Denmark (responsible for Greenland's defense), Germany, France, Sweden, and Norway have confirmed plans to deploy military personnel to the sparsely populated island this week for a joint military exercise. These NATO members are preparing to repel a US invasion of Greenland. We wish we were kidding. A much less far-fetched scenario is that China will invade Taiwan.

The stock market isn't taking either scenario seriously. Taiwan Semiconductor (TSMC) rose to a record high today on better-than-expected earnings. Then again, the Trump administration announced today that Taiwanese chip and technology companies will invest at least $250 billion in US production capacity, and the Taiwanese government will guarantee $250 billion in credit for these companies. Might they be preparing to shut down their operations in Taiwan in the event of an invasion by China? That might be more likely following Trump's excellent adventure in Venezuela and his threat to grab Greenland.

Late last year, we downgraded S&P 500 Information Technology to market weight and the Magnificent-7 to underweight, while maintaining our overweight on S&P 500 Semiconductors, which are relatively cheap given their soaring earnings (chart).

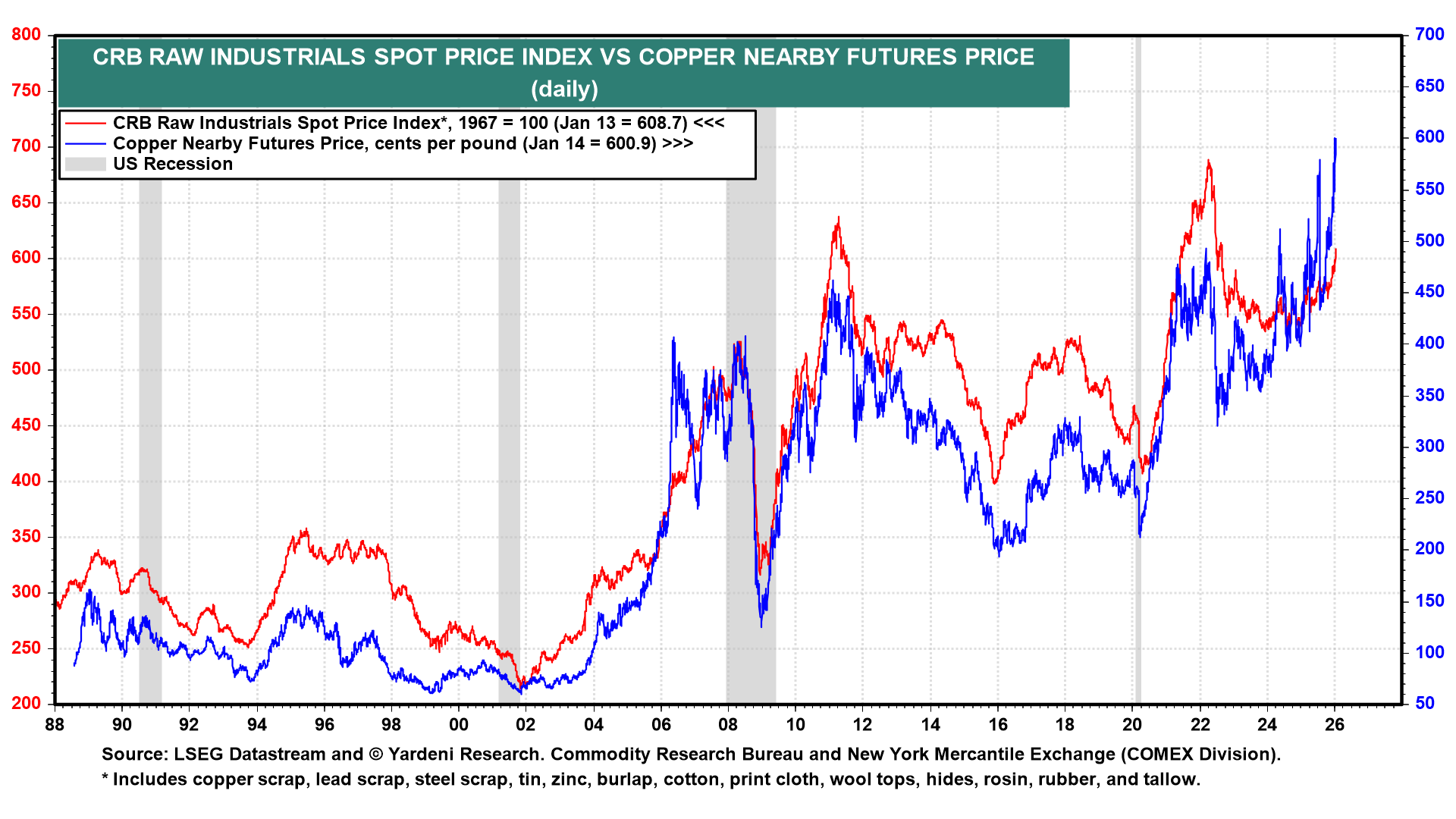

Meanwhile, copper is becoming more expensive, reflecting rising demand from the AI industry, including semiconductors (chart). Dr. Copper is often described as the "base metal with a PhD in economics." The professor may be signaling stronger global economic growth in 2026. (BTW: Los Angeles has experienced recent blackouts due to copper wire theft, which might be a sign of a top.)

