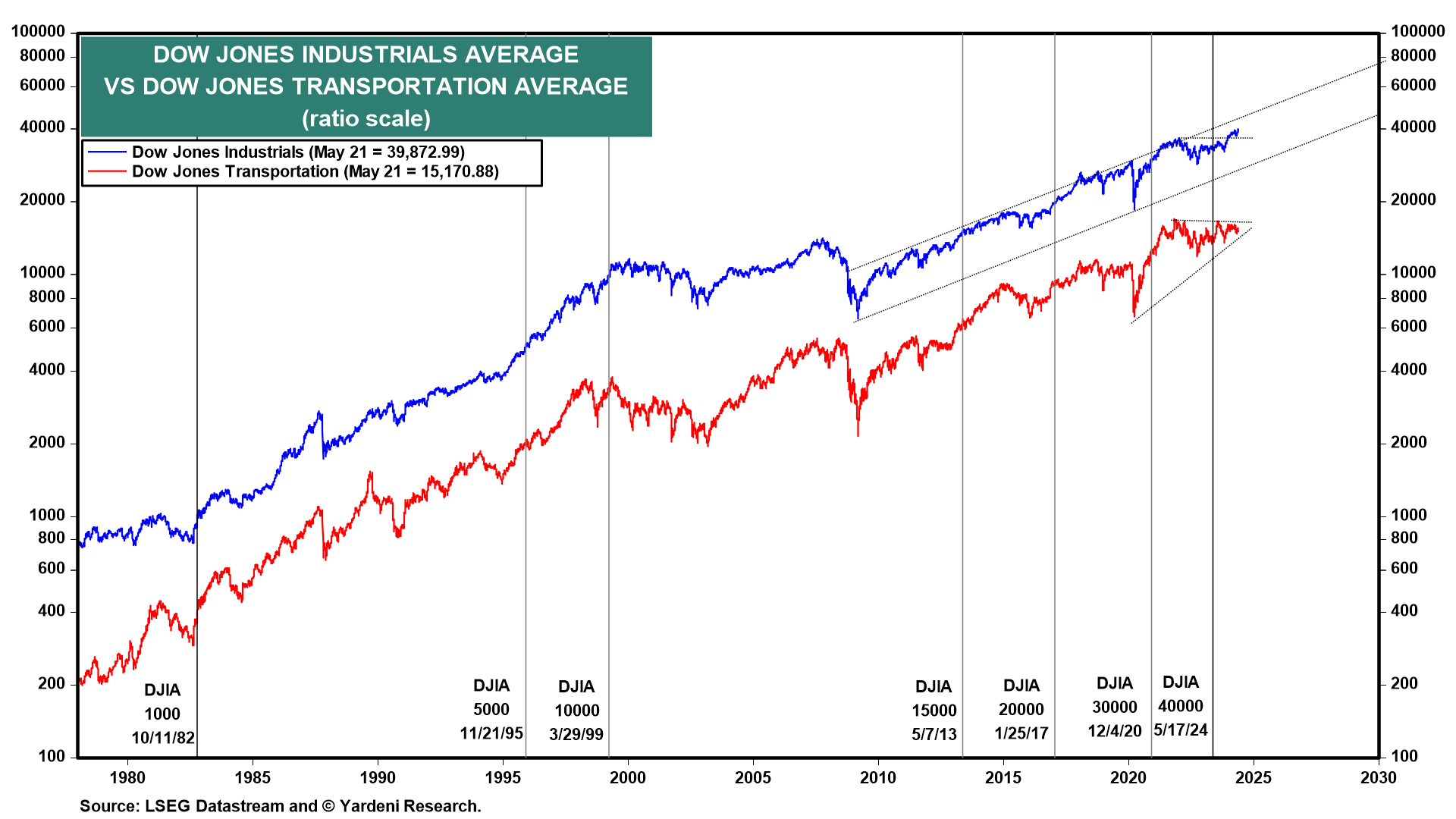

The Dow Jones Industrial Average closed above 40,000 for the first time on Friday, May 17 (chart). Today it is back down slightly below this level. We hope the title of this QT doesn't turn out to be a jinx, but we are still aiming for Dow 60,000 by 2030 in our Roaring 2020s scenario. Along the way, there could be corrections and even another bear market. But we expect that earnings will drive the stock market higher.

Just for fun, we drew some trend lines on a chart of the DJIA and stumbled on a channel that started around 2010 which can be extrapolated to a range of 45,800 to 76,700 by the end of the decade. The mid-point is 61,250. Mark your calendars!

For the here and now, Dow Theory suggests that the DJIA's recent rise to a new high won't be sustainable unless it is confirmed by the Dow Jones Transportation Average (DJTA), which remains below its record high. We think that leaner business inventories will soon boost demand for transporting goods and relatively stable fuel prices will also benefit transports. (Jackie will cover this story in tomorrow's Morning Briefing.)

