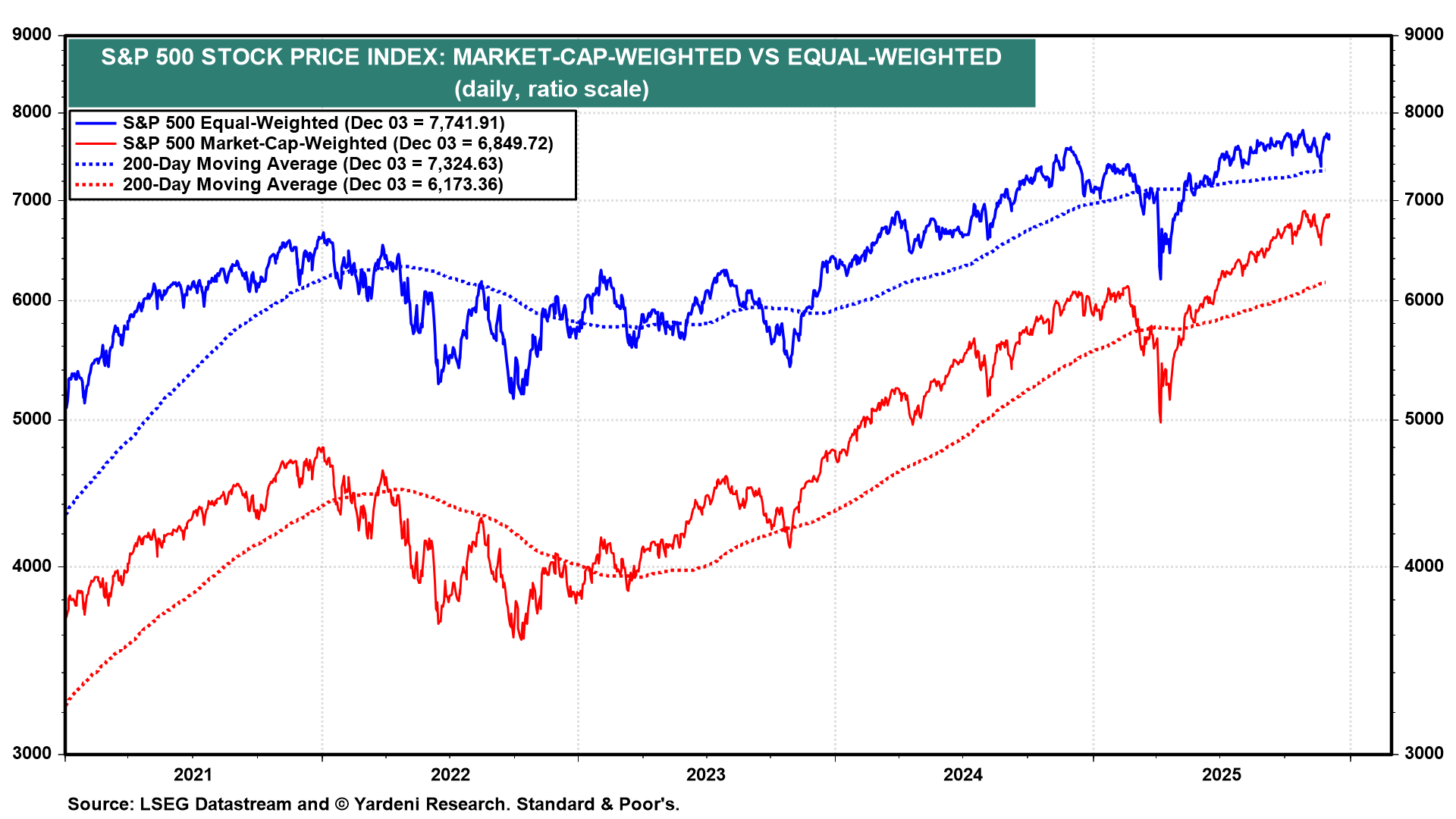

Yet despite all the confusion, both the market-cap-weighted and equal-weighted S&P 500 indexes are near their October 29 record highs (chart).