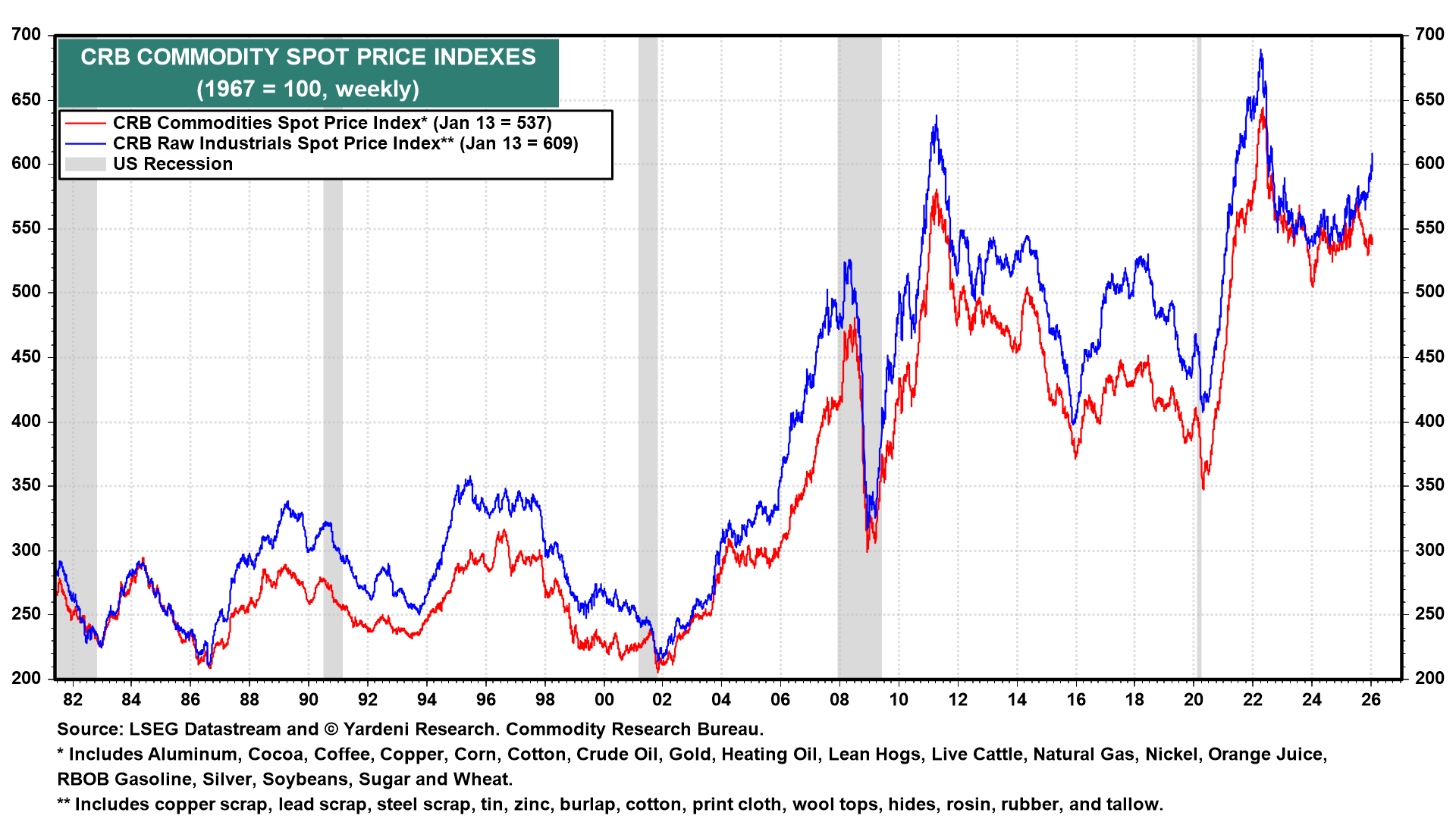

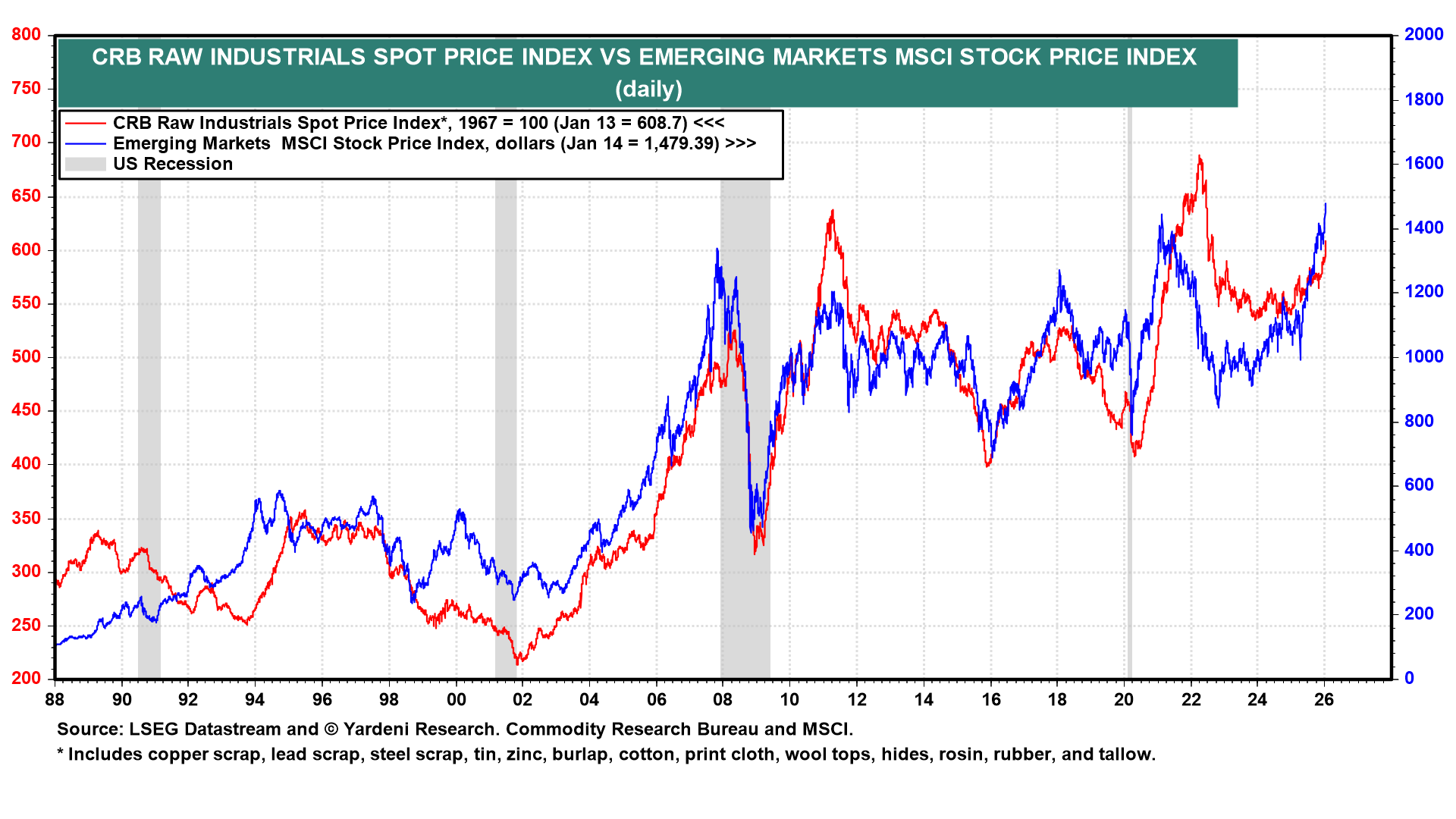

We have long monitored the CRB raw industrials spot price index as a less volatile barometer of global economic growth than copper (chart). It has been rising over the past two years.

