US stocks rose to record highs on Wednesday. European stocks did the same today after the ECB lowered its official interest rate to 3.75%, down from a record 4.00%, where it has been since September 2023 and the first cut since 2019. Leading the rate-cutting pack of the major central banks was the People's Bank of China, which lowered its prime rate last year on August 21. The Swiss National Bank was the first major central bank to cut its rate this year on March 21. Then on May 8, the Swedish Riksbank joined the rate-cutting party. The Bank of Canada did so on Wednesday.

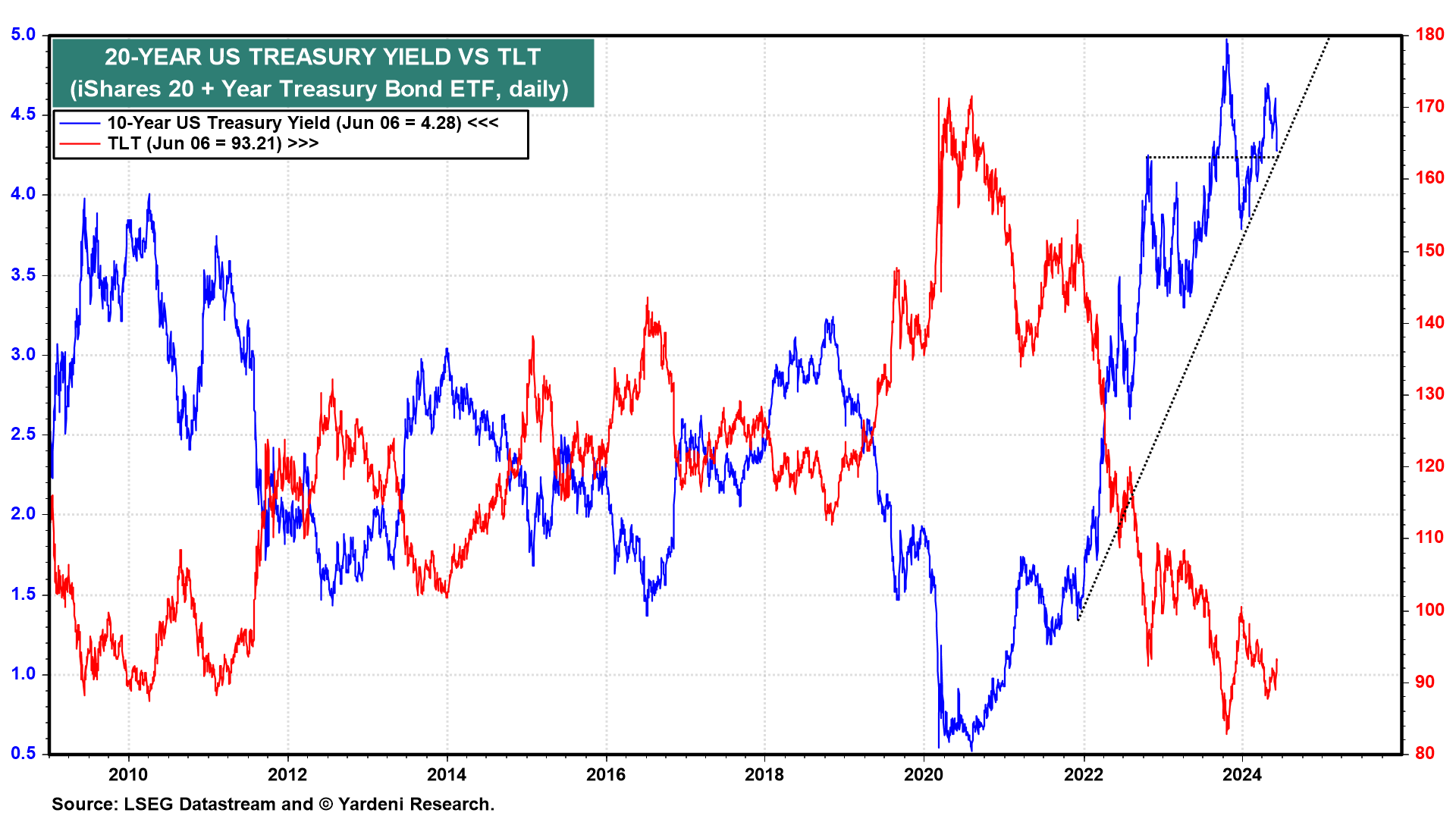

So where is Waldo? In the past, the Fed usually led the pack of central banks. The financial markets are expecting the Fed will soon join the rate pack with a cut. The 10-year US Treasury bond yield has dropped sharply in recent days to 4.28%. Tomorrow's May employment report should determine whether the yield will bounce off 4.25% or drop below it (chart). We've been forecasting a range of 4.00%-5.00% with the yield mostly below the midpoint of this range this year.