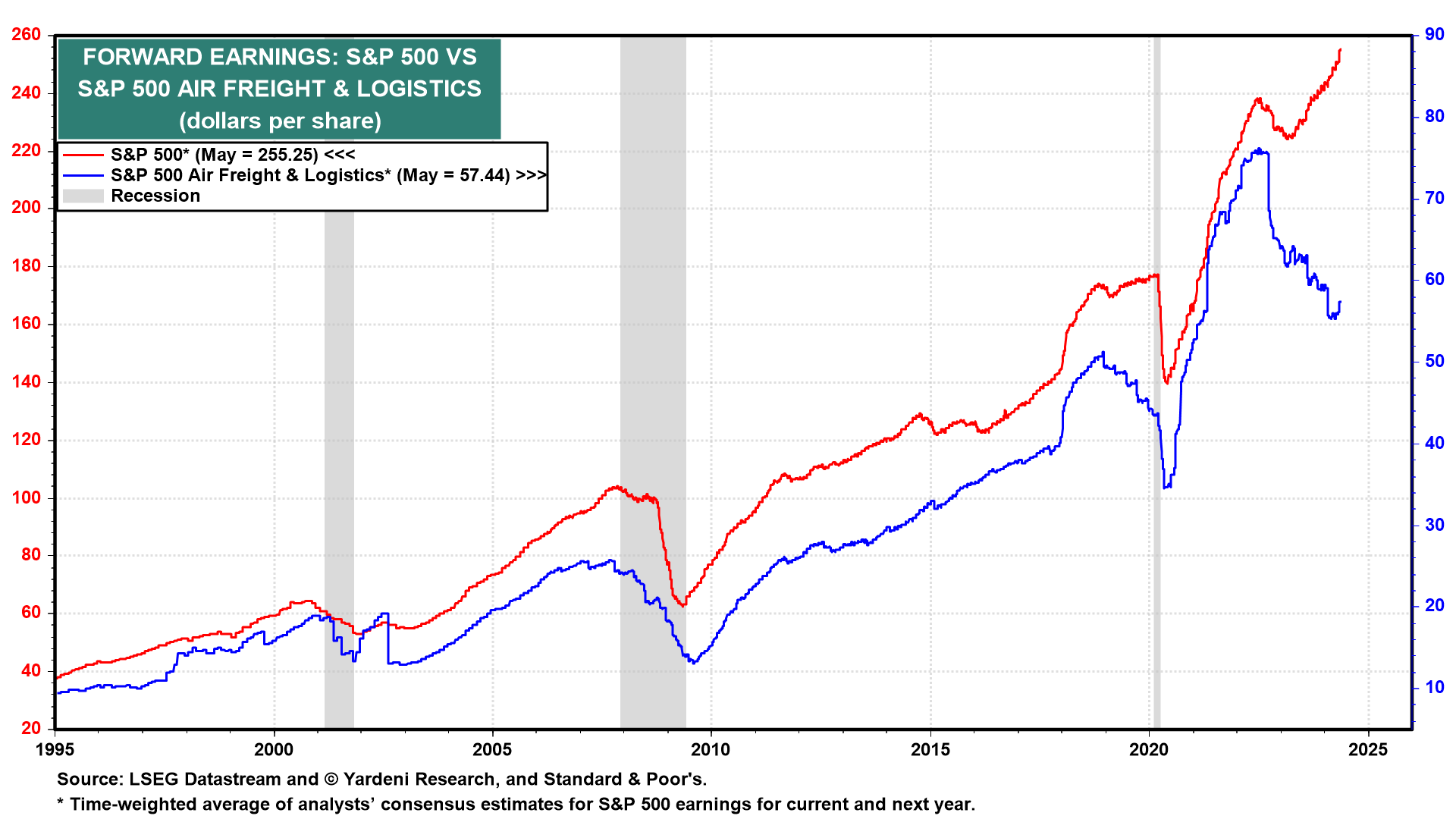

It may be that services matter a lot more than goods for the economy. So maybe the DJIA can diverge from the DJTA. Another interesting divergence is between the forward earnings of the S&P 500--which is at a record high--and of the S&P 500 Air Freight & Logistics industry (CHRW, EXPD, FDX, and UPS)– which is well off its record high (chart). The former is getting a boost from the strength of the US economy, while the latter might be weighed down by weakness in the global economy.