The broader-based CRB commodities spot index has been held down over the past two years by weak crude oil prices (chart).

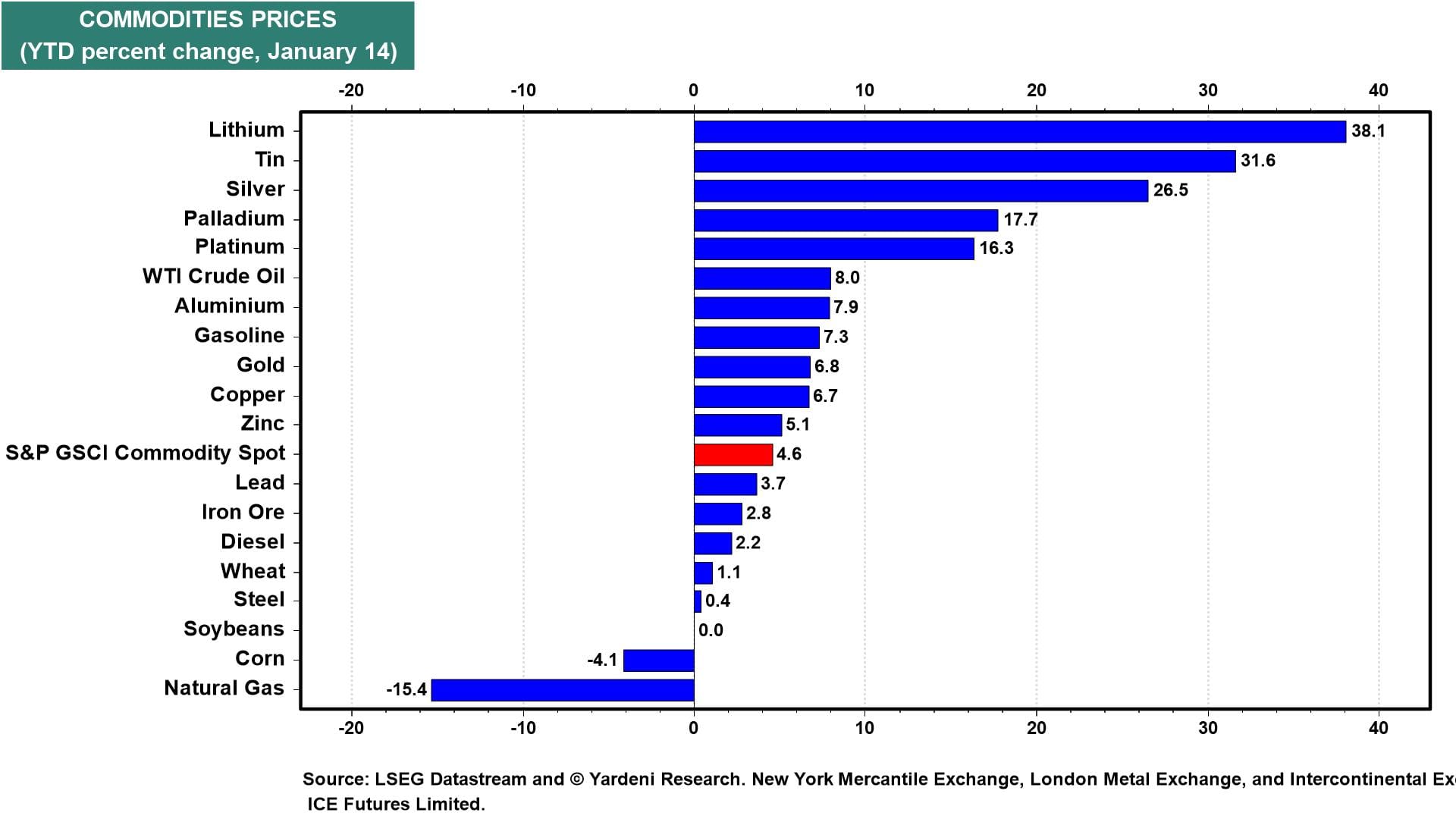

Base metals, along with precious metals, have outperformed the S&P GSCI commodity spot price index ytd (chart).