Let's review today's mostly bond-friendly data:

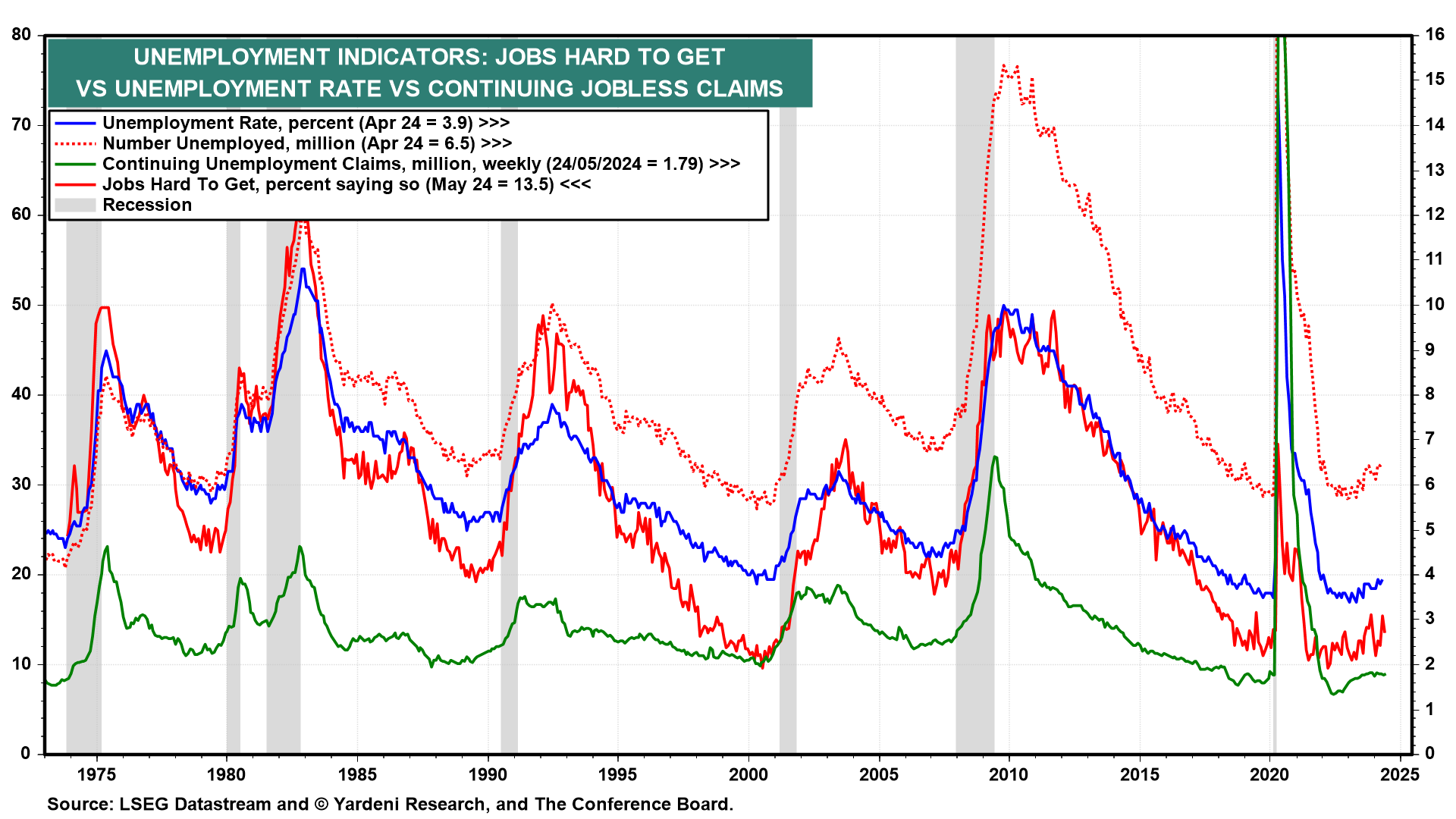

(1) Labor market. Weekly initial unemployment claims rose 8,000 to 229,000 during the May 31 week suggesting some slowing of the labor market. However, the boost was probably attributable to the Memorial Day holiday. Excluding seasonal adjustment, new claims fell below 196,000. Continuing claims edged higher but remained below 1.80 million, suggesting that the May's unemployment rate remained below 4.0% for the 28th consecutive month. Tomorrow, we expect to see that 150,000 to 200,000 jobs were added in May.