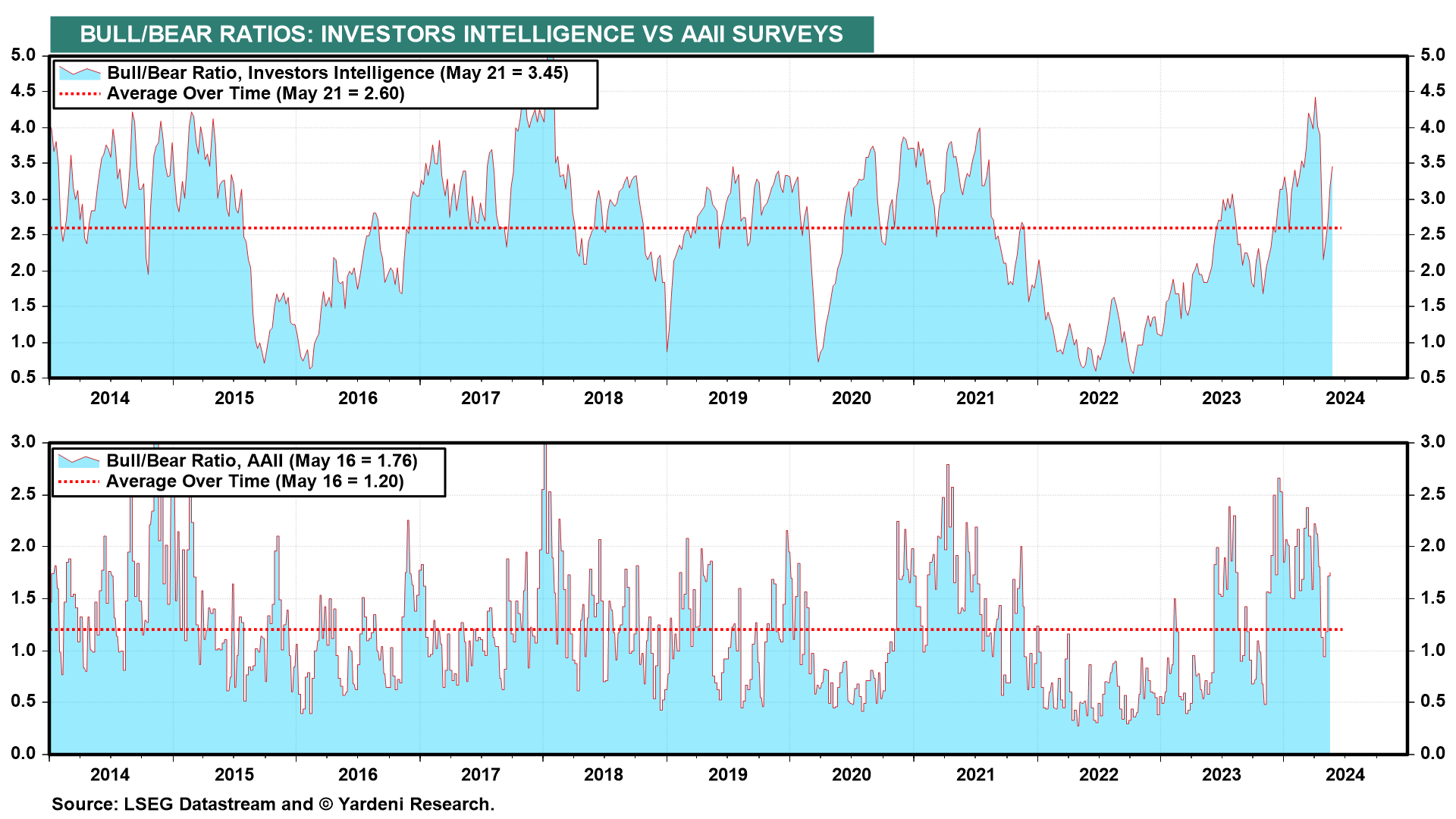

The fun continues with the rollercoaster ride in the Bull/Bear Ratios (BBR) (chart). The Investors Intelligence BBR during the week of May 21 rose back up to 3.45. There has been a stampede back into the bullish camp with 59.4% bulls and only 17.2% bears. There may be too many bulls again to decisively break out above Dow 40,000 for now.

A word about copper: Our good friends at Barron's posted an interesting story today titled "Move Over, Nvidia. Copper Is Getting a Big AI Boost Too." Profit takers sold on the news today with the price of copper down 5.5%. Also this morning, Reuters reported that China has plenty of copper.

Meanwhile, it's hot here in New York. So the price of natural gas is up 5.4%. Citi Research says the recent rally won't last.

Finally, the latest FOMC minutes came out this afternoon and showed that the committee is perplexed. They aren't sure about the degree of the Fed's restrictiveness and are concerned that inflation hasn't been falling faster to their 2.0% target. Some of them mentioned that the Fed might have to tighten if inflation stalls. Stocks edged lower on the news. We suggest that they take the summer off until they are less uncertain.

Nvidia reports Q1 earnings after the bell.