Late last year, we recommended overweighting the Emerging Markets ex-China MSCI. The index, including China, remains highly correlated with the CRB raw industrials spot price index (chart). Both are sensitive to global economic growth.

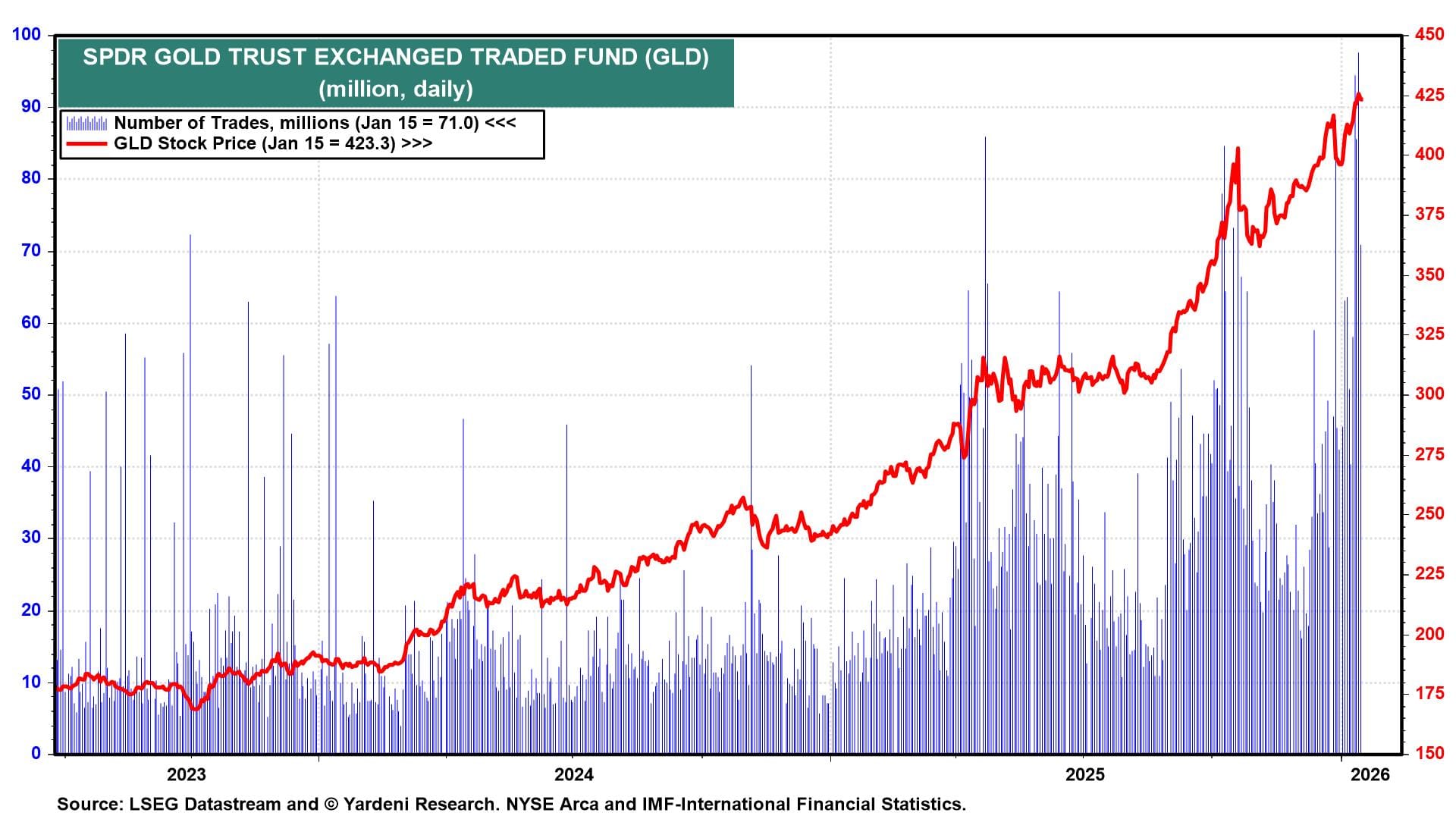

The rally in precious metals continues. The SPDR Gold Trust ETF (GLD) is at a record high on record high volume (chart).