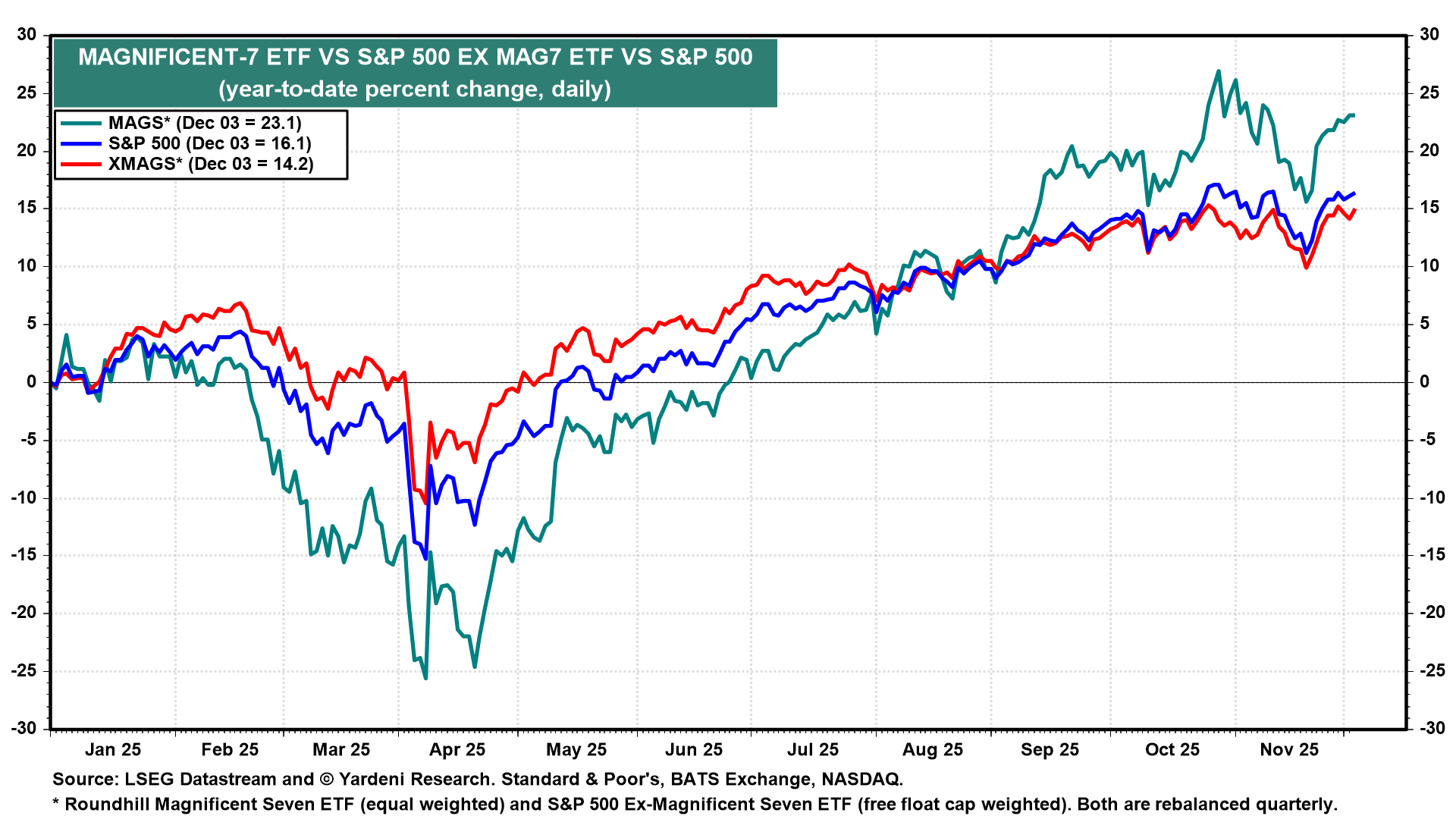

The S&P 500 is up 16.1% ytd, with the Magnificent-7 up 23.1% and the “Impressive-493” up 14.2% (chart).

The forward P/E of Nvidia has dropped sharply in recent days, while that of Google has jumped higher as investors have reconsidered which leaping frog to bet on for now (chart).

The economic data are also confusing. The question is how much longer can real GDP grow close to 4% (saar) as it has in Q2 and Q3 while the labor market remains lackluster at best?