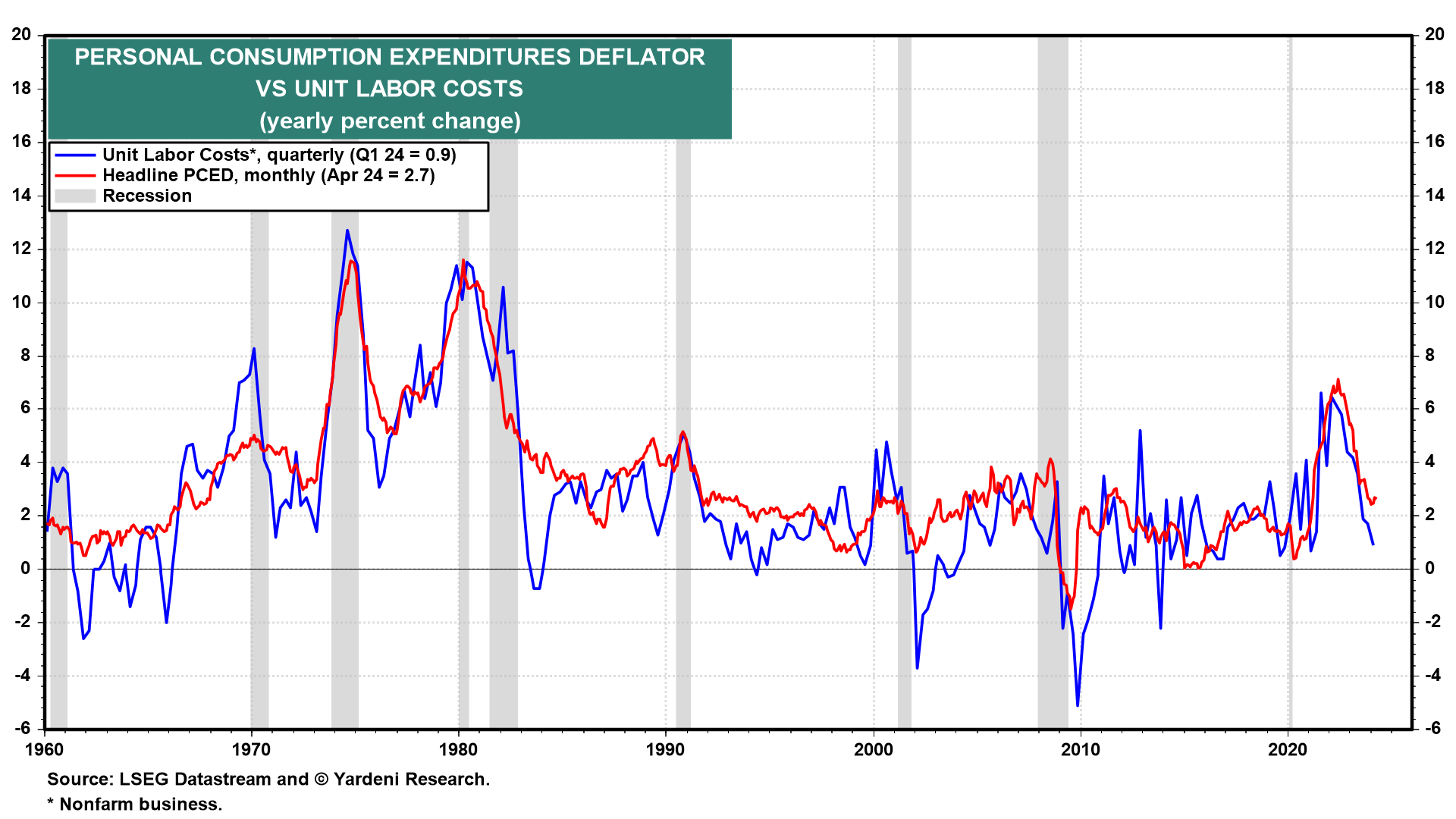

(2) Productivity & labor costs. Q1's unit labor costs (ULC) was revised down to 4.0% (q/q, saar) from 4.7% as hourly compensation was revised down from 5.0% to 4.2%. ULC for Q4-2023 was also revised much lower, to -2.8% from 0.0%, as hourly compensation was slashed from 3.5% to 0.6%!

That brought the y/y rise in ULC to only 0.9%, keeping PCED inflation firmly on track toward the Fed's 2% target by the end of this year(chart). Meanwhile, productivity rose to a three-year high of 2.9% y/y, even though Q1 was revised down slightly from 0.3% to 0.2%..