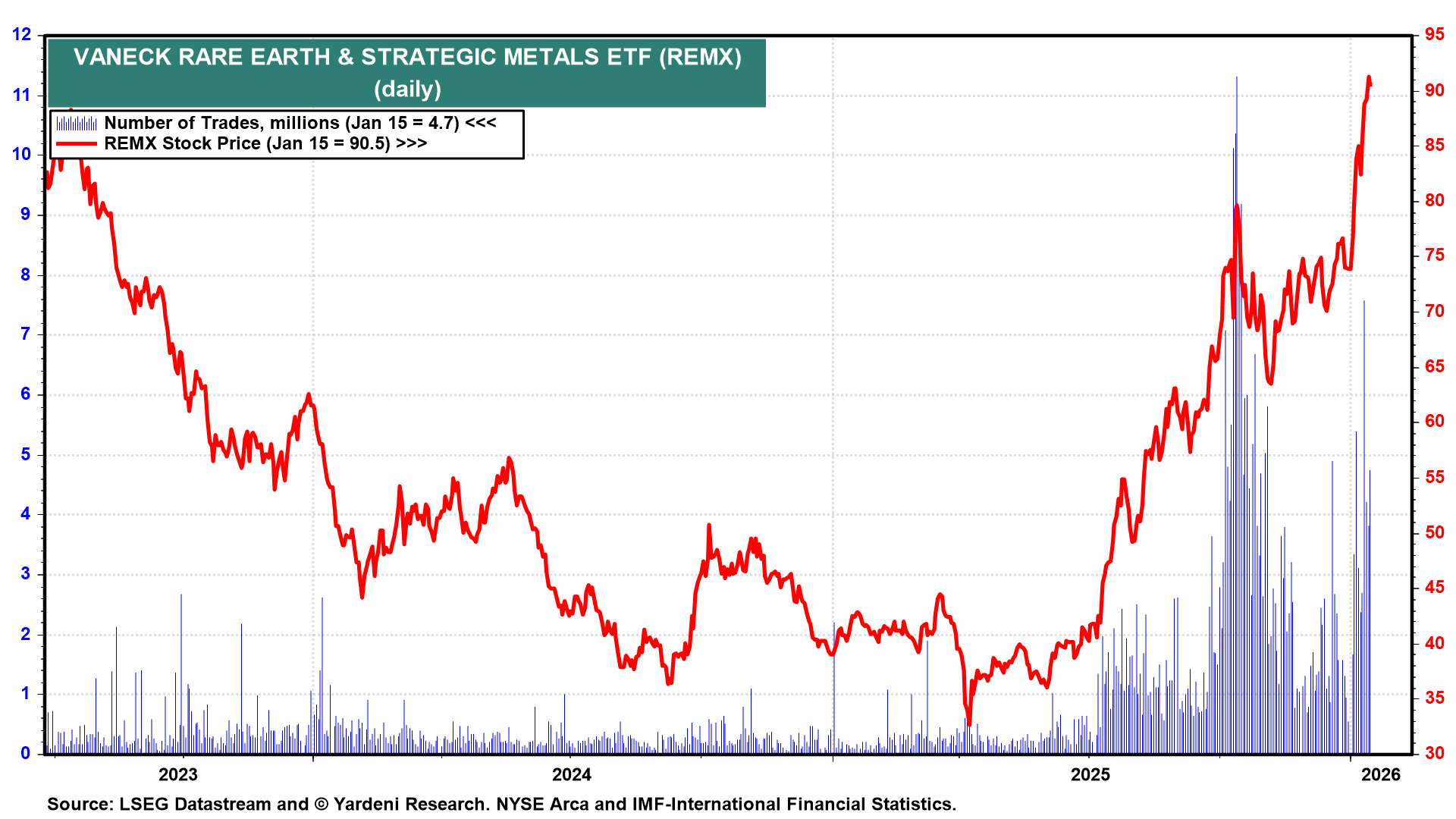

Also flying so far in the new year is the Vaneck Rare Earth & Strategic Metals ETF (chart). The demand for precious metals, base metals, and rare earth minerals is driven not only by AI-related demand but also by rising global defense spending.