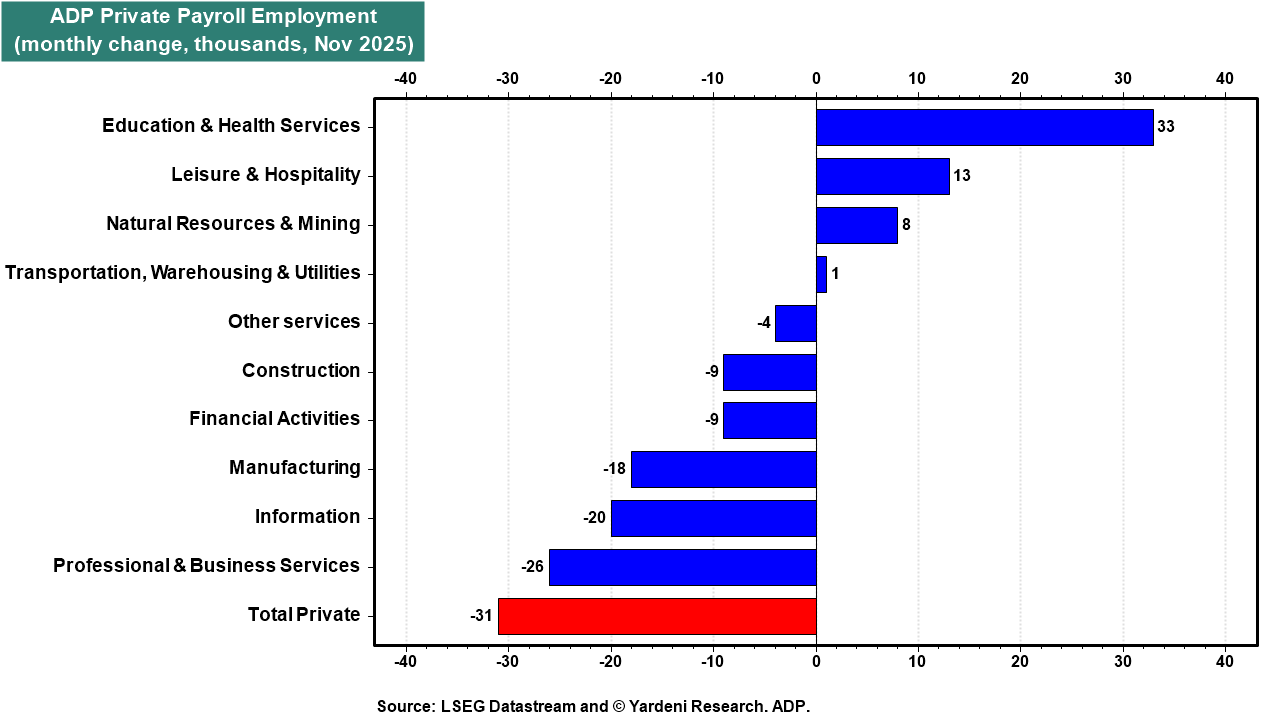

In November, private companies cut 32,000 workers, with small businesses hit the hardest, payrolls processing firm ADP reported today (chart). Larger enterprises, i.e., companies with 50 or more employees, actually reported a net gain of 90,000 workers. However, establishments with fewer than 50 on the payroll shed 120,000 workers.

Despite weak payroll employment, retail sales are holding up surprisingly well, as evidenced by the 7.6% y/y increase in the Redbook Retail Sales Index during the November 28 week (chart).