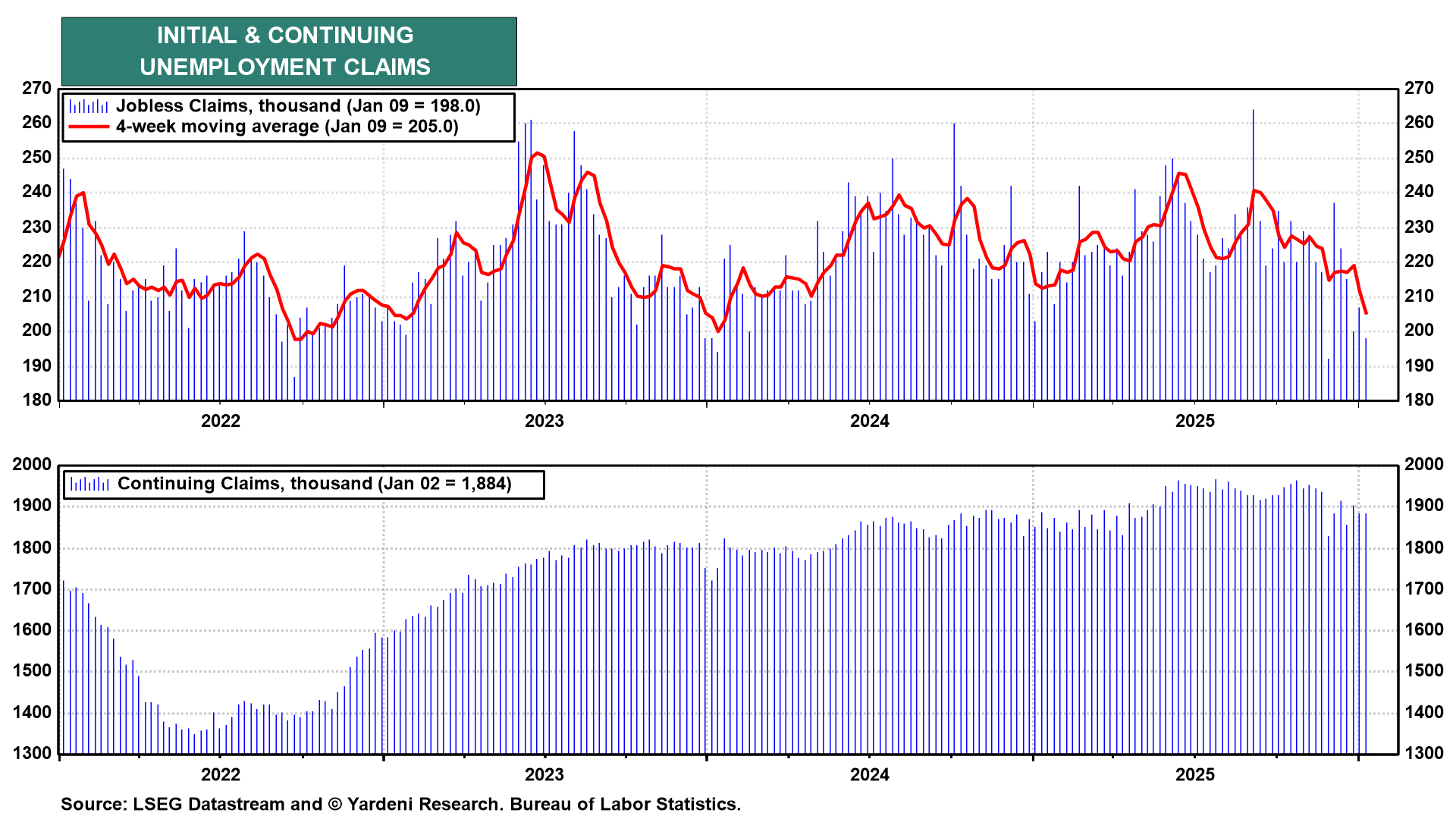

The big surprise of 2026 might be a rebound in payroll employment. The latest unemployment insurance claims report shows that both initial and continuing claims are falling (chart).

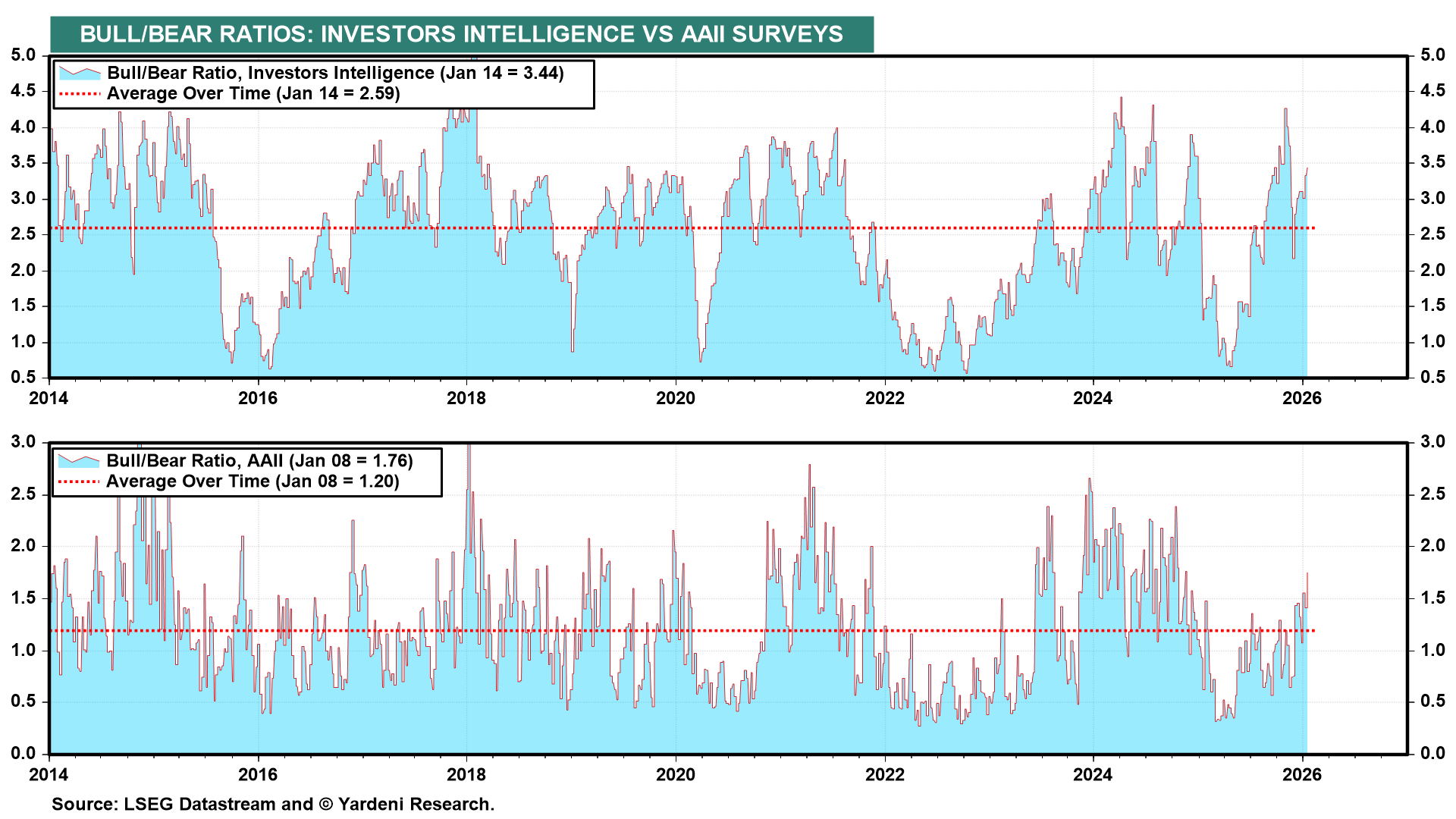

Meanwhile, the latest readings of the Bull-Bear Ratios that we track are showing rising bullishness (chart). They aren't high enough to worry us about a stock market pullback, yet.