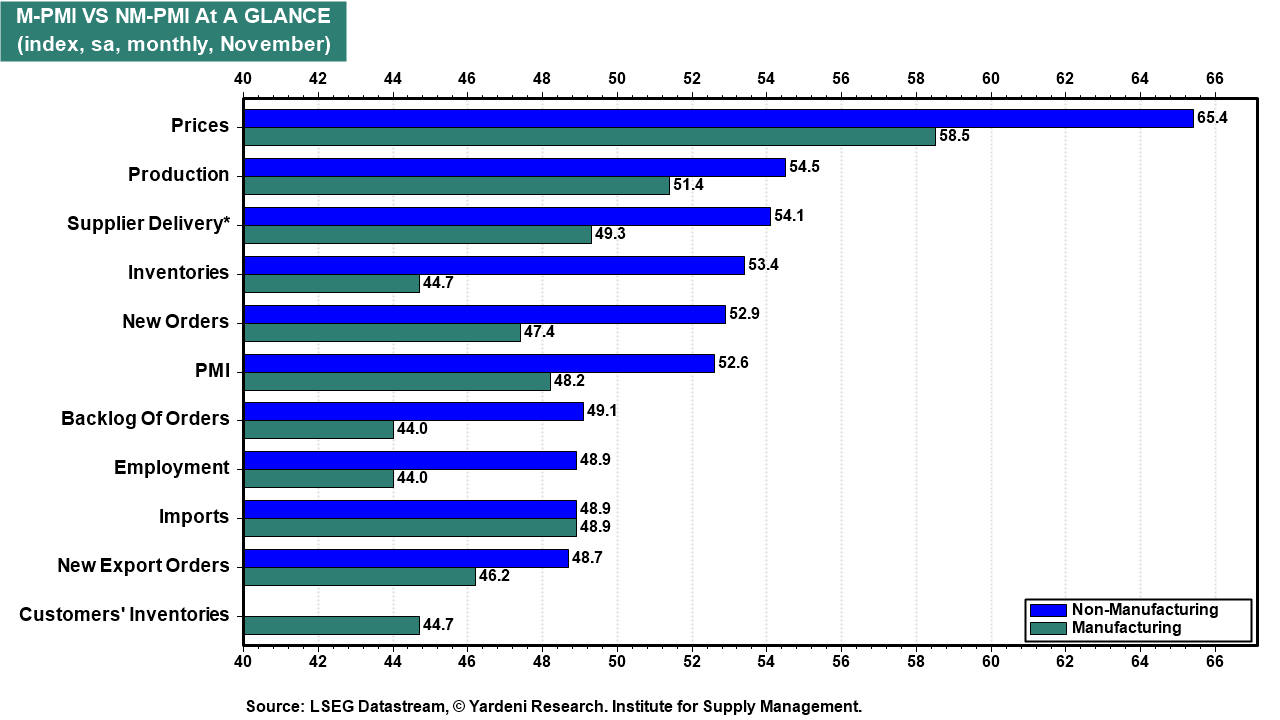

November's ISM purchasing managers’ survey showed more of the same, i.e., manufacturing remains weak while services are still going strong. The prices-paid indexes remain elevated in both surveys (chart).

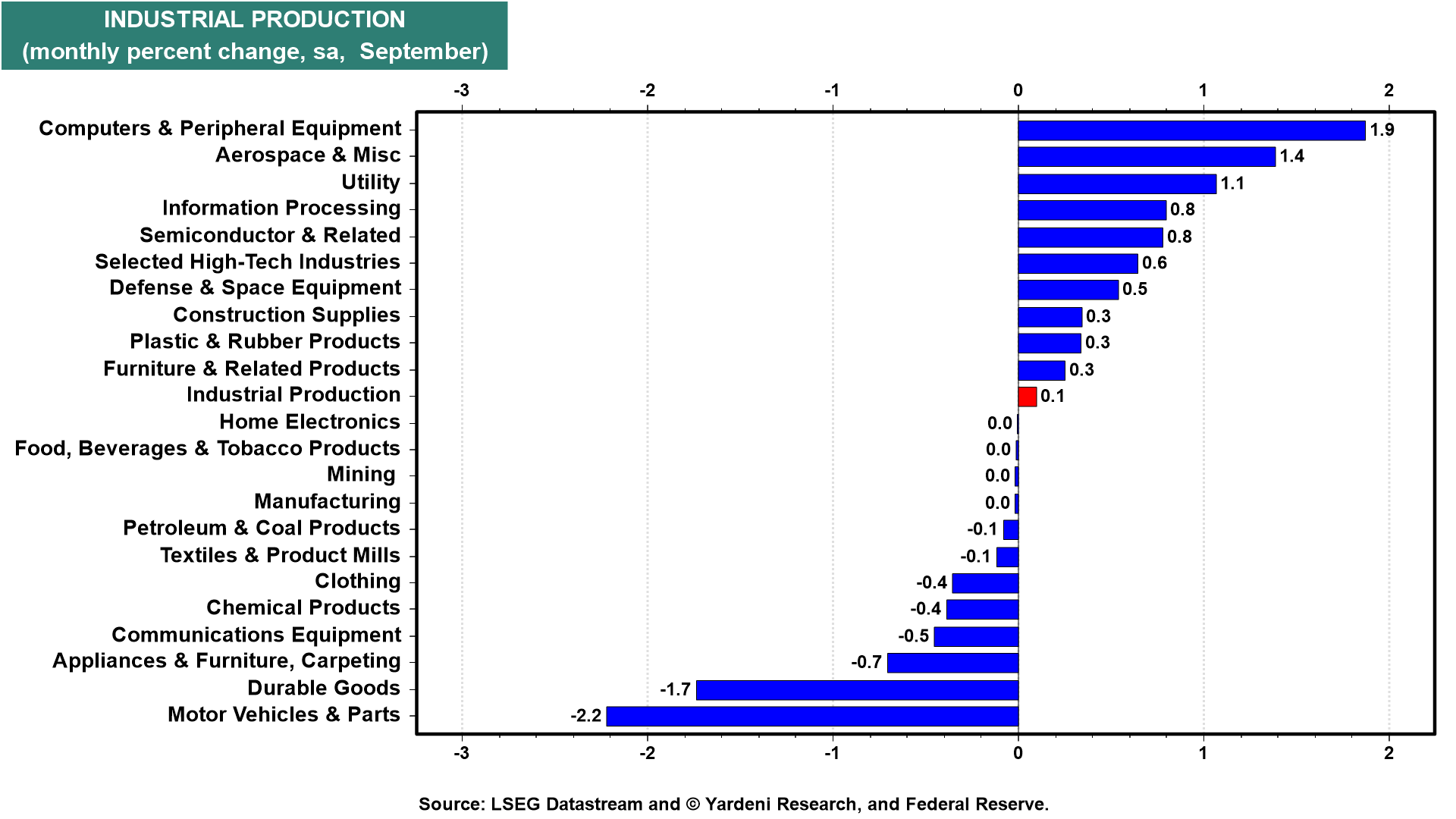

Overall, industrial production hasn't been growing for a while. However, production is skyrocketing in the technology and defense industries, offsetting weakness in other areas of the economy.